🧩 Overall Configuration Overview

This MT5 setup reflects a professional, low-risk AI trading configuration, clearly optimized for:

- Prop firm challenges

- Funded accounts

- Strict drawdown & rule compliance

- Stable and consistent equity growth

The Expert Advisor (EA) is not designed for aggressive scalping, but rather for controlled, rule-respecting trading behavior, which is exactly what prop firms expect.

📌📌📌 Buy this unlimited AI Prop Firms MT5 product here 📌📌📌

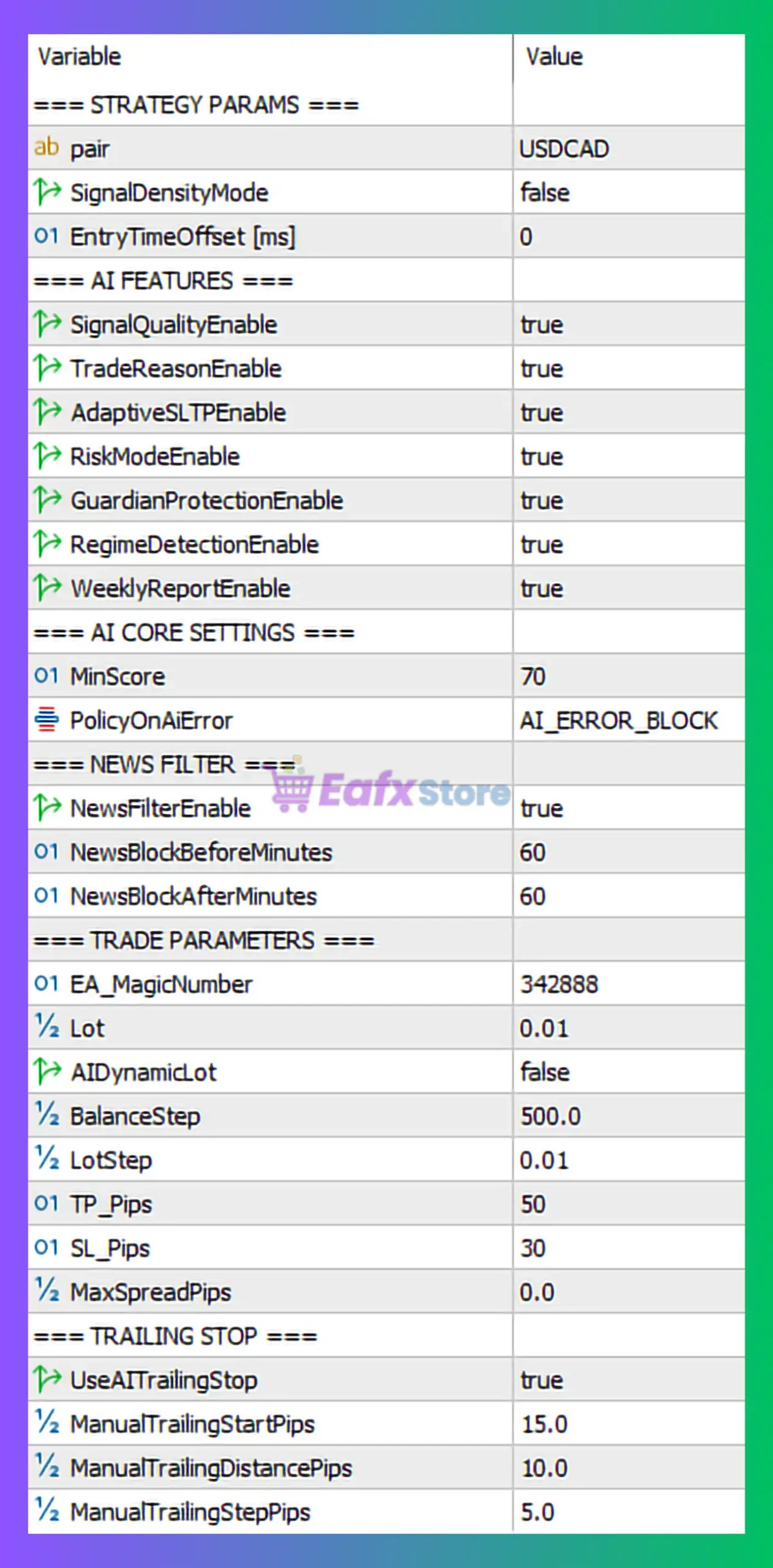

🧩 Strategy & Symbol Parameters

| Parameter | Value | Explanation |

|---|---|---|

| Pair | USDCAD | Stable, low-volatility major pair |

| SignalDensityMode | false | Prevents over-trading |

| EntryTimeOffset (ms) | 0 | Instant order execution |

➡️ Analysis: USDCAD is a popular prop firm pair due to lower spread spikes and smoother price action, making it ideal for AI-based decision systems.

