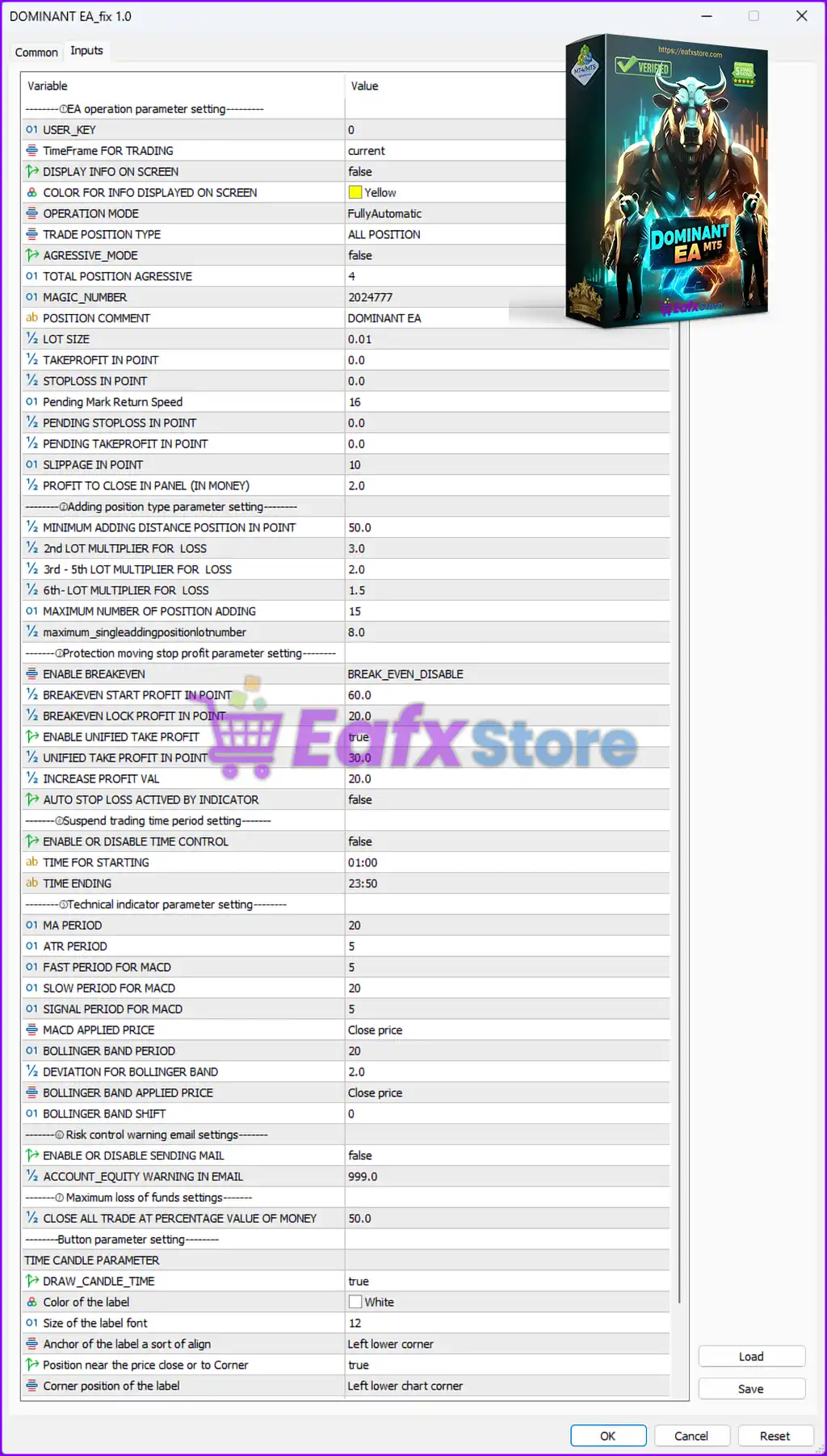

Dominant EA MT5 is a fully automated forex trading robot that incorporates advanced position management, risk control, and technical indicators to optimize trade execution. Below is a comprehensive breakdown of its input parameters, strategy, and trading logic.

Introduction

Dominant EA MT5 is a powerful and sophisticated Expert Advisor (EA) designed for traders seeking automated precision and consistent profitability on the MetaTrader 5 (MT5) platform. This advanced forex trading robot specializes in executing high-accuracy trades, particularly excelling in XAUUSD (Gold) and other currency pairs. By leveraging cutting-edge algorithmic strategies, Dominant EA eliminates the complexities of manual trading, ensuring optimal trade execution while maintaining controlled risk management.

🔹 Key Trading Parameters & Settings

📌 EA Operation & Execution Settings

| Parameter | Value | Explanation |

|---|---|---|

| OPERATION MODE | FullyAutomatic | The EA runs in full automation, meaning no manual intervention is required. |

| TRADE POSITION TYPE | ALL POSITION | The EA can handle both buy and sell positions. |

| AGGRESSIVE_MODE | False | Disables aggressive trading; implies a conservative approach. |

| TOTAL POSITION AGGRESSIVE | 4 | Limits aggressive positions to 4 trades at a time. |

| LOT SIZE | 0.01 | Minimum lot size per trade; low risk setting. |

| MAGIC_NUMBER | 2024777 | Unique identifier for trade tracking. |

| STOPLOSS IN POINT | 0.0 | No fixed stop-loss, meaning dynamic exit strategies might be used. |

| TAKEPROFIT IN POINT | 0.0 | No fixed take-profit; exit is determined by market conditions or trailing stops. |

📌 Trading Mode Insight:

👉 Low-risk settings with automated control over trade entry and exit.

