🔍 What is Indicement MT4?

The Indicement MT4 Expert Advisor (EA) is a powerful multi-index automated trading system designed to trade US500, US30, and NAS100 with high precision and institutional-grade risk management. Below is a detailed review of its configuration parameters and what they reveal about its overall strategy, logic, and robustness.

📌📌📌 Buy this unlimited Indicement MT4 product here 📌📌📌

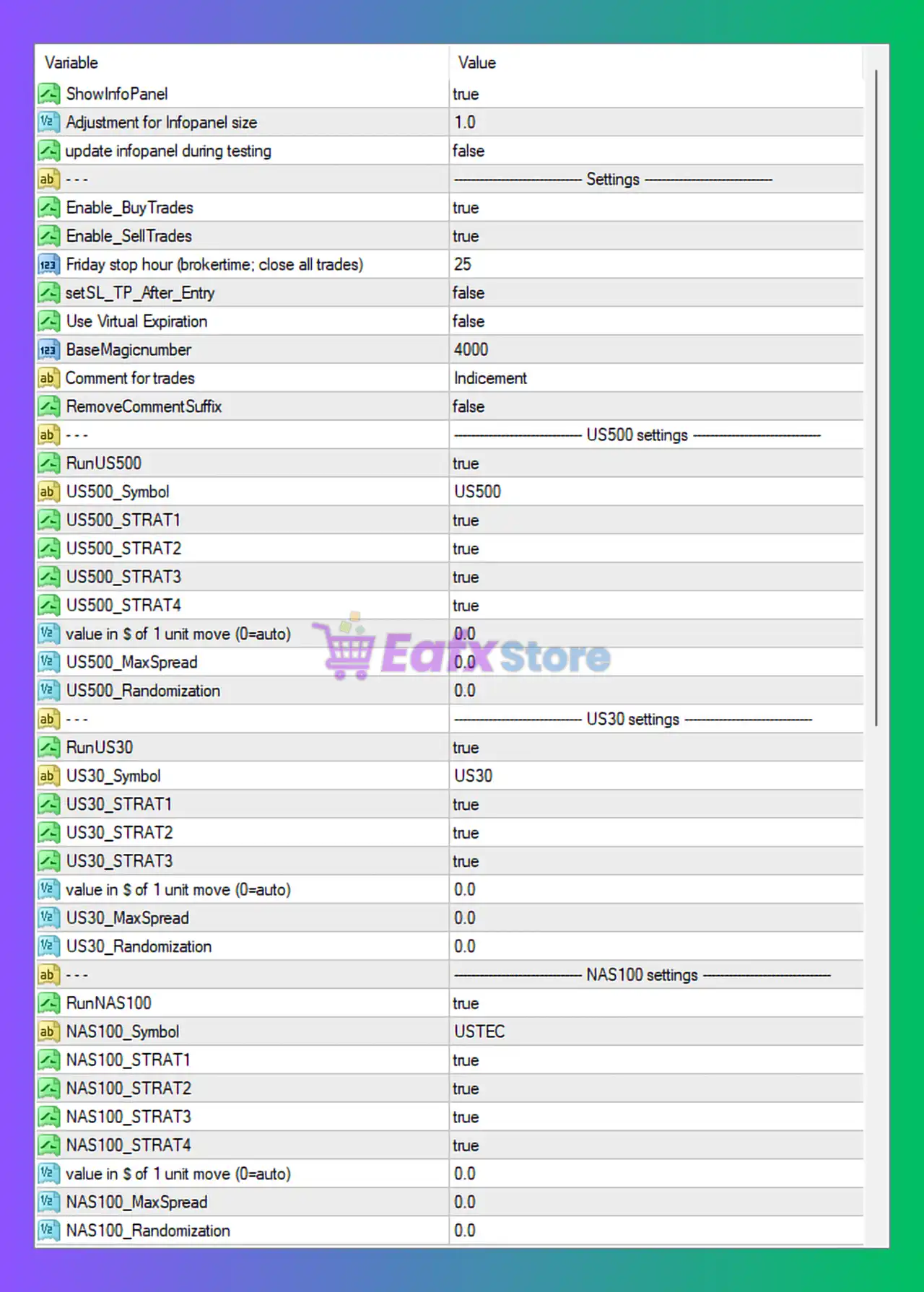

⚙️ General Configuration Overview

- Info Panel Display:

true

→ Shows real-time trade and strategy information directly on the chart for better monitoring. - Trade Direction:

- Buy Trades: Enabled

- Sell Trades: Enabled

→ The EA operates in both bullish and bearish markets, adapting dynamically to trend reversals.

