🧩 What is Dow Jones Rocket EA?

The Dow Jones Rocket EA MT5 is an automated trading system designed primarily for Dow Jones Index (US30 / DJ30) trading. Based on the provided settings image, this Expert Advisor (EA) focuses on controlled risk, indicator-based entries, and strict daily profit/loss limits, making it structurally different from aggressive martingale systems.

📌📌📌 Buy this unlimited Dow Jones Rocket EA MT5 product here 📌📌📌

Below is a complete breakdown of each parameter group and what these settings imply for real trading conditions.

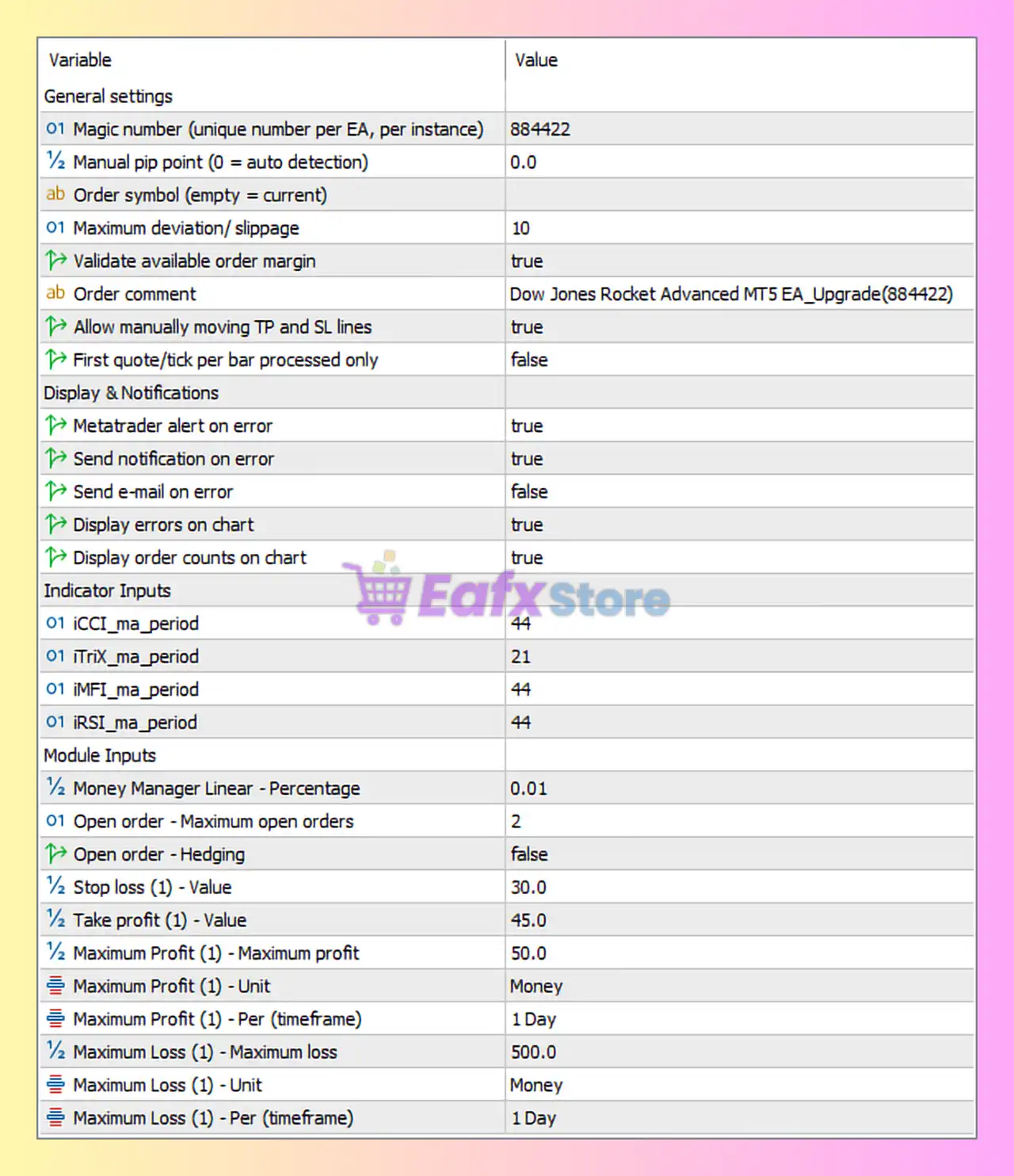

🧩 General Settings

🔹 Magic Number: 884422

- Unique identifier per EA instance

- Correctly configured to avoid trade conflicts

🔹 Manual Pip Point: 0.0

- Auto-detection enabled

- Ensures compatibility across brokers and symbols

🔹 Order Symbol: (empty)

