Home »

Blog »

Master Grid MT5 Settings Review & Full Analysis Master Grid MT5 Settings Review & Full Analysis

🧩 What is Master Grid MT5?

The provided configuration shows a SELL Grid–focused Master Grid Expert Advisor (EA) on MetaTrader 5 (MT5), with:

Time, Profit and Price limiting modules disabled .Manual grid control enabled .Moderate risk exposure .No automatic trading shutdown rules active .

This setup is suitable for manual or semi-automatic grid trading , especially in range-bound or retracement market conditions .

Master Grid MT5 Settings Review & Full Analysis 5 Master Grid MT5 Settings Review & Full Analysis 6 🧩 Trading Time Limitation Settings

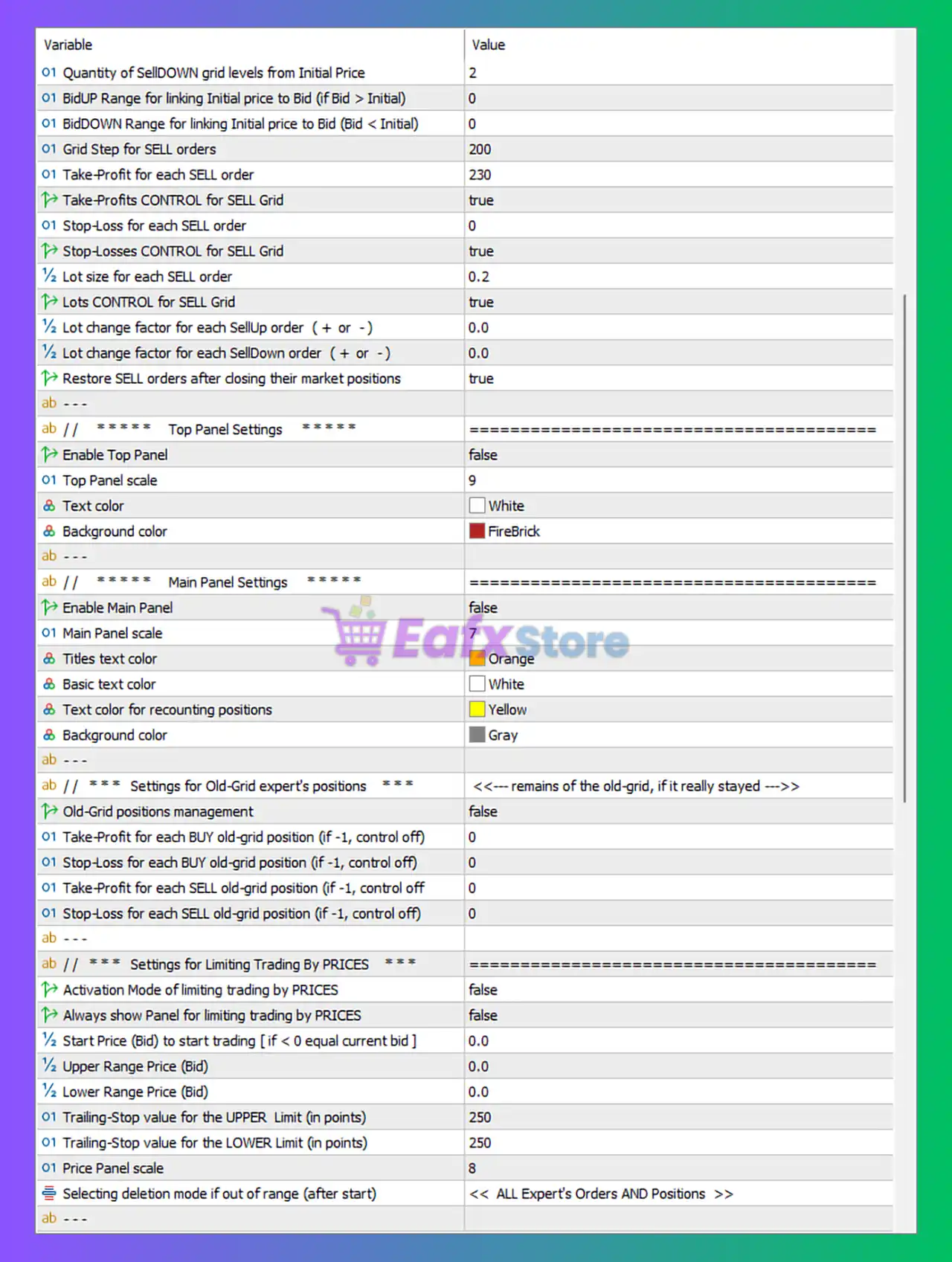

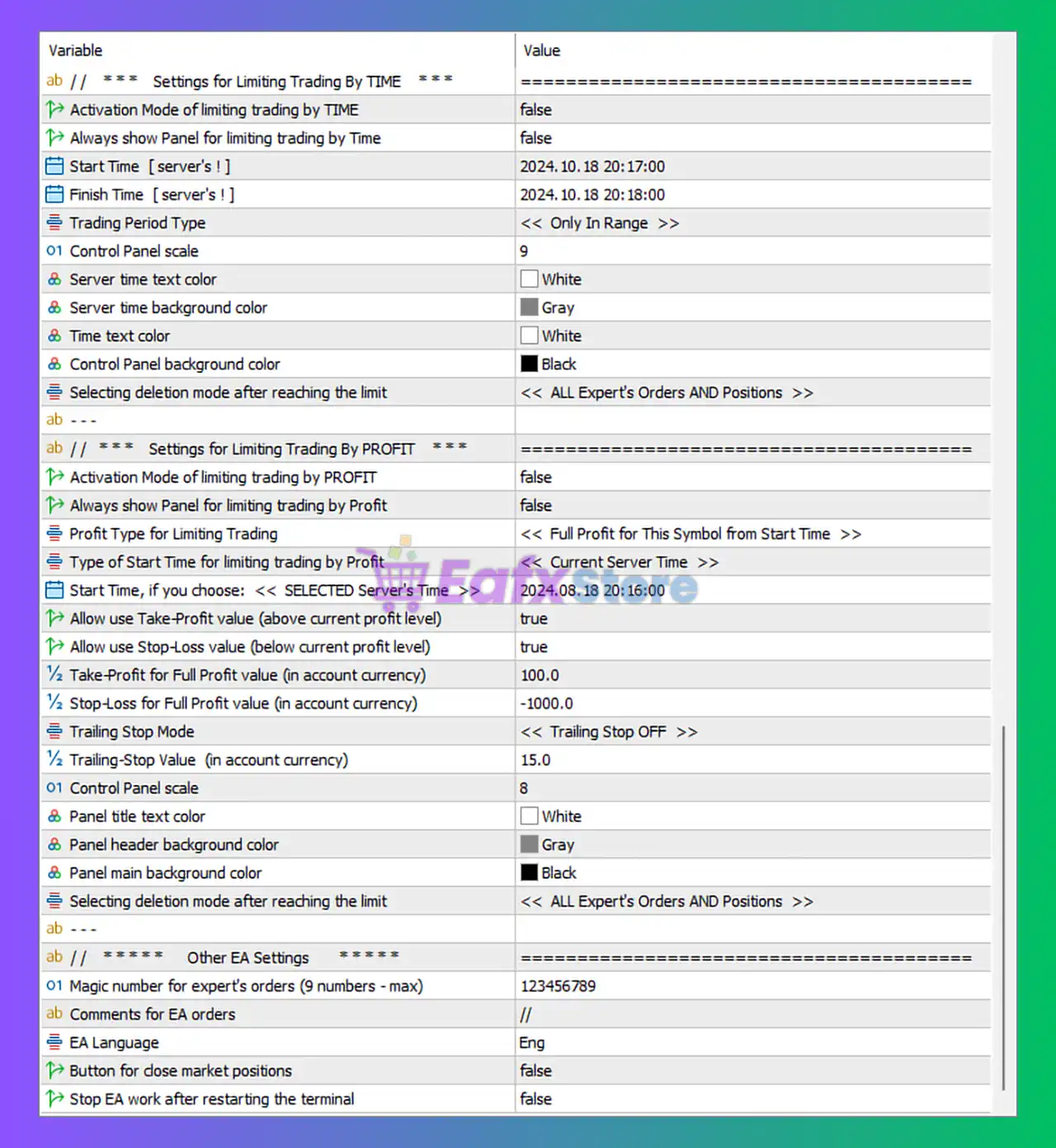

Parameter Value Explanation Activation Mode (Time) false EA trades without time restriction Always Show Time Panel false Time control panel hidden Start Time (Server) 2024.10.18 20:17 Defined but not active Finish Time (Server) 2024.10.18 20:18 Defined but not active Trading Period Type Only In Range Effective only if activated Deletion Mode After Limit All Expert’s Orders and Positions Full cleanup when enabled

🔍 Analysis

Time-based trading is fully disabled .

EA can open positions 24/7 .

High flexibility but no protection during news or rollover .

🧩 Profit Limitation Settings (Account-Level)