- Friday Close Hour:

25

→ Automatically closes open trades before market close to prevent weekend gaps and volatility risks. - Stop Loss/Take Profit Management:

setSL_TP_After_Entry= false

→ Stop loss and take profit are pre-set before trade execution, ensuring instant protection.

- Virtual Expiration: Disabled

→ The system uses broker-visible SL/TP levels for transparency and execution reliability.

📈 Symbol-Specific Trading Systems

The EA includes three major indices with independent strategies:

🟩 US500 Settings

- Symbol: US500

- Strategies Active: STRAT1, STRAT2, STRAT3, STRAT4 =

true

→ All four strategy modules are enabled, each likely using different algorithms (trend-following, reversal, and volatility-based). - Spread & Randomization:

0.0

→ Indicates strict execution with no random deviation, focusing on stability and backtest accuracy.

🟦 US30 Settings

- Symbol: US30

- Strategies Active: STRAT1–STRAT3 =

true

→ Balanced configuration optimized for the Dow Jones index, likely using shorter timeframes and stronger trend filters. - Max Spread:

0.0→ Ideal for ECN brokers with low latency.

🟥 NAS100 Settings

- Symbol: USTEC (NASDAQ 100)

- Strategies Active: STRAT1–STRAT4 =

true

→ Full activation suggests the EA applies high-volatility strategies optimized for NASDAQ’s fast price movements.

