Gold Hitter EA Overview

Gold Hitter EA is a cutting-edge automated trading system meticulously designed for Gold (XAUUSD) trading on the MetaTrader 4 (MT4) platform. Leveraging an advanced blend of trend-following and mean reversion strategies, this expert advisor (EA) is optimized to navigate gold market volatility with precision.

Why choose Gold Hitter EA?

- Fully Automated Trading – Execute trades seamlessly without manual intervention.

- Customizable Settings – Adapt strategies to suit individual risk preferences.

- Robust Risk Management – Minimize drawdowns and protect capital.

- Verified Performance – MyFxBook-certified real trading results validate its effectiveness.

Backed by extensive historical backtesting and live trading success, Gold Hitter EA has demonstrated remarkable profitability. With an impressive +54.69% profit in just three months, coupled with a controlled drawdown, it stands as a reliable and profitable EA for serious gold traders.

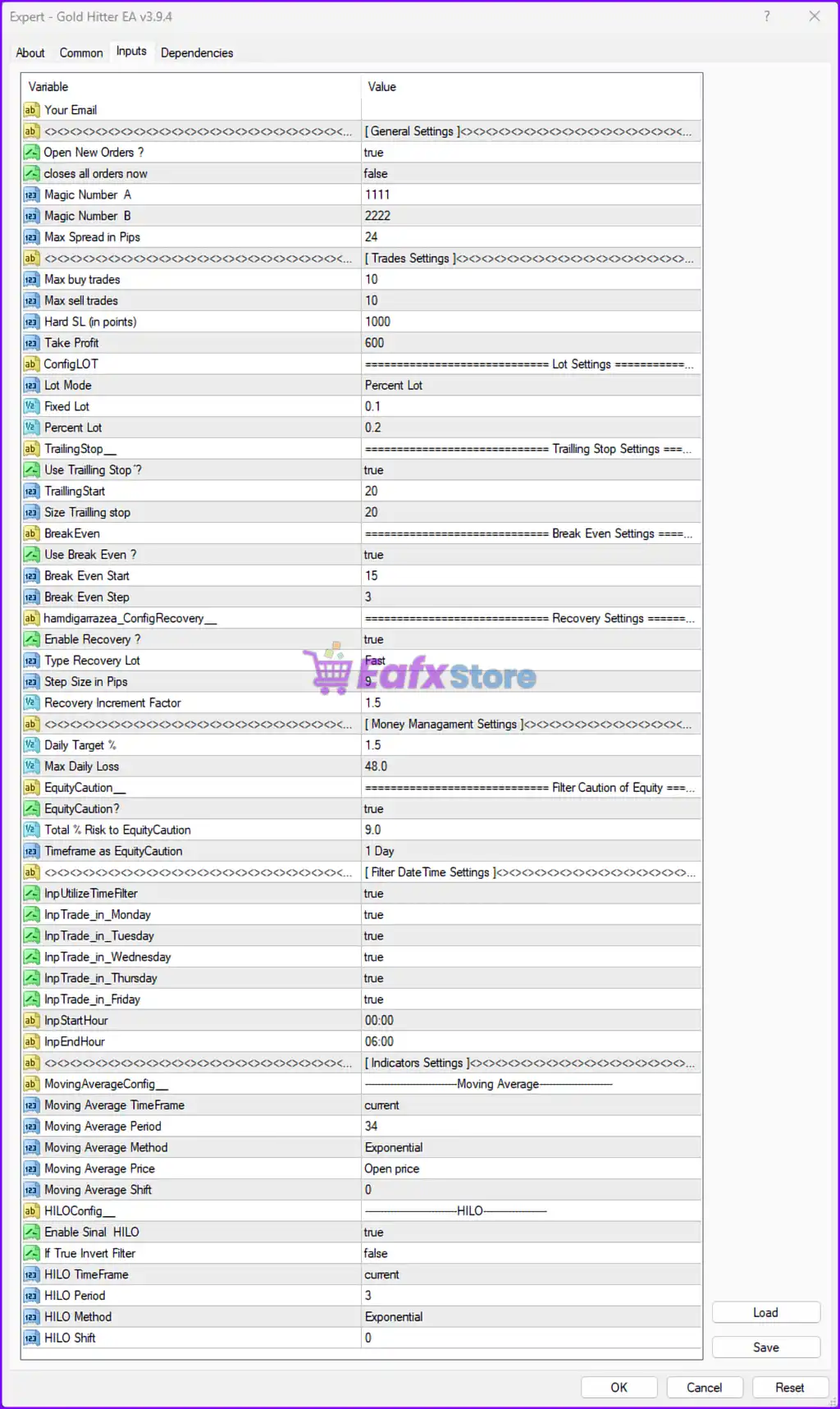

Installation Panel Details

The Gold Hitter EA is a trading algorithm with various configurable settings, focusing on trade management, lot sizing, stop-loss/take-profit strategies, recovery mechanisms, money management, and indicator-based trading. Below is an in-depth analysis of its parameters.

1. General Settings

- Open New Orders? →

true- The EA is enabled to open new trades.

- Close all orders now →

false- Currently, the EA does not have an active function to close all open positions.

- Magic Number A →

1111- This ensures that trades opened with this EA are uniquely identified and managed separately.

- Magic Number B →

2222- A secondary magic number, potentially for managing different trade types or strategies.

- Max Spread in Pips →

24- The EA will not execute trades if the spread exceeds 24 pips, which is a relatively high tolerance.

2. Trade Settings

- Max buy trades →

10- The EA can open a maximum of 10 buy positions at the same time.