Parameter Value Explanation Activation Mode (Profit) false Profit limiter is OFF Profit Type Full Profit for This Symbol Symbol-based profit calculation Take-Profit (Account Currency) 100.0 Target profit if enabled Stop-Loss (Account Currency) -1000.0 Max loss if enabled Trailing Stop Mode OFF No equity trailing Deletion Mode All Expert’s Orders and Positions Full close on trigger

🔍 Analysis

No global profit protection active .EA relies entirely on grid TP per order .

Risk of equity drawdown accumulation in strong trends.

🧩 SELL Grid Core Trading Settings

Parameter Value Explanation Number of SELL Grid Levels 2 Only 2 grid layers Grid Step (Points) 200 Distance between grid orders Take-Profit per SELL Order 230 TP larger than grid step Stop-Loss per SELL Order 0 No SL (grid-style trading) Lot Size per Order 0.2 Medium exposure Lot Control Enabled EA manages lot logic Lot Change Factor 0.0 Fixed lot (no martingale) Restore Closed Orders true Grid auto-recovery enabled

🔍 Analysis

Very conservative grid depth .Fixed lot = lower risk .

No SL = relies entirely on grid recovery .

Suitable for low-volatility or ranging markets .

🧩 Visual Panels & Interface Settings

Panel Type Status Notes Top Panel Disabled Clean chart Main Panel Disabled No dashboard shown Panel Scale 7–9 Balanced if enabled Color Scheme Black / Gray / White High contrast readability

🔍 Analysis

EA runs silently in background .

Suitable for experienced traders .

