🧩 What is Inova Prime EA?

The Inova Prime EA is designed for traders seeking a balance between smart order block detection, martingale recovery, and trend management. By combining adaptive lot sizing and advanced trade management, the EA offers flexibility for both high-risk and conservative strategies.

📌📌📌 Buy this unlimited Inova Prime EA MT4 product here 📌📌📌

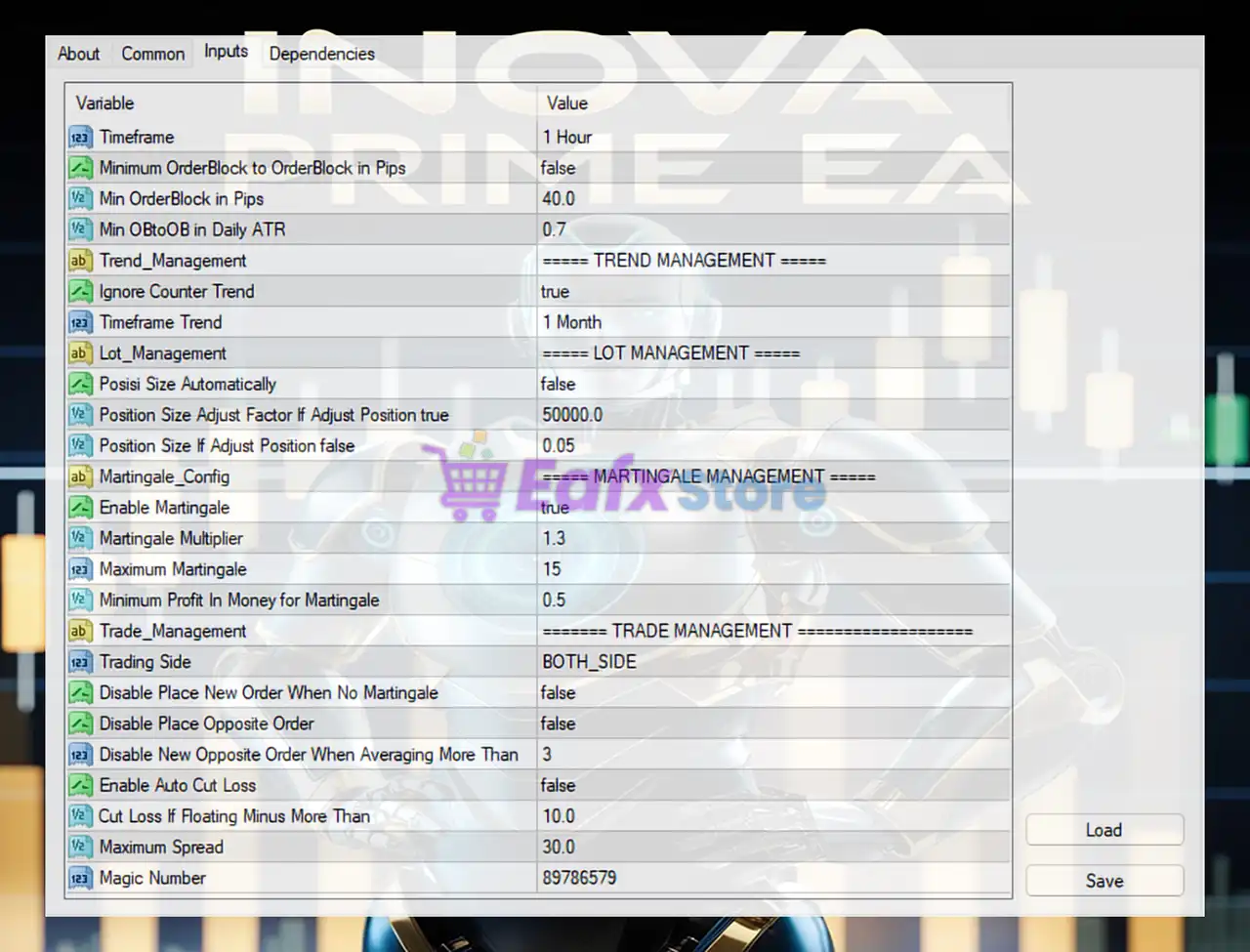

🧩 Timeframe & Order Block Settings

- Timeframe: 1 Hour – The EA uses H1 for trade entries, balancing precision and market noise.

