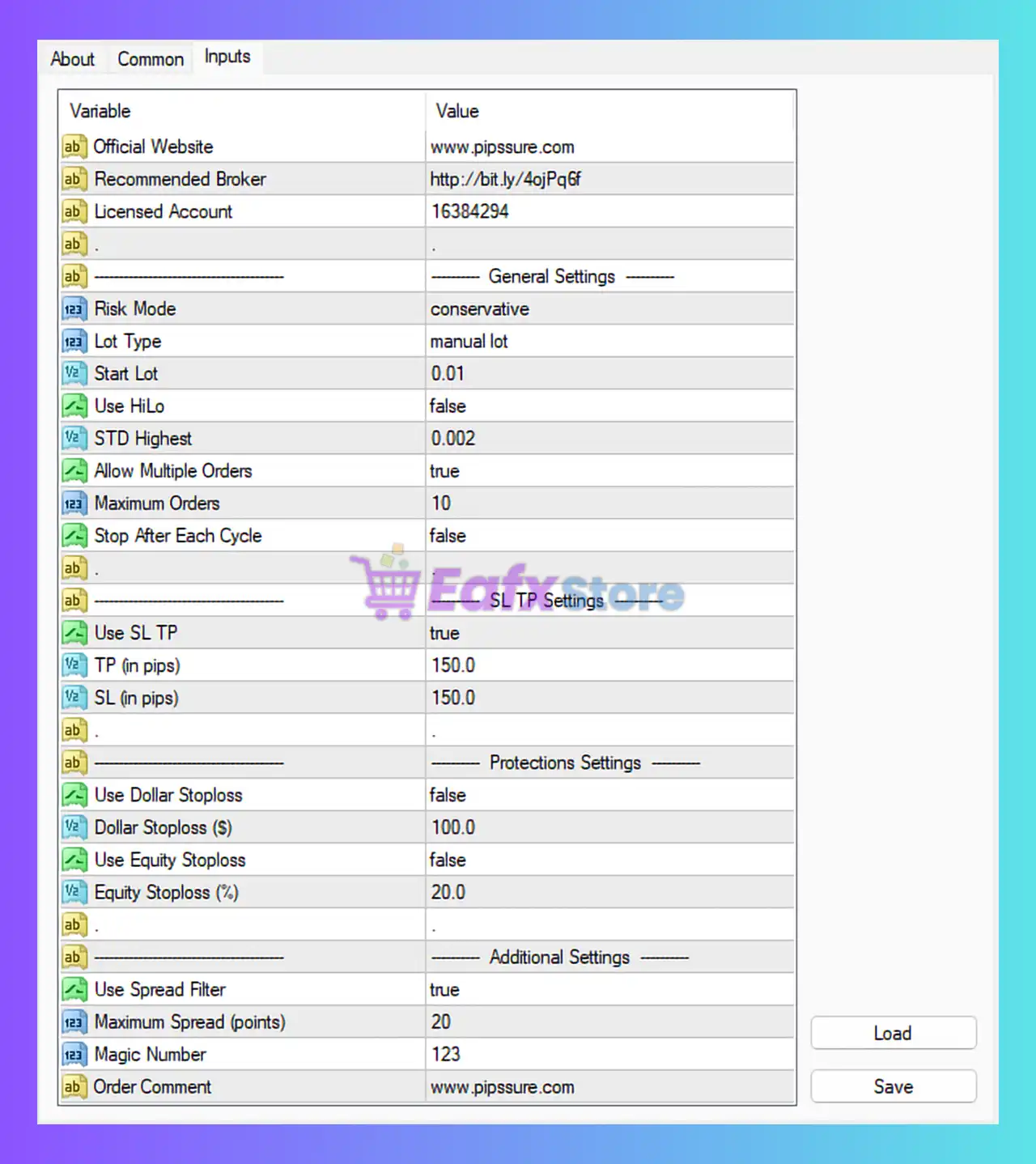

What is Pips Sure EA MT4?

The Pips Sure EA MT4 is an automated Forex trading system designed to deliver consistent and controlled results through a conservative trading approach. The settings displayed reflect a focus on risk management, stability, and flexible control, making this EA suitable for both beginners and experienced traders who value safety over aggressive profit-seeking.

📌📌📌 Buy this unlimited Pips Sure EA MT4 product here 📌📌📌

General Settings and Trading Logic

🔹 Risk Mode: Conservative

The EA is configured to trade conservatively, prioritizing capital preservation over rapid growth. This risk mode ensures that each trade’s exposure is limited and the account remains stable even during volatile market conditions.

🔹 Lot Type: Manual Lot

The manual lot setting means trade volume is fixed by the user rather than adjusted dynamically based on account balance.

- Start Lot = 0.01, which is minimal and safe, allowing gradual scaling of positions.

This approach is ideal for small accounts or traders testing the EA on live markets.

🔹 Use HiLo: False

The “HiLo” filter—often used to trade based on high and low price zones—is disabled. This suggests the EA relies on its internal algorithmic entry conditions, such as volatility or candle pattern analysis, rather than fixed price extremes.

