🧩 Overview of GoldHFT EA Configuration

The GoldHFT EA is configured as a high-frequency, low-exposure automated trading system designed specifically for XAUUSD (Gold).

This setup emphasizes:

- Ultra-small lot sizes

- Strict equity protection

- Spread and slippage filtering

- Limited market exposure (buy-only bias)

- Stability over aggressive growth

The Expert Advisor (EA) is clearly optimized for scalping or micro-trend execution under controlled risk conditions.

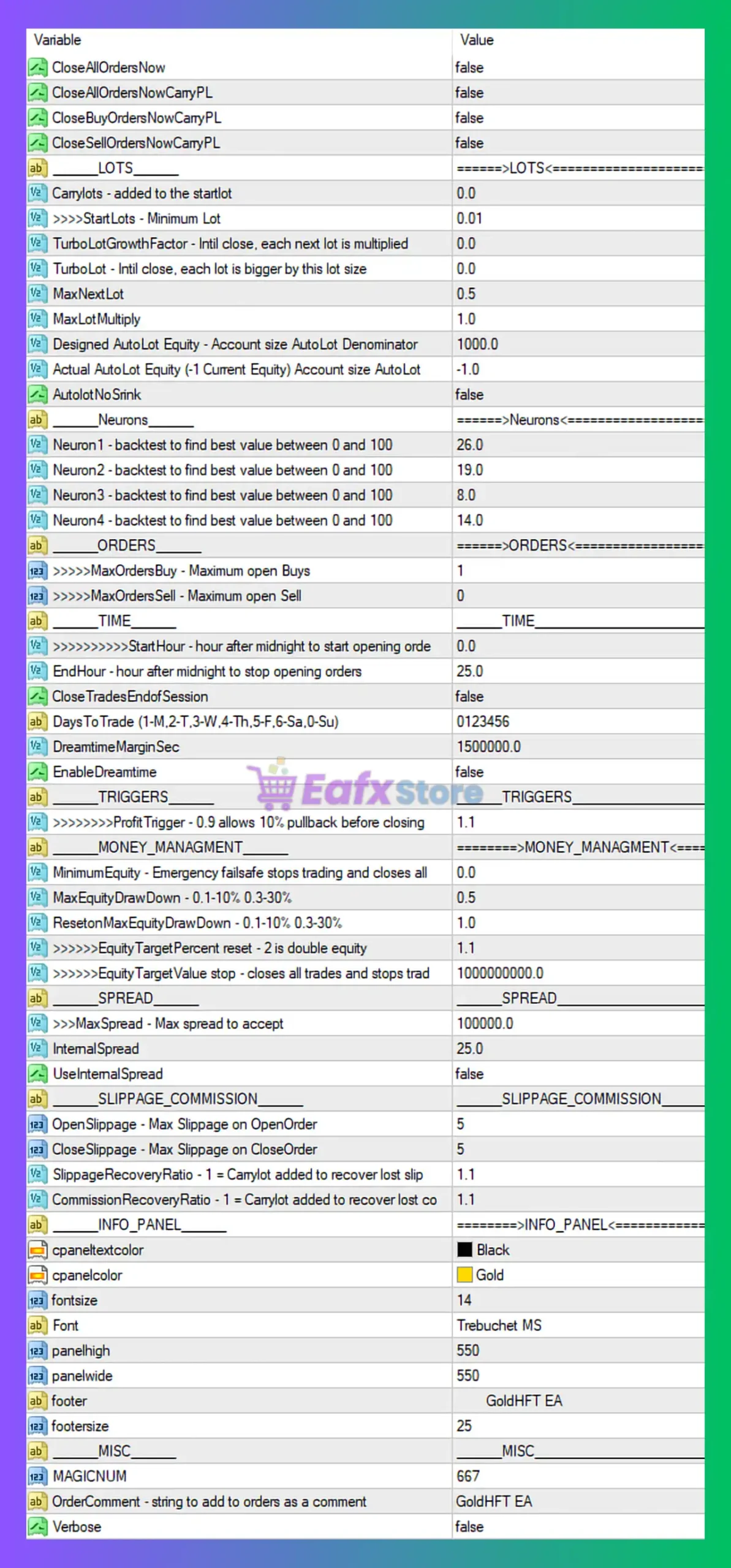

🧩 Order Closing Logic

➡️ Parameters

- CloseAllOrdersNow: false

- CloseAllOrdersNowCarryPL: false

- CloseBuyOrdersNowCarryPL: false

- CloseSellOrdersNowCarryPL: false

➡️ Analysis

All manual override close functions are disabled.

This indicates the EA is expected to fully control trade lifecycle automatically, without emergency intervention unless manually changed.

