🧩 What is AW Breakout Catcher EA?

AW Breakout Catcher EA for MetaTrader 4 (MT4) focuses on trading parameters, risk behavior, grid logic, breakout strategies, and overall stability.

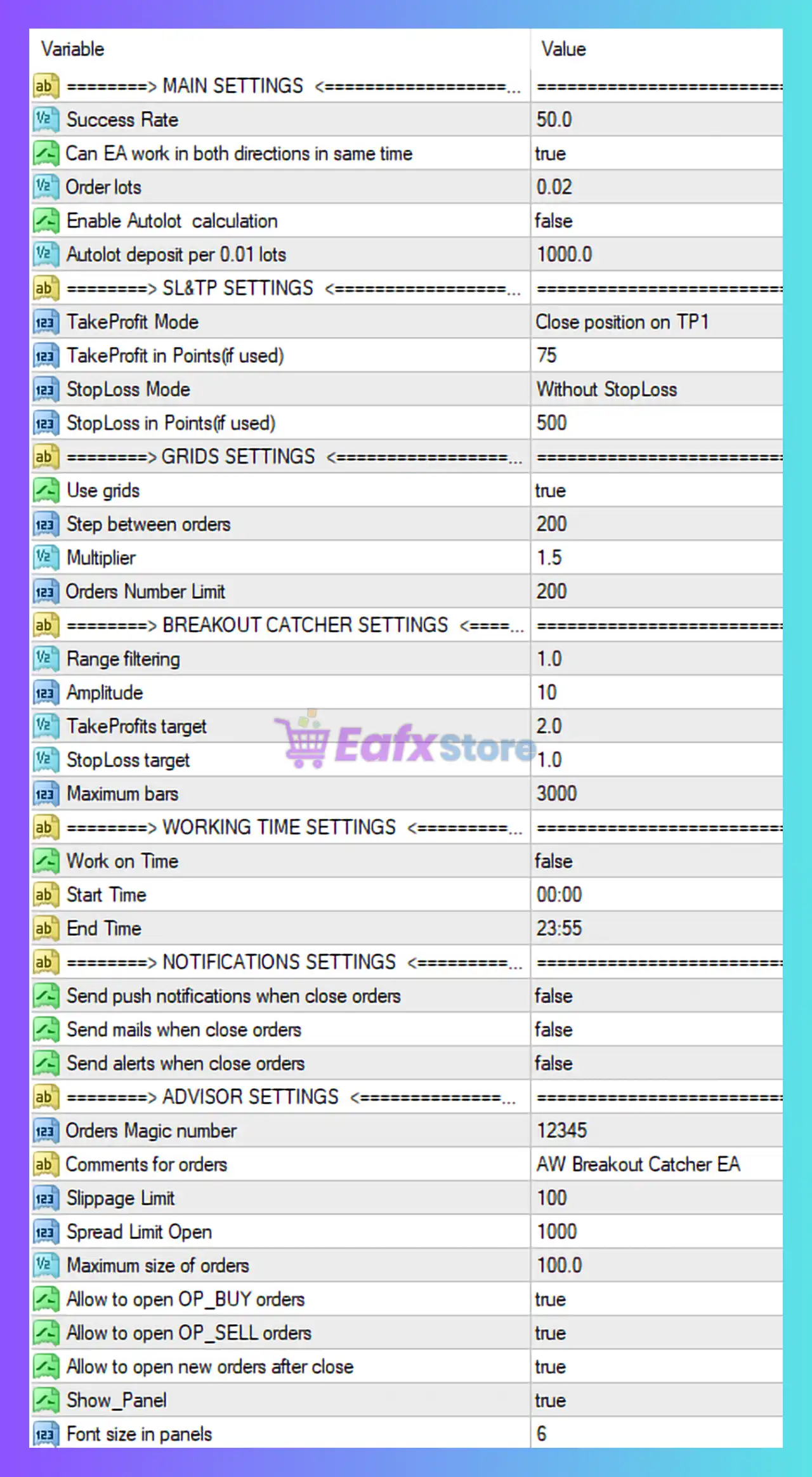

🧩 Main Trading Settings – Core Behavior

➡️ Success Rate: 50.0

- This is a reference parameter, not a guarantee.

- Indicates the EA is designed to work with probability balance, relying on money management and grid logic rather than high win rate.

➡️ Can EA work in both directions at same time: true

- The EA can open BUY and SELL trades simultaneously.

- This is common in breakout and grid strategies, allowing capture of volatility in either direction.

- ⚠️ Increases margin usage and exposure.

➡️ Order Lots: 0.02

- Fixed lot size.

- Suitable for small to medium accounts, but still risky when grids expand.

- No dynamic lot scaling unless AutoLot is enabled.

➡️ Enable Autolot calculation: false

- EA does not adjust lot size based on balance or equity.

