Why is Understanding the Role of Expert Advisors in Forex so Important? Many traders have traded manually for many years and are facing many losses, but have you tried trading with an expert advisor before?

How do you add the Expert Advisor to MT4?

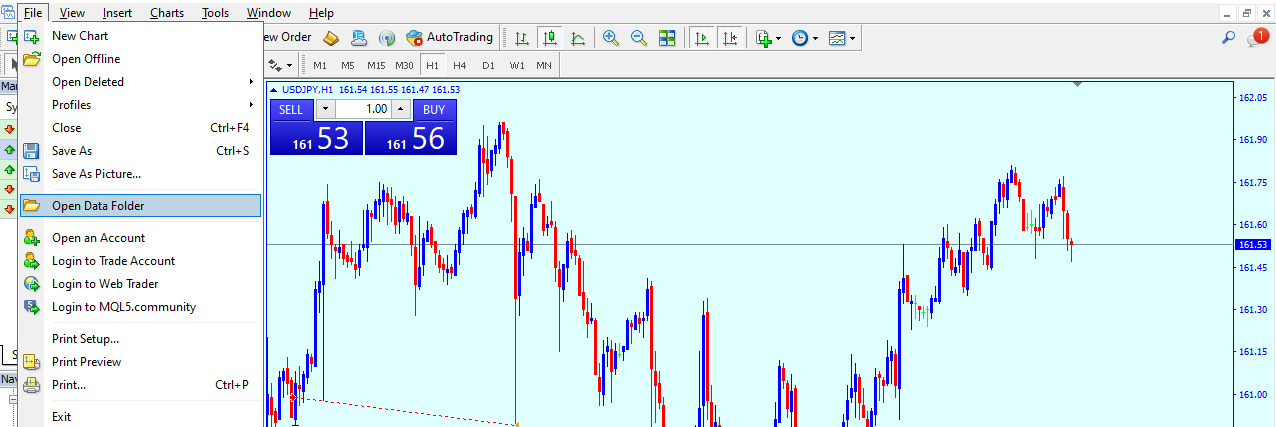

- Open the Metatrader 4

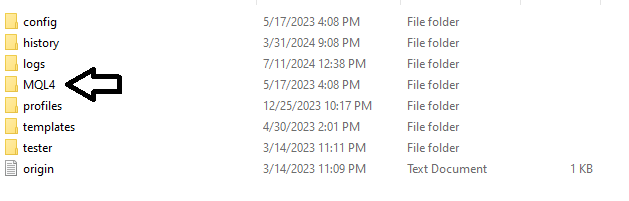

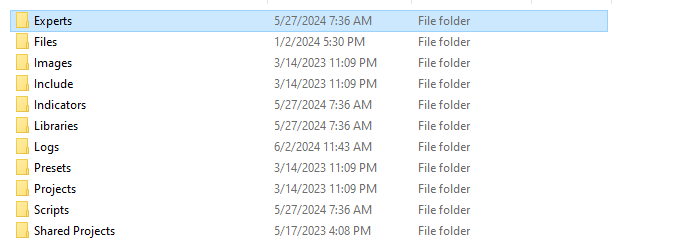

- Choose File ->> open data folder ->> MQL4 file ->>Experts

- Copy and paste Your Expert advisor to “Experts” file

Instructions for installing EA

Instructions for installing EA

Instructions for installing EA

1 – Is Expert Advisor is profitable?

There is no clear answer to that question because if there is a way to make money without any loss, everybody would be a millionaire right now, right? However, an expert advisor may help you get consistent profit in the long term with a good strategy that you have already backtested to see the potential results of the real account. Losses may occur; of course, in the forex market, everything can happen. Expert Advisor is not a Golden Egg or a magical Lamp that will guarantee you 100% profit because there is no 100% in the forex market, but after one month, you may get 5% profit, and the following month 7%,3% So on,,, if you see losses during/end of the month it’s very normal the main goal in the market is making a constant profit in the long term

2 – Why do traders use Expert Advisors (EA) instead of manual trading?

Why do traders trade manually? If they can get an expert Advisor, isn’t that easy enough for everyone? Trading manually has its Benefits and harms. For example, if you are planning to trade manually, you have to learn Technical analyzing/SMC for +2 years. You need to be patient and accept the losing trades as you take the winning trades, and during this period, you try to improve yourself in analyzing and many many things you will discover when you choose to trade manualI I’m not saying it lousy im trading manually too and when you understand how to control your self while trading you will start making money, that’sat’s the problem in forex market the emotional factor is the most important thing that made the traders losing their money because they Cant control their emotions in front of the chart, and many traders see maybe the solution is just OFF your brain and let the AI do the job for you.

3 – How to use the Expert Advisor?

