What is The ORB Master MT5?

The ORB Master MT5 is a powerful Expert Advisor (EA) designed to capitalize on the Opening Range Breakout (ORB) principle across four major indices (DAX, US500, US30, NAS100). It features time-optimized entries during high-volatility sessions and integrates advanced news filtering and prop firm-friendly risk controls for robust, automated trading.

📌📌📌 Buy this unlimited The ORB Master MT5 product here 📌📌📌

🔧 Core Trading Logic – Settings Breakdown

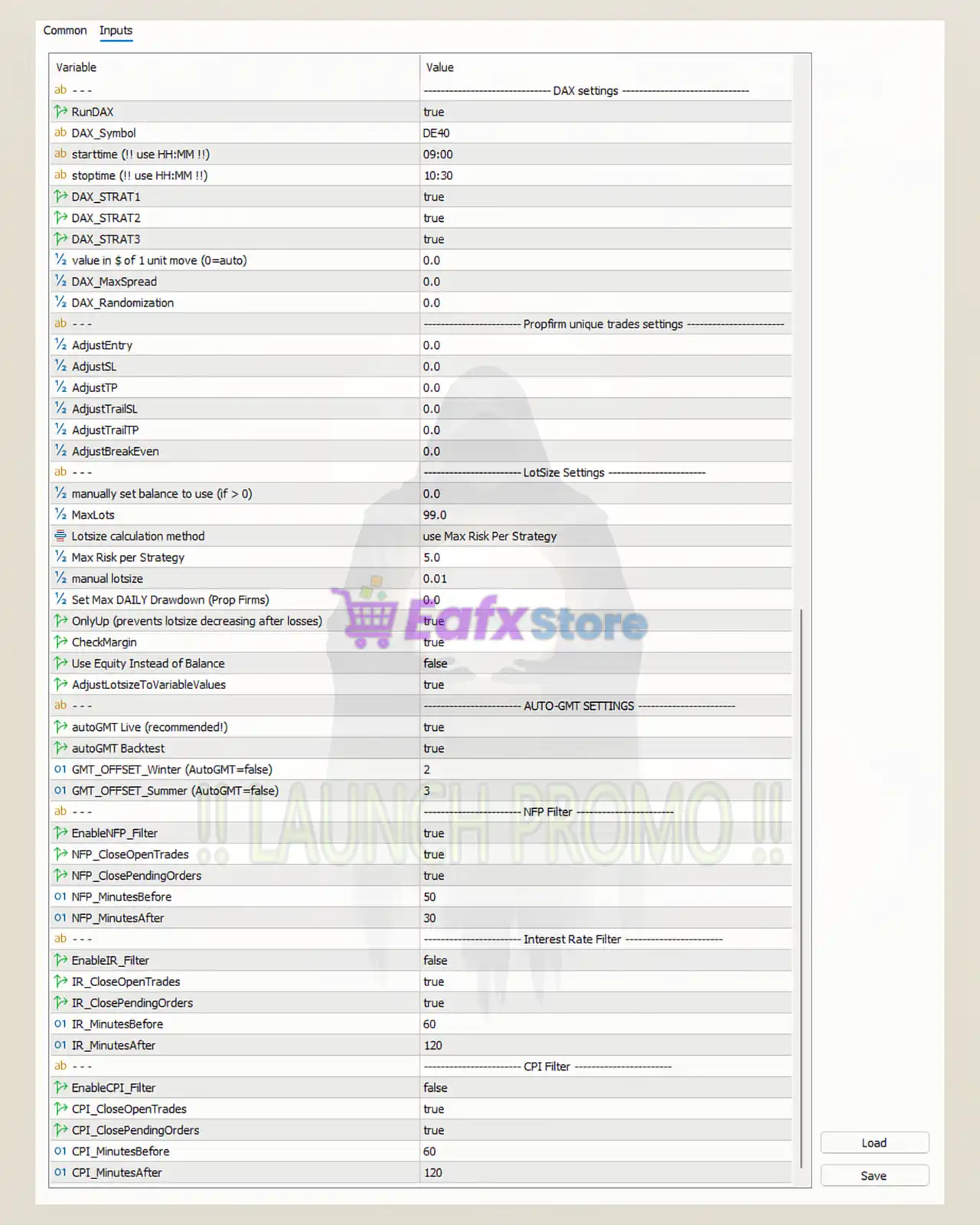

1. DAX Trading Configuration

- RunDAX:

true→ Enables trading on DAX (DE40). - Trading Time:

09:00to10:30→ Focused on the high-volatility period after the Frankfurt open. - DAX_STRAT1, STRAT2, STRAT3: All enabled (

true) → Multiple strategies running simultaneously. - Max Spread:

0.0→ Tight or no spread tolerance. Broker must offer low spreads for this EA. - Randomization:

0.0→ No entry/exit timing randomness – ideal for prop firm trading.

