RTX Barbar EA MT5 v3.35 with SetFiles (Unlimited)

Subscriptions for Special Plan

- 30 EA package is more economical!

- Special package with 99%

- Download 1 EA/Day

Subscriptions for Premium Membership

- Download Unlimited in 1 Year

- Get 100% Discount

- Get free access to all

Subscriptions for Gold Membership

- 1 Year Membership

- Get 100% Discount

- Access EA+Indicator+Course

Frequently bought together 🎁

Add these products to enhance your purchase

What is RTX Barbar EA MT5?

RTX Barbar EA is an advanced automated trading system built for experienced traders who require adaptability, layered risk control, and intelligent execution. It combines indicator-filtered entries with dynamic position management, recovery logic, and protective mechanisms to operate across volatile and ranging markets while maintaining stability, controlled exposure, and disciplined risk management.

Key Features of RTX Barbar for MT5

🔹 Smart Indicator Entries: Combines SAR, EMA and RSI to filter trades and improve signal quality.

🔹 Multi-Layer Risk Control: Dynamic break-even, recovery modes, and equity safeguards.

🔹 Adaptive Position Management: Grid, scaling, and paired closing for drawdown control.

🔹 Session & Spread Filters: Avoids poor liquidity and high-cost market conditions.

What is the RTX Barbar EA Trading Strategy?

🔹 Indicator-Based Trade Filtering: Trades only when trend and momentum align.

🔹 Grid & Martingale Logic: Structured scaling with caps and recovery systems.

🔹 Dynamic Break-Even System: Secures positions faster as exposure increases.

🔹 Advanced Recovery & Pair Closing: Reduces net exposure during prolonged ranges.

RTX Barbar EA MT5 Review

The RTX Barbar EA have achieved impressive profit performance over many years of trading. The advisor shows amazing ability to master the market and increase profits.

The results of the RTX Barbar MT5’s reverse test trading showed impressive profit performance over 2 months on the XAUUSD pair.

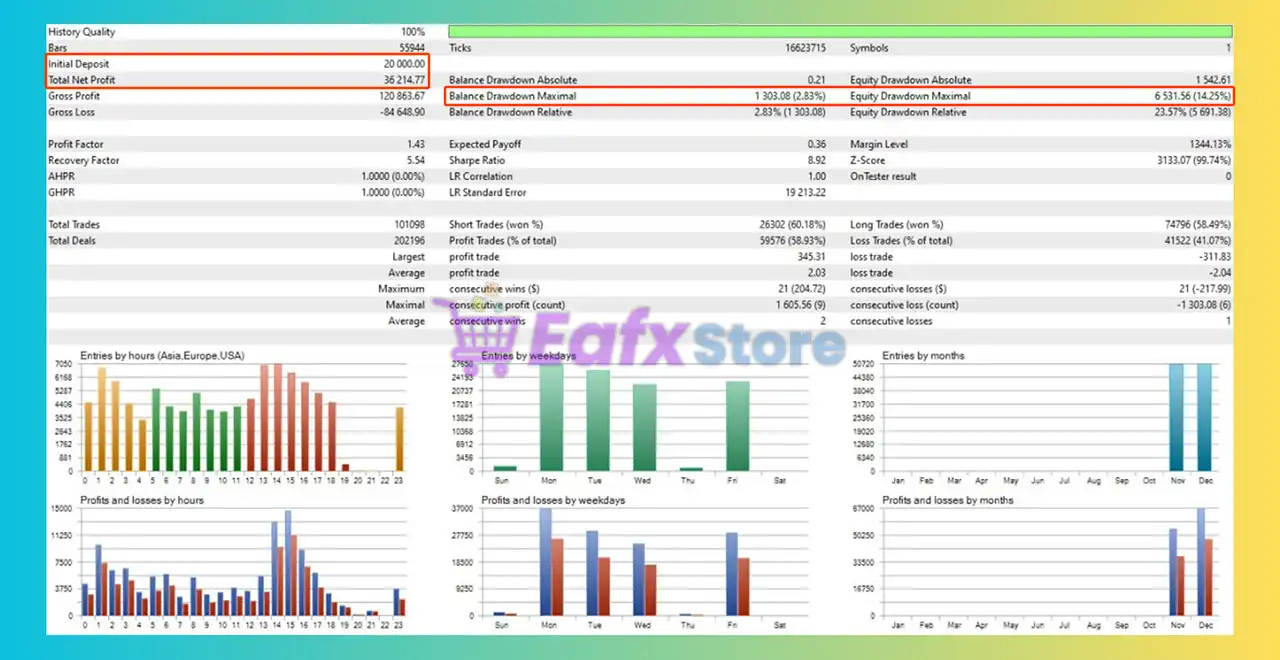

RTX Barbar EA MT5 Backtest

RTX Barbar MT5 Backtest

Why Choose & Use RTX Barbar EA?

🔹 Professional-Grade Automation: Designed for complex market behavior.

🔹 Strong Recovery Capabilities: Multiple tools to manage and reduce drawdown.

🔹 High Customization: Flexible risk, lot, and strategy controls.

🔹 Marketplace Ready: Ideal for advanced users seeking powerful, adaptive automation.

