SuperGoldBot EA Overview

SuperGoldBot EA is a cutting-edge gold scalping Expert Advisor (EA) designed to maximize profits in XAU/USD trading. Powered by a proprietary high-frequency algorithm, this M1 (1-minute) scalping bot detects strong market momentum shifts, ensuring fast, precise, and strategic trade execution with optimized risk management.

Built for both standard trading accounts and prop firm challenges, SuperGoldBot EA incorporates a strict stop-loss strategy on every trade to protect capital and minimize risk. With over a year of verified live trading results on Myfxbook, this gold trading robot has consistently delivered exceptional returns and sustainable profitability.

Enhance your gold trading strategy with SuperGoldBot EA – a proven solution for scalping XAU/USD with unmatched efficiency.

Detailed Analysis of SuperGoldBot EA

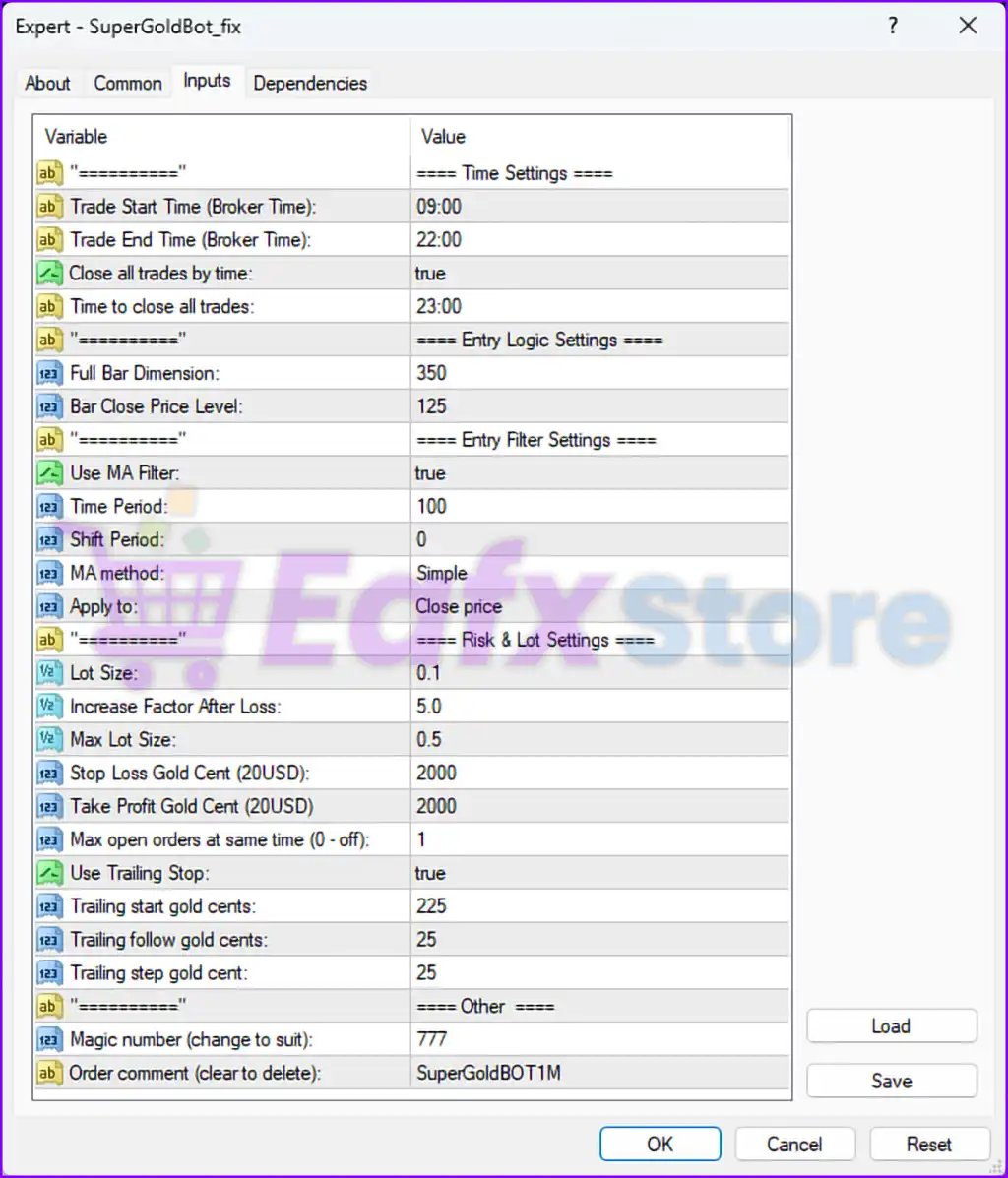

The SuperGoldBot EA is an automated trading system optimized for gold trading (XAU/USD) with time-based trade execution, moving average (MA) filtering, trailing stops, and risk management settings. Below is a detailed breakdown of its settings and potential optimizations.

1. Time Management Settings:

| Parameter | Value | Description |

|---|---|---|

| Trade Start Time (Broker Time) | 09:00 | Trading begins at 09:00 broker time. |

| Trade End Time (Broker Time) | 22:00 | Trading stops at 22:00 broker time. |

| Close All Trades by Time | true | Ensures all trades are closed at a specific time. |

| Time to Close All Trades | 23:00 | All trades will be closed at 23:00. |

🟢 Implications:

- Ensures trading occurs within a controlled session.

