Trading Parameters and Risk Settings

📌📌📌 Buy this unlimited StorageFX EA MT4 product here 📌📌📌

The StorageFX EA comes with a flexible setup that allows both conservative and aggressive trading approaches:

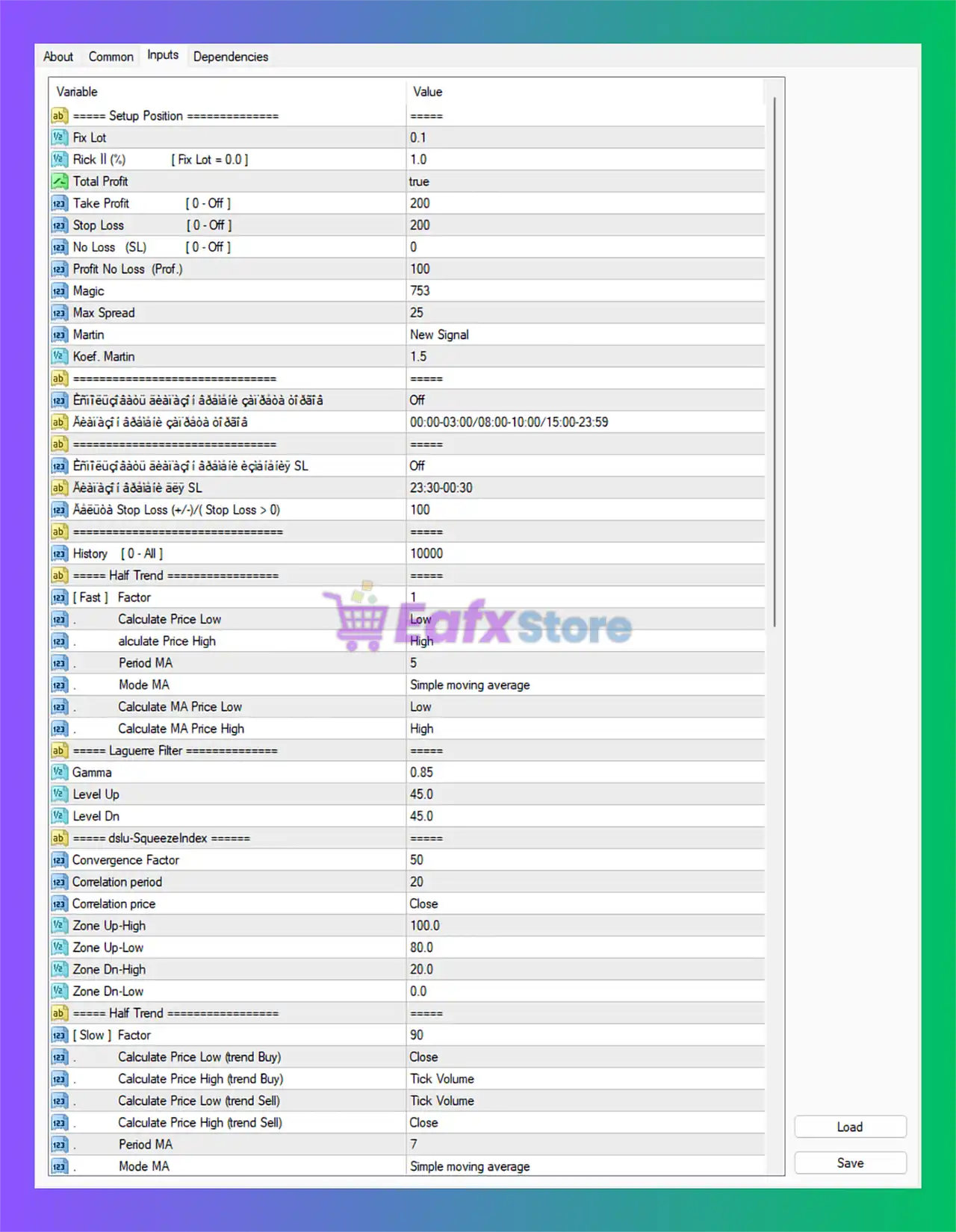

- Lot Size Control: Traders can use a fixed lot (0.1) or risk-based lot sizing (1.0% per trade) for automated money management.

- Take Profit & Stop Loss: Default TP and SL are both set at 200 points, providing a balanced risk-to-reward ratio.

- Profit Locking: The EA supports No Loss (breakeven) at 100 points and trailing features to secure profits.

- Martingale System: Enabled with a multiplier of 1.5, allowing recovery trades with controlled risk.

- Maximum Spread: Limited to 25 points, which ensures trades are placed under favorable market conditions.

These settings show that StorageFX EA is optimized for both stability and profit growth, with built-in mechanisms to protect accounts from extreme volatility.

Trading Filters and Conditions

StorageFX EA integrates multiple advanced filters for precise trade execution:

- Time Filters: Active trading sessions are strictly defined (e.g., 00:00–03:00, 08:00–10:00, 15:00–23:59), avoiding high-risk market hours.

- News Filter: The EA can avoid trading during high-impact news events by pulling updates from external sources.

- Daily Stop Loss: Risk is capped with a daily stop limit to prevent drawdowns.

This shows the EA is designed to adapt to different market conditions, avoiding unnecessary exposure to unexpected volatility.

Technical Indicators Used

StorageFX EA employs a blend of technical indicators for trend and momentum confirmation:

- Moving Averages (MA): Uses short-term (5-period) and long-term (500–2000 periods) simple moving averages for multi-timeframe trend analysis.

- Laguerre Filter: Smooths price movements with gamma set at 0.85, reducing false signals.

- Squeeze Index: Identifies volatility breakouts with customizable up/down zones.

- Correlation Filters: Ensures alignment with broader market momentum to avoid counter-trend trades.

This combination highlights that the EA relies on multi-layered confirmations to improve accuracy and reduce noise in trading signals.

Asset Coverage and Customization

- The EA is designed for major Forex pairs such as USD, EUR, GBP, CHF, CAD, AUD, and JPY.

- Color-coded interface parameters (Red, Blue, Lime, DeepSkyBlue) simplify visualization of signals.

- Adjustable history depth (default 100,000 bars) ensures robust backtesting.

Conclusion

The backtest setup of StorageFX EA demonstrates a well-structured risk management framework, combined with advanced filters and multi-timeframe strategies.

✅ Strengths:

- High adaptability with customizable TP/SL and martingale controls.

- Strong protection systems, including spread filters, news filters, and time filters.

- Multi-indicator confirmation for trend-following and volatility breakout strategies.

⚠️ Considerations:

- Martingale (1.5x) increases recovery potential but must be used cautiously on smaller accounts.

- Requires a low-spread broker and preferably VPS hosting for uninterrupted execution.

📌 Final Verdict: StorageFX EA is a robust and versatile Expert Advisor designed for traders who want both automation and flexibility. With its combination of advanced filters, risk controls, and adaptive strategies, it shows strong potential for long-term profitability when used on the right trading conditions.