Trade Strike EA MT5 + SetFiles (Latest version) – GroupBuy

Main Slot Purchase Phase

Main Slot Price: $75.00

0 out of 4 main slots sold

What is Trade Strike EA MT5?

Trade Strike EA is a high-frequency Expert Advisor (EA) designed for automated grid trading with adaptive risk controls. Built to scale from small to large accounts, it combines intelligent market filters, volatility-aware grid logic, and strict safety mechanisms to improve stability, adaptability, and disciplined risk management across multiple asset classes.

About the Author

This product is compiled by Ming Ying Lee. This author has more than +4 years of experience working on MQL5 with many famous products such as Trade Strike EA MT5, Extreme Reversion Trader EA MT5, MingTraderAUDCAD for MT4, Friday Pro EA MT4 and others. Among them, Trade Strike EA is his best performing product.

Key Features of Trade Strike EA for MT5

🔹 Intelligent Grid Architecture: Multi-level grid with adjustable spacing and capped exposure for controlled scaling.

🔹 Advanced Market Filters: Uses trend, momentum, volatility, spread and time filters to avoid poor conditions.

🔹 Comprehensive Risk Controls: Equity protection, daily drawdown limits, and auto-shutdown enhance account safety.

🔹 Small Account Optimization: Preset configurations allow operation on micro balances with disciplined risk control.

🔹 Professional Trading Dashboard: Real-time visibility of equity, margin, drawdown and grid status.

Why Choose & Use Trade Strike EA MT5?

🔹 Scalable Performance Design: Efficient logic that works on small accounts and scales naturally with capital growth.

🔹 Risk-Aware Automation: Built-in safety systems reduce the chance of uncontrolled drawdowns.

🔹 Flexible Configuration Options: Multiple presets suit conservative, balanced or aggressive trading preferences.

🔹 Broad Market Coverage: Supports forex, indices, commodities and crypto on a single automated framework.

🔹 Marketplace-Ready Solution: Transparent logic, clear risk disclosure and adaptable settings for serious traders.

Trade Strike EA MT5 Review

The Trade Strike EA have achieved impressive profit performance over many years of trading. The advisor shows amazing ability to master the market and increase profits.