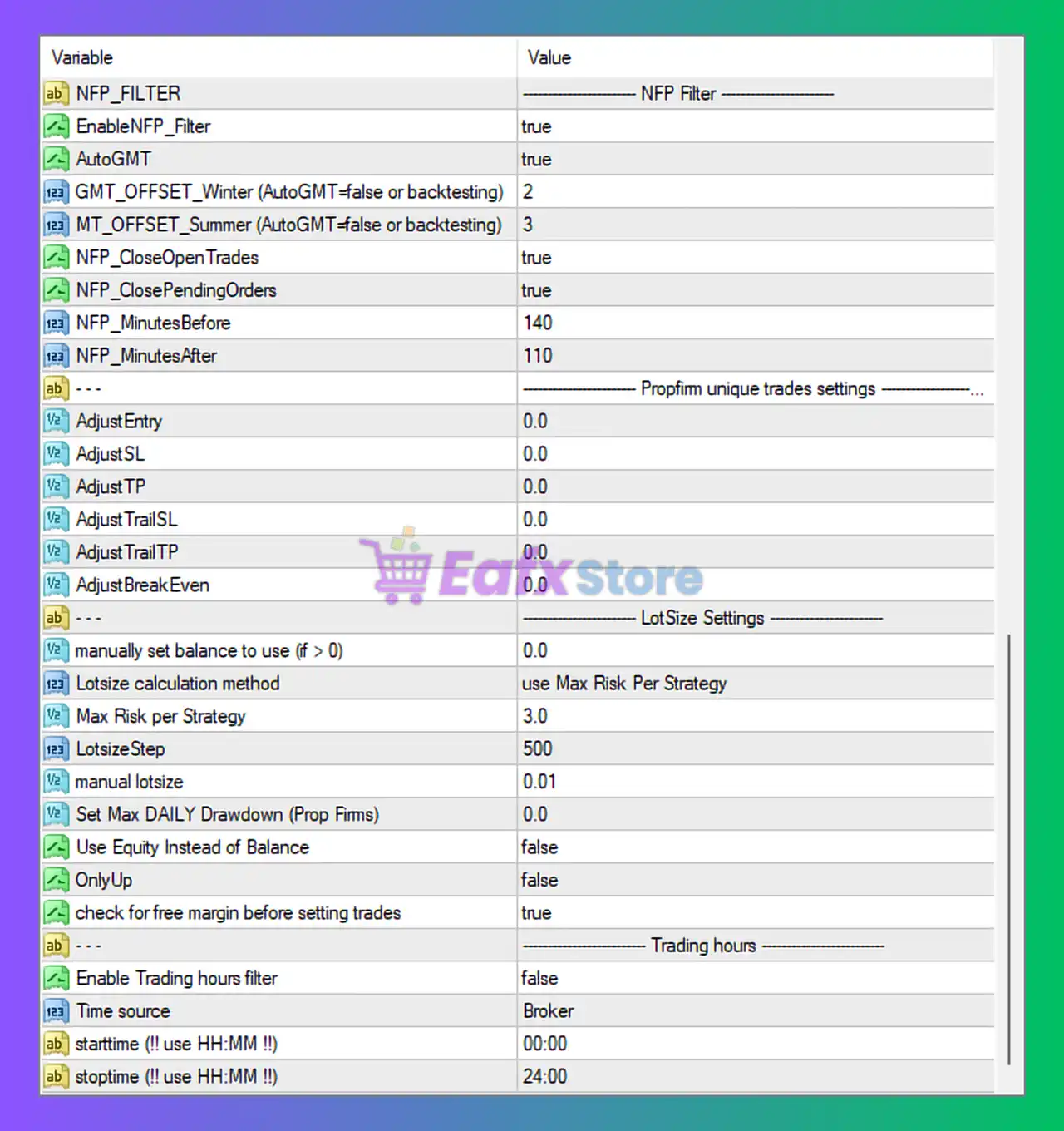

📅 NFP & High-Impact News Protection

- EnableNFP_Filter:

true - NFP_CloseOpenTrades:

true - Minutes Before/After NFP:

140/110

→ The EA automatically pauses and closes trades around Non-Farm Payroll (NFP) releases, protecting against unpredictable spikes.

→ This feature is crucial for prop firm compatibility and capital protection. - AutoGMT:

true

→ Automatically detects broker time offset (winter/summer = 2 / 3), ensuring correct NFP timing.

💰 Lot Size and Risk Management

- Lot Calculation:

use Max Risk Per Strategy - Max Risk per Strategy:

3.0%

→ Each active strategy risks a maximum of 3% of the account, maintaining balance between profitability and safety. - LotSizeStep:

500, Manual Lot:0.01

→ Default micro-lot for small accounts with scalable progression based on balance. - Daily Drawdown Limit:

0.0

→ Configurable for Prop Firm trading, allowing compliance with firm risk restrictions. - Free Margin Check:

true

→ The EA checks available margin before placing trades — prevents over-leveraging.

🕒 Trading Time Management

- Trading Hours Filter:

false

→ By default, the EA trades 24/5 (00:00–24:00) using broker time.

→ Can be customized for session-based optimization (London or New York sessions). - Time Source:

Broker

→ Ensures time synchronization with broker server — critical for precise NFP and session timing.

🧠 Additional Advanced Parameters

- AdjustEntry / AdjustSL / AdjustTP / AdjustTrailSL / AdjustBreakEven:

0.0

→ Default neutral configuration — users can fine-tune these values for more aggressive or conservative performance. - Use Equity Instead of Balance:

false

→ Trades are calculated based on account balance, not floating equity — more stable lot management. - OnlyUp:

false

→ EA does not limit trading direction — suitable for trending and ranging markets alike.

🧩 Overall Strategy Logic

The Indicement MT4 EA combines multi-index diversification with modular trading strategies (STRAT1–STRAT4) per symbol. Its core strengths lie in:

- Intelligent news avoidance (NFP filter)

- Dynamic risk allocation by strategy

- Multi-symbol operation for smoother equity curves

- Compatibility with prop firm rules (drawdown and margin control)

This EA focuses on low-risk institutional logic while maintaining enough flexibility for aggressive optimization.

📊 Summary

| Feature | Description |

|---|---|

| Platform | MetaTrader 4 |

| Assets | US500, US30, NAS100 |

| Trade Type | Buy & Sell |

| Risk Control | Max Risk 3% per strategy, Drawdown management |

| News Filter | NFP Protection (AutoGMT enabled) |

| Trading Hours | 24/5 or customizable |

| Lot Management | Auto lot with scaling and step adjustment |

| Broker Compatibility | ECN recommended |

| Ideal For | Prop Firms, Scalpers, and Index Traders |

🧾 Final Verdict

The Indicement MT4 EA is a professional-grade automated trading system optimized for U.S. indices. With advanced risk controls, NFP news protection, and modular multi-strategy logic, it offers traders a reliable balance between safety and performance.

Its default setup is conservative yet adaptable, making it suitable for prop firm challenges, long-term portfolio trading, and low-drawdown growth strategies.