Flip Bot EA Overview

Flip Bot EA is a state-of-the-art automated trading Expert Advisor (EA) meticulously designed for Gold trading on the MetaTrader 4 (MT4) platform. Optimized for a 1-minute time frame, this EA offers unparalleled performance even with a small starting capital of just $200. With a focus on stability and risk management, Flip Bot EA avoids risky trading strategies while effectively navigating the challenges of the dynamic forex market.

- View backtest transaction results: Here

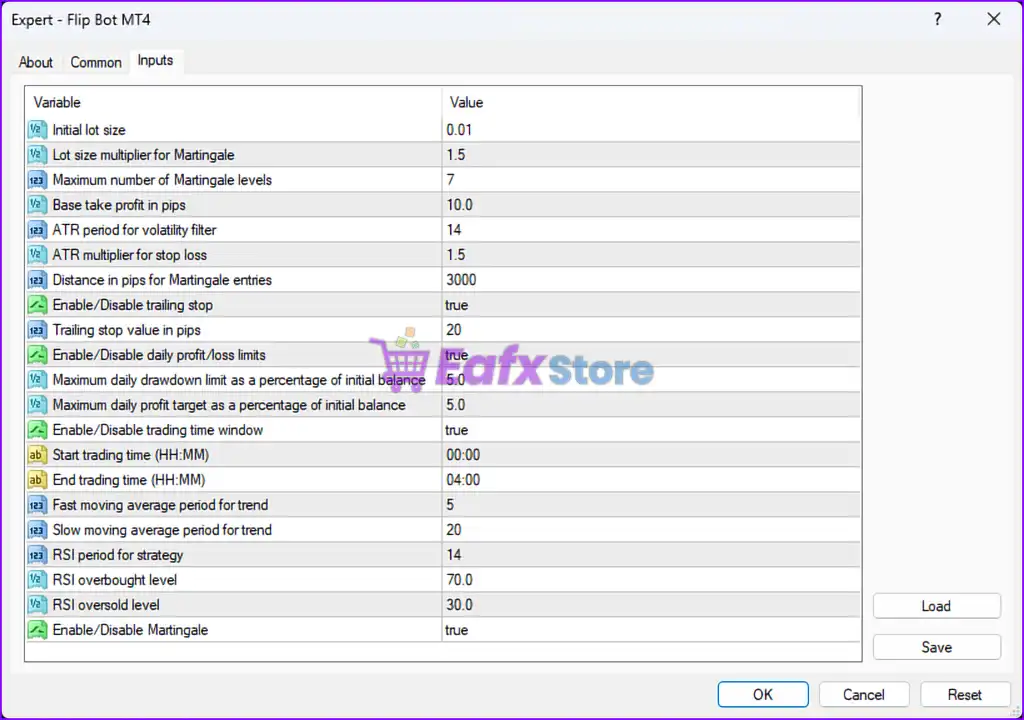

Installation panel Parameters

Below are the details of the parameters in the advisor’s trading system settings table:

1. Lot Size and Martingale Settings:

- Initial lot size: 0.01 – The starting lot size for the EA’s trades. Suitable for low-risk strategies or small account sizes.

- Lot size multiplier for Martingale: 1.5 – When a Martingale trade is triggered, the lot size is multiplied by 1.5 for subsequent trades.

- Maximum number of Martingale levels: 7 – Limits the EA to a maximum of 7 levels in the Martingale strategy. Beyond this, no further doubling of lot size will occur.

2. Take Profit and Stop Loss:

- Base take profit in pips: 10.0 – Sets a fixed take profit level of 10 pips for trades.

- ATR period for volatility filter: 14 – Uses a 14-period Average True Range (ATR) to calculate volatility.

- ATR multiplier for stop loss: 1.5 – Stop loss is calculated based on 1.5 times the ATR value, adapting dynamically to market volatility.

3. Trade Entry and Management:

- Distance in pips for Martingale entries: 3000 – Specifies the distance in pips for entering new trades in the Martingale sequence. This value seems abnormally high and might require adjustment.

- Enable/Disable trailing stop: true – Trailing stop functionality is enabled, allowing profits to be locked in dynamically.

- Trailing stop value in pips: 20 – The trailing stop will activate when the trade is 20 pips in profit.

4. Daily Profit and Loss Limits:

- Enable/Disable daily profit/loss limits: true – Activates daily trading limits for both profit and loss.

- Maximum daily drawdown limit as a percentage of initial balance: 5.0 – Stops trading for the day if the account drawdown exceeds 5% of the initial balance.

- Maximum daily profit target as a percentage of initial balance: 5.0 – Stops trading for the day once a 5% profit is achieved.

5. Trading Time Settings:

- Enable/Disable trading time window: true – Activates time restrictions for trading.

- Start trading time (HH:MM): 00:00 – The EA starts trading at midnight.

- End trading time (HH:MM): 04:00 – The EA stops trading at 4:00 AM.

6. Trend and RSI Settings:

- Fast moving average period for trend: 5 – A fast-moving average with a period of 5 is used for trend detection.

- Slow moving average period for trend: 20 – A slow-moving average with a period of 20 is used to confirm the trend.

- RSI period for strategy: 14 – The RSI is calculated using a 14-period setting.

- RSI overbought level: 70.0 – Trades are avoided when the RSI crosses above 70, indicating overbought conditions.

- RSI oversold level: 30.0 – Trades are avoided when the RSI crosses below 30, indicating oversold conditions.

7. Martingale Settings:

- Enable/Disable Martingale: true – Activates the Martingale strategy, which increases lot size after a losing trade to recover losses.

Analysis and Recommendations

1. Risk Management:

- Martingale Risk:

- The Martingale strategy has an aggressive risk profile, especially with a multiplier of 1.5 and up to 7 levels. Ensure the account size can handle potential drawdowns.

- Stop Loss and Take Profit:

- The use of ATR-based stop loss adapts to market conditions, which is good for dynamic volatility. However, a fixed TP of 10 pips versus a stop loss dependent on ATR may result in an unfavorable risk-reward ratio.

- Daily Limits:

- The 5% daily profit and loss limits are reasonable for risk control. These settings help ensure the account is not overexposed in a single trading day.

2. Trading Efficiency:

- Trading Time:

- Restricting trading to 00:00 – 04:00 is likely optimized for specific market conditions or sessions. Ensure this aligns with the pairs being traded.

- Trend and RSI Filters:

- The combination of moving averages and RSI levels provides a good balance of trend and momentum confirmation. Monitor the effectiveness of these filters in volatile markets.

- Trailing Stop:

- The trailing stop of 20 pips is useful for locking in profits but might need adjustment for higher volatility pairs.

3. Recommendations:

- Adjust Martingale Settings:

- Reduce the number of levels or the lot multiplier to minimize the risk of significant drawdowns during prolonged losing streaks.

- Review Distance for Martingale Entries:

- The

3000 pipsentry distance appears to be an error or extreme setting. Verify and adjust it to align with typical market movements.

- The

- Backtest and Optimize:

- Test the EA extensively on historical data to ensure the settings are optimized for your trading pairs and conditions.

- Monitor RSI and Trend Filters:

- Fine-tune the RSI and moving average periods to ensure they match the market behavior of your selected currency pairs.

Conclude

The Flip Bot EA employs a mix of Martingale, trend detection, and RSI filtering to identify trading opportunities. It features robust risk management with daily limits, trailing stops, and ATR-based stop losses. However, the Martingale component introduces high risk and should be carefully tested and monitored. Ensure that all settings are tested in a demo account before live trading to minimize potential losses.