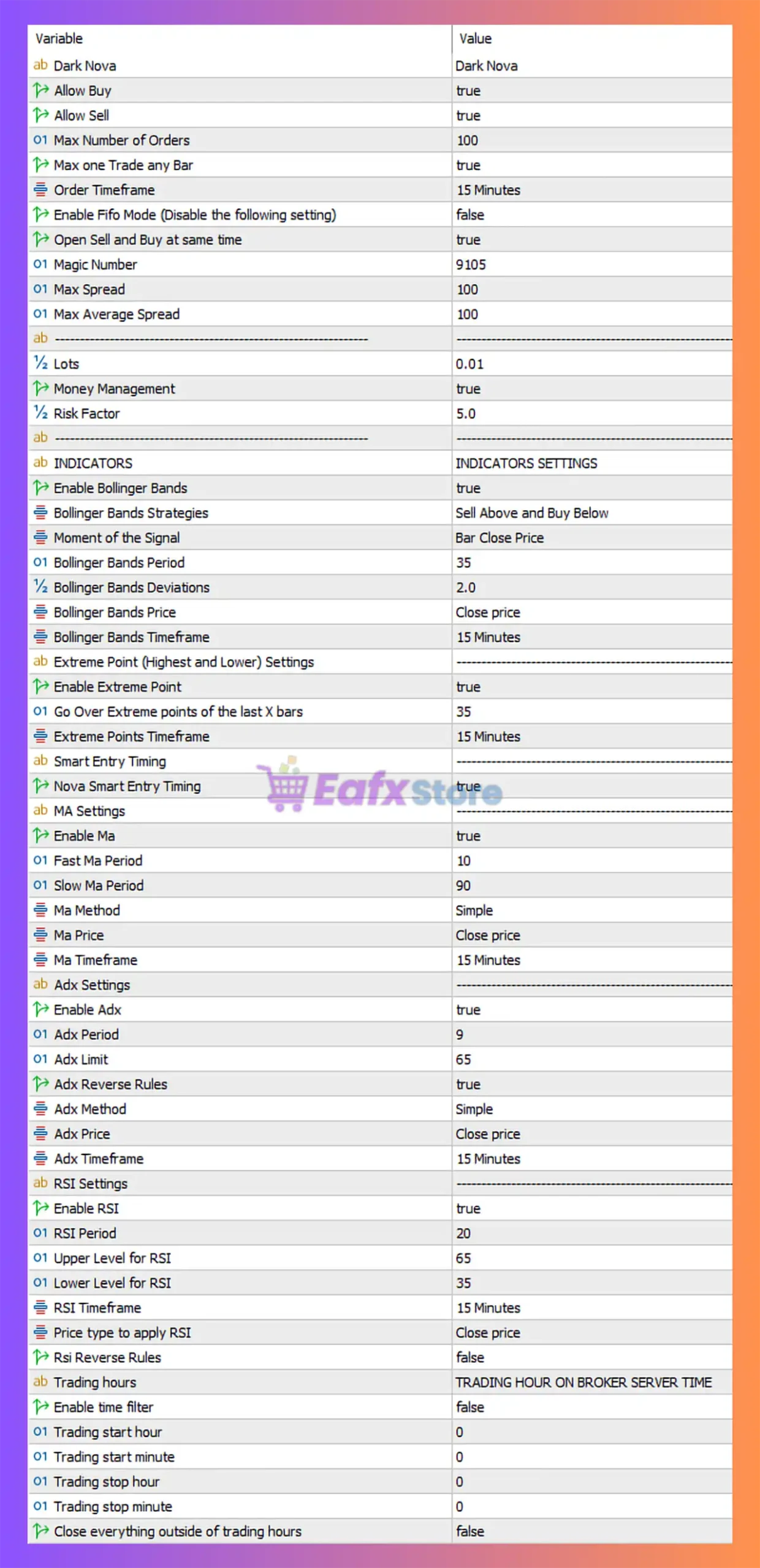

🧩 Overview of Dark Nova MT5

Dark Nova is a grid-based automated trading Expert Advisor (EA) for MetaTrader 5 (MT5), combining Bollinger Bands, Moving Averages, ADX, RSI, and Extreme Point logic with smart entry timing and risk-managed grid trading.

The settings indicate that Dark Nova is designed for:

- High-frequency intraday trading.

- Trend + mean-reversion strategies.

- Controlled grid expansion.

- Strict spread and risk filters.

📌📌📌 Buy this unlimited Dark Nova MT5 product here 📌📌📌

🧩 General Trading Configuration

| Parameter | Value | Explanation |

|---|---|---|

| Allow Buy | true | Enables long (buy) trades |

| Allow Sell | true | Enables short (sell) trades |

| Max Number of Orders | 100 | Caps total open orders to control risk |

| Max One Trade Any Bar | true | Prevents overtrading within the same candle |

| Order Timeframe | 15 Minutes | EA logic is calculated on M15 |

| FIFO Mode | false | Allows hedging (non-FIFO brokers) |

| Buy & Sell Same Time | true | Enables hedging (buy and sell simultaneously) |

| Magic Number | 9105 | Unique ID to isolate EA trades |

| Max Spread | 100 | Hard spread filter |

| Max Average Spread | 100 | Prevents trading during unstable spreads |

✅ Assessment: This setup is suitable for hedging brokers, aggressive intraday strategies, and volatile pairs.

