Introduction

The Titany X Pro(P) EA v2.7 is a moderate-risk Forex trading bot designed to trade multiple currency spreads simultaneously. This Expert Advisor (EA) leverages spread-based trading strategies while integrating mediation techniques to optimize risk management.

If you are looking for an automated trading solution that operates across multiple currency pairs, this EA offers spread-focused strategies with customizable profit targets and risk controls.

Key Features of Titany X Pro(P) EA

1️⃣ Trading Mechanism

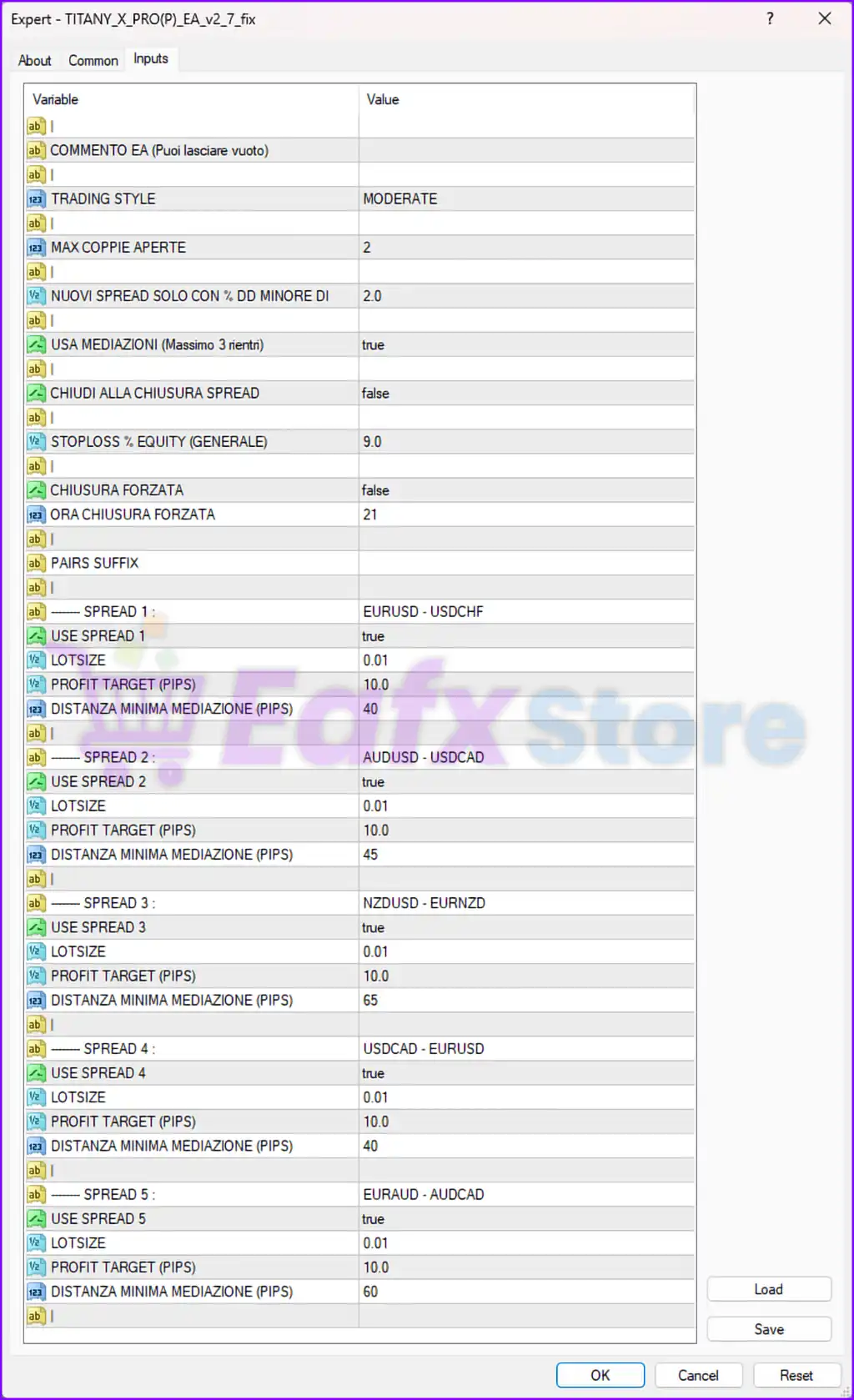

| Setting | Value | Explanation |

|---|---|---|

| Trading Style | MODERATE | Uses a balanced risk approach between conservative and aggressive trading. |

