🧩 What is AI Gold Prime EA?

AI Gold Prime EA for MT5 is an automated trading system designed specifically for XAUUSD (Gold). It combines multi-strategy swing logic, risk-based money management, AI-assisted adaptive behavior, and prop-firm protection mechanisms.

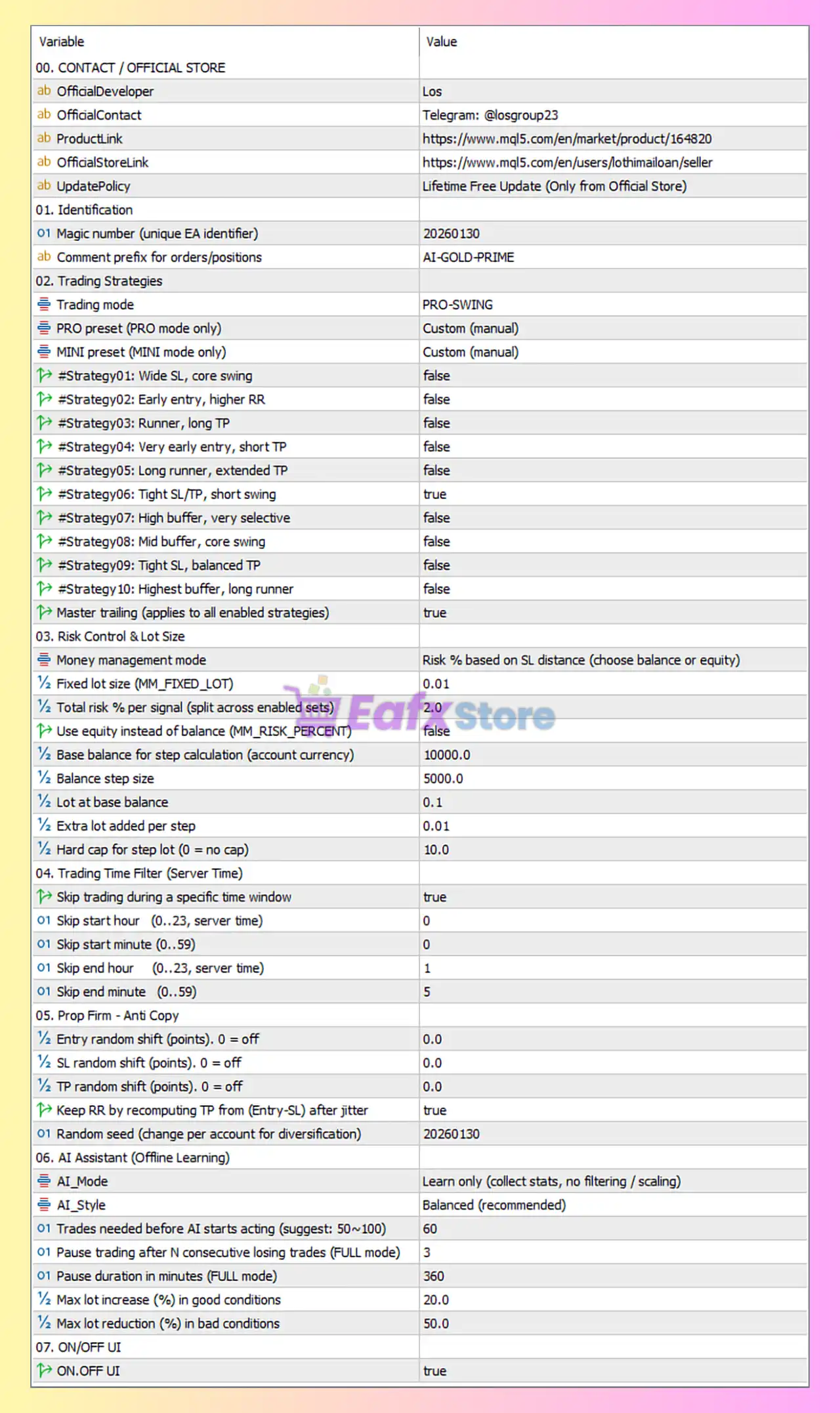

From the settings shown in the image, the Expert Advisor (EA) is configured in PRO-SWING mode, with a short-swing strategy enabled, risk-based position sizing, master trailing, and AI learning activated.

📌📌📌 Buy this unlimited AI Gold Prime EA MT5 product here 📌📌📌

This article provides a complete breakdown of all trading parameters, structured for clarity and optimization.

🧩 Contact & Official Store Information

| Parameter | Value | Explanation |

|---|---|---|

| Official Developer | Los | EA creator |

| Telegram | @losgroup23 | Support channel |

| Product Link | MQL5 Market | Official purchase source |

| Update Policy | Lifetime Free Update | Valid only if purchased from official store |

➡️ Always download from the official MQL5 store to ensure security and lifetime updates.