- EA trades the current chart symbol

- Ideal for single-instrument deployment (Dow Jones)

🔹 Maximum Deviation (Slippage): 10

- Moderate slippage tolerance

- Suitable for indices trading, which often experiences volatility

🔹 Validate Available Order Margin: true

- Prevents trade execution if margin is insufficient

- Strong safety feature for account protection

🔹 Order Comment:

Dow Jones Rocket Advanced MT5 EA_Upgrade (884422)

- Useful for tracking EA performance in account history

🔹 Allow Manually Moving TP & SL: true

- Trader can manually adjust stop loss and take profit

- Helpful for semi-automated trading

🔹 First Quote/Tick Per Bar Processed Only: false

- EA reacts to every tick, not only new candles

- Increases execution accuracy but raises trade frequency

🧩 Display & Notifications

All critical monitoring options are enabled:

- MetaTrader alerts on errors

- Push notifications on errors

- Error display on chart

- Order count display on chart

📌 Verdict:

This setup is transparent and trader-friendly, allowing fast detection of execution or broker issues.

🧩 Indicator Inputs (Trading Logic Core)

The EA relies on a multi-indicator confirmation system, reducing false signals.

🔹 iCCI MA Period: 44

- Commodity Channel Index smoothing

- Filters overbought/oversold conditions

🔹 iTRIX MA Period: 21

- Trend momentum indicator

- Short-to-medium trend detection

🔹 iMFI MA Period: 44

- Money Flow Index

- Confirms volume-backed price movements

🔹 iRSI MA Period: 44

- Relative Strength Index smoothing

- Prevents entries during extreme momentum

📌 Indicator Verdict:

Using high MA periods (44) suggests:

- Fewer trades

- Higher signal quality

- Better performance on M15–H1 timeframes

🧩 Money Management & Risk Control

🔹 Money Manager Linear – Percentage: 0.01

- Extremely low risk per trade (0.01%)

- Very conservative position sizing

- Ideal for long-term capital preservation

🔹 Maximum Open Orders: 2

- Prevents overexposure

- Limits drawdown during volatile sessions

🔹 Hedging: false

- No opposing positions

- Cleaner trade logic and margin usage

📌 Risk Management Verdict:

This EA is clearly designed for capital safety, not aggressive growth.

🧩 Trade Exit & Daily Limits

🔹 Stop Loss: 30.0

🔹 Take Profit: 45.0

- Risk/Reward Ratio = 1 : 1.5

- Statistically favorable configuration

🔹 Maximum Profit per Day: 50.0 (Money)

- EA stops trading after hitting daily profit target

- Prevents overtrading and emotional market conditions

🔹 Maximum Loss per Day: 500.0 (Money)

- Hard daily loss cap

- Protects account from abnormal market behavior

📌 Daily Control Verdict:

Professional-grade daily profit and loss limits, commonly used in prop firm trading.

🧩 Overall Trading Style Summary

| Aspect | Evaluation |

|---|---|

| Trading Type | Indicator-based intraday trading |

| Risk Profile | Very low risk |

| Martingale | ❌ No |

| Hedging | ❌ No |

| Overtrading Protection | ✅ Yes |

| Daily Drawdown Control | ✅ Yes |

| Suitable Market | Dow Jones / US30 |

| Best Timeframes | M15 – H1 |

🧩 Final Conclusion – Is Dow Jones Rocket EA MT5 Worth Using?

✅ Strengths

- Strong risk management framework.

- No martingale or grid system.

- Favorable risk-to-reward ratio.

- Multi-indicator confirmation reduces false entries.

- Daily profit and loss limits (prop firm friendly).

- Suitable for long-term, stable trading.

❌ Limitations

- Very low risk = slow account growth.

- Not suitable for small accounts seeking fast returns.

- Requires patience and proper broker execution.