Enza EA MT5 with SetFiles (Latest version) – GroupBuy

Main Slot Purchase Phase

Main Slot Price: $80.00

0 out of 5 main slots sold

What is Enza EA?

Enza EA is a fully automated trading system designed for consistent long-term growth using mean reversion logic, fixed Stop Loss and drawdown protection. It supports AUDCAD M15 by default, allows up to 6 additional entries for recovery profitability, includes strong news filters, and features open parameters for optimization across multiple pairs.

➡️ Vendor website: View here

➡️ This is GroupBuy ==> How to Join

About the Author

This product is compiled by Anton Kondratev. This author has more than +4 years of experience working on MQL5 with many famous products such as Enza EA MT5, Razor MT5, Aurum MT5, Nova EA, DOW King EA MT5, Zonda EA MT5 and other advisors. Among them, Enza EA is his best performing product.

Key Features of Enza EA for MT5

🔹Fully automated architecture: Runs independently with open parameters for customizable setups.

🔹Drawdown control system: Fixed Stop Loss (SL) and controlled additional entries to manage risk safely.

🔹Mean reversion model: Uses Q KING Algo with optional bonus settings included on request.

🔹News & volatility filtering: Built-in SNF filter avoids FOMC/NFP high-impact spikes.

What is the Enza EA trading strategy?

🔹Market mean-reversion logic: Targets price pullbacks and returns to equilibrium for profit.

🔹Multi-layer entry structure: Up to 6 adaptive trades added during drawdown to enhance recovery.

🔹Fixed global Stop Loss: Transparent risk exposure with predefined exit rules.

🔹Spread & slippage awareness: Automatically adjusts execution for dynamic market conditions.

