🧩 What is VectorPrime EA MT5?

VectorPrime EA MT5 is a fully automated trading system optimized exclusively for XAUUSD (Gold), combining dynamic risk management with high-speed execution filters. It utilizes a risk-based lot sizing approach for proportional exposure and features Trailing Stop Loss for dynamic profit protection, alongside built-in drawdown caps for prop firm safety.

📌📌📌 Buy this unlimited VectorPrime EA MT5 product here 📌📌📌

Below is a complete breakdown of each major setting section and how it contributes to the EA’s overall strategy and risk management.

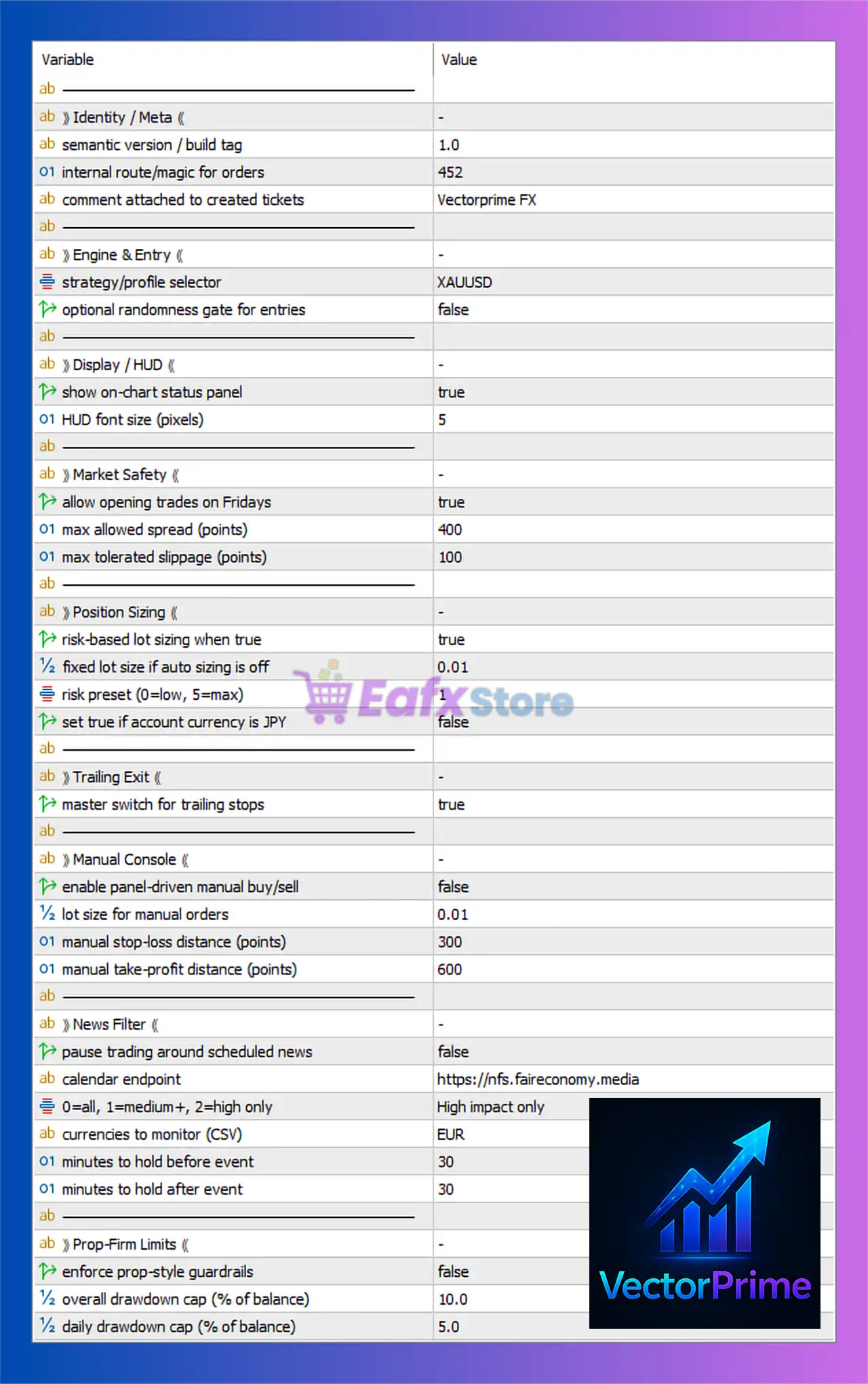

🧩 Meta & Engine Configuration

- Semantic Version: 1.0

- Magic Number: 452

- Comment Attached to Orders: VectorPrime FX

- Trading Pair: XAUUSD

- Randomized Entries: False

✅ The setup confirms that VectorPrime EA is specifically optimized for gold (XAUUSD) — a high-volatility instrument requiring precision risk management.

