🧩 What is Akali EA?

Akali EA is an automated scalping system built for high-precision gold trading under fast market conditions. It focuses on stability and adaptability by reacting instantly to volatility while securing profits with intelligent trailing logic. With strict risk management and selective execution, Akali EA is designed to capture short-term opportunities while maintaining controlled exposure and consistent performance.

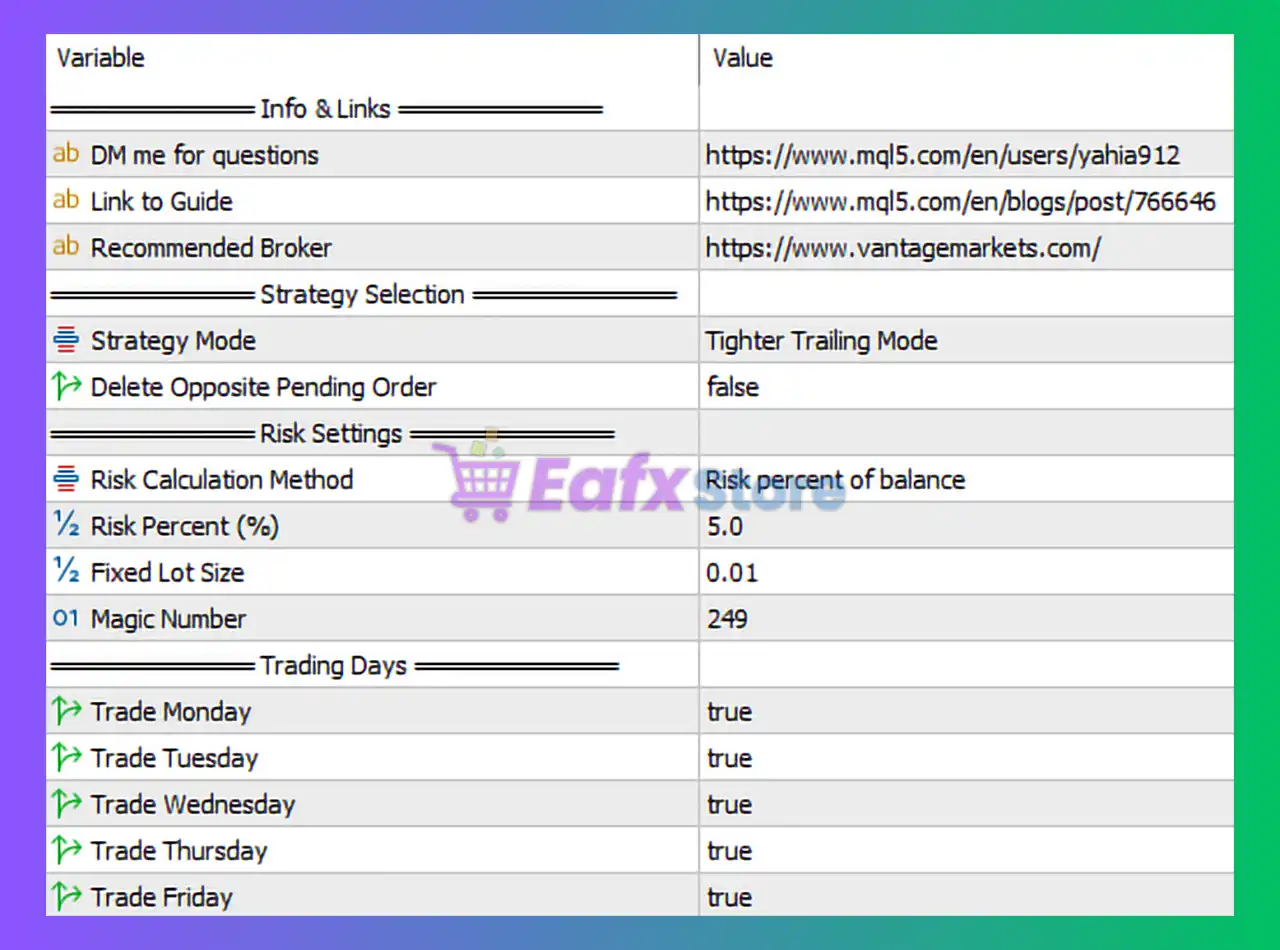

🧩 Info & External Links Section

🔶 DM me for questions

- Direct link to the developer’s MQL5 profile.

