1. Introduction: The Art and Logic of Price Action Trading

The Price Action Trading Strategy is one of the purest and most powerful approaches to the financial markets. Unlike indicator-based systems that rely on lagging signals, price action trading focuses directly on the price movements themselves—candles, wicks, market structure, and momentum.

This strategy reflects how professional traders, institutions, and algorithms read market psychology. It is not only a visual method but also a logical framework that interprets buyers’ and sellers’ intentions through the footprints left on the chart.

In modern algorithmic trading, price action is no longer reserved for human traders. AI-driven Expert Advisors (EAs) now integrate price structure recognition, candlestick pattern detection, and contextual filters to automate the process with precision and consistency.

2. What Is Price Action Trading?

At its core, price action trading is the study of raw price movement without relying heavily on lagging indicators. Every candle tells a story: who is in control—buyers or sellers—and whether the market is likely to continue or reverse.

2.1 The Key Principles

- Price reflects everything: All known information (economic data, sentiment, institutional positioning) is already priced in.

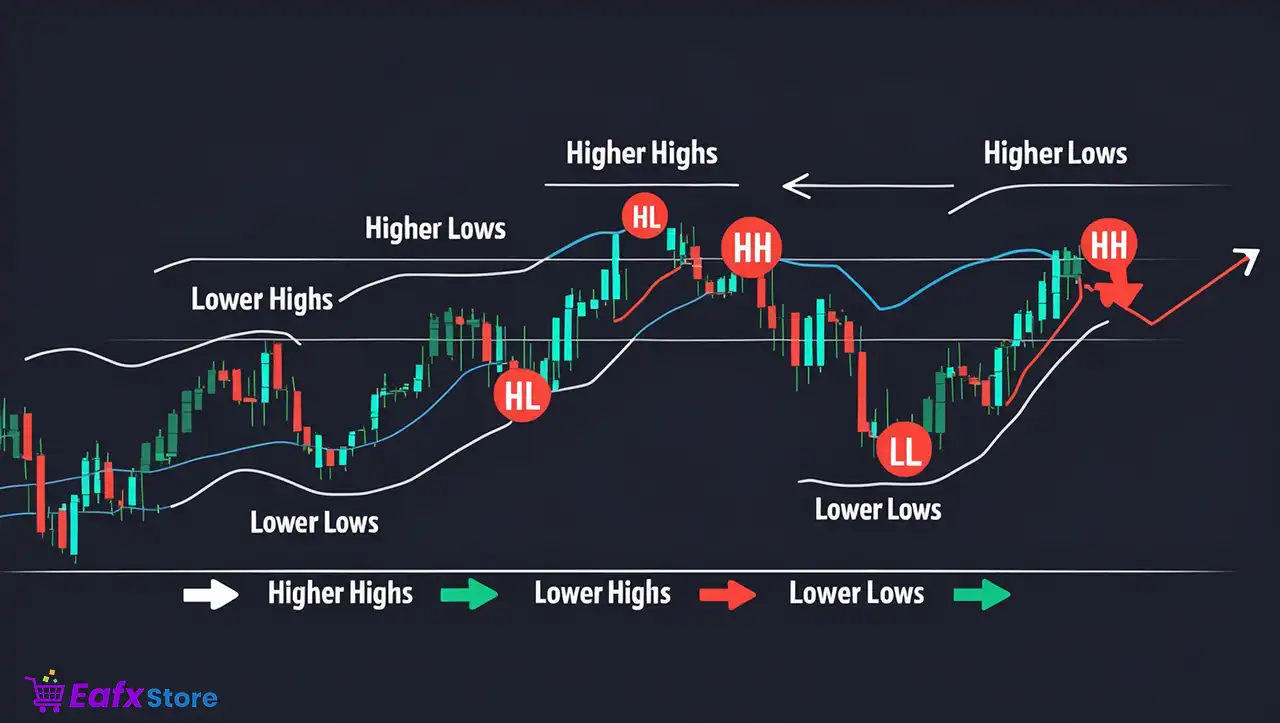

- Market structure matters: Traders analyze higher highs, lower lows, and consolidation ranges to determine trend direction.

- Context is key: Patterns like pin bars, engulfing candles, or breakouts only make sense when read within market context—trend, support/resistance, and volatility.

2.2 The Price Action Environment

The market moves in three main conditions:

- Trending markets – strong directional movement with clear structure.

- Ranging markets – sideways behavior between key levels.

- Transitional phases – reversals or breakouts that shift control from buyers to sellers.

A good price action trader identifies which phase the market is in and adapts their entries accordingly.

3. Core Components of a Price Action Strategy

3.1 Market Structure Analysis

Understanding swing highs and swing lows is the foundation.

- Uptrend: higher highs (HH) and higher lows (HL).

- Downtrend: lower highs (LH) and lower lows (LL).

- Range: equal highs (EQH) and equal lows (EQL).

Market structure provides the framework for entries, stop-loss placement, and profit-taking.

3.2 Support and Resistance Zones

Support and resistance represent psychological price levels where liquidity and order flow concentrate.

- Traders often mark these zones on daily or H4 charts.

- Price reactions at these zones reveal institutional activity and order imbalance.

- Combined with candlestick confirmation, these levels become powerful trading areas.

3.3 Candlestick Patterns and Confirmation

Some of the most reliable price action signals include:

- Pin Bar (Rejection candle): signals a reversal or exhaustion of a move.