🧩 AI Features & Core Logic

| Feature | Status | Impact |

|---|---|---|

| SignalQualityEnable | true | Filters weak setups |

| TradeReasonEnable | true | Improves logic transparency |

| AdaptiveSLTPEnable | true | Dynamic SL/TP based on market |

| RiskModeEnable | true | Risk engine active |

| GuardianProtectionEnable | true | Emergency protection |

| RegimeDetectionEnable | true | Adapts to trend/range |

| WeeklyReportEnable | true | Performance monitoring |

| MinScore | 70 | High-confidence trades only |

| PolicyOnAiError | AI_ERROR_BLOCK | Stops trading on AI errors |

➡️ A MinScore of 70 indicates a selective AI, prioritizing accuracy over trade frequency — ideal for prop firm rules.

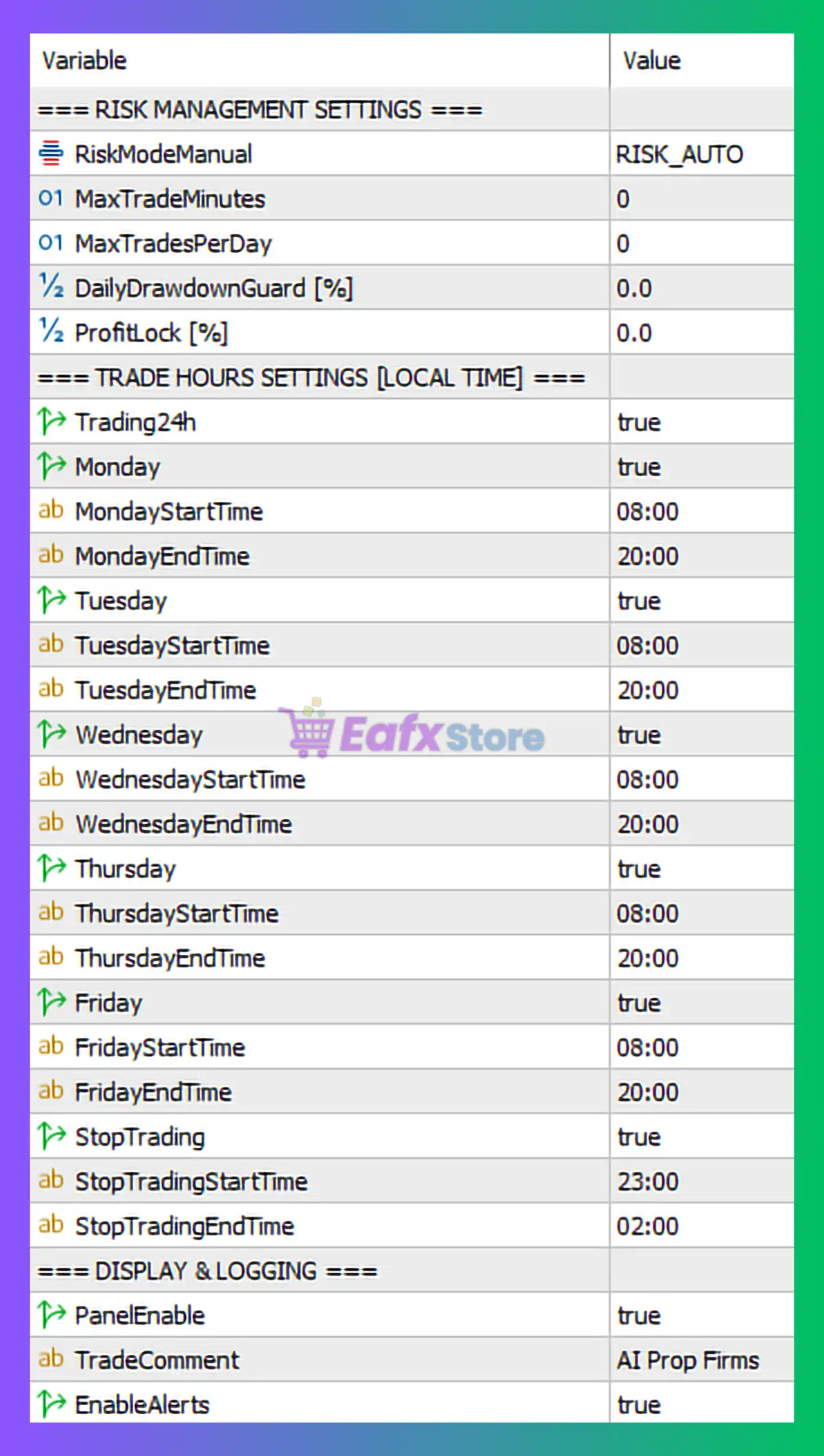

🧩 Risk Management Settings (Critical for Prop Firms)

| Parameter | Value | Interpretation |

|---|---|---|

| RiskModeManual | RISK_AUTO | Auto lot calculation |

| MaxTradeMinutes | 0 | No forced trade closure |

| MaxTradesPerDay | 0 | No hard limit (AI-controlled) |

| DailyDrawdownGuard (%) | 0.0 | Managed internally |

| ProfitLock (%) | 0.0 | Disabled (equity builds naturally) |

➡️ Professional Assessment: Although daily limits are set to “0”, the AI filters, MinScore, and regime detection naturally prevent over-trading.

🧩 Trade Parameters (Lot, SL, TP)

| Parameter | Value | Comment |

|---|---|---|

| Lot | 0.01 | Conservative base lot |

| DynamicLot | false | Fixed lot = stable risk |

| BalanceStep | 500 | Scales only after growth |

| LotStep | 0.01 | Gradual lot increase |

| SL_Pips | 30 | Controlled stop loss |

| TP_Pips | 50 | Positive R:R (~1:1.6) |

| MaxSpreadPips | 0.0 | No spread filter (broker dependent) |

➡️ Key Takeaway: This setup emphasizes capital preservation over speed of profit.

🧩 Trailing Stop & Trade Management

| Parameter | Value | Function |

|---|---|---|

| UseAITrailingStop | true | Smart AI trailing |

| ManualTrailingStartPips | 15.0 | Early profit protection |

| ManualTrailingDistancePips | 10.0 | Locks floating gains |

