🧩 What is Jog Trader EA MT4?

Jog Trader EA is an automated trading robot that combines money management (MM) with an active Martingale recovery system. The settings shown indicate a strategy designed to target consistent profits while accepting higher risk through position scaling.

This Expert Advisor (EA) is more suitable for experienced traders who understand drawdown behavior and account exposure.

📌📌📌 Buy this unlimited Jog Trader EA MT4 product here 📌📌📌

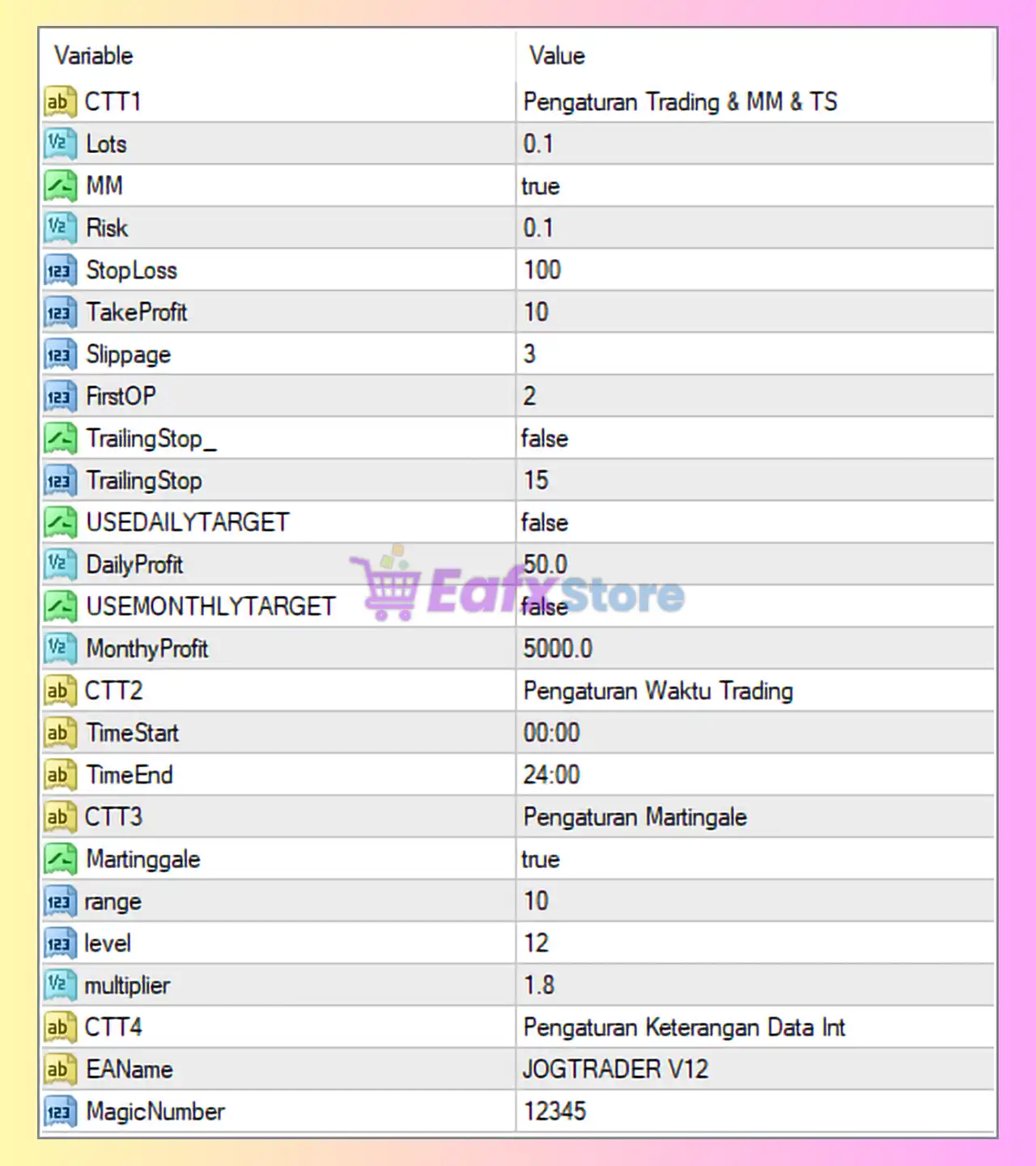

🧩 Trading & Money Management Settings (CTT1)