- Engulfing Pattern: indicates a strong shift in momentum.

- Inside Bar: represents consolidation before a breakout.

These patterns should never be traded in isolation; they are confirmation tools, not signals themselves.

3.4 Liquidity and Smart Money Concepts (SMC)

Advanced price action includes understanding liquidity grabs—where the market sweeps stop losses above highs or below lows before reversing.

Smart Money traders use concepts like:

- Order blocks (zones where institutions place large orders),

- Fair Value Gaps (FVGs),

- Breaker blocks, and

- Liquidity pools.

This institutional layer brings precision to traditional price action.

4. How to Trade Price Action Manually

A solid manual strategy typically includes:

- Market Context Identification: Define trend direction using higher timeframe structure.

- Key Zone Marking: Identify daily and 4-hour support/resistance levels.

- Entry Confirmation: Wait for price action signal (e.g., pin bar, engulfing).

- Risk Management: Place stop loss below the last swing and calculate position size based on risk percentage (usually 1–2%).

- Trade Management: Use partial profit-taking, trailing stops, or move stop loss to breakeven.

Example Trade Setup

- Pair: EURUSD

- Timeframe: H1

- Context: Uptrend with higher highs and higher lows.

- Signal: Bullish engulfing candle after a pullback to support.

- Entry: Market buy at close of engulfing candle.

- SL: Below last swing low.

- TP: Previous high or next resistance zone.

This type of setup is high probability when combined with confluence from higher timeframes.

5. Advantages and Disadvantages of Price Action Trading

5.1 Advantages

✅ Clarity and Simplicity: No need for dozens of indicators.

✅ Adaptability: Works across all markets—Forex, commodities, indices, crypto.

✅ Institutional Logic: Aligns closely with how professionals analyze price.

✅ Timing Precision: Provides clear entries based on actual market reaction.

5.2 Disadvantages

❌ Subjectivity: Requires experience to interpret signals correctly.

❌ Emotional Influence: Manual traders may overtrade or misread context.

❌ Time-Intensive: Constant monitoring is needed for confirmation candles.

However, when automated in EAs, these drawbacks can be significantly reduced.

6. Price Action in Automated Trading (Expert Advisors)

With advancements in AI and quantitative modeling, price action concepts can now be coded into Expert Advisors (EAs) that recognize patterns and execute trades automatically.

6.1 How EAs Use Price Action

Modern EAs can:

- Detect candle formations (e.g., pin bars, engulfing, inside bars).

- Identify breakouts or false breakouts based on recent swing structure.

- Analyze order blocks, imbalances, and liquidity zones using algorithmic logic.

- Apply AI or neural networks to adapt to changing market behavior.

For instance, an AI-powered EA can evaluate the probability of a pattern’s success rate under certain volatility conditions and automatically filter out low-quality setups.

6.2 Benefits of Automating Price Action

🤖 Consistency: Removes emotional bias and human error.

📊 Speed: Executes trades the moment a condition is met.

⚙️ Optimization: Backtesting helps refine entry and exit rules.

🧠 AI Integration: Deep learning models can adapt to new market data, enhancing accuracy.

6.3 Example: Price Action FX MT5

An advanced robot like Price Action FX MT5 can:

- Analyze breakouts and reversals across multiple pairs (e.g., GOLD, USDJPY).

- Detect key zones using multi-timeframe structure.

- Place trades only when strict confluence conditions are met (momentum + structure + confirmation).

- Apply stop loss, take profit, and trailing systems automatically.

Such systems reflect how manual Price Action logic can evolve into intelligent, data-driven automation.

7. Building Your Own Price Action EA

If you want to develop a Price Action-based EA, here’s a basic framework:

- Define Your Structure Rules: How does the EA detect HH, HL, LH, LL?

- Pattern Recognition: Which candle types are valid confirmations?

- Risk and Trade Management: Include SL, TP, trailing stop, breakeven.

- Filters: Add volatility filters (ATR), time filters, or news filters.

- Machine Learning Integration (Optional): Use AI models to optimize strategy selection dynamically.

Testing should include both backtesting and live forward testing on demo accounts before deployment on real capital.

8. Combining Price Action with Indicators and AI

While pure price action avoids indicators, combining minimal tools can enhance precision:

- Volume Profile: Helps identify real liquidity levels.

- Moving Average (for trend bias): Filters trades in the dominant direction.

- RSI or Momentum: Confirms strength of a breakout.

AI-driven systems can analyze statistical performance of each confluence, dynamically weighting the most reliable conditions per market phase.

9. Practical Tips for Success with Price Action

For Manual Traders:

- Always start from higher timeframes (H4/D1) for directional bias.

- Wait for confirmation—never anticipate.

- Risk small and let compounding do the work.

For EA Traders:

- Optimize parameters for each pair and timeframe.

- Avoid overfitting: focus on logic, not curve-fitted results.

- Use VPS hosting for stable 24/7 operation.

10. Conclusion: The Future of Price Action Trading

The Price Action Trading Strategy remains one of the most reliable, transparent, and universal frameworks in trading.

Its logic—reading raw price behavior—transcends all markets and timeframes.

In manual form, it empowers traders to understand the market’s heartbeat.

In automated form, it enables EAs and AI systems to replicate professional decision-making with precision and discipline.

The future of trading lies in hybrid intelligence—where human intuition and AI-driven price action analysis work together to create smarter, safer, and more adaptive trading systems.