🧩 What is AW Bollinger Bands EA?

The AW Bollinger Bands EA is a fully automated trading robot designed for MetaTrader 4 (MT4) that capitalizes on the statistical properties of the Bollinger Bands indicator. It is built on the core principle of Mean Reversion—the idea that price extremes are temporary and will eventually return to the average (middle band).

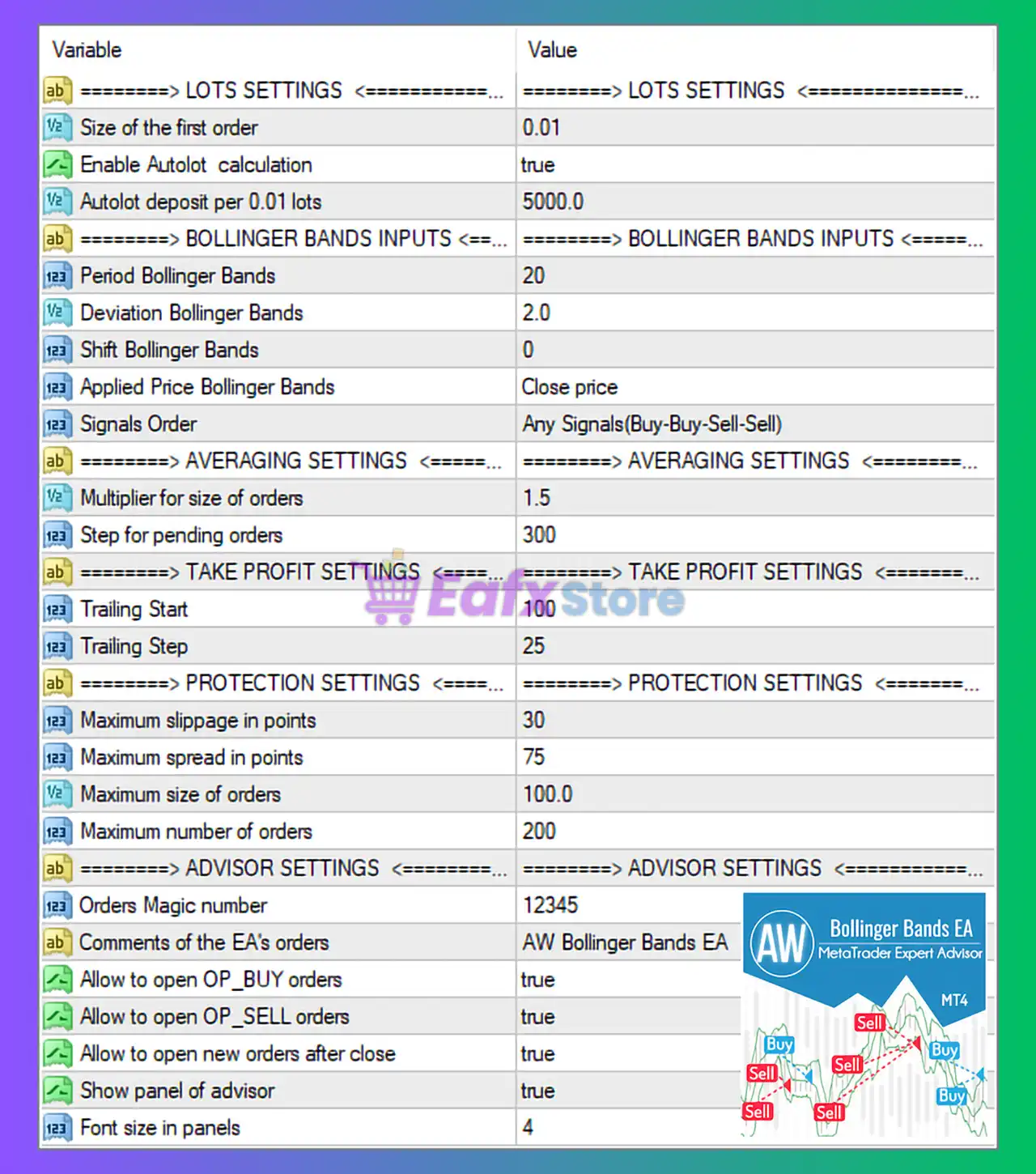

🧩 Lot Settings – Risk & Money Management

➡️ Size of the first order: 0.01

- Very small initial lot size.

- Suitable for small accounts, cent accounts, or conservative starting exposure.