Enza EA MT5 Review

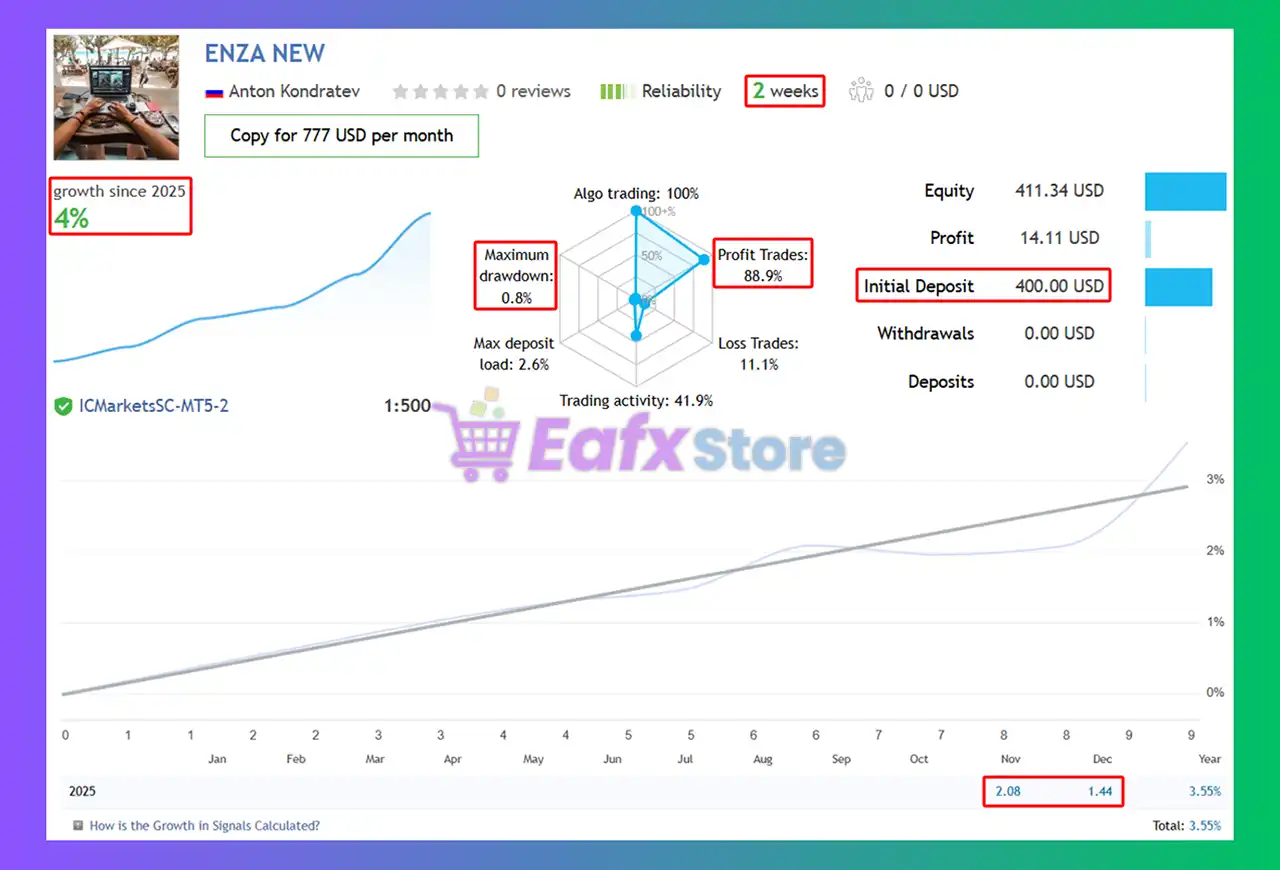

1. Enza EA Signal Results:

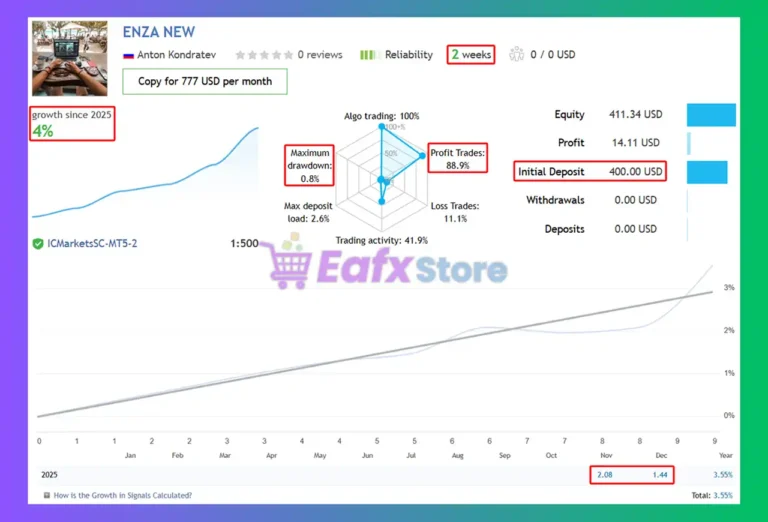

The Enza EA achieved impressive profit performance when trading with AUDCAD pair. Trading results on real account for 2 consecutive weeks of trading:

✅ Initial Deposit: $400

✅ Growth Rate: +4%

✅ Win Rate (% of total): 88.90%

✅ Maximum Drawdown: 0.80%

Enza EA MT5 Signal Results

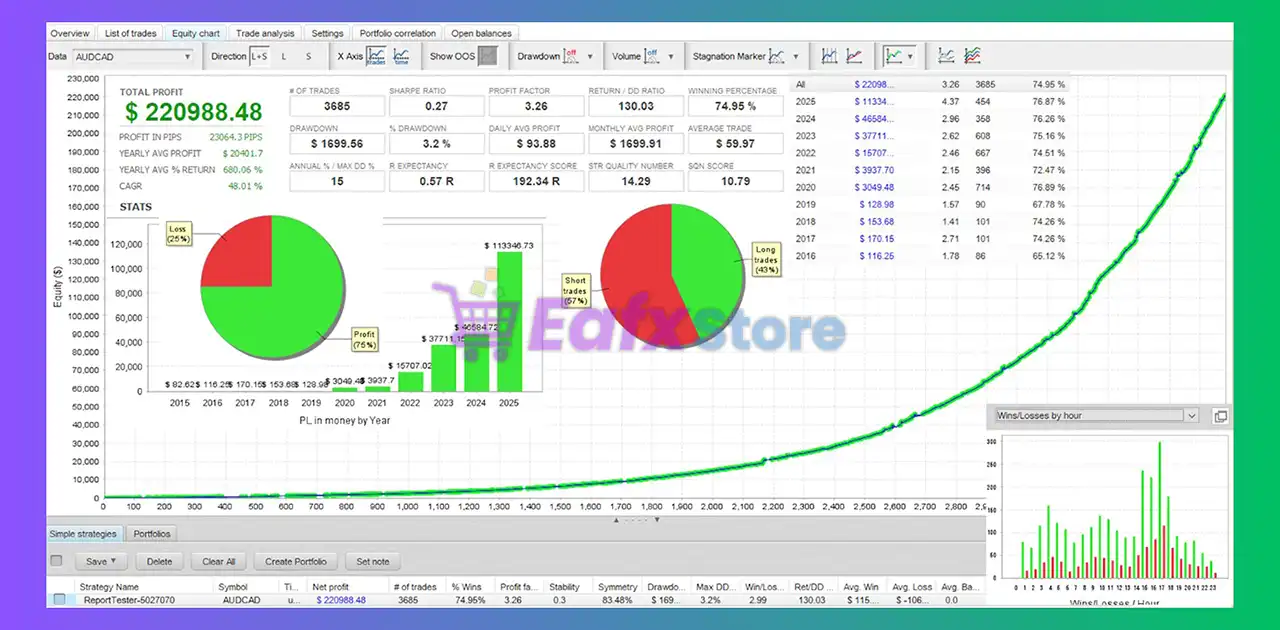

2. Enza MT5 Backtest:

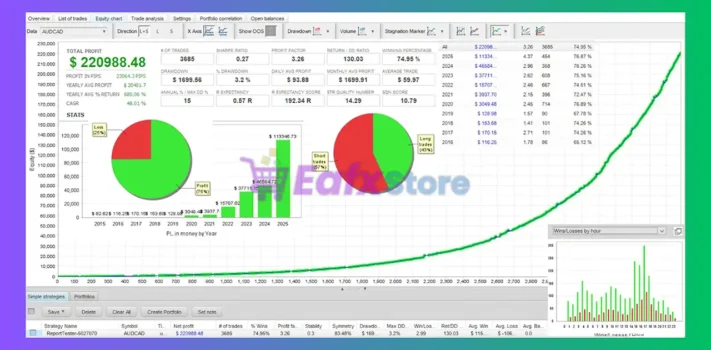

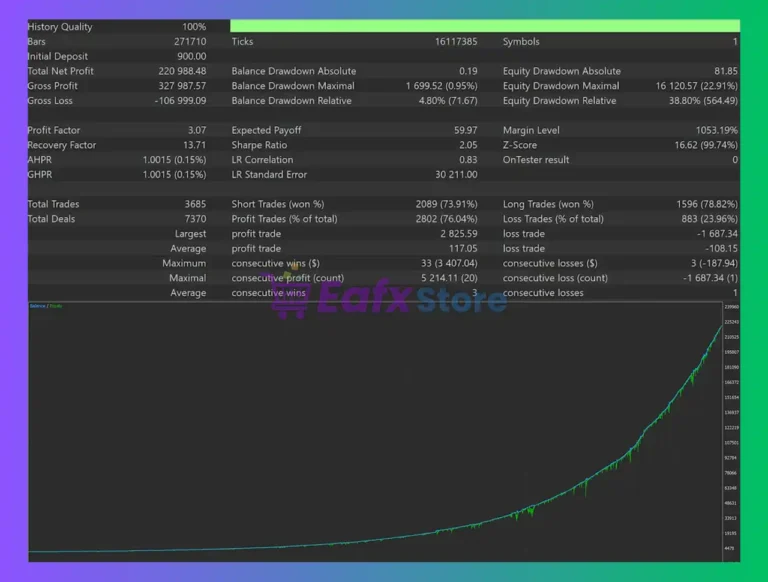

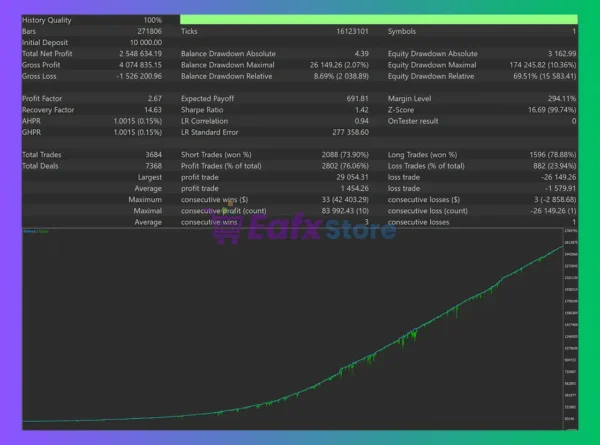

The Enza backtest trading results achieved impressive profit performance for 12 months. The advisor showed the ability to maintain safe stars on the 15-minute chart.

✅ Initial Deposit: $900

✅ Total Net Profit: $220,988.48

✅ Win Rate (% of total): 74.95%

✅ Maximum Drawdown: 3.20%

Enza MT5 Review

Why choose & use Enza EA?

🔹Consistent monthly growth: Proven performance over 10 years of real MT5 quote testing.

🔹Prop-firm friendly design: Includes special FTMO-ready configurations when requested.

🔹Adaptable to any broker: ABRT mechanism adjusts settings in real time for execution quality.