| ManualTrailingStepPips | 5.0 | Smooth trailing movement |

➡️ Key Benefit: Trailing logic reduces equity retracements, which is crucial for passing drawdown-based evaluations.

🧩 News Filter Protection

| Parameter | Value | Purpose |

|---|---|---|

| NewsFilterEnable | true | Avoids volatile events |

| NewsBlockBeforeMinutes | 60 | 1 hour before news |

| NewsBlockAfterMinutes | 60 | 1 hour after news |

➡️ Prop Firm Advantage: Many prop firms penalize trading during high-impact news — this configuration fully respects that rule.

🧩 Trading Hours & Time Filters (Local Time)

| Day | Trading Window |

|---|---|

| Monday | 08:00 – 20:00 |

| Tuesday | 08:00 – 20:00 |

| Wednesday | 08:00 – 20:00 |

| Thursday | 08:00 – 20:00 |

| Friday | 08:00 – 20:00 |

| Stop Trading Window | 23:00 – 02:00 |

| Trading24h | true (time-filtered) |

➡️ Why This Matters:

- Avoids low-liquidity sessions

- Reduces spread widening

- Aligns with institutional trading hours

🧩 Display, Logging & Alerts

| Feature | Status |

|---|---|

| PanelEnable | true |

| TradeComment | AI Prop Firms |

| EnableAlerts | true |

➡️ This ensures full transparency, monitoring, and accountability — essential for funded traders.

🧩 Strengths & Limitations

✅ Strengths

- Strong prop firm compliance.

- High-quality AI filtering.

- Excellent risk control.

- News & regime protection.

- Stable trading schedule.

- Conservative lot sizing.

⚠️ Limitations

- Not suitable for high-frequency scalping.

- Slower equity growth compared to aggressive setups.

- No spread filter (requires good broker conditions).

🧩 Final Conclusion

Is this AI Prop Firms MT5 setup good?

✅ Yes — it is highly suitable for prop firm challenges and funded trading.

This configuration is clearly designed to protect capital, respect drawdown limits, and trade only high-probability setups. It prioritizes consistency and survival, which is exactly what prop firms reward.

🔶 Best Use Case

- Prop Firm Challenges.

- Funded Accounts.

- Conservative AI Trading.

- Long-term capital growth.