1. General Overview

This configuration represents a conservative, prop-firm-friendly AI trading setup designed for risk control, rule compliance, and long-term consistency rather than aggressive profit chasing.

The Expert Advisor (EA) focuses on:

- High-quality trade filtering.

- Strong risk & drawdown protection.

- Time-based trading discipline.

- News and regime detection.

- Suitability for prop firm challenges and funded accounts.

📌📌📌 Buy this unlimited AI Prop Firms MT4 product here 📌📌📌

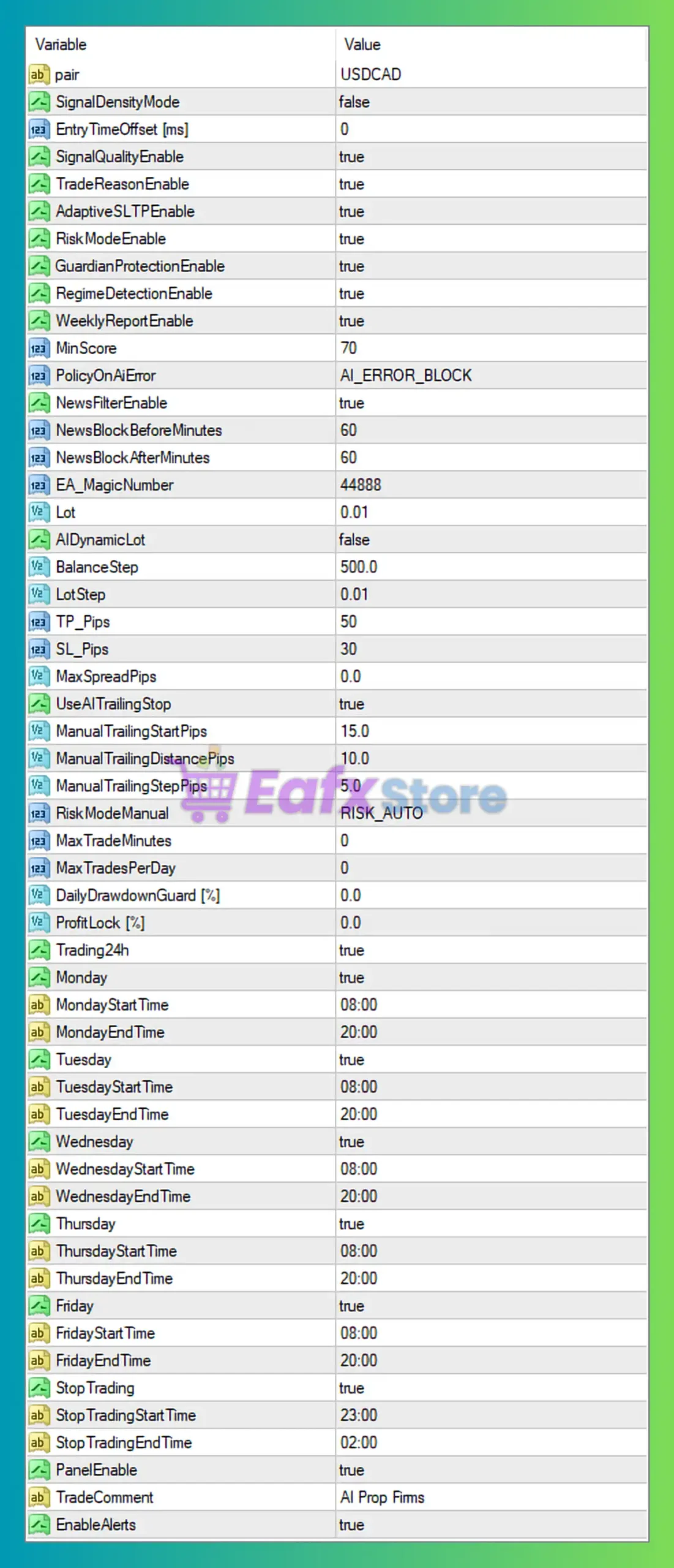

2. Trading Instrument & Core Signal Settings

| Parameter | Value | Analysis |

|---|---|---|

| Pair | USDCAD | Stable, low-volatility pair suitable for prop firms |

| SignalDensityMode | false | Avoids over-trading |

| EntryTimeOffset (ms) | 0 | Immediate execution |

| MinScore | 70 | High signal quality threshold |

| SignalQualityEnable | true | Filters weak signals |

| TradeReasonEnable | true | Improves trade logic transparency |

| RegimeDetectionEnable | true | Adapts to market conditions |

| AdaptiveSLTPEnable | true | Dynamic SL/TP based on market |

➡️ Insight: This setup prioritizes high-probability trades and avoids random or low-confidence entries — a key requirement for passing prop firm evaluations.

