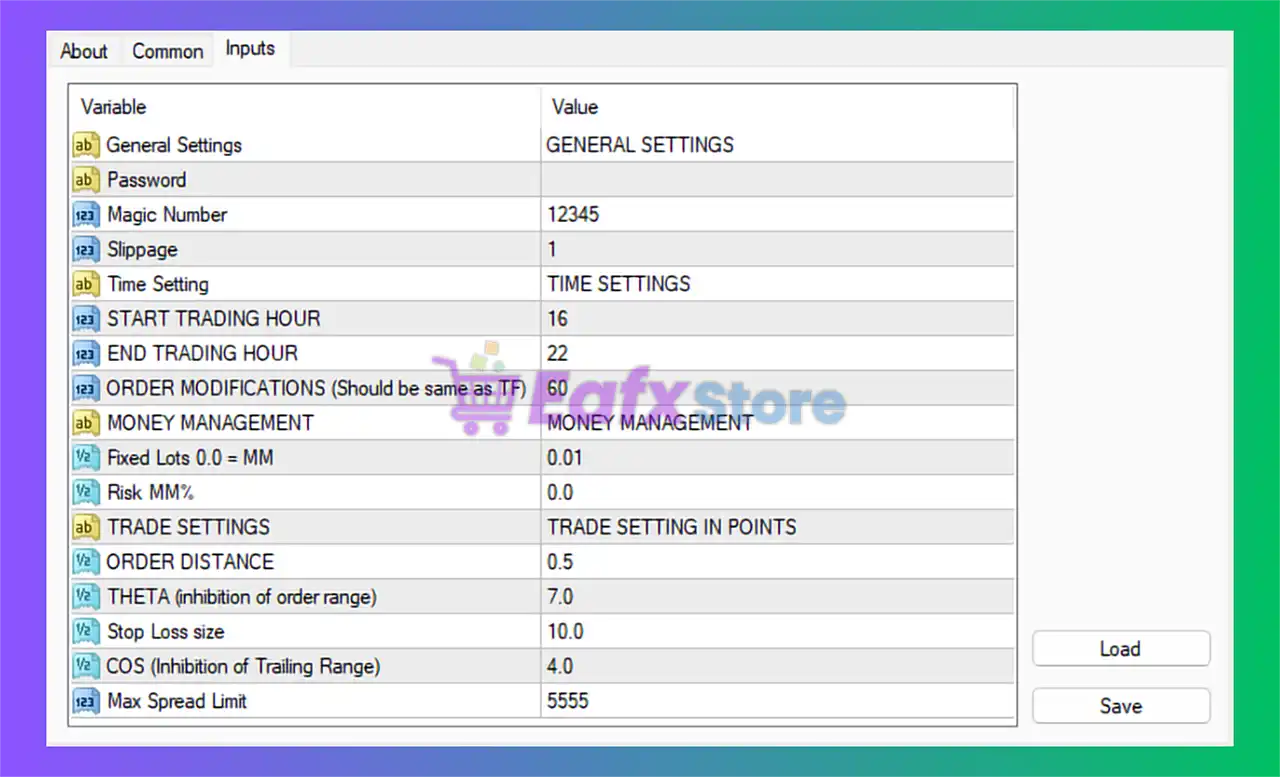

The High Frequency Trading Bot (HFT Bot) comes with advanced configuration options that allow traders to fine-tune execution, money management, and order placement with precision. These customizable inputs are designed to optimize trading performance under different market conditions while giving traders flexibility in controlling risk.

📌📌📌 Buy this unlimited High Frequency Trading Bot MT4 product here 📌📌📌

General Settings

- Magic Number: 12345

Used to uniquely identify trades opened by the EA, ensuring no conflicts with other Expert Advisors running on the same account. - Slippage: 1

Allows only minimal price deviation, which is crucial for HFT strategies where execution speed and precision are critical.

Time Settings

- Start Trading Hour: 16

- End Trading Hour: 22

The bot trades within a defined time window, focusing on high-liquidity sessions where spreads are tighter and volatility is more predictable. This helps avoid unnecessary exposure during unstable or low-volume market hours.

Money Management

- Fixed Lot: 0.01

Default trade size set at a conservative level, suitable for testing or gradual growth. - Risk %: 0.0

Indicates manual lot size mode, meaning the EA does not automatically calculate lot size based on account equity unless risk management is enabled.

Trade Settings

- Order Distance: 0.5 points

Very tight order spacing, aligning with high-frequency trading principles where multiple micro-opportunities are captured quickly. - Stop Loss Size: 10.0

Tight stop-loss to control risk exposure per trade, protecting capital in volatile conditions. - Max Spread Limit: 5555

Extremely high limit, essentially disabling spread filtering. This means the bot will execute trades regardless of spread conditions – potentially risky for live accounts but useful for testing.

Advanced Controls

- Theta (Inhibition of Order Range): 7.0

Helps filter out unnecessary trades by limiting order clustering within a specific price zone. - Cos (Inhibition of Trailing Range): 4.0

Restricts trailing stop activation, ensuring only valid profitable moves are locked in. - Order Modifications: 60 seconds

Ensures trade adjustments are not too frequent, preventing overload of broker servers and avoiding execution errors.

Conclusion

The High Frequency Trading Bot is optimized for scalping and micro-trading strategies with precise control over order distance, timing, and money management. Its configuration reveals:

✅ Strengths:

- Ultra-fast execution with minimal slippage.

- Time-filtered trading for optimal market conditions.

- Tight stop-loss for strong risk control.

- High customizability of order and trailing parameters.

⚠️ Risks:

- The extremely high Max Spread Limit (5555) can expose the system to poor execution in live trading.

- Risk % set to 0.0 disables automatic capital-based lot sizing, which may not be ideal for traders seeking adaptive money management.

👉 Best suited for:

- Traders who want to exploit high-frequency scalping opportunities.

- Users who prefer manual control over risk parameters.

- Advanced traders who can fine-tune settings for different brokers and market sessions.

In summary, the High Frequency Trading Bot offers powerful customization for aggressive scalping strategies, but requires careful parameter adjustments—especially for spread control and lot sizing—to maximize profitability and minimize risk in real trading environments.