🧩 What is VR Locker MT5?

VR Locker MT5 is an automated trading system built around a lock, averaging, and recovery-based trading logic. The Expert Advisor (EA) focuses on position averaging, step-based order placement, and profit locking, making it suitable for traders who understand controlled martingale-style risk management.

📊 VR Locker MT5 – Trading Settings Explained

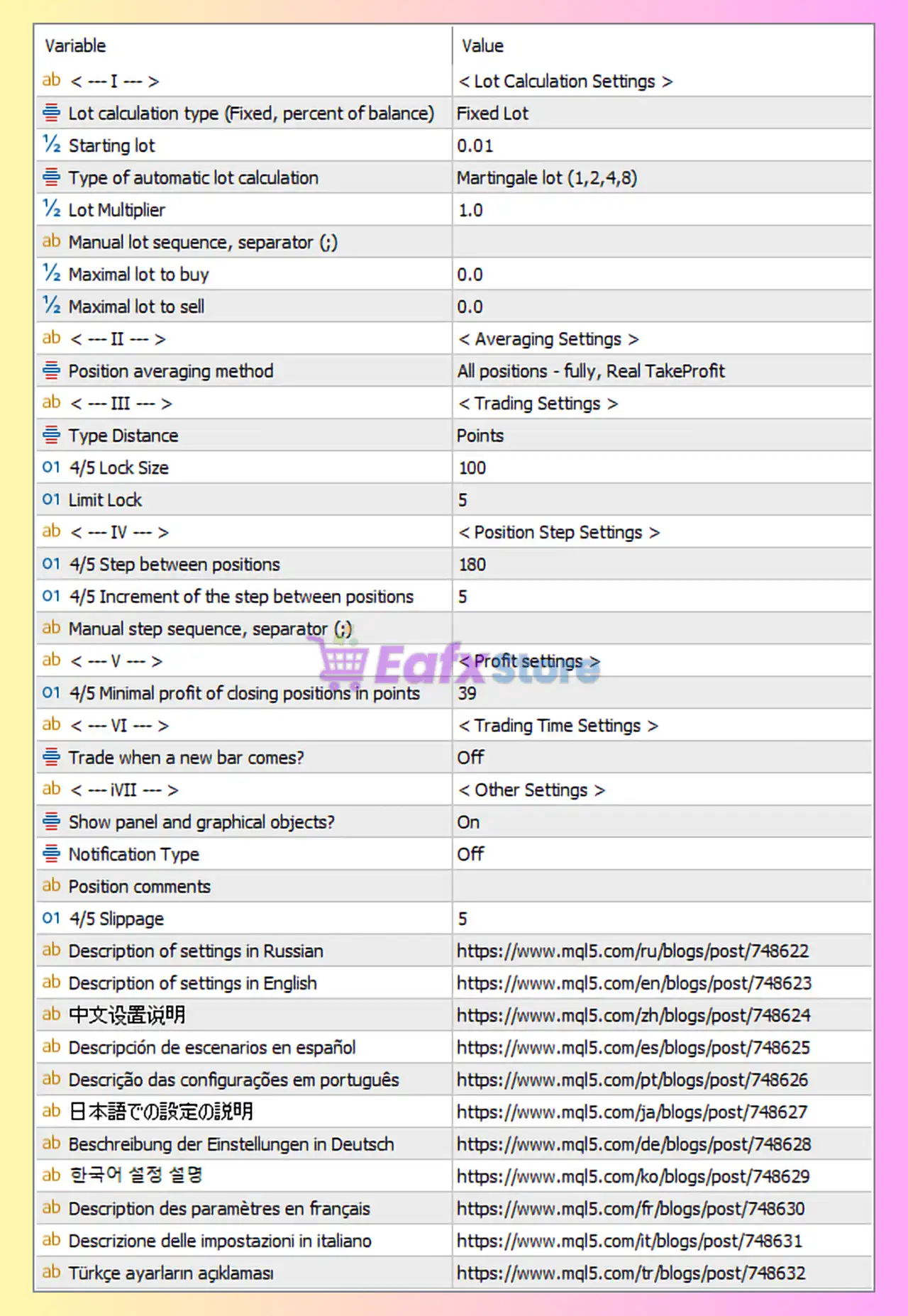

🔹 Lot Calculation Settings

| Parameter | Value | Analysis |

|---|---|---|

| Lot calculation type | Fixed Lot | Ensures predictable lot sizing without equity-based scaling. |