Using expert advisors will help you make a constant profit in the long term, but the strategy of the Expert advisor is essential because in manual trading, as we said before, the most crucial factor that makes traders lose is their emotions while trading, if you will use expert advisor its a match machine doesn’t have emotions that’s how you will get free from this condition because you will not trade by your hand,

4 – There are two ways to get an Expert Advisor

First. You can buy one from Eafxstore. It has already been tested by our team, and you can see the results in the past years

Second. create your own Expert advisor; now we will focus on the strategy (Entry&Exit conditions – Risk percentage – indicators (if needed) – initial investment)

To set up an expert advisor, you need to be good as a trader first, so it will be a little bit hard for you if you don’t have experience in trading. Still, we also offer Expert advisors already backtested by our team, and you can choose what suits you.

Top 10 Best Expert advisors from Eafxstore

- FT Gold Robot MT4

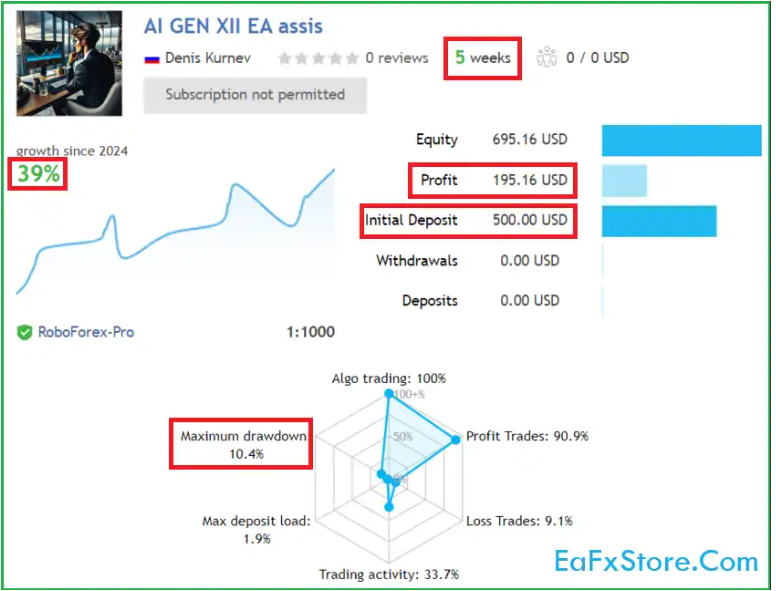

- AI Gen XII MT4

- Algo Pro Bot v2.0 MT5

- Hermes EA MT4

- SignalPro007 v13.3 EA MT4

- PIP CLUB EA BOT

- Ouro Hedge Scalping

- Asia Scalper Pro EA Source Code

- SpaceX Prop EA Source Code 2024

- Gold Hunt EA Source Code MQ4

5 – Expert Advisors (EA) Profits

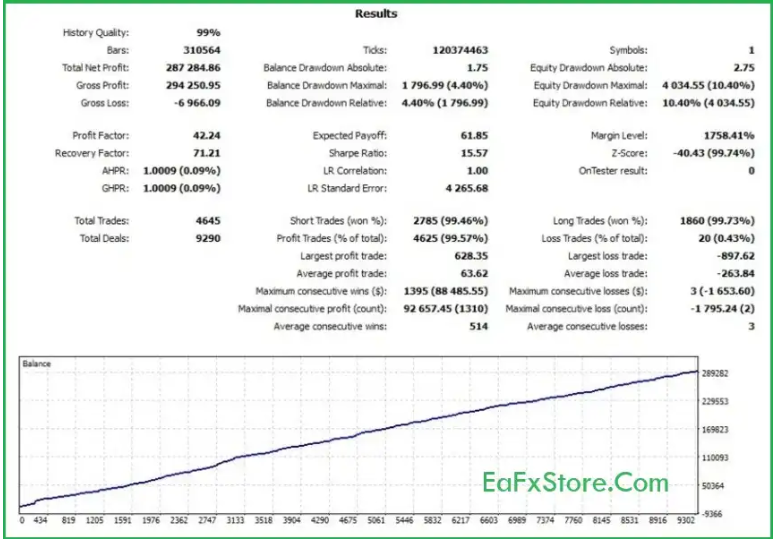

the profits are very variable. There is no fixed percentage of profit every month, but you can expect the profit you will make through backtests; here, we present some backtests of Eafxstore products

So, how do I start? Here are a few steps to help you start in forex, but first, you need to answer this question

1 – Why do you want to start Forex?

Yes, you have read the question correctly. Why do you want to start trading in Forex? Of course, it is money, but my question is: Do you want to join because you want to win a lot of money in a short or long time?