- Max sell trades →

10- The EA can open a maximum of 10 sell positions at the same time.

- Hard SL (in points) →

1000- A stop-loss of 100 pips per trade, which is quite large and suggests a long-term trading approach.

- Take Profit →

600- A take-profit of 60 pips, giving an SL:TP ratio of 100:60, which is not ideal as the risk is greater than the reward.

3. Lot Size Configuration

- Lot Mode →

Percent Lot- The EA calculates lot size dynamically based on account balance.

- Fixed Lot →

0.1- If the fixed lot mode were enabled, each trade would open with 0.1 lots.

- Percent Lot →

0.2- When using percentage-based lot sizing, the EA will allocate 0.2% of the account balance per trade.

4. Trailing Stop Strategy

- Use Trailing Stop? →

true- The EA employs a trailing stop to protect profits.

- Trailing Start →

20- The trailing stop activates when a trade reaches 20 pips in profit.

- Size Trailing Stop →

20- Once the trailing stop is activated, the stop-loss moves 20 pips behind the price, securing profits as the market moves in favor.

5. Break-Even Strategy

- Use Break Even? →

true- Enables automatic break-even adjustment.

- Break Even Start →

15- The EA will set a stop-loss at break-even when the trade moves 15 pips into profit.

- Break Even Step →

3- The stop-loss will be adjusted every 3 pips after activation.

6. Recovery Mode

- Enable Recovery? →

true- The EA includes a recovery mechanism to compensate for previous losses.

- Type Recovery Lot →

Fast- Uses a fast lot-increase method in case of losing trades.

- Step Size in Pips →

9- Defines the pip distance before opening a recovery trade.

- Recovery Increment Factor →

1.5- The EA increases the lot size by 1.5x for recovery trades.

7. Money Management Settings

- Daily Target % →

1.5- The EA will attempt to achieve a 1.5% profit per day before stopping further trading.

- Max Daily Loss % →

48.0- If the EA experiences a 48% loss in a single day, it will stop trading.

8. Equity Protection Settings

- Equity Caution? →

true- The EA monitors equity to prevent excessive drawdown.

- Total % Risk to Equity Caution →

9.0- If the risk reaches 9% of total equity, the EA triggers a cautionary mechanism.

- Timeframe as Equity Caution →

1 Day- The EA monitors risk over a 1-day period.

9. Trading Time and Filters

- Time Filter Enabled →

true- The EA follows a time-restricted trading schedule.

- Trading Days →

Monday - Friday(true)- The EA is set to trade every weekday, avoiding weekends.

- Trading Start Time →

00:00 - Trading End Time →

06:00- The EA operates during the first 6 hours of the trading day, which may target volatility during the Asian session.

10. Indicator-Based Trading

10.1. Moving Average Settings

- Moving Average TimeFrame →

current - Moving Average Period →

34 - Moving Average Method →

Exponential - Moving Average Price →

Open price - Moving Average Shift →

0- Uses a 34-period exponential moving average (EMA) based on the open price, which is likely used for trade filtering.

10.2. HILO Indicator Settings

- Enable Signal HILO →

true- The EA utilizes High-Low (HILO) indicator for trading decisions.

- If True Invert Filter →

false- The filter logic is not inverted.

- HILO TimeFrame →

current - HILO Period →

3 - HILO Method →

Exponential - HILO Shift →

0- Uses a 3-period exponential high-low indicator, likely for trend identification.

Analysis and Recommendations

1. Positive Aspects

- Equity Protection

- Max Daily Loss (48%) and Risk Limit (9%) prevent excessive drawdowns.

- Trailing Stop and Break-Even Features

- Trailing stop activation at 20 pips and break-even settings protect profits.

- Time-Based Trading Filter

- The EA operates only between 00:00 – 06:00, likely optimizing for market volatility.

- Recovery System Enabled

- The EA includes a fast recovery system with a 1.5x multiplier, which helps regain losses.

2. Potential Issues & Improvements

- Risk-to-Reward Ratio is Unfavorable

- Stop-Loss (100 pips) > Take-Profit (60 pips) → Risk is greater than reward.

Suggested Change: Adjust SL:TP to 80:80 or 60:100 for better profitability.

- Stop-Loss (100 pips) > Take-Profit (60 pips) → Risk is greater than reward.

- Max Spread is Too High (24 pips)

- Trading at such high spreads could lead to unnecessary losses.

Suggested Change: Lower Max Spread to 5-10 pips for better trade execution.

- Trading at such high spreads could lead to unnecessary losses.

- Aggressive Recovery Mode

- The 1.5x recovery multiplier could lead to exponential lot sizes in consecutive losing trades.

Suggested Change: Reduce Recovery Factor to 1.2-1.3 for safer trading.

- The 1.5x recovery multiplier could lead to exponential lot sizes in consecutive losing trades.

Final Summary

The Gold Hitter EA v3.9.4 is a well-structured system using moving averages and HILO indicators for trading signals. It includes trailing stops, break-even settings, equity protection, and a recovery system. However, the risk-to-reward ratio is unfavorable (100 pips SL vs. 60 pips TP), and the max spread limit (24 pips) is too high. Optimizing these values will improve performance.

Recommended Adjustments

| Setting | Current | Suggested |

|---|---|---|

| Stop-Loss | 100 pips | 80 pips |

| Take-Profit | 60 pips | 80-100 pips |

| Max Spread | 24 pips | 5-10 pips |

| Recovery Factor | 1.5 | 1.2-1.3 |