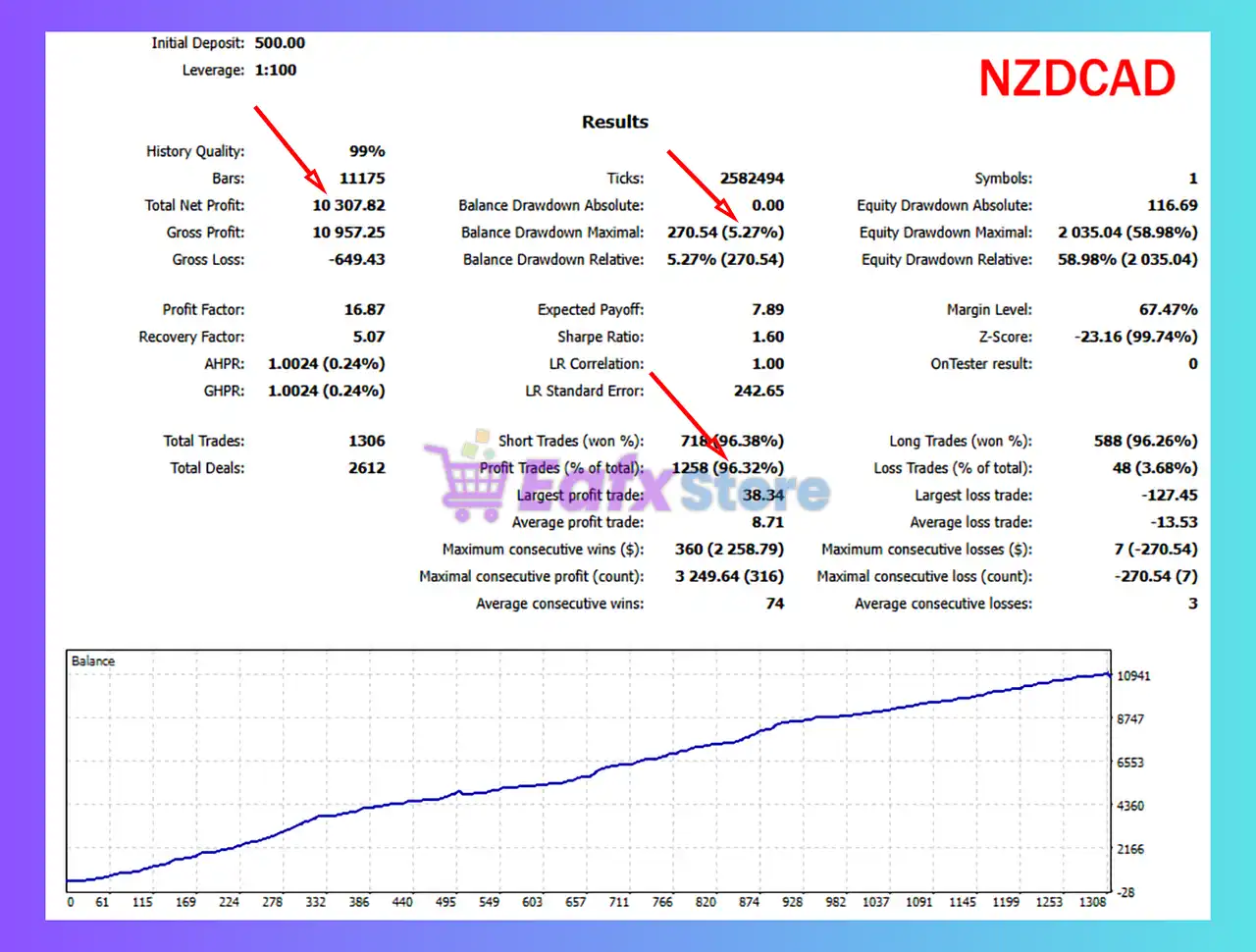

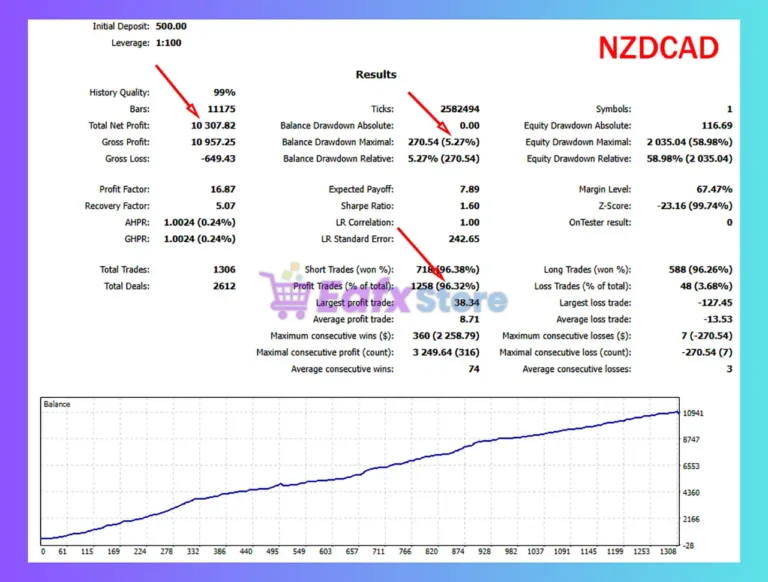

🔶 The Trade Strike EA backtest trading results achieved impressive profit performance for 12 months on the NZDCAD pair.

