FTMO Protector EA Overview

The FTMO Protector EA is a powerful risk management tool designed to safeguard your trading account by continuously monitoring performance across multiple trading robots and instruments. It operates in real-time, ensuring strict adherence to FTMO’s risk management rules.

Every day at 01:00 system time, the EA records your account balance and meticulously tracks daily profits and losses. If your predefined profit target is achieved or the maximum loss limit is reached, the EA instantly closes all active trades and suspends further trading.

This automated protection system ensures consistent risk control, minimizes potential losses, and helps you stay compliant with FTMO’s funding program. With the FTMO Protector EA, you can trade confidently, knowing your account is safeguarded against excessive drawdowns.

<<< See more PROP FIRRM trading robots here >>>

Detailed Analysis of FTMO Protector EA MT4

The FTMO Protector EA is a specialized risk management tool designed for prop firm traders, particularly for FTMO or other proprietary trading challenges. This EA ensures strict adherence to risk limits, which is critical for passing and maintaining funded accounts.

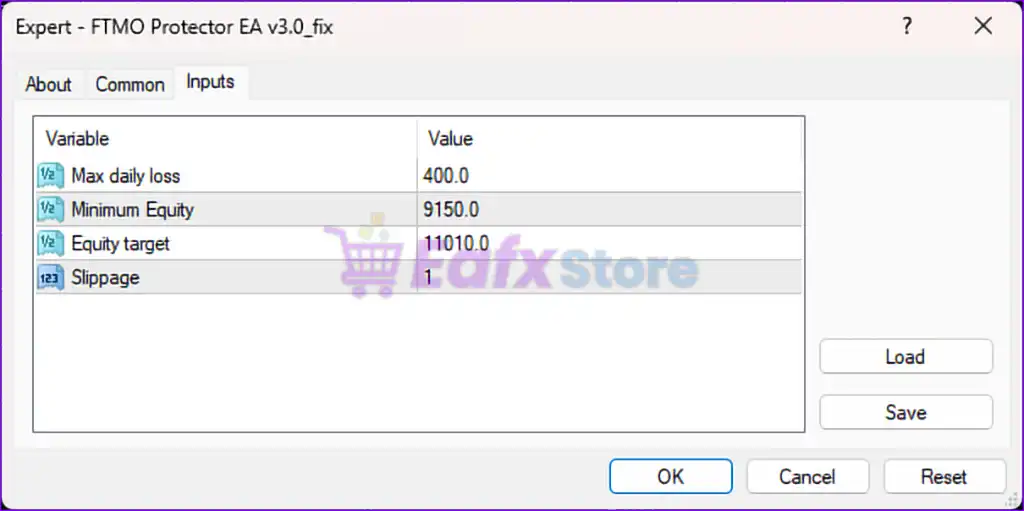

🔹 Key Features & Settings:

| Parameter | Value | Description |

|---|---|---|

| Max Daily Loss | 400.0 | The EA will close all trades if losses reach $400 in a day. |

| Minimum Equity | 9150.0 | If the equity falls below $9,150, the EA will stop trading. |

| Equity Target | 11010.0 | If the account reaches $11,010, trading stops to lock in profits. |

| Slippage | 1 | Ensures tight order execution with minimal slippage. |

1. Risk Management & Daily Loss Control:

The Max Daily Loss is set at $400, meaning:

- If losses exceed $400 in a single day, the EA will automatically close all trades.

- This aligns with FTMO’s daily loss rule, helping traders avoid rule violations.

🔹 Why is this important?

- FTMO & other prop firms have strict rules on daily drawdowns (e.g., 5% of account size).

- This setting acts as a safety net, preventing accidental breaches of rules.

⚠️ Recommendation:

- If your prop firm allows a higher daily drawdown (e.g., 5% on a $10,000 account = $500), adjust this setting accordingly.

- If you’re trading high-volatility instruments (like gold), consider raising the max loss slightly to avoid premature closures.

2. Minimum Equity Protection:

- Minimum Equity is set to $9,150, meaning:

- If account equity drops below $9,150, the EA will stop trading.

- This prevents further losses & protects capital.

🔹 Why is this important?

- Prop firms like FTMO have strict account balance rules.

- Ensuring trading stops before critical levels are reached prevents account termination.

⚠️ Recommendation:

- This setting assumes a starting balance of $10,000.

- If you are using a different balance (e.g., $25,000 or $50,000), adjust this accordingly.

3. Equity Target & Profit Lock-in:

- Equity Target is set to $11,010, meaning:

- Once the account reaches $11,010, the EA stops trading to lock in profits.

- Helps secure gains & prevent unnecessary risk exposure.

🔹 Why is this important?

- FTMO challenges often require traders to reach a specific profit target (e.g., 10% of the account).

- This ensures profits are locked in, preventing giving back profits to the market.

⚠️ Recommendation:

- If your target is higher (e.g., 10% = $11,000), ensure this setting matches your firm’s challenge goals.

- Consider using a trailing profit system rather than a hard stop, allowing more gains.

4. Slippage Control

- Slippage is set to

1, meaning the EA:- Limits order execution to 1 pip of slippage.

- Helps prevent poor fills during high volatility.

- Ensures orders execute at intended price levels.

🔹 Why is this important?

- In FTMO challenges, bad fills can impact risk management.

- This setting ensures orders are executed at precise prices, minimizing unwanted losses.

⚠️ Recommendation:

- If trading highly volatile assets (e.g., gold, indices), consider increasing slippage tolerance (e.g., 2-3 pips).

- This will prevent orders from being rejected during fast market conditions.

Final Summary & Recommendations

| Feature | Current Setting | Recommendation |

|---|---|---|

| Max Daily Loss | ✅ $400 | Adjust to fit your prop firm’s daily drawdown limit. |

| Minimum Equity Protection | ✅ $9,150 | Ensure it matches your prop firm’s absolute drawdown limit. |

| Equity Target | ✅ $11,010 | Consider adding a trailing profit system for flexibility. |

| Slippage Control | ✅ 1 pip | Increase to 2-3 pips for high-volatility pairs. |

Conclusion

The FTMO Protector EA is a powerful risk management tool that helps traders safeguard their capital while complying with proprietary trading firm rules. With its real-time monitoring, automatic profit and loss control, and seamless trade management, this EA minimizes risks and enhances profitability. Its user-friendly interface and compatibility with various trading instruments make it a valuable asset for both novice and experienced traders.