If you ask anyone this question, he will tell you, of course, I want to get the most significant amount of money in the shortest time possible, and this is self-evident, but is this happening in reality? The answer is yes, this may happen, but it will not happen immediately after entering the Forex directly; a study conducted on those who work in the forex market found that 90% of those in the forex market lose! that’s means that only 10% win in the forex market, and the rest are all losers. Why? Of course, not one reason makes them losers, But the vast majority lose because of the same reason you joined Forex (quick profit). Forex is not a sea of treasures; you want to extend your hand and take from it what you want.

I agree with you that you can make big profits from it. I do not disappoint you, but I want you not to be fooled by the tempting advertisements and delusional dreams that push you to enter the forex market. So, do not look only at the good side of the picture—that Forex makes a lot of money—but you should also pay attention. On the other hand, how can a large field like this and only 10% get profits?

How do you become a 10% forex winner?

Simply, it would be best if you dealt with Forex as an investment career. In other words, the profit that you will get from it will not be in a short time, but rather it will be a monthly profit, and it is possible after a year or two (any large field that needs patience, and if you do not be patient, you will lose your time. And your money) to be able to trade and be able to profit from 5% to 15% per month, and this is a good percentage for an average trader, and with time this percentage will gradually increase

2 – Time and commitment

The advantage of self-employment is that it does not impose any specific time or commitment to specific dates, so you can open the trading platform from anywhere in the world and at any time you want (Excluding holidays). Still, there is a commitment that you specify for the times of education and trading based on your strategy, And we will get to know it shortly.

Education times

Of course, when you start trading in Forex, you will need to learn. There is a time daily that you will give to Forex in which you will learn new things every day 1 to 3 hours per day. It is preferable to have two periods to be able to absorb the information that you have learned and not exhaust yourself in education (Remember that patience is essential) Usually, the theoretical part is not less than a month. If you are aware of the basics of Forex after a month, you can start the practical part, and it will be from 3 months to 6 months on a demo account in which you test what you learned and build a strategy to work with

Organize Your time

Before starting trade in Forex, you must reconcile between regular working and forex times; as Forex is very flexible, you do not require specific times, but before starting, there must be a clear picture of the future of the plan that you will stick to, can you devote 3 hours to Forex? It may be hard for the head of a family who works all day, a housewife, or a student. Suppose you see that it is not easy to provide 3 hours a day. In that case, you can make it an hour or two, so the important thing here is to abide by any decision you take, whatever it is, even if it takes an hour a day, so continue to learn. Frequently, it brings you closer to be ready to start trading in Forex. The result of interrupting learning is that it makes you forget what you learned earlier, and you will distract yourself.

3 – Avoid opening a real account during the training period

Always remember the first thing we discussed: greed and quick profit. Do not try to open a real account during the learning period. I mean the learning period from 3 months to a year of theoretical and practical learning on a demo account, so whatever your information or experience in forex when opening a real account, you will lose in the end (it is possible to win some trades, but the profit will not last) you must learn first. Then, when you are ready and able to trade, you can decide to open a real account and start working. The most important thing you should focus on during this period is learning and not being distracted by brokers’ offers or joining with them.

Account Capital

Many traders deposit small funds, hoping that they will soon have thousands of dollars, but as usual, they are among the 90% who lose.

What’s the solution?

Simply the lowest deposit you can start with and the application of strict capital management is 1000$ less than this amount, it is considered a waste of time and money, and if you do not have this amount, I do not advise you to start trading in Forex until this amount is available so that you do not waste your money for illusions that will not happen and Be very careful when starting the practical part (the demo account) that the capital of the demo account is the same as the capital that you intend to invest in Forex.

Example: You want to start trading in Forex with 1000$. First, you will open a demo account with 1000$ and train on it for a period of 3 months to a year. While you master the strategy you work with and get continuous profits, you can open a real account and deposit the 1000$.

4 – Understand Forex terminology

Now that you have determined the reason for joining forex and the appropriate times for you and have reconciled between your other work and forex, we will move to the steps of starting trading. There are terms in Forex that you should know well during your learning journey, for example (general trend, gap, leverage, spread Islamic account … etc) all of these terms are among the very many terms in Forex that traders use constantly, each term denotes something in the market or forex in general and on your journey to learn you will encounter many of these terms and at first glance, you will not understand most of them but in Your continuing to learn will understand some of them little by little, and if you don’t understand some term, you can search for it on the Internet in order not to stop reading and learning because of a term you did not know its meaning.

5 – Risk management

Before choosing the strategy that you work with, you must know a significant factor that makes you continue to make profits in the long term and the main reason that makes only 10% win (Risk management), I want you to memorize and understand this sentence well because you will depend on it For the rest of your trading journey, a successful trader is someone who puts strict Risk management, the profit and loss are very small compared to capital so that he wins small amounts in the long term, and in the event of loss, the loss is very small so that he does not lose his account and becomes outside the market, so managing the capital depends on the basis that you stay in the market for as long as possible, and the loss and the profit are at rates ranging from 5% to 15% per month (and it is possible in one trade for those with experience)