✅ Initial Deposit: $500

✅ Total Net Profit: $10,307.82

✅ Win Rate (% of total): 96.32%

✅ Maximum Drawdown: 5.27%

Trade Strike EA Backtest

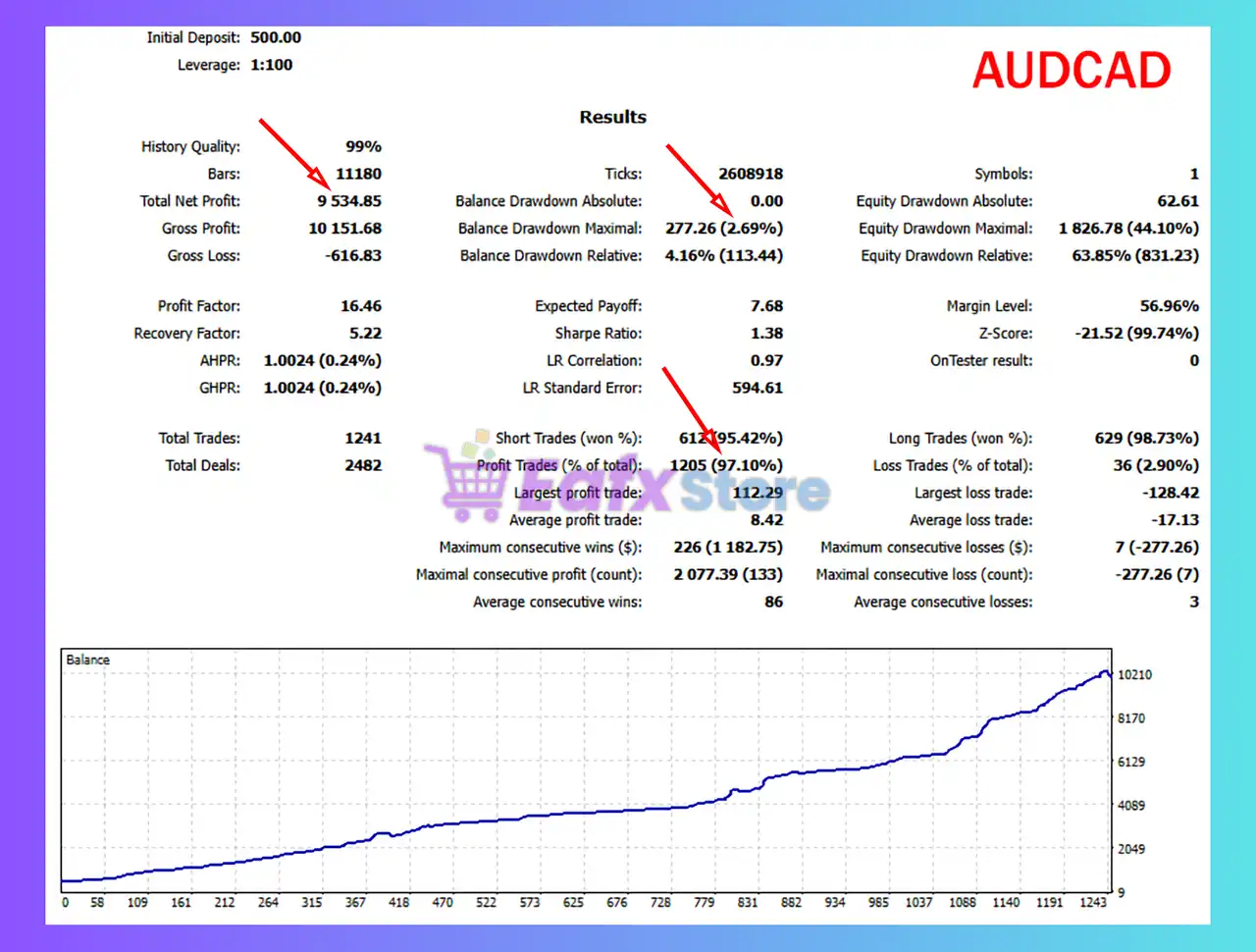

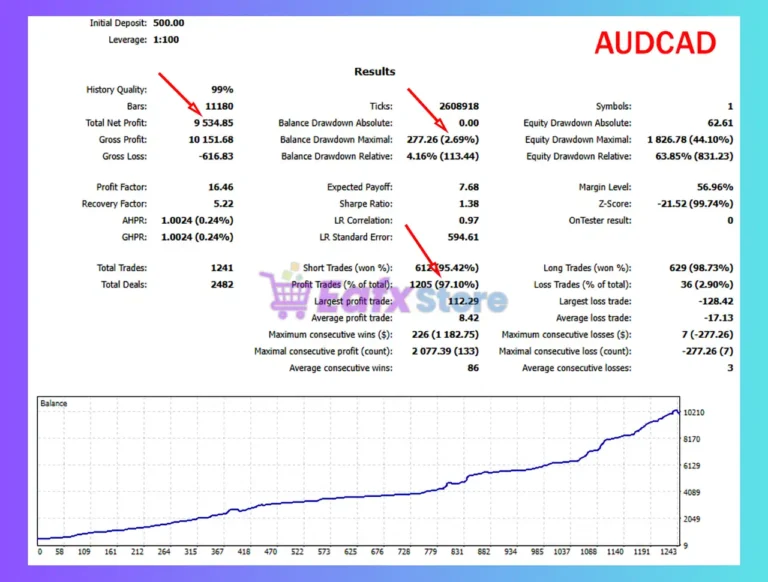

🔶 The Trade Strike EA backtest trading results achieved impressive profit performance for 12 months on the AUDCAD pair.