✅ A dedicated magic number (452) allows tracking of orders across accounts, ensuring no conflict with other Expert Advisors.

✅ The absence of random entry logic ensures consistent and repeatable backtest performance, enhancing trust in historical testing and real-world results.

🖥️ Display & HUD Options

- On-Chart Status Panel: True

- Font Size: 5

✅ The built-in Head-Up Display (HUD) gives traders real-time updates on open positions, profit/loss, and trade statistics.

✅ Small font sizing ensures that the panel is visible yet non-intrusive, ideal for continuous live monitoring.

🛡️ Market Safety Settings

- Allow Friday Trades: True

- Max Allowed Spread: 400 points

- Max Slippage: 100 points

✅ The EA can trade on Fridays — a sign of short- to medium-term trade duration and high execution confidence.

✅ Spread and slippage protections (400/100) prevent trades from opening in unstable market conditions, maintaining consistent order quality even in volatile gold sessions.

✅ This section emphasizes execution integrity and broker protection filters — critical for scalping or swing systems on gold.

💰 Position Sizing and Risk Management

- Risk-Based Lot Sizing: True

- Fixed Lot Size (if manual): 0.01

- Risk Preset: 1 (low)

- JPY Account Adjustment: False

✅ Dynamic lot sizing based on balance ensures proportional risk exposure — a cornerstone for long-term capital growth.

✅ The risk preset = 1 indicates a conservative configuration, designed for low drawdown and high stability.

✅ This structure shows a professional-grade approach, ideal for traders managing accounts under prop firm limits or steady portfolio scaling.

🔁 Trailing Exit Control

- Master Switch for Trailing Stops: True

✅ Trailing Stop Loss (TSL) is always active, meaning the EA automatically locks profits as the trade moves in the favorable direction.

✅ This dynamic exit feature converts volatile price swings into secured gains, reducing emotional decision-making and protecting accumulated equity.

🧠 Manual Console Features

- Panel Manual Trading: False

- Manual Lot Size: 0.01

- Manual Stop Loss: 300 points

- Manual Take Profit: 600 points

✅ Manual controls are disabled, confirming fully automated trading logic.

✅ Default manual parameters (SL 300 / TP 600) suggest that if manual trading were enabled, the EA still maintains a 1:2 risk-reward ratio, consistent with strong risk management principles.

📰 News Filter Configuration

- Pause Around News: False

- Calendar Endpoint: https://nfs.faireconomy.media

- News Impact Level: High Impact Only

- Currencies Monitored: EUR

- Pause Before/After Event: 30 minutes

✅ Although the news filter is off by default, the EA supports integrated economic event avoidance, protecting against high-volatility periods like FOMC, NFP, or CPI releases.

✅ It uses a reliable external news source (Faireconomy) and focuses on high-impact EUR events, which often influence gold volatility indirectly through USD correlations.

✅ This feature makes VectorPrime EA adaptable for prop firm compliance and low-drawdown strategies if enabled.

🏦 Prop-Firm Guardrails

- Enforce Prop-Style Limits: False

- Overall Drawdown Cap: 10%

- Daily Drawdown Cap: 5%

✅ The EA includes prop firm–style drawdown restrictions, ensuring strict control over losses.

✅ When enabled, it automatically halts trading if daily or total loss limits are exceeded — an excellent safeguard for FTMO, MyForexFunds, or TrueForexFunds evaluations.

✅ Even though disabled by default, these guardrails show serious design attention to funded account rules.

🔍 Strategic Summary

The VectorPrime EA MT5 is built around institutional-grade trading discipline.

Its architecture focuses on low-risk gold trading, smart trailing exits, and dynamic position sizing, with optional modules for news avoidance and prop-firm rule compliance.

Core Trading Philosophy:

- 🎯 Focused on XAUUSD (Gold)

- 🔒 Full automation with strict risk-per-trade

- 📊 Risk-based position sizing (adaptive to account balance)

- ⚡ High-speed execution filters for spreads and slippage

- 🧱 Built-in drawdown caps for funded account safety

- 🧩 Optional fundamental (news) awareness

✅ Conclusion

VectorPrime EA MT5 is a smart, safety-first gold trading system designed for professional and prop firm traders.

It balances adaptive automation with robust execution filters, aiming for steady and sustainable account growth.

- 📈 Best suited for: XAUUSD on MT5.

- 💰 Trading style: Medium-term, risk-controlled.

- 🧠 Risk management: Advanced (auto lot, TSL, drawdown guardrails).

- 🕒 Trading schedule: 24/5 with optional Friday trades.

- 🧩 Ideal for: Traders seeking low-drawdown, prop firm-compatible performance.