➡️ Lot & Risk Configuration

| Parameter | Value | Analysis |

|---|---|---|

| Lots | 0.1 | Base fixed lot size |

| MM (Money Management) | true | Dynamic lot sizing enabled |

| Risk | 0.1 | Very low per-trade risk |

| Stop Loss | 100 | Wide SL to allow trade recovery |

| Take Profit | 10 | Small TP, scalping style |

| Slippage | 3 | Reasonable execution tolerance |

📌 Insight

- The TP is much smaller than SL, confirming a high-win-rate / low-reward strategy.

- Profit consistency relies heavily on Martingale recovery, not on individual trade R:R.

🧩 Trade Execution & Position Control

| Parameter | Value | Explanation |

|---|---|---|

| FirstOP | 2 | Likely max initial orders |

| Trailing Stop Enabled | false | No dynamic exit |

| Trailing Stop Distance | 15 | Ignored (disabled) |

🔍 Evaluation

- Trades are closed primarily by fixed TP or Martingale averaging, not by trailing logic.

- Disabling trailing stop preserves recovery calculations.

🧩 Daily & Monthly Profit Targets

➡️ Profit Limitation System

| Parameter | Value |

|---|---|

| Use Daily Target | false |

| Daily Profit | 50.0 |

| Use Monthly Target | false |

| Monthly Profit | 5000.0 |

📊 Analysis

- Profit targets exist but are disabled.

- This means the EA will continue trading without stopping, increasing exposure during trending markets.

👉 Risk Note: Without profit caps, Martingale EAs can overtrade during unfavorable conditions.

🧩 Trading Time Settings (CTT2)

| Parameter | Value |

|---|---|

| TimeStart | 00:00 |

| TimeEnd | 24:00 |

⏰ Interpretation

- The EA trades 24/5 without session filtering.

- This increases trade frequency but also:

- Exposure to low-liquidity periods

- Risk during spread widening (rollover)

🧩 Martingale Configuration (CTT3)

➡️ Core Risk Component

| Parameter | Value | Meaning |

|---|---|---|

| Martingale | true | Martingale enabled |

| Range | 10 | Distance between recovery trades |

| Level | 12 | Maximum Martingale steps |

| Multiplier | 1.8 | Lot size increase factor |

⚠️ Critical Risk Analysis

- 12 Martingale levels with 1.8x multiplier can result in very large position sizes.

- While effective in ranging markets, this setup is highly vulnerable to strong trends.

📉 Worst-Case Scenario

- Prolonged one-directional price movement may cause:

- High drawdown

- Margin exhaustion

- Account wipe if undercapitalized

🧩 EA Identification & Trade Management (CTT4)

| Parameter | Value |

|---|---|

| EA Name | JOGTRADER V12 |

| Magic Number | 12345 |

✔️ Ensures trade separation from other Expert Advisors.

🧩 Overall Trading Strategy Summary

➡️ Strategy Type

- Scalping + Martingale Recovery

- Focus on small, frequent profits

- Relies on mean-reversion behavior

➡️ Risk Profile

- 🔴 High Risk

- 🟡 Low initial risk but exponential exposure

- 🟢 High win rate under stable conditions

🧩 Pros and Cons of Jog Trader EA MT4

✅ Advantages

- High trade accuracy in ranging markets.

- Flexible money management.

- Can grow accounts quickly in calm conditions.

- Simple setup and automation.

❌ Disadvantages

- Martingale significantly increases drawdown.

- No news filter or session filter.

- No daily/monthly stop protection enabled.

- Vulnerable to strong trends and high volatility.

🧩 Final Conclusion – Is Jog Trader EA MT4 Safe to Use?

Jog Trader EA MT4 is a high-risk, high-frequency Martingale trading system. The configuration shown is aggressive, even though the base risk looks small.

➡️ Recommended For:

- Large balance accounts.

- Traders who actively monitor drawdown.

- Short-term or experimental use.

- Cent or demo accounts.

➡️ Not Recommended For:

- Funded (prop firm) accounts.

- Small capital accounts.

- Traders seeking low-risk, long-term stability.