Money Box Robot MT4 is a fully automated trading system designed for the MetaTrader 4 (MT4) platform. Each parameter plays an important role in determining the behavior and risk level of the robot during live trading or backtesting.

📌📌📌 Buy this unlimited Money Box Robot MT4 product here 📌📌📌

⚙️ Key Trading Parameters

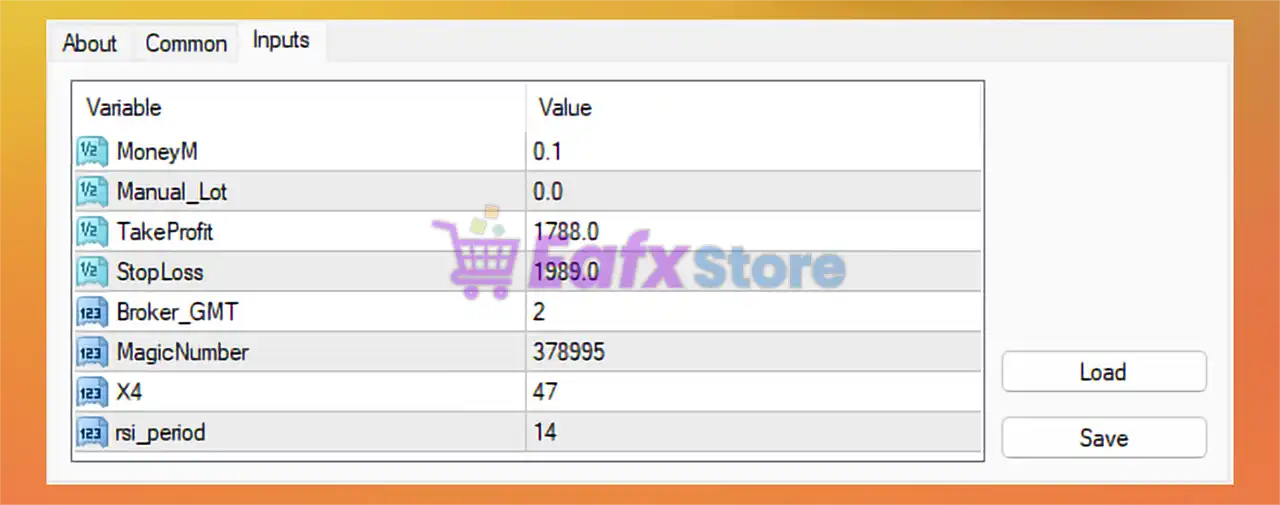

| Variable | Value | Description |

|---|---|---|

MoneyM | 0.1 | Money Management factor – likely determines lot size scaling per equity. |

Manual_Lot | 0.0 | Indicates automatic lot sizing is active (overrides manual lot settings). |

TakeProfit | 1788.0 | The Take Profit level set in price (likely for XAUUSD or similar assets). |

StopLoss | 1989.0 | The Stop Loss level, also based on price – unusually wide risk threshold. |

Broker_GMT | 2 | Time offset from GMT to sync with broker’s server time (important for timing). |

MagicNumber | 378995 | Unique identifier for the EA’s trades to avoid conflict with other EAs. |

X4 | 47 | Custom variable – possibly a volatility filter, signal strength, or period. |

rsi_period | 14 | Standard Relative Strength Index (RSI) period – used for trend detection. |

🧠 Strategy Insights

- The Money Management system is active (

MoneyM = 0.1), while fixed lot size (Manual_Lot) is disabled, making the EA dynamically adjust risk based on balance/equity. - With a Take Profit at

1788.0and Stop Loss at1989.0, the robot is likely trading reversal or countertrend setups. The values resemble price levels, suggesting this EA trades symbols like XAUUSD (Gold). - The RSI period of 14 is a classic default, hinting at momentum or overbought/oversold detection as part of the entry logic.

- The wide distance between TP and SL indicates that the EA may rely on tight filtering conditions to ensure high-probability entries, rather than frequent scalping.

- The Broker GMT offset ensures the robot operates at optimal trading sessions, such as the London or New York open.

✅ Conclusion

Money Box Robot MT4 uses a smart combination of price-level targeting and RSI-based entry signals. The automatic money management system adjusts trade sizes according to account balance, helping traders maintain consistent risk exposure. With wide TP/SL levels and unique identifiers, the EA is clearly designed for medium- to long-term swing trades, especially on assets like gold (XAUUSD).

These settings suggest a strategy focused on precision entries, strict control, and adaptability to various broker environments — making it ideal for both retail traders and those trading under proprietary firm conditions.