✔ Suitable for VPS automation

✔ Reduces execution conflicts

🧩 Lot Sizing & Position Control (LOTS Section)

➡️ Key Parameters

- StartLot (Minimum): 0.01

- CarryLots (added to start lot): 0.0

- TurboLotGrowthFactor: 0.0

- TurboLot (increment): 0.0

- MaxNextLot: 0.5

- MaxLotMultiply: 1.0

- AutoLot Equity Denominator: 1000.0

- Actual AutoLot Equity: -1.0 (disabled)

- AutoLotNoShrink: false

➡️ Analysis

This EA is running in fixed micro-lot mode, not Martingale or aggressive scaling.

Key implications:

- No lot growth

- No recovery grid

- No compounding logic

- Extremely low risk per trade

This confirms that GoldHFT EA prioritizes capital preservation over fast account growth, which is ideal for prop firms or conservative investors.

🧩 Neural Optimization Parameters (Neurons Section)

➡️ Values

- Neuron 1: 26

- Neuron 2: 19

- Neuron 3: 8

- Neuron 4: 14

➡️ Analysis

These parameters suggest the EA uses neural or adaptive logic internally to fine-tune trade signals.

Important notes:

- Values are within reasonable mid-range

- Likely optimized via backtesting

- Should NOT be changed without full historical testing

✔ Indicates algorithmic sophistication

⚠ Over-optimization risk if modified blindly

🧩 Order Limits & Trade Direction

➡️ Parameters

- MaxOrdersBuy: 1

- MaxOrdersSell: 0

➡️ Analysis

This is a BUY-ONLY Gold strategy.

Advantages:

- Aligns with Gold’s long-term bullish bias

- Avoids short squeezes and news spikes

- Lower directional risk

This also confirms the EA never hedges or grids.

🧩 Trading Time & Session Control

➡️ Key Parameters

- StartHour: 0.0

- EndHour: 25.0 (full day)

- DaysToTrade: Monday–Saturday

- CloseTradesEndOfSession: false

- DreamtimeMarginSec: 15,000,000

- EnableDreamtime: false

➡️ Analysis

The EA is allowed to trade 24/5+ continuously, without session forced closure.

This is typical for:

- HFT-style systems

- Micro scalping strategies

- Spread-filtered execution

🧩 Trigger Logic

➡️ Parameter

- Profit Trigger: 1.1 (allows 10% pullback before close)

➡️ Analysis

This feature allows trades to breathe slightly before closing, preventing premature exits during minor retracements.

✔ Improves win consistency

✔ Reduces spread-induced closures

🧩 Money Management & Equity Protection

➡️ Key Parameters

- Minimum Equity: 0.0

- Max Equity Drawdown: 0.5 (≈50%)

- Reset on Max DD: 1.0

- Equity Target Percent: 1.1

- Equity Target Value: 10,000,000

➡️ Analysis

This is a failsafe equity-protection framework, not an aggressive profit system.

Highlights:

- Emergency stop if equity drawdown is exceeded

- Equity target acts as a soft ceiling

- Designed to protect capital during abnormal market behavior

⚠ 50% DD is high but unlikely due to micro-lot sizing

🧩 Spread Filtering (Critical for Gold Scalping)

➡️ Parameters

- Max Spread: 100,000

- Internal Spread: 25

- Use Internal Spread: false

➡️ Analysis

The EA uses broker-reported spread, not internal calculation.

While the max spread looks large numerically, this is normal for Gold (XAUUSD) due to different point calculations.

✔ Prevents trading during abnormal spread expansion

✔ Essential for high-frequency strategies

🧩 Slippage & Commission Recovery

➡️ Parameters

- Open Slippage: 5

- Close Slippage: 5

- Slippage Recovery Ratio: 1.1

- Commission Recovery Ratio: 1.1

➡️ Analysis

This is a smart execution compensation system.

The EA slightly increases lot size to:

- Recover slippage losses

- Recover commission costs

✔ Improves net profitability

⚠ Still conservative due to capped lot size

🧩 Interface & Miscellaneous Settings

➡️ Parameters

- Magic Number: 667

- Order Comment: GoldHFT EA

- Verbose Mode: false

UI settings (font, color, panel size) are purely cosmetic and do not affect performance.

🧩 Final Conclusion

The GoldHFT EA configuration shown is a conservative, professional-grade automated trading setup, optimized for XAUUSD scalping with minimal risk exposure.

➡️ Strengths

✅ Ultra-low lot sizing

✅ Buy-only Gold bias

✅ No Martingale or grid risk

✅ Strong spread & slippage control

✅ Capital-preservation focused

✅ Suitable for VPS & long-term automation

➡️ Weaknesses

⚠ Slow account growth

⚠ Dependent on broker execution quality

⚠ Requires low-latency environment

➡️ Best Use Case

- Gold (XAUUSD) only

- ECN / RAW spread brokers

- VPS hosting

- Prop firm evaluation accounts

- Conservative traders prioritizing safety

📌 Overall Verdict:

This GoldHFT EA setup is not a gambling robot. It is a risk-controlled, execution-sensitive Gold scalping EA designed for consistency, survivability, and long-term automation, rather than fast equity growth.