✅ Conclusion: Tight and disciplined DAX setup for high-precision entries during the key European trading window.

2. Lot Size & Risk Management

- MaxLots:

99.0(high cap) - LotSize Calculation Method: Uses “Max Risk Per Strategy”.

- Max Risk Per Strategy:

5.0→ Risk-heavy setup; consider reducing for conservative accounts. - Manual Lot Size:

0.01→ Used only if fixed lot sizing is activated. - Set Max Daily Drawdown (Prop Firms):

0.0→ Currently inactive; enable if using on challenge accounts. - OnlyUp (Prevents Lot Size Decrease After Loss):

true→ Uses martingale-style progression.

⚠️ Risk Warning: Aggressive risk settings — recommended for experienced traders or demo testing first.

3. Auto GMT Detection

- AutoGMT Live & Backtest:

true→ Automatically syncs time for accurate backtesting & trading. - GMT Offsets: Winter:

2, Summer:3→ Adjusted for EU daylight saving time.

👍 Verdict: Proper GMT handling ensures reliable performance across brokers and sessions.

4. News Filters for Fundamental Risk Management

✅ NFP Filter:

- EnableNFP_Filter:

true - Closes Trades & Pending Orders: Yes, both.

- Minutes Before/After:

50/30

🚫 Interest Rate Filter:

- EnableIR_Filter:

false

🚫 CPI Filter:

- EnableCPI_Filter:

false

💡 Expert Tip: NFP filter is crucial for protecting trades from extreme volatility. Consider enabling CPI and IR filters for added safety.

📈 Additional EA Features

1. Info Panel

- ShowInfoPanel:

true - Adjustable Positioning: Yes, via

Adjustment for Infopanel size

2. Trade Types & Order Behavior

- Enable_BuyTrades / SellTrades: Both enabled

- Use Virtual Expiration:

true→ Hides expiry time from broker, enhancing stealth. - AdjustSL_After_Slippage:

false→ Disables SL adjustment post slippage. - Comment for trades: “The ORB Master”

🕒 Trading Hours Management

- Enable Trading Hours Filter:

true - Delete Pending Orders:

true - Time Source: Optimized (recommended)

🌐 Multi-Symbol Trading Configuration

US500 (S&P 500)

- Symbol:

US500 - Time Window:

15:30 – 17:00 - STRAT1, STRAT2, STRAT3: All enabled

- Max Spread:

0.0

US30 (Dow Jones)

- Symbol:

US30 - Same Time Window & Strategy Configuration as US500

NAS100 (NASDAQ)

- Symbol:

USTEC - Time Window:

15:30 – 17:00 - STRAT1, STRAT2, STRAT3: All enabled

- Max Spread:

0.0

📌 Observation: U.S. indices are configured to trade during the U.S. stock market open – a period of high liquidity and volatility.

📌 Final Thoughts – Is The ORB Master MT5 Worth It?

✅ Pros:

- Designed for prop firm challenges (tight drawdown controls, equity management).

- Multi-index support with time-optimized entries.

- Built-in news filters (NFP, optional CPI & IR).

- Fully automated with detailed control over risk and lot sizing.

⚠️ Cons:

- Aggressive risk settings by default (Max Risk Per Strategy: 5.0%).

- Requires a low-spread ECN broker for best performance.

- News filters for CPI and Interest Rates are disabled — manual review may be needed.

📊 Conclusion: The ORB Master MT5 Review

The ORB Master MT5 is a solid, high-performance EA for traders looking to capitalize on breakout strategies across major indices like DE40, US500, US30, and NAS100. It’s packed with prop firm-friendly features, risk controls, and robust automation. However, users should adjust the risk parameters based on their trading capital and objectives.

🔒 Best For: Experienced traders, Prop Firm Challenge participants, and those who prefer data-driven breakout strategies during high-volume market opens.