Introduction

In the world of financial trading—whether Forex, Stocks, Cryptocurrencies or Commodities—Averaging is one of the most commonly used strategies among both manual and automated traders (EAs and robots). It is designed to reduce risk, improve entry accuracy, and optimize exit positions by gradually layering trades into the market. While averaging can be highly effective when used correctly, it also carries significant risks if misunderstood or misused.

This comprehensive guide explains everything you need to know about Averaging in trading, from its core concept and types to real-world use cases, risk management techniques, and best practices. Whether you’re a beginner, a professional trader, or an EA developer, this article will help you better understand how averaging works—and how to use it safely and effectively.

What Is Averaging in Trading?

Averaging is a position management technique where a trader adds new trades to an existing position (buy or sell) at different price levels. The purpose is to improve the average entry price, which makes it easier to close all positions at a profit or break-even if the market reverses.

Simple Explanation

Instead of opening just one trade, a trader opens multiple positions as the price moves up or down. This adjusts the total entry price to a more favorable level.

🔹 Example:

You buy EUR/USD at 1.1000. Price drops to 1.0950, and you open another buy to lower your average entry to 1.0975. If the price rises to 1.0975 or higher, you can close both trades at break-even or profit.

Key Objectives of Averaging

- Reduce drawdown impact when the market moves against your first entry

- Increase the probability of closing in profit

- Manage trades more dynamically compared to single-entry strategies

- Adapt to market volatility and price fluctuations

- Support both manual and automated trading systems (EAs)

Types of Averaging Strategies

1. Classic Averaging

Traders add positions at predefined price intervals (e.g., every 20 pips). This is simple, manual, and commonly used.

2. Martingale-Based Averaging

In this type, traders increase the lot size with each successive trade (usually doubling), aiming for faster recovery. While profitable at times, it carries high risk.

3. Anti-Martingale (Reverse Averaging)

New positions are added only when trades are profitable, usually on trend-following strategies.

4. Adaptive Averaging

This uses smart logic and algorithms to open trades only in key liquidity zones, support/resistance levels, or during strong market conditions. Most modern EAs use adaptive averaging.

How Averaging Works: A Technical Breakdown

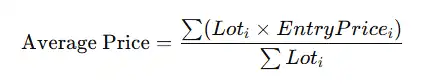

Formula for Average Entry Price

For multiple positions:

Where:

- Lot_i = size of each trade

- Entry Price_i = opening price of each position

Averaging helps bring the overall entry price closer to current market price, making it easier to exit profitably.

Why Traders Use Averaging

| Benefit | Explanation |

|---|---|

| Higher Probability of Profit | Multiple entries improve recovery chances even if market moves against you |

| More Flexible Exit Options | You can close at break-even or small profit instead of waiting for big trend |

| Works Well in Sideways Markets | Perfect for ranging markets when no clear trend is present |

| Suitable for Automated EAs | Algorithms can calculate optimal entry spacing and lot sizing |

Averaging vs. Hedging: What’s the Difference?

| Feature | Averaging | Hedging |

|---|---|---|

| Main Purpose | Reduce loss and improve average price | Protect existing orders |

| Market Direction | Same direction | Opposite direction |

| Risk Level | Medium to high | Lower risk |

| Used By | Grid EAs, Martingale systems, traders in ranging markets | Mostly institutional traders |

Real-World Use Cases of Averaging

1. Grid Trading Systems

Commonly used in EAs, grid trading opens buy and sell positions in both directions as price fluctuates. Averaging is used to improve overall entry price.

2. Mean Reversion Strategies

Traders expect price to return to its average (mean), making averaging ideal for capturing reversal setups.

3. Automated Expert Advisors (EAs)

Most advanced EAs use averaging filters to enter multiple trades in structure zones, supply-demand areas, or liquidity pools.

Mistakes Traders Make with Averaging

Even though averaging is a powerful strategy, many traders misuse it, especially when emotions or greed take control.

Common Mistakes

❌ Using fixed lots without risk limits

❌ Averaging while trading against strong trends

❌ Not using Stop Loss or Equity Protection

❌ Averaging with high leverage and small margin

❌ Using martingale without understanding risk

Best Risk Management Practices for Averaging

| Risk Management Tool | Purpose |

|---|---|

| Equity Protection | Prevents account blowout by closing trades at safe thresholds |

| Soft Grid Limiter | Stops opening new positions if price deviates too far |

| Maximum Trades Limit | Controls excessive order stacking |

| Dynamic Lot Sizing | Adjusts lot size based on balance and volatility |

| Time Filters | Avoids trading during news or unstable market periods |

Advanced Averaging Techniques Used in EAs

1. Volatility-Based Averaging

Uses ATR or Bollinger Bands to decide where to open new positions.

2. Structure-Based Averaging

Averaging trades only when price reaches support/resistance or Fibonacci levels.

3. Liquidity-Based Averaging

Uses smart algorithms to identify price manipulation zones (liquidity grabs, stop hunts).

4. Hybrid Averaging

Combines grid, trend filtering, break-even logic, and scaling for safer performance.

Advantages and Disadvantages of Averaging

Advantages

✔ Helps recover from bad entries

✔ Ideal for range-bound markets

✔ Increased profit potential when managed correctly

✔ Suitable for automated trading systems

Disadvantages

❌ Requires strong risk control

❌ High drawdown risk if used improperly

❌ Can destroy accounts during high volatility or news

❌ Not recommended for beginners without EA or risk rules

When Is Averaging Most Effective?

| Market Condition | Averaging Performance |

|---|---|

| Sideways/Range | ⭐⭐⭐⭐⭐ Excellent |

| Soft Trend | ⭐⭐⭐⭐ Good |

| Strong Trend | ⭐⭐ Risky |

| News/High Volatility | ⭐ Very risky |

Is Averaging Suitable for All Traders?

| Trader Type | Suitability |

|---|---|

| Beginner Manual Trader | ⚠ Use with caution |

| Intermediate Trader | 👍 Suitable with risk control |

| Professional Trader | ⭐ Highly effective |

| EA Developer | ⭐ Essential technique |

| High-Risk Trader | ⭐⭐ Available but dangerous |

Conclusion

Averaging is a powerful yet risky strategy that, when used intelligently, can significantly improve profitability, help recover poor entries, and optimize trade exits. It is widely used in both manual and automated trading systems—especially in Expert Advisors (EAs)—to adapt to dynamic market conditions. However, without proper risk control, averaging can quickly lead to large drawdowns or account failure.

To use Averaging effectively:

✔ Avoid averaging against strong trends

✔ Always use protective equity settings

✔ Combine averaging with volatility, liquidity, or support/resistance filters

✔ Prefer smart or adaptive averaging over classic or martingale systems

When applied strategically, averaging can become a profitable long-term trading tool and a cornerstone of effective automated strategies.