Beginners may prefer enabling panels.

🧩 Old Grid Position Management

Parameter Value Explanation Old Grid Management false Old trades not managed TP / SL for Old Positions 0 No forced control

🔍 Analysis

No recovery or cleanup of legacy trades.

Safe only if EA is not restarted mid-cycle .

🧩 Price Range Limitation Settings

Parameter Value Explanation Activation Mode (Price) false Price filter OFF Upper / Lower Range 0.0 No boundary Trailing Stop for Limits 250 points Inactive Deletion Mode (Out of Range) All Orders Would close all if enabled

🔍 Analysis

EA trades regardless of price level .

No protection against breakouts or trends .

Not recommended for volatile sessions without manual supervision.

🧩 Other EA Technical Settings

Parameter Value Explanation Magic Number 123456789 Unique EA trade identifier EA Language English Interface language Close Market Button false No manual close shortcut Stop EA After Restart false EA resumes automatically

🧩 Final Conclusion – Is This a Good Master Grid MT5 Setup?

🔶 Strengths

✔ Simple and clean configuration.manual control traders .

🔶 Weaknesses

⚠ No global profit or loss protection.strong trending markets .

🧩 Best Use Case Recommendation

This Master Grid MT5 configuration is best suited for:

✅ Range-bound markets .

✅ Experienced grid traders .

✅ Manual monitoring .

❌ Not suitable for unattended trading during news.

❌ Not ideal for high volatility symbols.