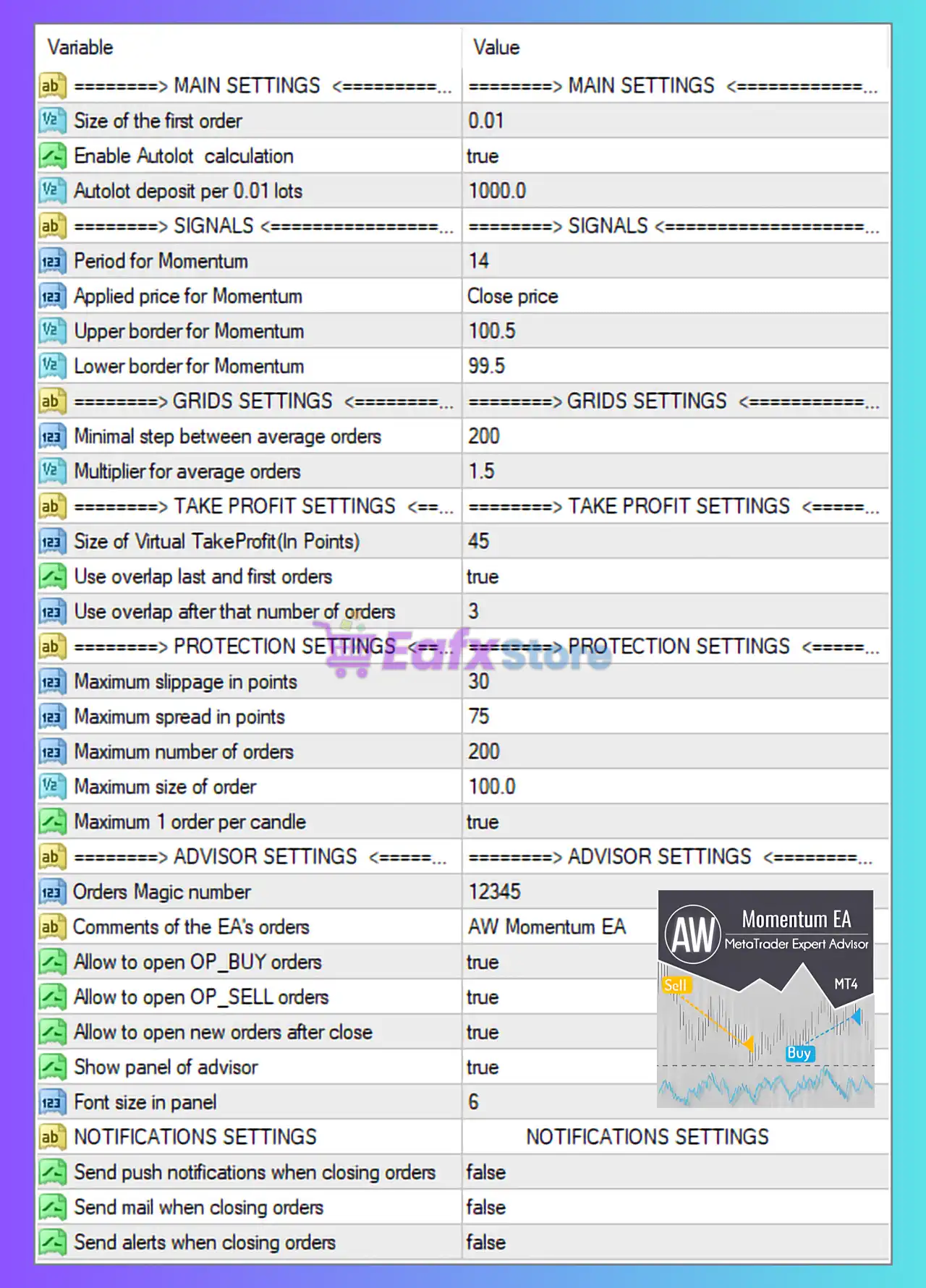

🧩 Overview of AW Momentum EA

AW Momentum EA is an automated trading system for MetaTrader 4 (MT4) that combines Momentum indicator signals with a Grid and Averaging strategy, enhanced by risk protection and virtual take-profit logic. The settings shown in the image indicate a balanced-to-aggressive configuration, suitable for trending and semi-ranging markets when properly managed.

