🧩 What is Ryukai Scalper EA?

Ryukai Scalper EA uses a high-precision scalping structure designed for fast intraday entries with controlled risk management. The configuration features a highly sensitive Parabolic SAR calculation and tight trailing logic, optimized for quick profit capture in volatile markets while maintaining safe exit protection.

📌📌📌 Buy this unlimited Ryukai Scalper EA MT4 product here 📌📌📌

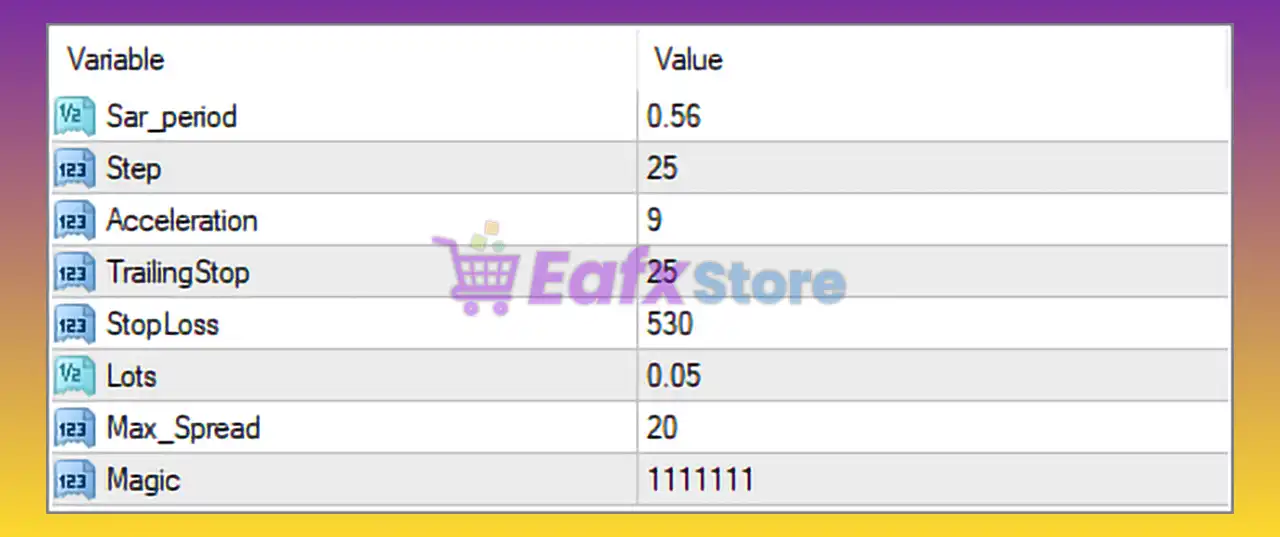

🧩 Parameter Explanation

| Parameter | Description |

|---|---|

| Sar_period = 0.56 | Custom Parabolic SAR calculation speed – lower period makes the indicator highly sensitive and faster reacting to micro trend reversals. |

| Step = 25 | Defines order modification step and trailing progression distance. Helps improve precision during small price swings. |

| Acceleration = 9 | Very aggressive SAR acceleration factor – this makes the EA react faster to trend changes, ideal for scalping environments. |

| TrailingStop = 25 | Once price moves into profit, positions will be protected at 25 points distance. Good for locking micro profits systematically. |

| StopLoss = 530 | Fixed safety stop loss – wide enough so the EA does not exit prematurely during short-term volatility spikes. |

| Lots = 0.05 | Medium lot size compared to most micro-scalper defaults. Suitable for medium accounts. Risk should be lowered for small funding or prop accounts. |

| Max_Spread = 20 | Spread filter used to prevent entries during abnormal volatility or news spikes – important for scalping stability. |

| Magic = 1111111 | Unique identifier for this strategy so it does not mix with other running EAs. |

🧩Conclusion

The Ryukai Scalper EA configuration shows a highly sensitive Parabolic SAR-based scalping strategy with fast acceleration and tight trailing logic. With a trailing stop of 25 points and spread protection, this expert advisor is engineered for quick profit capture while still maintaining safe exit protection through a controlled Stop Loss (SL) at 530 points. This setup is optimized for high volatility pairs and short-term market fluctuations, making it suitable for traders seeking high-frequency intraday gains with defined risk boundaries.