- Increases transparency and trustworthiness of the EA.

- Useful for support, updates, and strategy clarification.

🔶 Link to Guide

- Official usage guide hosted on MQL5.

- Essential for correct setup, symbol selection, and optimization.

- Strong positive signal for professional EA development.

🔶 Recommended Broker

- Vantage Markets.

- Indicates the EA is likely optimized for:

- Low spreads

- Fast execution

- ECN-style accounts

- Using the recommended broker can significantly improve performance consistency.

🧩 Strategy Selection

🔶 Strategy Mode = Tighter Trailing Mode

- This mode focuses on tight trailing stop management.

- Profits are protected earlier once price moves in favor.

- Advantages:

- Reduced drawdown

- Higher win protection

- Trade-off:

- May exit trades earlier, limiting maximum profit in strong trends

✅ Best suited for volatile but choppy markets and conservative traders.

🔶 Delete Opposite Pending Order = false

- Opposite pending orders remain active.

- Suggests a dual-direction or grid-style logic.

- Allows Akali EA to capture breakouts in either direction.

⚠️ Can increase exposure during high volatility if not paired with strict risk control.

🧩 Risk Management Settings

🔶 Risk Calculation Method = Risk percent of balance

- Dynamic lot sizing based on account balance.

- Automatically adapts position size as equity grows or declines.

- Recommended for long-term account sustainability.

🔶 Risk Percent (%) = 5.0

- Aggressive risk level.

- Suitable for:

- Medium to large accounts

- Traders seeking faster growth

- Not recommended for very small accounts or low-risk investors.

⚠️ Conservative traders may reduce this to 1–2%.

🔶 Fixed Lot Size = 0.01

- Backup or alternative lot size if fixed mode is selected.

- Minimum volume, useful for testing or small accounts.

🔶 Magic Number = 249

- Unique identifier for Akali EA trades.

- Prevents conflicts with:

- Other EAs

- Manual trades

- Essential for clean trade management in MT5.

🧩 Trading Days Configuration

Akali EA is configured to trade all weekdays:

- Trade Monday = true

- Trade Tuesday = true

- Trade Wednesday = true

- Trade Thursday = true

- Trade Friday = true

🔶 Implications:

- Full market exposure throughout the week.

- Increased trade frequency.

- Potential risk on Fridays due to:

- Low liquidity

- News volatility

- Weekend gaps

🔍 Some conservative traders may disable Friday trading to reduce gap risk.

🧩 Overall Strategy Profile

Based on the settings shown, Akali EA appears to be:

- A dynamic risk-based MT5 Expert Advisor

- Uses tight trailing stops for capital protection

- Allows bi-directional pending orders

- Optimized for high-quality brokers with low latency

🧩 Final Conclusion – Is Akali EA MT5 Worth Using?

From the image, Akali EA MT5 is configured for moderate-to-aggressive automated trading, with a strong focus on trailing stop optimization and dynamic risk calculation.

✅ Strengths:

- Percentage-based risk management

- Tight trailing strategy reduces drawdown

- Trades all weekdays for higher opportunity capture

- Clear documentation and developer transparency

⚠️ Potential Risks:

- 5% risk per trade can be aggressive

- Keeping opposite pending orders increases exposure

- Friday trading may introduce weekend gap risk

🧩 Summary

Akali EA MT5 is a professional automated trading robot designed for traders seeking dynamic position sizing, active weekly trading, and tight trailing stop protection. With proper risk adjustment and broker selection, it can be suitable for both growth-focused and semi-conservative trading strategies.