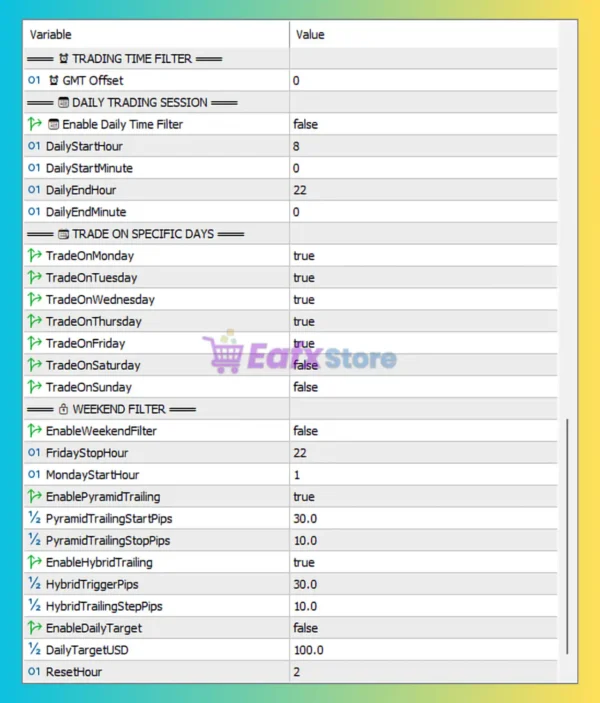

Recommended settings

Recommended settings and parameters to pay attention to from developers and experts:

| Features | Type |

|---|---|

| Trading platform | MetaTrader 5 (MT5) |

| Time frames | Any |

| Currency pairs | XAUUSD (Gold) |

| Minimum / Recommended deposit | $100 (For use with Cent accounts) |

| Minimum / Recommended leverage | Any |

| Account types | Any |

| Product type | NoDLL / Unlimited |

| Additional services | Unlock and Decompile |

| Recommended brokers | Exness Broker, Icmarkets Broker |

| Recommended VPS | MyfxVPS.com (Blue VPS, Golden VPS). Lowest Latency, 2 week Free Trial, 100% Free for 12-18 Months. |

Product Download Package?

The download package of the product suite includes:

Conclusion

In short, RTX Barbar for MT5 is a powerful tool for those who want the high returns of a grid/martingale system but with the safety of modern indicator filters. Its ability to “pair close” losing trades makes it much more resilient during long one-way trends than standard grid bots. To maximize stability, it is best paired with a high-leverage (1:500) account and a low-latency VPS.

User Reviews

Only logged in customers who have purchased this product may leave a review.

❓ What is the core trading strategy of RTX Barbar EA?

The EA uses a Multi-Indicator Filter strategy. It analyzes market momentum and trends using SAR (Parabolic Stop and Reverse), EMA (Exponential Moving Average), and RSI (Relative Strength Index). Trades are only initiated when these indicators align, ensuring the bot enters during high-probability setups rather than just random price movements.

❓ How does the "Recovery Mode" work?

If a trade moves into a drawdown, the EA activates its Advanced Recovery & Pair Closing logic. It uses a structured grid system to place additional orders at strategic levels. Crucially, it employs "Paired Closing," where profitable orders are used to offset and close the furthest losing orders in a basket, effectively reducing net exposure and "cleaning up" the drawdown without needing a full market reversal.

❓ Is RTX Barbar EA suitable for Gold (XAUUSD)?

Yes, it is primarily designed and optimized for Gold. Gold is known for having sharp trends followed by significant retracements; RTX Barbar’s strategy is built to survive the "trend" phase and exit profitably during the "retracement" or ranging phase.

❓ What are the verified backtest results?

In 2-month reverse testing on XAUUSD:

✅ Initial Deposit: $20,000

✅ Total Net Profit: $36,214.77

✅ Maximum Drawdown: 2.83%

Note: These results indicate a very high-performance setup with low risk, but real-world results depend heavily on the broker's spread and execution speed.

❓ Does it use Martingale logic?

It uses a Structured Martingale/Grid Scaling logic. However, it is not "blind" martingale. The lot multiplication is controlled by specific caps and recovery systems, meaning it won't infinitely double lot sizes until the account is blown. It focuses on "Smart Scaling" based on indicator confirmations.

❓ What is the "Dynamic Break-Even" system?

As the number of open orders in a grid (a "basket") increases, the EA automatically adjusts the Break-Even point. This ensures that as exposure grows, the target profit level moves closer to the current price, allowing the EA to exit the entire trade sequence much faster once the market shows signs of a reversal.

❓ Can I use it on a Cent account?

Absolutely. In fact, for traders with smaller balances (starting at $100), using a Cent Account is highly recommended. This allows the EA to have the necessary "margin room" to execute its grid and recovery logic without hitting a margin call.

❓ What are the recommended settings for risk?

Experts recommend utilizing the Session & Spread Filters. These settings prevent the EA from opening new grids during high-impact news or periods of poor liquidity (like the market rollover). Keeping the "Recovery Mode" active is essential for maintaining the low drawdown seen in tests.

❓ Is RTX Barbar EA "Prop Firm" friendly?

Because of its Multi-Layer Risk Control and low drawdown (2.83% in tests), it is a strong candidate for prop firm challenges. However, users must ensure the "Daily Loss Limit" and "Equity Safeguard" settings are strictly configured to match the specific prop firm's rules.

❓ Does it require a VPS?

Yes. Because RTX Barbar manages complex grids and dynamic break-even points, it must remain connected to the broker server 24/7. Even a brief disconnect could cause the EA to miss a "Paired Closing" event, leading to an unmanaged drawdown. A low-latency Forex VPS is mandatory.

🔥 Get This EA for FREE with Our Membership! 🚀🚀

Unlock access to this EA, premium Indicators, and exclusive trading tools completely FREE with any of our Membership Plans! Thousands of traders already benefit from our VIP library—join them and level up your trading instantly. Choose Your Membership:

- SPECIAL – 1 Month Membership

- GOLD – 1 Year Membership

- PREMIUM – 1 Year Membership

There are no reviews yet.