🧩 Overview of VR Lollipop MT5

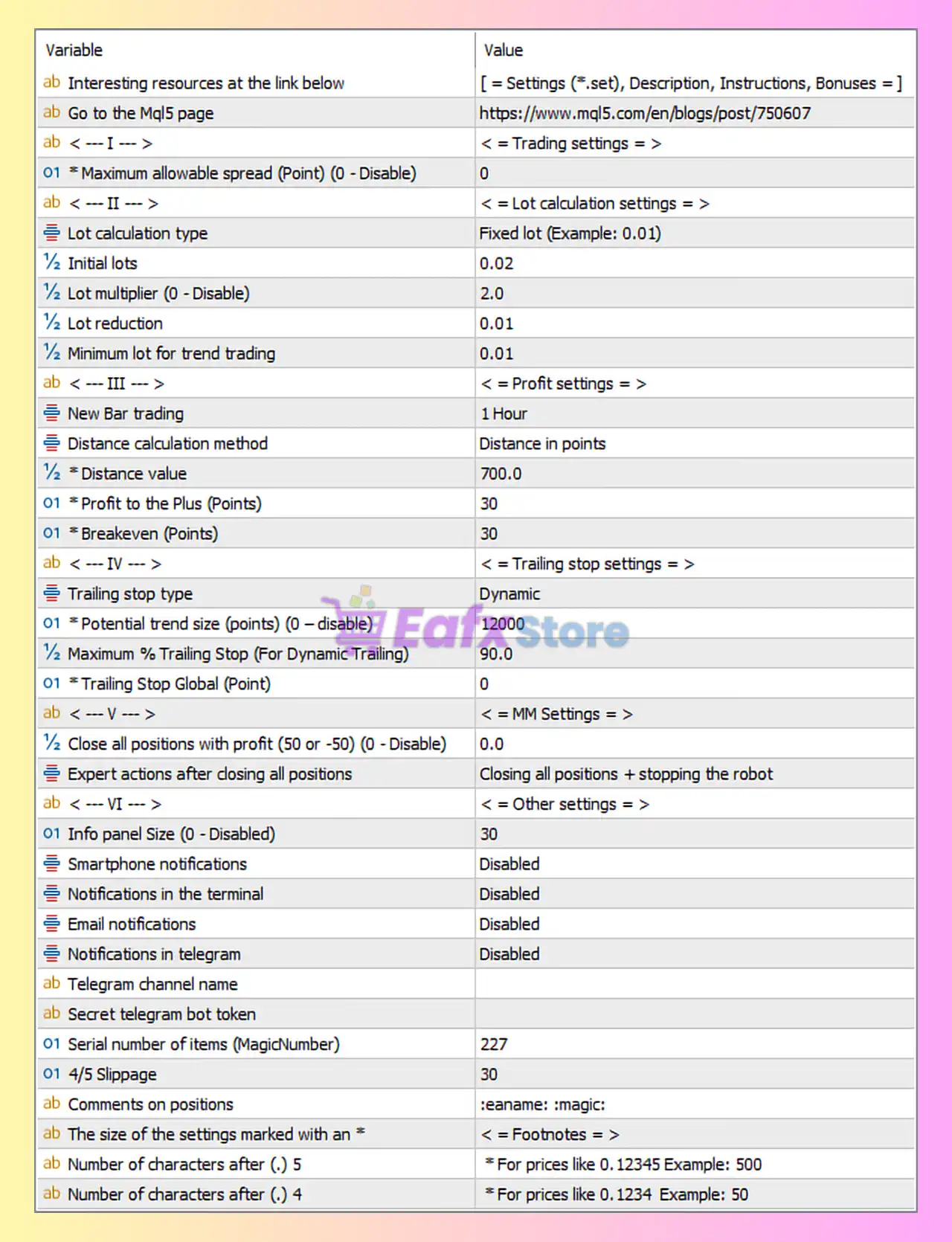

VR Lollipop MT5 is an automated trading Expert Advisor (EA) designed with a fixed-lot, trend-following grid logic, combined with dynamic trailing stops and basic profit protection mechanisms. The configuration shown in the image reflects a moderate-risk, semi-conservative trading setup, suitable for traders seeking controlled automation rather than aggressive martingale strategies.