🔹 STD Highest: 0.002

This parameter likely sets a volatility threshold based on standard deviation. The low value (0.002) ensures that the EA avoids trading in extremely volatile conditions, maintaining trade accuracy and minimizing slippage.

🔹 Allow Multiple Orders: True

Multiple orders are enabled, meaning the EA can open several trades simultaneously, either as part of a grid or scaling strategy.

However, combined with the conservative risk setting, this function is managed carefully to prevent overexposure.

🔹 Maximum Orders: 10

The EA limits open positions to a maximum of 10 trades at once, providing a safety cap to protect against runaway position buildup.

This balance between opportunity and protection reflects disciplined risk control.

🔹 Stop After Each Cycle: False

The EA is set to continue trading after completing a trade cycle, enabling continuous operation. This is beneficial for traders running the EA on VPS setups 24/7.

Stop Loss (SL) and Take Profit (TP) Configuration

🔹 Use SL/TP: True

Both Stop Loss (SL) and Take Profit (TP) parameters are enabled, confirming that the EA uses fixed exit levels to manage trades safely and systematically.

🔹 Take Profit (TP): 150 pips

Each trade targets 150 pips of profit, which indicates that the EA aims for medium-term trade holding, possibly combining scalping entry logic with swing exit logic.

🔹 Stop Loss (SL): 150 pips

The EA applies a 1:1 risk-to-reward ratio, meaning it risks and aims to gain an equal amount of pips.

This balanced setup is ideal for stable equity growth and helps maintain a healthy win/loss equilibrium over time.

Protection and Risk Management Settings

🔹 Use Dollar Stoploss: False

While the EA can use a fixed dollar stop limit, it’s currently disabled. This may be adjusted manually depending on account size or trading goals.

🔹 Dollar Stoploss: $100

If enabled, this would cap total loss per trade to $100, offering another layer of capital protection. It’s an important feature for traders with fixed-risk tolerance.

🔹 Use Equity Stoploss: False

Equity-based protection is disabled by default. When active, it would stop trading if the account equity drops below a set percentage.

🔹 Equity Stoploss (%): 20

The EA includes an equity protection feature set at 20%, meaning it would halt trading operations if equity decreases by 20% of total balance.

Although currently disabled, this feature is a strong safeguard against large drawdowns.

Additional Safety Filters

🔹 Use Spread Filter: True

This critical setting ensures that the EA avoids placing trades during widened spreads—often seen during news releases or low-liquidity hours.

This protects against poor execution and helps maintain accuracy in scalping or semi-scalping conditions.

🔹 Maximum Spread (points): 20

The EA refuses to open trades if the current spread exceeds 20 points (2.0 pips). This confirms that spread sensitivity is a built-in protection, suitable for brokers with tight spreads and stable execution environments.

🔹 Magic Number: 123

The unique identifier for trades allows users to run multiple EAs or strategies on the same account without interference. This promotes organized trade management across symbols and timeframes.

🔹 Order Comment: www.pipssure.com

Every order includes a comment linking back to the EA’s source, useful for identifying trades in reports and statements.

Summary of Trading Philosophy

The overall structure of the Pips Sure EA MT4 settings reflects a conservative, safety-oriented trading philosophy:

- Trades are entered with strict SL/TP control.

- Multiple orders are allowed, but capped at 10, ensuring no over-leverage.

- Protective features like spread filters and equity control minimize unnecessary exposure.

- The manual lot mode and fixed risk-reward ratio enable steady, predictable growth.

This configuration is perfect for traders who prefer slow, steady account compounding rather than high-risk, high-reward methods.

Key Strengths

✅ Balanced 1:1 Risk/Reward Ratio – Offers stable equity curve and long-term consistency.

✅ Conservative Risk Mode – Ideal for small and medium-sized accounts.

✅ Spread Filter Enabled – Prevents slippage and entry during unstable market conditions.

✅ Scalable Design – Compatible with manual lot adjustment and multiple order logic.

✅ Equity Stoploss Option – Allows activation of automatic drawdown control when needed.

Weaknesses or Considerations

⚠️ No Dynamic Lot Scaling – Profit growth may be slower without auto lot size adjustment.

⚠️ HiLo Filter Disabled – Could miss strong breakout opportunities.

⚠️ Dollar/Equity Stoploss Disabled by Default – Requires user activation for enhanced safety.

Conclusion

The Pips Sure EA MT4 configuration shown in this setup is highly risk-controlled and optimized for sustainable trading.

It adopts a conservative yet flexible approach, making it ideal for traders who prioritize capital safety, steady returns, and transparency.

With proper broker conditions (tight spreads and low slippage), the EA can perform efficiently across various market phases.

This EA suits:

- Funded account traders seeking compliance with drawdown limits.

- Long-term investors aiming for passive, low-volatility growth.

- Beginners wanting a safe automation system with clear logic and protection filters.