🧩 Identification Settings

| Parameter | Value | Meaning |

|---|---|---|

| Magic Number | 20260130 | Unique trade identifier |

| Comment Prefix | AI-GOLD-PRIME | Order label in terminal |

🔶 Why Magic Number Matters

The Magic Number (20260130) ensures:

- No conflict with other EAs

- Trade separation for multi-EA accounts

- Accurate backtesting logs

🧩 Trading Strategy Configuration

🔶 Active Mode

- Trading Mode: PRO-SWING

- PRO Preset: Custom (Manual)

- MINI Preset: Custom (Manual)

🔶 Strategy Activation

| Strategy | Description | Status |

|---|---|---|

| Strategy 1 | Wide SL, Core Swing | ❌ Disabled |

| Strategy 2 | Early Entry, Higher RR | ❌ Disabled |

| Strategy 3 | Runner, Long TP | ❌ Disabled |

| Strategy 4 | Very Early Entry, Short TP | ❌ Disabled |

| Strategy 5 | Long Runner, Extended TP | ❌ Disabled |

| Strategy 6 | Tight SL/TP, Short Swing | ✅ Enabled |

| Strategy 7 | High Buffer, Very Selective | ❌ Disabled |

| Strategy 8 | Mid Buffer, Core Swing | ❌ Disabled |

| Strategy 9 | Tight SL, Balanced TP | ❌ Disabled |

| Strategy 10 | Highest Buffer, Long Runner | ❌ Disabled |

🔶 What This Means

Only Strategy 6 – Tight SL/TP, Short Swing is active.

This configuration suggests:

- Shorter holding time

- Smaller stop loss

- Faster TP execution

- Higher trade frequency compared to swing runners

🔶 Master Trailing

- Enabled (true)

This means:

- Trailing stop applies to active strategy

- Locks profits dynamically

- Reduces risk exposure

🧩 Risk Control & Lot Size Management

🔶 Money Management Type

Risk % based on SL distance

The lot size adjusts automatically according to stop loss distance.

🔶 Risk Settings Table

| Parameter | Value | Explanation |

|---|---|---|

| Fixed Lot | 0.01 | Ignored (risk mode active) |

| Total Risk per Signal | 2.0% | Risk per trade |

| Use Equity Instead of Balance | False | Uses balance |

| Base Balance for Step | 10,000 | |

| Balance Step Size | 5,000 | |

| Lot at Base Balance | 0.1 | |

| Extra Lot per Step | 0.01 | |

| Hard Cap Lot | 10.0 |

🔶 Risk Analysis

- 2% per trade = Moderate risk

- Good for steady growth

- Suitable for accounts ≥ $5,000

- Hard cap prevents lot explosion

➡️ Important: If using prop firm accounts, 2% may be aggressive depending on daily drawdown limits.

🧩 Trading Time Filter (Server Time)

| Parameter | Value |

|---|---|

| Skip Time Enabled | True |

| Skip From | 00:00 |

| Skip To | 01:05 |

🔶 Interpretation

The EA avoids trading between:

00:00 – 01:05 server time

This typically avoids:

- Low liquidity rollover spread

- Swap spike volatility

🧩 Prop Firm – Anti Copy Protection

| Parameter | Value |

|---|---|

| Entry Random Shift | 0 |

| SL Random Shift | 0 |

| TP Random Shift | 0 |

| Keep RR After Jitter | True |

| Random Seed | 20260130 |

🔶 Analysis

Currently:

- Randomization is OFF

- Risk/Reward preserved

➡️ If using prop firm accounts, consider enabling slight jitter to avoid identical trade detection.

🧩 AI Assistant (Offline Learning)

| Parameter | Value |

|---|---|

| AI Mode | Learn Only |

| AI Style | Balanced |

| Trades Before AI Action | 60 |

| Pause After Losing Streak | 3 |

| Pause Duration | 360 minutes |

| Max Lot Increase (Good Conditions) | 20% |

| Max Lot Reduction (Bad Conditions) | 50% |

🔶 AI Mode Breakdown

Learn Only Mode means:

- AI collects statistics

- No filtering or scaling applied yet

After 60 trades:

- AI evaluates performance

- In full mode, it can increase/decrease risk

🔶 Risk Behavior

- In good market conditions → +20% lot increase

- In bad conditions → -50% lot reduction

- After 3 consecutive losses → 6-hour pause

➡️ This protects against drawdown spirals.

🧩 UI Settings

| Parameter | Value |

|---|---|

| EA UI | Enabled |

Displays:

- Active strategy

- Drawdown stats

- AI condition

- Risk data

🧩 Overall Configuration Summary

Current Setup Characteristics:

- ✔ PRO-SWING Mode

- ✔ Short swing strategy

- ✔ 2% risk per trade

- ✔ Trailing stop enabled

- ✔ AI learning active

- ✔ Time filter active

- ❌ Multi-strategy stacking disabled

- ❌ Random anti-copy disabled

🧩 Risk Profile Assessment

| Category | Level |

|---|---|

| Aggressiveness | Medium |

| Drawdown Potential | Moderate |

| Trade Frequency | Medium-High |

| Prop Firm Safety | Medium |

| Long-Term Stability | Good (with AI enabled) |

🧩 Optimization Suggestions

If your goal is:

🔶 Conservative Trading

- Reduce risk to 1%

- Enable Strategy 7 (high buffer)

- Use equity instead of balance

🔶 Aggressive Growth

- Enable Strategy 9 or combine 6 + 9

- Increase AI max lot increase to 30%

- Keep trailing ON

🔶 Prop Firm Safety

- Risk 0.5–1%

- Enable slight random shift (1–5 points)

- Reduce max lot increase to 10%

🧩 Conclusion

The AI Gold Prime EA configuration shown in the image is optimized for short-swing gold trading with moderate risk exposure (2%) and AI-based adaptive protection.

The current setup is:

- Balanced for growth.

- Suitable for $5,000–$20,000 accounts.

- Not overly aggressive.

- Protected by trailing stop and losing streak pause.

However, for prop firm accounts or smaller balances, reducing risk to 1% is strongly recommended.

If configured correctly, this EA setup can provide:

- Controlled drawdowns.

- Adaptive lot scaling.

- Structured swing trading logic.

- AI-enhanced trade learning.