🔹Beginner-friendly setup: Simple installation, runs 24/7 and requires minimal supervision.

🔹No martingale or AI tricks: Clean logic focused on safety, clarity and long-term stability.

Recommended settings

Recommended settings and parameters to pay attention to from developers and experts:

| Features | Type |

|---|---|

| Trading platform | MetaTrader 5 (MT5) |

| Time frames | M15 (15 minute chart) |

| Currency pairs | AUDCAD |

| Minimum / Recommended deposit | $200 |

| Minimum / Recommended leverage | 1:100 and below |

| Account type | RAW/Pro/ECN broker |

| Product type | Original version |

| Additional services | Unlock and Decompile |

| Recommended brokers | Exness Broker, Icmarkets Broker |

| Recommended VPS | MyfxVPS.com ( Blue VPS, Golden VPS). Lowest Latency, 2 week Free Trial, 100% Free for 12-18 Months. |

➡️ Reviewed by David Easton

Product Download Package?

The download package of the product suite includes:

✅ Setting (If Any).docx

✅ Installation Guide.docx

Conclusion

In short, Enza EA combines a disciplined mean-reversion engine, controlled multi-layer entries, and strict global risk limits to deliver stable long-term performance. With proven live and backtest results, news filtering, prop-firm compatibility, and beginner-friendly automation, it offers a safe and efficient trading framework for AUDCAD. Ultimately, Enza EA stands out as a precision-built system engineered for consistency and confident growth.

User Reviews

Only logged in customers who have purchased this product may leave a review.

❓ What trading strategy does Enza EA use and how does it generate consistent profits?

Enza EA operates on a mean-reversion model, analyzing price deviations from equilibrium and entering trades when the market is statistically likely to revert. Its Q KING Algo and multi-layer entry structure allow it to capture retracements safely, while a fixed global Stop Loss ensures controlled and transparent risk during every cycle.

❓ Which currency pairs and timeframes are officially supported by Enza EA?

The EA is optimized primarily for AUDCAD on the M15 timeframe, where it has shown the most stable performance. However, its open parameters allow users to run optimization and adapt the EA to additional pairs, creating flexibility for multi-pair portfolios when configured properly.

❓ How does Enza EA manage drawdown and protect the trading account?

Enza EA uses a fixed Stop Loss, combined with intelligent placement of up to 6 additional recovery entries. This structure strengthens profitability while keeping exposure controlled. Its built-in volatility and news filters also help avoid high-risk conditions that typically cause large drawdowns.

❓ Does Enza EA use martingale or other high-risk strategies?

No. Enza EA does not use martingale, grid-doubling, or any high-risk multiplier systems. All additional entries are fixed, controlled, and strategically placed for recovery—not for exponential lot growth—making it significantly safer than classic grid or martingale EAs.

❓ Can Enza EA be used for prop-firm challenges like FTMO or MFF?

Yes. The EA includes prop-friendly configurations upon request, ensuring compatibility with strict drawdown, max-loss, and consistency rules. With fixed SL, stable entries, and news filters, Enza EA fits well into prop-firm risk frameworks.

❓ What are the recommended account types, leverage, and deposit requirements?

Developers recommend using a RAW, Pro, or ECN account, with a minimum deposit of $200 and leverage from 1:100 and below. These settings ensure proper execution, lower spread impact, and safer performance, especially during recovery cycles or volatile sessions.

❓ How effective is Enza EA in real trading compared to backtests?

Real data from AUDCAD shows +4% growth in two weeks, an 88.90% win rate, and very low drawdown at 0.80%. Backtests over a 12-month period demonstrated $220,988+ in net profit from a $900 starting deposit with 3.20% drawdown, proving long-term stability across different market phases.

❓ Does Enza EA require continuous monitoring or manual intervention?

No. Enza EA is designed to run fully automated 24/7. Once installed, it handles entries, exits, risk controls, and filtering autonomously. Traders only need to monitor account conditions occasionally, especially around major news events.

❓ How does the News & Volatility Filter work in Enza EA?

The built-in SNF filter blocks trading during high-impact events such as NFP, FOMC, and CPI releases. By avoiding these spikes, the EA prevents unnecessary slippage, spreads, and unpredictable price movements—contributing significantly to its low-drawdown profile.

❓ Is Enza EA suitable for beginners and easy to install?

Yes. Enza EA is beginner-friendly, featuring a straightforward setup process and open parameters that users can modify according to their experience level. Its fixed SL, clear logic, and automated execution make it accessible even to traders with limited technical knowledge.

There are no reviews yet.