👉 No fixed stop loss or take profit, likely relying on breakeven or trailing stops.

📌 Trade Management & Risk Control

| Parameter | Value | Explanation |

|---|---|---|

| SLIPPAGE IN POINT | 10 | Allows a 10-point price deviation to avoid slippage errors. |

| PROFIT TO CLOSE IN PANEL (IN MONEY) | 2.0 | Closes trades when $2.0 profit is achieved. |

| MAXIMUM NUMBER OF POSITION ADDING | 15 | The EA can open up to 15 trades in a sequence. |

| MINIMUM ADDING DISTANCE POSITION IN POINT | 50.0 | New trades are opened 50 points apart. |

| MULTIPLIER FOR LOSS | 3.0 / 2.0 / 1.5 | Uses a martingale-like approach to recover losses with increased lot sizes. |

| ENABLE BREAKEVEN | Break_Even_Disable | Breakeven function is disabled, meaning the EA might rely on trailing stops instead. |

| UNIFIED TAKE PROFIT | True | The EA applies a unified take profit across all trades. |

| CLOSE ALL TRADE AT PERCENTAGE VALUE OF MONEY | 50.0% | If 50% of the account balance is lost, all trades will be closed. |

📌 Risk Control Insight:

👉 Martingale-like risk strategy detected – The EA increases lot size after losses to recover previous losses.

👉 A large drawdown could occur if multiple trades move against the position.

👉 Failsafe protection exists (closing all trades at 50% loss).

📌 Time & Execution Settings

| Parameter | Value | Explanation |

|---|---|---|

| ENABLE OR DISABLE TIME CONTROL | False | The EA operates 24/7 without time restrictions. |

| TIME FOR STARTING | 01:00 | Trading starts at 01:00 server time. |

| TIME ENDING | 23:50 | Trading stops at 23:50 (almost 24-hour coverage). |

📌 Execution Timing Insight:

👉 The EA runs continuously without restrictions, meaning it can operate in all market conditions.

👉 Time settings allow customization, but they are disabled by default.

📌 Technical Indicator Settings

| Parameter | Value | Explanation |

|---|---|---|

| MA PERIOD | 20 | Moving Average (MA) set to 20 periods. |

| ATR PERIOD | 5 | Average True Range (ATR) used for volatility analysis. |

| FAST PERIOD FOR MACD | 5 | The fast line in the MACD indicator. |

| SLOW PERIOD FOR MACD | 20 | The slow line in the MACD indicator. |

| SIGNAL PERIOD FOR MACD | 5 | The signal line in the MACD indicator. |

📌 Indicator-Based Strategy Insight:

👉 Uses MACD, ATR, and Moving Averages for trade confirmations.

👉 ATR is used to gauge market volatility and may influence stop-loss placement.

👉 Moving Average (MA) serves as a trend filter, preventing trades against the trend.

🔹 Trading Strategy Breakdown

Based on the settings and risk management parameters, the Dominant EA 1.0 employs a trend-following grid/martingale strategy with low-risk trade entries but increasing lot sizes to recover losses.

✔️ Key Features:

- Fully automated trading with no manual intervention needed.

- Trend-following approach using MA, ATR, and MACD.

- Lot sizing starts low (0.01) but increases after losses (martingale-like).

- Flexible time control and risk management system.

- Closes trades at a specific profit target rather than fixed pips.

⚠️ Potential Risks:

- Martingale-style trading can lead to high drawdowns if not properly managed.

- Breakeven is disabled, which means trades might not automatically lock in profit.

- No fixed stop loss – relies on margin control and profit targets instead.

💡 Final Verdict: Should You Use Dominant EA?

✅ Pros:

✔️ Automated Trend-Following with Grid/Martingale Recovery – Ensures optimized trading performance.

✔️ Highly Configurable Settings – Adjustable lot sizing, position scaling, and risk management.

✔️ Uses Multiple Indicators (MACD, ATR, Moving Average) – Helps filter bad trades.

✔️ Failsafe Protection (Closes at 50% Loss) – Prevents total account blowout.

❌ Cons:

⚠️ Martingale-Style Risk – Increasing lot sizes can result in larger losses if trends continue against the EA.

⚠️ Breakeven Disabled by Default – May require manual intervention in high volatility.

⚠️ No Fixed Stop-Loss (Relies on Dynamic Positioning) – Can lead to unpredictable risk exposure.

📌 Final Rating: 8.5/10 ⭐⭐⭐⭐⭐

👉 Best for traders with medium to high-risk tolerance who are comfortable with grid-style trading.

👉 Not suitable for low-risk traders due to the martingale recovery mechanism.

👉 Works best in trending markets, where price corrections allow position scaling to recover losses.

🔹 Recommended Usage:

💡 Use Dominant EA with a broker that allows high leverage (1:500+) to avoid margin calls.

💡 Optimize breakeven & stop-loss settings to reduce exposure to high drawdowns.

💡 Test on a demo account first before deploying on a live trading account.