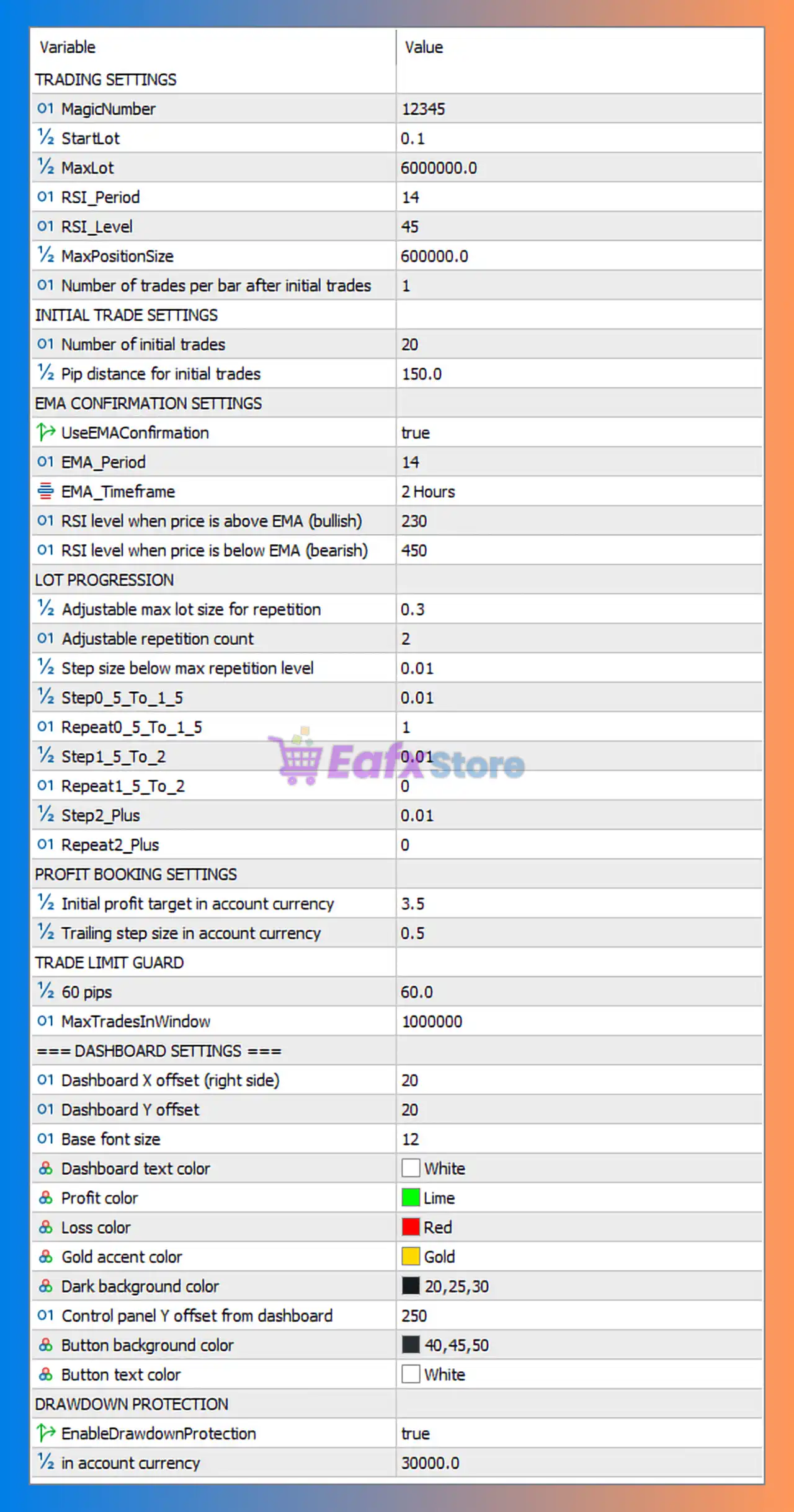

The settings of JKJK FINAL VERSION V3 Pro MT5 reveal a multi-layered algorithm that mixes RSI-based trend filtering, EMA confirmation, controlled lot progression, and strict drawdown protection. This configuration shows a focus on high safety, structured scaling, and precision entries, making the EA suitable for long-term automated trading.