- Avoids overnight positions, reducing swap costs.

- Closes all trades at 23:00 to limit exposure.

⚠️ Recommendation:

- Ensure alignment with market volatility (e.g., adjust settings to match peak trading hours for gold).

- Consider extending the trade window to 23:30 to capture late-market movements.

2. Entry Logic Settings:

| Parameter | Value | Description |

|---|---|---|

| Full Bar Dimension | 350 | Sets a threshold for bar size before opening a trade. |

| Bar Close Price Level | 125 | Defines price level logic for trade entries. |

🟢 Implications:

- Trades are based on bar size and price levels, ensuring more structured entries.

⚠️ Recommendation:

- Test different Bar Close Price Levels to optimize entry conditions.

- Monitor the Full Bar Dimension setting to ensure trades are not skipped due to overly strict filters.

3. Entry Filter Settings (Moving Average):

| Parameter | Value | Description |

|---|---|---|

| Use MA Filter | true | The EA uses a Moving Average (MA) filter to confirm entries. |

| Time Period | 100 | Uses a 100-period moving average. |

| Shift Period | 0 | No shift applied to the moving average. |

| MA Method | Simple | Uses a Simple Moving Average (SMA). |

| Apply to | Close price | The MA calculation is based on the closing price. |

🟢 Implications:

- Filters out bad trades by ensuring the price aligns with the moving average.

- The 100-period MA provides strong trend confirmation.

⚠️ Recommendation:

- Test with different MA periods (e.g., 50, 200) to find optimal trade confirmation.

- Consider Exponential Moving Average (EMA) for faster reaction to price changes.

4. Risk & Lot Management:

| Parameter | Value | Description |

|---|---|---|

| Lot Size | 0.1 | Fixed lot size per trade. |

| Increase Factor After Loss | 5.0 | If a loss occurs, the next trade increases lot size 5x. |

| Max Lot Size | 0.5 | Limits trade size to 0.5 lots. |

| Stop Loss (Gold Cent – 20USD) | 2000 | Stop loss is set at 2000 cents ($20). |

| Take Profit (Gold Cent – 20USD) | 2000 | Take profit is set at 2000 cents ($20). |

| Max Open Orders at Same Time | 1 | The EA only opens one position at a time. |

🟢 Implications:

- Prevents over-leveraging by limiting open orders.

- Lot size increases after a loss, which can recover losses but also increases risk.

- Stop loss and take profit are set at equal amounts, ensuring a 1:1 risk-reward ratio.

⚠️ Recommendation:

- Reduce “Increase Factor After Loss” from 5.0 to 2.0 to prevent excessive risk.

- Use a dynamic risk-based lot sizing strategy instead of a fixed lot to scale trades efficiently.

5. Trailing Stop Mechanism:

| Parameter | Value | Description |

|---|---|---|

| Use Trailing Stop | true | Trailing stop is activated. |

| Trailing Start (Gold Cent) | 225 | The trailing stop activates when profit reaches 225 cents ($2.25). |

| Trailing Follow Gold Cents | 25 | The trailing stop follows 25 cents ($0.25) below the price. |

| Trailing Step Gold Cent | 25 | The step increment for the trailing stop is 25 cents ($0.25). |

🟢 Implications:

- Locks in profits when the trade moves in the right direction.

- Ensures the trade remains active while maximizing profits.

⚠️ Recommendation:

- Increase Trailing Start to 300-400 cents for a better profit-locking mechanism.

- Reduce Trailing Step to 15 cents to prevent premature stop-outs.

6. Additional Settings:

| Parameter | Value | Description |

|---|---|---|

| Magic Number | 777 | A unique identifier for tracking EA trades. |

| Order Comment | SuperGoldBOT1M | Used for trade labeling. |

🟢 Implications:

- Allows tracking of EA performance in trade history.

⚠️ Recommendation:

- Customize the magic number if using multiple instances of this EA on different pairs.

📌 Final Summary

| Feature | Setting | Analysis |

|---|---|---|

| Time-Based Trading | ✅ 09:00 – 22:00 | Prevents trading outside active market hours |

| Moving Average Filter | ✅ 100 SMA | Ensures trades align with the trend |

| Fixed Lot Size | ✅ 0.1 | Controlled risk exposure |

| Max Orders at Same Time | ✅ 1 | Prevents over-trading |

| Stop Loss & Take Profit | ✅ $20 SL & TP | Maintains a 1:1 risk-reward ratio |

| Trailing Stop | ✅ Enabled | Locks in profits |

| Martingale Increase Factor | ⚠️ 5.0 | High risk – Reduce to 2.0 for safety |

✅ Suggested Optimizations

1️⃣ Reduce the “Increase Factor After Loss” from 5.0 to 2.0 to avoid aggressive lot size jumps.

2️⃣ Test shorter MA periods (e.g., 50 EMA) for faster trend detection.

3️⃣ Extend the trading window to 23:30 to capture late gold market volatility.

4️⃣ Adjust trailing stop settings (increase start threshold to 300-400 cents) for better profit-locking.

5️⃣ Use dynamic lot sizing instead of fixed lot size for better capital management.

Conclusion

The SuperGoldBot EA is a structured gold trading system with strong risk management, moving average filters, and trailing stops. However, the lot increase factor (5.0) is high-risk and should be reduced. Optimizing the moving average filter and trailing stop settings could further improve profitability and reduce unnecessary trade exits.