🧩 Main Settings Analysis

🔹 Size of the first order: 0.01

- Minimum lot size, ideal for small accounts or testing.

- Helps reduce initial risk exposure.

🔹 Enable Autolot calculation: true

- EA dynamically adjusts lot size based on account balance.

- Improves scalability and capital efficiency.

🔹 Autolot deposit per 0.01 lots: 1000.0

- For every $1,000 balance, EA trades 0.01 lot.

- Indicates conservative money management.

✅ Assessment: Safe starting configuration suitable for long-term use.

🧩 Signals (Momentum Indicator Settings)

🔹 Period for Momentum: 14

- Standard momentum period.

- Well-balanced between sensitivity and noise filtering.

🔹 Applied price for Momentum: Close price

- Uses confirmed candle close data.

- Reduces false signals compared to open or median prices.

🔹 Upper border: 100.5

🔹 Lower border: 99.5

- Defines momentum breakout thresholds.

- Trades are triggered when price shows real directional strength.

✅ Assessment: Reliable momentum filtering, not overly aggressive.

🧩 Grid Settings

🔹 Minimal step between average orders: 200 points

- Prevents over-trading in tight ranges.

- Helps reduce drawdown during consolidation.

🔹 Multiplier for average orders: 1.5

- Mild martingale behavior.

- Risk increases gradually instead of exponentially.

⚠️ Assessment: Moderately aggressive grid logic—acceptable with proper account size.

🧩 Take Profit Settings

🔹 Size of Virtual TakeProfit (in points): 45

- Uses virtual TP instead of broker-side TP.

- Allows better order management and stealth execution.

🔹 Use overlap last and first orders: true

- Closes grouped positions together.

- Improves basket efficiency.

🔹 Use overlap after number of orders: 3

- Grid overlap activates after 3 trades.

- Helps recover floating drawdown earlier.

✅ Assessment: Smart basket-closing logic optimized for grid recovery.

🧩 Protection Settings (Risk Management)

🔹 Maximum slippage: 30 points

- Reasonable tolerance for volatile markets.

🔹 Maximum spread: 75 points

- Prevents trading during abnormal market conditions.

🔹 Maximum number of orders: 200

- High limit – suitable only for large or cent accounts.

🔹 Maximum size of order: 100.0 lots

- Safety cap for autolot escalation.

🔹 Maximum 1 order per candle: true

- Prevents over-execution on fast price spikes.

⚠️ Assessment: Strong protection features, but max orders should be reduced for small accounts.

🧩 Advisor (EA) Settings

🔹 Orders Magic Number: 12345

- Unique identifier to avoid conflict with other EAs.

🔹 Comments: AW Momentum EA

- Easy trade tracking in MT4 terminal.

🔹 Allow BUY orders: true

🔹 Allow SELL orders: true

- EA trades in both directions.

🔹 Allow new orders after close: true

- Continues trading immediately after basket closure.

🔹 Show panel of advisor: true

- Displays real-time EA information on chart.

🔹 Font size in panel: 6

- Compact UI, suitable for multiple charts.

🧩 Notifications Settings

🔹 Push notifications: false

🔹 Email alerts: false

🔹 Alerts when closing orders: false

📌 Assessment: Notifications disabled – suitable for VPS trading but not ideal for manual monitoring.

🧩 Final Conclusion (Expert Review)

The AW Momentum EA configuration shown in the image reflects a well-structured grid-based momentum trading system with:

- ✅ Conservative initial lot sizing

- ✅ Smart momentum filtering

- ✅ Controlled grid expansion

- ✅ Advanced virtual take-profit logic

- ✅ Solid protection against spread, slippage, and over-trading

However, the high maximum order limit (200) and martingale multiplier (1.5) mean this setup is best suited for medium to large accounts, preferably on low-spread brokers and VPS environments.

⭐ Overall Rating: 8.5 / 10

Best for traders who understand grid strategies and want a momentum-filtered EA with strong recovery logic.