- Helps reduce early drawdown when grid averaging begins.

➡️ Enable Autolot calculation: true

- Lot size is automatically calculated based on account balance.

- Improves long-term stability compared to fixed lots.

➡️ Autolot deposit per 0.01 lots: 5000.0

- For every $5,000 balance, the EA trades 0.01 lot.

- This is a conservative autolot ratio, significantly lowering risk.

📌 Conclusion (Lot Settings):

The EA uses safe and scalable money management, making it more suitable for long-term trading compared to aggressive grid systems.

🧩 Bollinger Bands Inputs – Entry Logic

➡️ Period Bollinger Bands: 20

- Standard Bollinger Bands period.

- Well-balanced for most timeframes.

➡️ Deviation Bollinger Bands: 2.0

- Classic deviation value.

- Signals are generated when price reaches statistical extremes.

➡️ Shift Bollinger Bands: 0

- No forward or backward shifting.

- Signals are based on real-time price action.

➡️ Applied Price Bollinger Bands: Close price

- Uses candle close, reducing false signals caused by spikes.

➡️ Signals Order: Any Signals (Buy-Buy-Sell-Sell)

- EA can open multiple orders in the same direction if signals persist.

- Works well with averaging strategies.

📌 Conclusion (Bollinger Bands Logic):

The EA follows a mean-reversion strategy, selling near upper bands and buying near lower bands, which performs best in ranging or sideways markets.

🧩 Averaging Settings – Grid & Recovery Logic

➡️ Multiplier for size of orders: 1.5

- Each new averaging order increases lot size by 1.5x.

- This is a moderate martingale multiplier, not overly aggressive.

➡️ Step for pending orders: 300 points

- Wide spacing between grid orders.

- Helps prevent over-trading during strong trends.

📌 Conclusion (Averaging Settings):

The EA uses a controlled averaging system, balancing recovery speed with drawdown control.

🧩 Take Profit Settings – Exit Strategy

➡️ Trailing Start: 100 points

- Trailing stop activates after 100 points of profit.

- Prevents premature trailing.

➡️ Trailing Step: 25 points

- Tight trailing distance.

- Locks in profits efficiently during favorable price movement.

📌 Conclusion (Take Profit Strategy):

Instead of a fixed TP, the Expert advisor (EA) relies on dynamic trailing, allowing profits to run while still protecting gains.

🧩 Protection Settings – Risk Filters

➡️ Maximum slippage in points: 30

- Reasonable execution tolerance.

- Avoids poor fills during high volatility.

➡️ Maximum spread in points: 75

- Prevents trading during high-spread conditions such as news or rollover.

➡️ Maximum size of orders: 100.0 lots

- Very high technical limit.

- Practically unreachable due to conservative autolot settings.

➡️ Maximum number of orders: 200

- High cap, but grid spacing and filters reduce the likelihood of reaching this limit.

📌 Conclusion (Protection):

The EA includes solid execution and spread protection, which significantly improves stability compared to unfiltered grid EAs.

🧩 Advisor Settings – Trade Control & Identification

➡️ Orders Magic Number: 12345

- Ensures the EA manages only its own trades.

➡️ Comments of the EA’s orders: AW Bollinger Bands EA

- Useful for trade tracking and analysis.

➡️ Allow OP_BUY orders: true

➡️ Allow OP_SELL orders: true

- EA can trade in both directions.

➡️ Allow to open new orders after close: true

- Continuous trading enabled.

➡️ Show panel of advisor: true

- Visual dashboard for monitoring.

➡️ Font size in panels: 4

- UI preference only.

🧩 Final Verdict – Overall Performance & Suitability

➡️ Strengths

✅ Conservative autolot money management

✅ Standard, proven Bollinger Bands strategy

✅ Controlled grid spacing

✅ Trailing profit system

✅ Spread and slippage protection

➡️ Weaknesses

❌ No hard Stop Loss

❌ Grid averaging still carries drawdown risk

❌ Performance weak in strong trending markets

🔵 Final Conclusion

The AW Bollinger Bands EA, based on the settings shown, is a medium-risk, mean-reversion trading system with well-balanced money management. Unlike aggressive martingale EAs, this setup prioritizes capital preservation, wide grid spacing, and dynamic profit protection.

👉 Best suited for:

- Sideways or ranging markets

- Medium to large accounts

- Traders seeking steady growth over time

⚠️ Not ideal for:

- Strong trending markets

- Traders who require strict stop-loss control