✅ Initial Deposit: $500

✅ Total Net Profit: $9,534.85

✅ Win Rate (% of total): 97.10%

✅ Maximum Drawdown: 2.69%

Trade Strike EA MT5 Backtest

What is the Trade Strike EA MT5 Trading Strategy?

🔹 Grid-Based Price Cycling: Trades price fluctuations using structured grid entries instead of single-point timing.

🔹 Dual-Direction Execution: Manages buy and sell baskets simultaneously to adapt to changing market flows.

🔹 Volatility-Adaptive Logic: Adjusts grid distance and profit targets dynamically using market volatility data.

🔹 Basket-Level Management: Closes trade series based on profit, time, or risk thresholds for stability.

🔹 High-Frequency Scalping Style: Executes multiple trades per day while maintaining strict exposure limits.

Is Trade Strike EA MT5 Safe?

Trade Strike EA shows significant potential in providing stable and reliable profits, making it a reliable tool in the forex market. The advisor is highly appreciated by the MQL5 community in many aspects and has won the trust of users.

Recommended settings

Recommended settings and parameters to pay attention to from developers and experts:

| Features | Type |

|---|---|

| Trading platform | MetaTrader 5 (MT5) |

| Time frames | Any |

| Currency pairs | XAUUSD (Gold), NZDCAD, EURUSD, AUDCAD (Forex, Indices, Commodities, Crypto) |

| Minimum / Recommended deposit | $100 |

| Minimum / Recommended leverage | Any |

| Account type | Hedging strategy |

| Product type | Original version |

| Additional services | Unlock and Decompile |

| Recommended brokers | Exness Broker, Icmarkets Broker |

| Recommended VPS | MyfxVPS.com (Blue VPS, Golden VPS). Lowest Latency, 2 week Free Trial, 100% Free for 12-18 Months. |

Product Download Package?

The download package of the product suite includes:

1. Experts:

2. SetFiles:

Conclusion

In short, Trade Strike EA is a powerful MT5 grid trading solution built for traders who value scalability, automation, and strict risk control. With intelligent volatility-aware grids, advanced market filters, and comprehensive equity protection, it delivers stable performance across forex, indices, commodities and crypto. Verified backtests confirm its suitability for both small and growing accounts.

User Reviews

Only logged in customers who have purchased this product may leave a review.

❓ What type of trading strategy does Trade Strike EA use?

Trade Strike EA uses a high-frequency grid trading strategy with volatility-adaptive logic to capture price cycles while keeping exposure controlled.

❓ Is Trade Strike EA suitable for small accounts?

Trade Strike EA is optimized for small accounts, offering presets, micro-lot support, and strict risk controls for disciplined growth.

❓ Which markets can Trade Strike EA trade?

Trade Strike EA supports forex, indices, commodities, and crypto, allowing traders to diversify within one automated system.

❓ Does Trade Strike EA use martingale?

Trade Strike EA uses controlled grid logic with capped exposure, not aggressive martingale, focusing on stability and risk awareness.

❓ How does Trade Strike EA manage risk?

Trade Strike EA includes equity protection, daily drawdown limits, spread filters, and auto-shutdown to protect account capital.

❓ Can Trade Strike EA adapt to changing volatility?

Trade Strike EA dynamically adjusts grid spacing and profit targets based on real-time volatility conditions.

❓ Is Trade Strike EA fully automated?

Trade Strike EA is fully automated, handling entries, grid management, exits, and risk controls without manual intervention.

❓ What timeframes work best with Trade Strike EA?

Trade Strike EA works on any timeframe, as its logic adapts internally using volatility and market condition filters.

❓ Does Trade Strike EA trade both buy and sell positions?

Trade Strike EA supports dual-direction trading, managing buy and sell baskets simultaneously to adapt to market flow.

❓ Is Trade Strike EA safe for long-term use?

Trade Strike EA is designed for long-term automation, prioritizing controlled drawdowns, stability, and scalable performance.

There are no reviews yet.