Home »

Blog »

Cherma MT4 – Full Settings Analysis & Trading Strategy Insights Cherma MT4 – Full Settings Analysis & Trading Strategy Insights

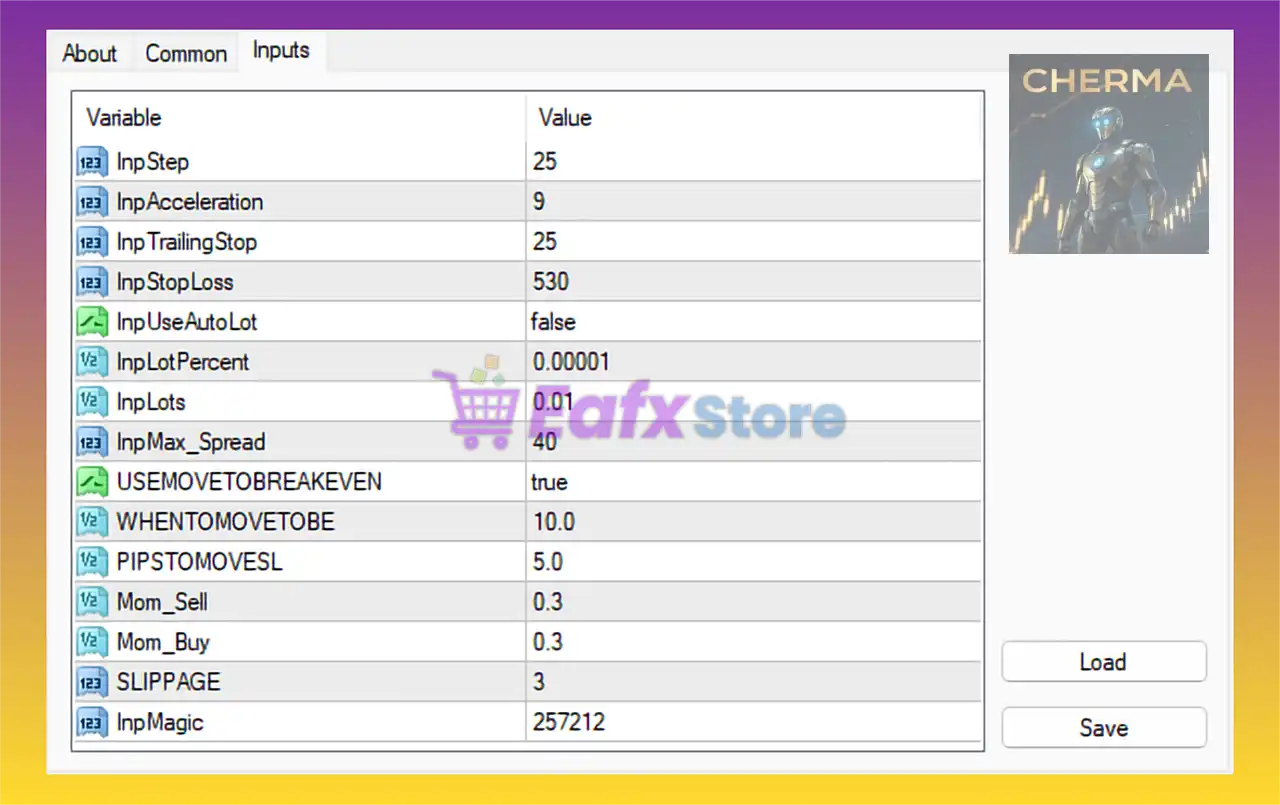

The following parameters are found in the Inputs tab of the Cherma Expert Advisor (MT4), offering insights into trade execution, risk management, and strategy behavior.

📌📌📌 Buy this unlimited Cherma MT4 product here 📌📌📌

Cherma MT4 – Full Settings Analysis & Trading Strategy Insights 4 🔧 Core Trading Settings

Parameter Value Description InpStep25 Distance in points between grid trades. Affects trade frequency and spacing. InpAcceleration9 Speed at which lot sizes or step distances increase in grid/martingale mode. InpTrailingStop25 Enables trailing stop after a trade is in profit by this number of points. InpStopLoss530 Fixed stop-loss in points, defining max loss per trade.

💼 Lot Sizing & Risk Management

Parameter Value Description InpUseAutoLotfalse Disables automatic lot sizing. Manual control is used. InpLotPercent0.00001 Used for dynamic lot calculation (when InpUseAutoLot = true). InpLots0.01 Fixed lot size per trade when auto lot sizing is off.

📉 Spread and Execution Settings

Parameter Value Description InpMax_Spread40 Maximum allowed spread in points for trade execution. Helps avoid high-cost trades. SLIPPAGE3 Maximum allowed slippage in points. Ensures execution within a controlled range.

⚙️ Break-Even and Momentum Controls

Parameter Value Description USEMOVETOBREAKEVENtrue Enables break-even functionality to secure profits when a trade moves favorably. WHENTOMOVETOBE10.0 Trade moves this many points in profit before breakeven activates. PIPSTOMOVESL5.0 After breakeven, the stop loss is moved this many points into profit. Mom_Sell0.3 Momentum threshold for initiating sell trades. Mom_Buy0.3 Momentum threshold for initiating buy trades.

🔢 Miscellaneous

Parameter Value Description InpMagic257212 Unique identifier for trades placed by this EA. Prevents conflicts with others.

📌 Conclusion: What Do These Settings Tell Us?

These Cherma EA settings suggest a conservative, grid-style strategy with the following characteristics:

Manual lot sizing is in use, likely for tighter control over risk.Moderate stop-loss (530 points) ensures risk protection per trade.Trailing stop (25 points) and break-even logic are implemented to protect profits.High momentum threshold (0.3) indicates trades are only taken under strong trend conditions.Spread filter (max 40 points) prevents trades in volatile market conditions.Slippage control (3 points) helps ensure optimal trade entries.