🧩 Risk & Money Management

| Parameter | Value | Explanation |

|---|---|---|

| Lots | 0.01 | Base fixed lot size |

| Money Management | true | Dynamic lot sizing enabled |

| Risk Factor | 5.0 | Aggressive risk multiplier |

⚠️ Risk Note: A Risk Factor of 5.0 is considered high. This setting increases exposure during grid expansion and should be used only on accounts with sufficient balance.

🧩 Bollinger Bands Strategy

| Parameter | Value | Explanation |

|---|---|---|

| Enable Bollinger Bands | true | Core trading indicator |

| Strategy Mode | Sell Above & Buy Below | Mean-reversion logic |

| Signal Moment | Bar Close Price | Confirms signals at candle close |

| Period | 35 | Smooth BB calculation |

| Deviation | 2.0 | Standard volatility range |

| Price Type | Close Price | Reliable for confirmation |

| Timeframe | 15 Minutes | Matches EA logic timeframe |

✅ Assessment: This configuration favors range trading and performs best in sideways or slow-trend markets.

🧩 Extreme Point Filter (High/Low Logic)

| Parameter | Value | Explanation |

|---|---|---|

| Enable Extreme Point | true | Detects local highs/lows |

| Lookback Bars | 35 | Recent structure confirmation |

| Timeframe | 15 Minutes | Consistent with BB logic |

🎯 Purpose: Avoids entering trades at random levels by confirming market exhaustion zones.

🧩 Smart Entry & Moving Average Filter

Smart Entry Timing

| Parameter | Value |

|---|---|

| Nova Smart Entry Timing | true |

✔ Improves entry precision by filtering low-quality signals.

Moving Average Settings

| Parameter | Value | Explanation |

|---|---|---|

| Enable MA | true | Trend filter |

| Fast MA | 10 | Short-term trend |

| Slow MA | 90 | Long-term trend |

| MA Method | Simple | SMA |

| MA Price | Close Price | Stable signal |

| MA Timeframe | 15 Minutes | Matches core logic |

📈 Assessment: Helps align grid entries with market bias, reducing drawdown.

🧩 ADX Trend Strength Filter

| Parameter | Value | Explanation |

|---|---|---|

| Enable ADX | true | Trend strength filter |

| ADX Period | 9 | Short reaction |

| ADX Limit | 65 | Strong trend threshold |

| Reverse Rules | true | Allows contrarian logic |

| Timeframe | 15 Minutes | Consistent logic |

⚠️ Important: ADX > 65 indicates very strong trends — risky for grid systems. Reverse logic attempts to fade extremes.

🧩 RSI Confirmation Filter

| Parameter | Value | Explanation |

|---|---|---|

| Enable RSI | true | Momentum filter |

| RSI Period | 20 | Balanced sensitivity |

| Upper Level | 65 | Overbought |

| Lower Level | 35 | Oversold |

| Reverse Rules | false | Classic RSI behavior |

| Timeframe | 15 Minutes | Standard |

✅ Assessment: Supports Bollinger Bands by confirming overbought / oversold conditions.

🧩 Trading Time & Day Filters

Trading Hours

| Parameter | Value |

|---|---|

| Time Filter | false |

| Close Outside Trading Hours | false |

➡ EA trades 24/7 based on broker server time.