- Minimum OrderBlock in Pips: 40.0 – Defines the minimum order block size for valid setups.

- Min OBtoOB in Daily ATR: 0.7 – Ensures trades are based on real volatility, avoiding weak signals.

- Minimum OrderBlock to OrderBlock in Pips: False – Disabled, but can be activated for stricter filtering.

✅ These parameters confirm that Inova Prime EA relies on price action and order block logic, a method popular among institutional-style trading systems.

🧩 Trend Management

- Trend Management: Enabled with a 1-Month timeframe.

- Ignore Counter Trend: True – The EA avoids trading against the higher timeframe trend.

✅ This shows the EA prioritizes trend-following strategies, reducing unnecessary counter-trend trades that often lead to drawdowns.

🧩 Lot Management

- Auto Lot Size: False – Manual lot size control is active.

- Position Size if Adjust = False: 0.05 lots – Default lot size.

- Position Size Adjust Factor: 50,000 – If enabled, scaling adapts to account size.

✅ Lot sizing is flexible, allowing both manual control and automated scaling for larger accounts.

🧩 Martingale Management

- Enable Martingale: True – Recovery mode is active.

- Martingale Multiplier: 1.3 – A conservative multiplier to gradually increase lot sizes.

- Maximum Martingale: 15 steps – Long recovery cycle enabled.

- Minimum Profit in Money for Martingale: 0.5 – Small profit targets to close martingale cycles.

✅ This confirms that Inova Prime EA uses a low-aggression martingale, aiming for gradual recovery without extreme risk, but still requires careful monitoring.

🧩 Trade Management

- Trading Side: Both (long and short).

- Disable Place New Order When No Martingale: False – Continues opening trades independently.

- Disable New Opposite Order When Averaging More Than 3: True – Restricts overexposure when too many averaging trades exist.

- Enable Auto Cut Loss: False – By default, the EA does not enforce hard cut loss.

- Cut Loss if Floating Minus More Than: 10.0 – A safeguard that triggers if equity drawdown exceeds 10%.

- Maximum Spread: 30 points – Protects from bad execution during volatile periods.

✅ The EA includes strong trade control filters, avoiding over-trading during unfavorable conditions while still allowing both trend and counter-trend strategies when settings permit.

🧩 Other Parameters

- Magic Number: 89786579 – Ensures trade separation from other EAs running on the same account.

🧩 Final Conclusion: Is Inova Prime EA Worth Using?

The Inova Prime EA offers a hybrid strategy that blends:

- 🔹 Order Block price action logic – institutional trading concept.

- 🔹 Trend-following filter – avoids trading against strong market momentum.

- 🔹 Controlled martingale recovery – helps recover from losses without excessive risk.

- 🔹 Lot flexibility – supports both fixed and adaptive risk management.

🔶 Strengths:

- ✅ Advanced order block detection for smarter entries.

- ✅ Trend filter reduces unnecessary losses.

- ✅ Conservative martingale multiplier (1.3) makes recovery safer.

- ✅ Risk cut-off at 10% equity drawdown ensures account protection.

🔶 Risks:

- ⚠️ Martingale mode is active – requires sufficient margin and careful monitoring.

- ⚠️ Auto cut loss disabled by default – traders should consider enabling it for prop firm challenges.

👉 Overall, Inova Prime EA is best suited for traders who want structured order block trading with built-in martingale recovery, making it adaptable for both personal accounts and prop firm challenges when tuned properly.