| Starting lot | 0.01 | Very conservative initial lot, ideal for small accounts. |

| Automatic lot calculation | Martingale (1,2,4,8) | Progressive lot increase to recover floating losses faster. |

| Lot multiplier | 1.0 | Neutral multiplier; martingale escalation follows fixed sequence. |

| Maximal lot to buy / sell | 0.0 | No explicit lot cap, increasing potential exposure risk. |

🔹 Averaging Settings

| Parameter | Value | Analysis |

|---|---|---|

| Position averaging method | All positions – fully, Real TakeProfit | All open positions are averaged and closed together at real profit. |

➡️ This confirms basket-based profit closing, a core element of lock/grid strategies.

🔹 Trading Distance & Lock Settings

| Parameter | Value | Analysis |

|---|---|---|

| Type Distance | Points | Distance calculations are point-based for precision. |

| Lock Size | 100 | Defines the price range where lock logic activates. |

| Limit Lock | 5 | Limits the number of lock cycles to reduce infinite exposure. |

🔹 Position Step Settings

| Parameter | Value | Analysis |

|---|---|---|

| Step between positions | 180 | Wide spacing reduces overtrading during ranging markets. |

| Increment of step | 5 | Gradually increases distance between subsequent orders. |

| Manual step sequence | Not used | EA relies on automatic step logic. |

🔹 Profit Settings

| Parameter | Value | Analysis |

|---|---|---|

| Minimal profit to close positions | 39 points | Basket closes once minimum profit is achieved. |

➡️ Encourages frequent basket closure, reducing prolonged drawdown periods.

🔹 Trading Time & Execution

| Parameter | Value | Analysis |

|---|---|---|

| Trade when a new bar comes | Off | Trades can be opened intra-bar for faster reaction. |

| Slippage | 5 | Allows moderate execution flexibility in volatile markets. |

🔹 Interface & Other Settings

| Parameter | Value | Analysis |

|---|---|---|

| Show panel and graphics | On | User-friendly visual control panel enabled. |

| Notifications | Off | No push or alert notifications by default. |

| Position comments | Enabled | Improves trade tracking and transparency. |

🧠 Strategy Logic Overview

VR Locker MT5 combines fixed-lot entry, martingale-style recovery, and basket profit closure into a structured lock-based trading system. Positions are opened with increasing distance and volume, averaged into a single basket, and closed once a predefined profit threshold is reached. The lock mechanism helps control adverse price movement while aiming to recover drawdown efficiently.

⚠️ Risk Management Assessment

➡️ Strengths

- Small starting lot (0.01)

- Wide step distance reduces trade frequency

- Basket-based profit closure avoids partial exits

- Lock limits restrict endless recovery cycles

➡️ Risks

- Martingale sequence increases lot exposure

- No hard maximum lot limit defined

- No explicit stop loss per trade

- Best suited for ranging or mean-reversion markets

⭐ Rating & Risk Level

⭐ Overall Rating: 7.5 / 10

VR Locker MT5 offers a well-structured lock and averaging system with customizable steps and profit logic. It is powerful but requires disciplined capital management.

⚠️ Risk Level: Medium – High

| Risk Factor | Level |

|---|---|

| Trading Style | Lock / Averaging / Martingale |

| Lot Escalation | Enabled |

| Stop Loss | Not defined |

| Drawdown Potential | Medium–High |

| Recommended Capital | Medium to Large accounts |

✅ Conclusion

VR Locker MT5 is a recovery-focused automated trading robot designed for experienced traders who understand lock-based and martingale strategies. With conservative starting lots, wide position spacing, and basket profit targets, the EA can perform well in sideways and corrective markets. However, due to the absence of fixed stop losses and the use of lot escalation, it should be traded with sufficient capital and strict risk awareness.