| Max Open Pairs | 2 | Limits the number of active currency pair trades at any given time. |

| Spread-Based Strategy | TRUE | Utilizes spread analysis to determine optimal trade entries. |

| Use Mediation | TRUE | Activates mediation mode to recover from unfavorable trades. |

✔️ Analysis:

- Moderate risk exposure, meaning it avoids overly aggressive trading behaviors.

- The spread-based strategy indicates the EA capitalizes on currency spread movements.

- Mediation strategy suggests it tries to recover from losses before closing a trade.

2️⃣ Stop Loss, Risk Management & Forced Closure

| Setting | Value | Analysis |

|---|---|---|

| Stop Loss % Equity | 9.0% | Stops trading if account equity drops by 9%, preventing large losses. |

| Close Trades When Spread Closes? | FALSE | Does not automatically close when the spread narrows. |

| Forced Closure | FALSE | Does not force close trades unless manual intervention occurs. |

| Forced Closure Time | 21:00 | A failsafe mechanism to close all trades at a specific hour. |

✔️ Analysis:

- ✅ Safe equity stop-loss mechanism (9% max loss per trade cycle).

- ✅ Manual intervention might be required if forced closure settings are not activated.

- ⚠️ Traders should monitor risk exposure, as the EA does not auto-close unfavorable spreads.

3️⃣ Multi-Currency Spread Trading Strategy

| Spread Pairs | Use? | Lot Size | Profit Target (Pips) | Minimum Mediation Distance (Pips) |

|---|---|---|---|---|

| EUR/USD – USD/CHF | ✅ | 0.01 | 10 | 40 |

| AUD/USD – USD/CAD | ✅ | 0.01 | 10 | 45 |

| NZD/USD – EUR/NZD | ✅ | 0.01 | 10 | 65 |

| USD/CAD – EUR/USD | ✅ | 0.01 | 10 | 40 |

| EUR/AUD – AUD/CAD | ✅ | 0.01 | 10 | 60 |

✔️ Analysis:

- ✅ Diversifies across five currency spreads, balancing risk exposure.

- ✅ Each spread pair has a predefined take-profit (TP) and mediation strategy.

- ⚠️ High mediation distances (up to 65 pips) may cause prolonged trade durations.

Risks & Recommended Optimizations

| Risk Factor | Current Setting | Recommended Adjustment |

|---|---|---|

| Max Open Pairs | 2 | ✅ Increase to 3-4 pairs for diversified exposure. |

| Forced Closure | FALSE | ✅ Enable to auto-close trades at key risk points. |

| Mediation Distance | 40-65 pips | ✅ Reduce for faster trade exits. |

| Stop-Loss % Equity | 9% | ✅ Adjust to 5-7% for better risk management. |

✔️ Suggestions:

- ✅ Enable Forced Closure to prevent excessive drawdown.

- ✅ Reduce mediation distances for quicker trade resolutions.

- ✅ Adjust stop-loss percentages for optimized capital protection.

Who Should Use Titany X Pro(P) EA?

✔️ Ideal for:

✅ Traders who prefer spread-based strategies.

✅ Users seeking moderate-risk automated trading.

✅ Traders looking to diversify currency pairs.

❌ Not recommended for:

❌ Scalpers who prefer fast trade execution.

❌ Traders who cannot monitor mediation trades.

❌ Beginners who lack risk management experience.

Final Verdict: A Smart Spread-Based EA with Room for Optimization

Titany X Pro(P) EA is a spread-focused trading bot with a moderate risk approach, capable of trading across multiple currency pairs. While risk control measures are in place, traders should enable forced closure settings and optimize mediation distances for improved capital protection.