- Risk does not scale automatically with account growth or drawdown.

➡️ Autolot deposit per 0.01 lots: 1000.0

- This value is inactive because Autolot is disabled.

📌 Conclusion (Main Settings):

The EA uses manual fixed risk, which gives control but requires strong discipline. Risk can grow quickly if grid orders accumulate.

🧩 SL & TP Settings – Exit Strategy

➡️ TakeProfit Mode: Close position on TP1

- The EA closes trades when the first Take Profit level is hit.

- This is a fast-exit approach, suitable for volatile breakout moves.

➡️ TakeProfit in Points (if used): 75

- A relatively small TP, aiming for quick profits.

- Works best in active sessions (London / New York).

➡️ StopLoss Mode: Without StopLoss

- ⚠️ High-risk configuration.

- Trades are protected only by grid expansion, not a hard SL.

➡️ StopLoss in Points (if used): 500

- Ignored because StopLoss is disabled.

📌 Conclusion (SL/TP):

This EA relies on grid recovery instead of stop loss, which can lead to deep drawdowns during strong trends.

🧩 Grid Trading Settings – Risk Amplifier

➡️ Use grids: true

- Confirms the EA is a Grid + Breakout hybrid strategy.

➡️ Step between orders: 200 points

- Moderate grid spacing.

- Helps avoid over-trading but still allows grid buildup in trends.

➡️ Multiplier: 1.5

- Each new grid order increases lot size by 1.5x.

- This is a martingale-style risk escalation.

➡️ Orders Number Limit: 200

- Very high limit.

- Practically allows unlimited grid expansion, which is dangerous in prolonged trends.

📌 Conclusion (Grid Settings):

This configuration favors aggressive recovery, but exposes the account to margin exhaustion if the market trends strongly without retracement.

🧩 Breakout Catcher Settings – Strategy Logic

➡️ Range filtering: 1.0

- Minimal filtering.

- EA is very sensitive to price movement, entering trades frequently.

➡️ Amplitude: 10

- Small breakout threshold.

- Suitable for scalping breakouts, but increases false signals.

➡️ TakeProfits target: 2.0

- Likely a multiplier-based TP, aiming for fast exits.

➡️ StopLoss target: 1.0

- Logical stop reference, but ineffective since SL is disabled globally.

➡️ Maximum bars: 3000

- Large historical range for breakout calculations.

- Helps adapt to long-term price structure.

📌 Conclusion (Breakout Logic):

The EA is tuned for frequent breakout detection, prioritizing entry speed over signal quality.

🧩 Working Time Settings – Trading Schedule

➡️ Work on Time: false

- EA trades 24/5 without time restriction.

➡️ Start Time: 00:00

➡️ End Time: 23:55

- These values are irrelevant unless time filtering is enabled.

📌 Conclusion:

Continuous trading increases opportunities but also exposes the EA to low-liquidity and news-driven risk.

🧩 Notifications Settings

All notification options are set to false:

- No push notifications

- No emails

- No alerts

📌 Conclusion:

The trader must actively monitor the account. This is not ideal for a high-risk grid EA.

🧩 Advisor & Execution Settings

➡️ Orders Magic Number: 12345

- Ensures trade isolation from other EAs.

➡️ Comments for orders: AW Breakout Catcher EA

- Helpful for tracking trades in history.

➡️ Slippage Limit: 100

- Very high.

- Allows execution even during volatile conditions, but increases entry risk.

➡️ Spread Limit Open: 1000

- Extremely permissive.

- EA may trade during high spread events (rollover, news).

➡️ Maximum size of orders: 100.0 lots

- Very high ceiling.

- Combined with grid + multiplier = extreme risk potential.

➡️ Allow BUY / SELL orders: true

- Full directional flexibility.

➡️ Allow open new orders after close: true

- EA can immediately re-enter the market, increasing trade frequency.

➡️ Show Panel: true

- Visual monitoring enabled.

➡️ Font size in panels: 6

- UI preference only.

🧩 Final Verdict – Overall Risk & Suitability

➡️ Strengths

✅ Fast breakout detection

✅ Works in both market directions

✅ Suitable for volatile markets

✅ Aggressive profit capture

➡️ Weaknesses

❌ No hard Stop Loss

❌ Grid + Martingale exposure

❌ Very high max orders and lot limits

❌ No trading session filter

❌ No alert or notification system

🔴 Final Conclusion

The AW Breakout Catcher EA, as configured in the image, is a high-risk breakout grid trading system. It is designed to capitalize on short-term volatility but relies heavily on grid recovery and increasing lot sizes instead of strict risk control.

👉 This setup is not recommended for conservative traders or small accounts.

👉 Best suited for experienced traders, cent or high-equity accounts, and carefully monitored environments.

⚠️ Without a Stop Loss and with aggressive grid settings, account drawdown or margin call is a real possibility during strong, one-directional market trends.