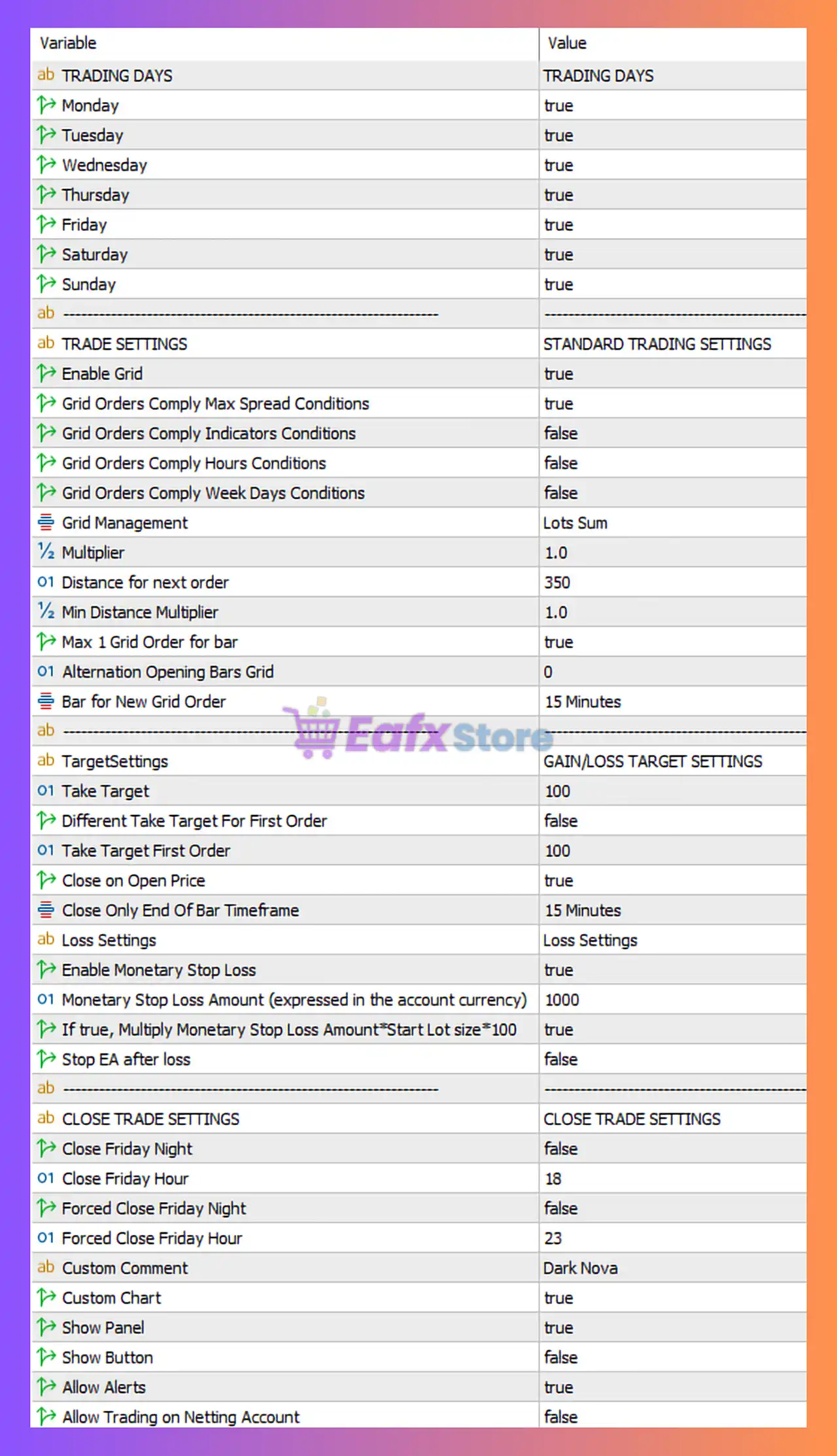

Trading Days

| Day | Enabled |

|---|---|

| Monday – Sunday | true |

⚠️ Risk Alert: Weekend trading (Sunday) may expose the EA to low liquidity & spread spikes.

🧩 Grid Trading Settings

| Parameter | Value | Explanation |

|---|---|---|

| Enable Grid | true | Core strategy |

| Grid Comply Spread | true | Spread safety |

| Grid Comply Indicators | false | Grid ignores indicator filters |

| Grid Management | Lots Sum | Cumulative lot sizing |

| Multiplier | 1.0 | No martingale |

| Distance | 350 points | Grid spacing |

| Max 1 Grid/Bar | true | Prevents stacking |

| Grid Timeframe | 15 Minutes | Stable execution |

🛡 Strength:

No martingale multiplier → lower risk grid.

🧩 Take Profit & Stop Loss Settings

Take Profit

| Parameter | Value |

|---|---|

| Take Target | 100 |

| Close on Open Price | true |

| Close Only End of Bar | true |

Stop Loss

| Parameter | Value |

|---|---|

| Monetary Stop Loss | true |

| Stop Loss Amount | 1000 (account currency) |

| Multiply by Lot Size | true |

| Stop EA After Loss | false |

⚠️ Important: Using monetary stop loss protects the account from catastrophic grid drawdowns.

🧩 Trade Closing & Interface

| Parameter | Value |

|---|---|

| Close Friday Night | false |

| Forced Close Friday | false |

| Custom Chart Label | Dark Nova |

| Show Panel | true |

| Alerts | true |

| Netting Account Trading | false |

🧩 Final Verdict: Is Dark Nova MT5 Worth Using?

Pros

✔ Multi-indicator confirmation

✔ Non-martingale grid system

✔ Strong risk controls (spread, SL, max orders)

✔ Smart entry timing & trend filters

Cons

⚠ Aggressive Risk Factor (5.0)

⚠ Trades all days & hours by default

⚠ Grid trading still vulnerable in strong trends

⭐ Best Use Case Recommendation

Dark Nova MT5 is best suited for:

- Experienced traders

- Medium to large accounts

- Range or semi-trending markets

- Forex pairs with stable spreads (EURUSD, GBPUSD, USDJPY)

🔧 Tip: Reduce Risk Factor, disable Sunday trading, and test on demo or cent accounts before live deployment.