➡️ Vendor website: View here

🧩 Trading & Spread Control Settings

🔹 Maximum Allowable Spread

- Value:

0(Disabled)

📌 Analysis:

The EA does not filter trades based on spread, meaning it can open positions during high-spread periods (e.g., news or low-liquidity sessions). This increases trade frequency but may reduce entry quality on volatile symbols.

⚠️ Best used on low-spread pairs (EURUSD, USDJPY, XAUUSD with ECN brokers).

🧩 Lot Calculation & Risk Management

🔹 Lot Calculation Type

- Type: Fixed Lot

- Initial Lot Size:

0.02

📌 Analysis:

The EA starts with a fixed 0.02 lot, ensuring predictable exposure. This is appropriate for small to medium accounts and avoids balance-based overexposure.

🔹 Lot Multiplier

- Multiplier:

2.0

📌 Analysis:

A lot multiplier of 2.0 introduces mild martingale behavior, meaning each additional position may double in size. This allows faster recovery but increases drawdown risk during strong trends.

🔹 Lot Reduction & Trend Protection

- Lot Reduction:

0.01 - Minimum Lot for Trend Trading:

0.01

📌 Analysis:

These parameters help limit excessive lot growth, especially during trend-following phases. This is a safety mechanism to prevent uncontrolled exposure.

✅ Balanced between recovery speed and capital protection.

🧩 Entry Logic & Profit Settings

🔹 New Bar Trading

- Timeframe: 1 Hour

📌 Analysis:

Trades are evaluated once per new H1 candle, reducing market noise and avoiding overtrading. This makes the EA more stable and systematic.

🔹 Distance Calculation

- Method: Distance in points

- Distance Value:

700 points

📌 Analysis:

This is a wide grid spacing, meaning new trades are placed far apart. This reduces trade frequency and drawdown but requires patience.

📌 Suitable for volatile instruments and trend-prone markets.

🔹 Profit & Breakeven Targets

- Profit to the Plus:

30 points - Breakeven:

30 points

📌 Analysis:

Once price moves 30 points in favor, the EA:

- Locks in breakeven

- Begins profit protection

This is a tight and efficient profit control mechanism, ideal for short-term market swings.

🧩 Trailing Stop Strategy

🔹 Trailing Stop Type

- Mode: Dynamic

- Potential Trend Size:

12000 points - Maximum Trailing %:

90% - Global Trailing Stop:

0(Disabled)

📌 Analysis:

The EA uses dynamic trailing stops based on trend strength, allowing profits to run while still protecting equity.

- Large potential trend size = suited for strong, sustained trends

- 90% trailing allows deep pullbacks before exit

This feature enhances profit maximization in trending markets.

🧩 Money Management (MM) Settings

🔹 Close All Positions Condition

- Value:

0.0(Disabled)

📌 Analysis:

There is no equity-based global stop or take profit. Trades are closed based on internal logic (TP, breakeven, trailing stop).

⚠️ This increases dependency on market behavior and requires adequate margin.

🔹 Post-Closure Action

- Action: Close all positions & stop the EA

📌 Analysis:

Once a global closure event happens (manual or condition-based), the EA stops trading, preventing revenge or re-entry trades.

🧩 Notifications & Interface Settings

- Info Panel Size:

30 - All Notifications: Disabled

- Magic Number:

227 - Slippage:

30 - Order Comments: Enabled

📌 Analysis:

This is a clean, minimalistic operational setup:

- Proper trade identification via Magic Number

- Slippage tolerance suitable for volatile assets

- No distractions from notifications

🧩 Technical & Price Formatting Settings

- Price Digits (0.5 pricing):

500 - Price Digits (0.4 pricing):

50

📌 Analysis:

These settings ensure correct price calculation across brokers with different decimal formats, improving execution accuracy.

🧩 Final Conclusion

The VR Lollipop MT5 settings shown in the image represent a moderately conservative, trend-aware automated trading strategy with controlled grid expansion and advanced trailing stop logic.

➡️ Key Strengths:

✔ Fixed initial lot with controlled multiplier

✔ Wide grid spacing reduces overtrading

✔ Dynamic trailing stop for trend capture

✔ New-bar (H1) execution for stability

✔ Built-in breakeven protection

➡️ Potential Risks:

⚠️ Martingale multiplier increases drawdown risk

⚠️ No equity-based stop loss

⚠️ Spread filtering disabled

➡️ Best Suited For:

- Traders seeking stable MT5 automation

- Medium-sized accounts with sufficient margin

- Trending or semi-volatile markets

- Long-term EA deployment with monitoring