📌📌📌 Buy this unlimited JKJK FINAL VERSION V3 Pro MT5 product here 📌📌📌

1️⃣ Trading Settings – Core Logic & Entry Filters

| Parameter | Value | Meaning |

|---|---|---|

| MagicNumber | 12345 | Unique identifier for safe trade management |

| StartLot | 0.1 | Initial lot for all first-cycle trades |

| MaxLot | 6000000 | Extremely high cap → practically unrestricted scaling |

| RSI_Period / RSI_Level | 20 / 45 | Primary RSI filter to detect overbought–oversold conditions |

| MaxPositionSize | 6000000 | Allows stacking positions when conditions repeat |

➡️ Interpretation:

The EA uses RSI as the main trigger while allowing a very large maximum position size, indicating that the system can function as a controlled averaging/martingale model in trend continuation or reversal phases.

2️⃣ Initial Trade Settings – Volume & Grid Start

| Parameter | Value |

|---|---|

| Number of initial trades | 20 |

| Pip distance | 150 pips |

➡️ The EA opens a cluster of 20 initial trades with a wide 150-pip spacing, a behavior similar to trend-based grid entry, allowing smoother distribution and reduced entry density.

3️⃣ EMA Confirmation – Trend Direction Filtering

| Parameter | Value | Purpose |

|---|---|---|

| UseEMAConfirmation | true | Enables dual confirmation logic |

| EMA_Period | 14 | Fast EMA for near-term bias |

| EMA_Timeframe | 2 hours | Medium TF for stronger trend confirmation |

| RSI above EMA (bull) | 230 | Strong 2.3 RSI offset used to confirm bullish condition |

| RSI below EMA (bear) | 450 | Strong 4.5 RSI offset to confirm bearish momentum |

➡️ Conclusion:

The EA uses both RSI and EMA together to filter trades, increasing accuracy and avoiding low-quality entries. This reduces drawdown and improves long-term stability.

4️⃣ Lot Progression – Custom Scaling System

| Setting | Value |

|---|---|

| Adjustable max lot size for repetition | 0.3 |

| Repetition count | 2 |

| Step size below max repetition | 0.01 |

| Step parameters | Step0_5_To_1_5 = 1 → 1.5 sizing with 0.01 increments |

➡️ Interpretation:

The EA does not rely on risky exponential martingale.

Instead, it uses a custom, incremental lot progression system with:

- Very small step increments

- Repetition caps

- Gradual lot increases

This is more stable for funded accounts and long-term operation.

5️⃣ Profit Booking – Risk-Controlled Exit Model

| Parameter | Value |

|---|---|

| Initial profit target | 3.5 (in account currency) |

| Trailing step size | 0.5 |

➡️ The EA locks profits using monetary targets instead of pip targets.

This allows flexible adaptation to different market conditions.

6️⃣ Trade Limit Guard – Safety Net

| Parameter | Value |

|---|---|

| Stop in pips | 60 |

| Max trades in window | 1,000,000 |

➡️ A 60-pip limit introduces an additional protection layer against extreme volatility, while the large trade window capacity shows the EA can scale heavily if needed.

7️⃣ Dashboard Settings – Visual Management

The dashboard settings control:

- Panel position

- Colors (profit = lime, losses = red, gold accent colors)

- Refresh rate (500ms)

This improves clarity for real-time monitoring and fast decision-making.

8️⃣ Drawdown Protection – Strong Safety Module

| Parameter | Value |

|---|---|

| EnableDrawdownProtection | true |

| % in account currency | 30,000 |

➡️ This enables a hard stop in equity drawdown, ensuring the EA shuts down before account risk becomes critical—ideal for prop firm challenges or capital preservation.

⭐ Conclusion

JKJK FINAL VERSION V3 Pro is a highly structured automated trading system combining RSI signals, EMA confirmation, controlled grid entries, and smart lot progression. With 20 initial trades, wide pip spacing, and multi-condition filters, the EA aims to balance profitability with safety. The inclusion of monetary profit targets, trailing logic, and strong drawdown protection makes it suitable for both long-term trading and prop firm accounts. This configuration shows a focus on stability, precision, and disciplined risk control—key elements for sustainable automated trading performance.