3. Risk Management & Capital Protection

| Parameter | Value | Interpretation |

|---|---|---|

| RiskModeEnable | true | Risk management active |

| RiskModeManual | RISK_AUTO | Auto risk calculation |

| Lot | 0.01 | Small base lot |

| DynamicLot | false | Fixed lot for consistency |

| BalanceStep | 500 | Scaling only after equity growth |

| LotStep | 0.01 | Gradual scaling |

| MaxDrawdownGuard (%) | 0.0 | Managed by internal logic |

| ProfitLock (%) | 0.0 | Disabled (manual equity growth) |

| GuardianProtectionEnable | true | Emergency protection layer |

➡️ Key Takeaway: This EA is designed to survive prop firm drawdown rules, not to gamble.

4. Stop Loss, Take Profit & Trade Management

| Parameter | Value | Comment |

|---|---|---|

| SL_Pips | 30 | Tight and controlled |

| TP_Pips | 50 | Positive risk-reward (~1:1.6) |

| UseAITrailingStop | true | Smart trailing |

| ManualTrailingStartPips | 15 | Locks profit early |

| ManualTrailingDistancePips | 10 | Protects floating profit |

| ManualTrailingStepPips | 5 | Smooth trailing behavior |

| MaxSpreadPips | 0.0 | No spread filter (broker dependent) |

➡️ Professional View: The AI trailing stop + reasonable SL/TP supports steady equity growth and drawdown control.

5. News & Event Protection

| Parameter | Value | Explanation |

|---|---|---|

| NewsFilterEnable | true | Avoids high-impact news |

| NewsBlockBeforeMinutes | 60 | 1 hour before news |

| NewsBlockAfterMinutes | 60 | 1 hour after news |

| PolicyOnAiError | AI_ERROR_BLOCK | Safety first |

➡️ Prop Firm Advantage: This is highly compliant with prop firm rules that penalize trading during news volatility.

6. Trading Frequency & Limits

| Parameter | Value | Meaning |

|---|---|---|

| MaxTradesPerDay | 0 | Unlimited (controlled by AI logic) |

| MaxTradeMinutes | 0 | No forced exit |

| Trading24h | true | Allowed but time-filtered |

➡️ Despite unlimited trades being allowed, high MinScore and filters naturally limit over-trading.

7. Trading Schedule (Time Filter)

| Day | Trading Time |

|---|---|

| Monday – Friday | 08:00 – 20:00 |

| Stop Trading Window | 23:00 – 02:00 |

Why this matters:

- Avoids low-liquidity sessions

- Reduces spread spikes

- Matches institutional trading hours

8. Monitoring, Reporting & Alerts

| Feature | Status |

|---|---|

| WeeklyReportEnable | true |

| PanelEnable | true |

| EnableAlerts | true |

| TradeComment | AI Prop Firms |

➡️ This allows clear tracking, performance review, and transparency — critical for funded traders.

9. Overall Strengths & Weaknesses

✅ Strengths

- Excellent risk control

- Prop-firm-compliant behavior

- News & regime detection

- Conservative drawdown protection

- Stable trading hours

- High signal quality threshold

⚠️ Potential Limitations

- Not suitable for aggressive scalpers

- Profit growth may be slower

- No dynamic lot sizing enabled

- Spread filter disabled (broker quality matters)

10. Final Conclusion

Is this AI Prop Firms MT4 setup good?

✅ Yes — especially for prop firm challenges and funded accounts.

This configuration is clearly optimized for capital preservation, rule compliance, and long-term consistency, not short-term gambling. It is ideal for traders who want to:

- Pass prop firm challenges

- Avoid drawdown violations

- Trade with discipline and structure

- Build steady equity growth over time

Best Use Case:

Prop Firm Challenges | Funded Accounts | Conservative AI Trading.