🧩 What is Market Master EA MT5?

The Market Master EA for MetaTrader 5 (MT5) is a versatile trading robot that utilizes a structured grid-based strategy combined with session-time filters. While its default configuration is conservative, it employs a sophisticated “Step Multiplier” logic that differentiates it from traditional high-risk martingale bots.

📌📌📌 Buy this unlimited Market Master EA MT5 product here 📌📌📌

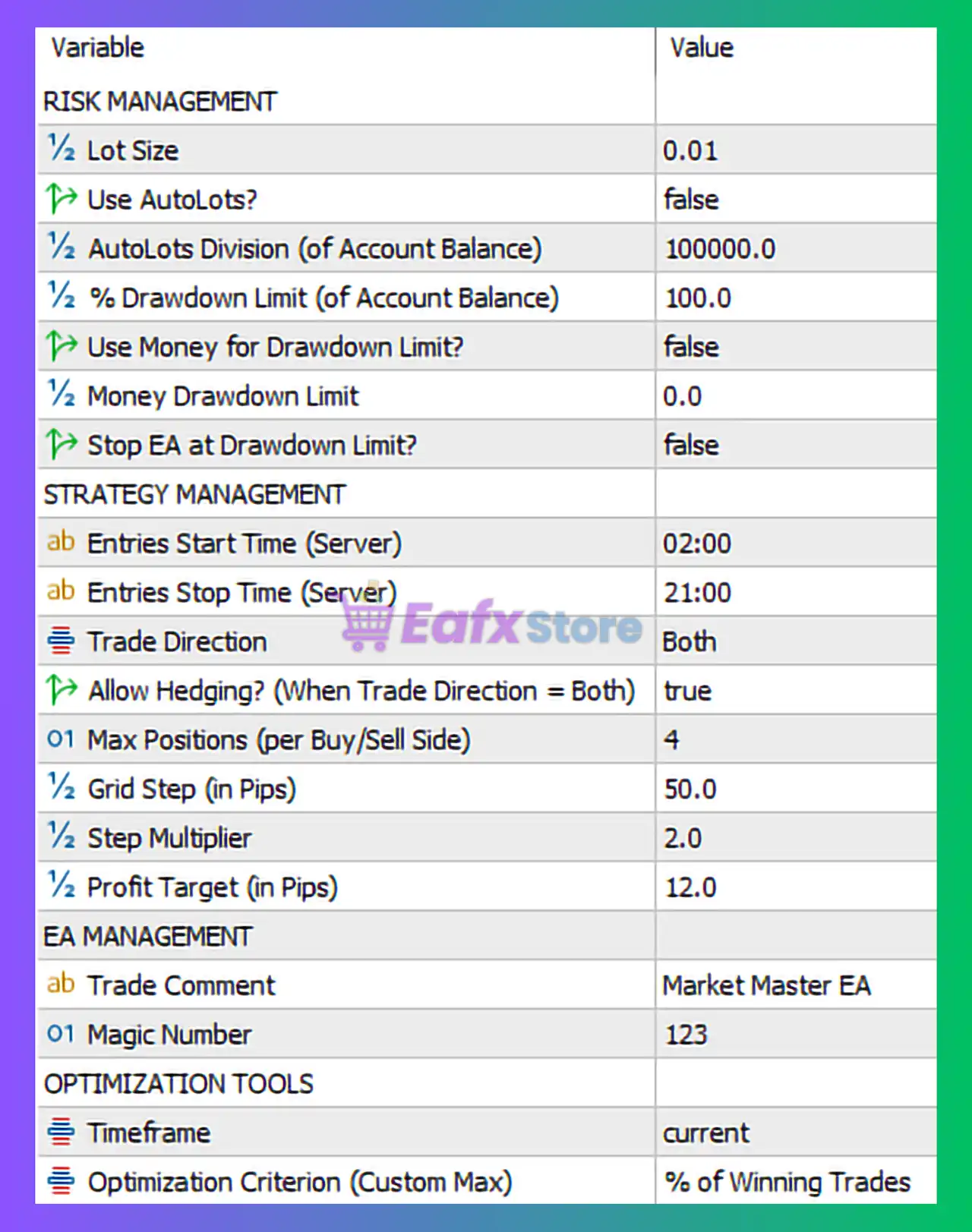

🧩 Risk Management Settings

🔹 Lot Size: 0.01

- Uses a fixed minimum lot size, suitable for beginners or small accounts.

- Very conservative, reducing exposure and drawdown risk.

🔹 Use AutoLots: false

- The EA does not automatically scale lot size based on account balance.

- This ensures predictable risk but limits account growth efficiency.

🔹 AutoLots Division (of Account Balance): 100000.0

- Irrelevant since AutoLots is disabled.

- Normally, this would define how balance translates into lot size.

🔹 Drawdown Limit (% of Account Balance): 100.0

- A value of 100% effectively means no drawdown protection is active.

- This increases risk during prolonged losing cycles.

🔹 Use Money for Drawdown Limit?: false

- Drawdown is not controlled by a fixed monetary value.

🔹 Money Drawdown Limit: 0.0

- Inactive because money-based drawdown control is disabled.

🔹 Stop EA at Drawdown Limit?: false

- The EA will not stop trading, even if drawdown becomes excessive.

✅ Risk Assessment:

Low lot size provides safety, but the absence of effective drawdown protection introduces long-term risk, especially for grid-based strategies.

🧩 Strategy Management Settings

🔹 Entries Start Time (Server): 02:00

🔹 Entries Stop Time (Server): 21:00

- The EA trades within a defined time window, avoiding low-liquidity rollover hours.

- Suitable for major forex sessions (London & New York).

🔹 Trade Direction: Both

- Allows buy and sell trades simultaneously, increasing trade frequency.

🔹 Allow Hedging (When Trade Direction = Both): true

- Enables hedging, which can reduce floating losses but increases margin usage.

- Recommended only for brokers that support hedging on MT5.

🧩 Position & Grid Control

🔹 Max Positions (per Buy/Sell Side): 4

- Limits overexposure by restricting the number of open trades per direction.

🔹 Grid Step (in Pips): 50.0

- A wide grid spacing, reducing trade clustering.

- Safer for volatile markets but slower recovery.

🔹 Step Multiplier: 2.0

- Grid distance doubles for each new level, a smart anti-martingale protection.

- Helps reduce drawdown acceleration.

🔹 Profit Target (in Pips): 12.0

- Small take-profit target, optimized for scalping or mean-reversion strategies.

🧩 EA Management Settings

🔹 Trade Comment: Market Master EA

- Useful for tracking trades in MT5 history.

🔹 Magic Number: 123

- Unique identifier to prevent trade conflicts with other EAs.

- Should be changed if running multiple EAs on the same account.

🧩 Optimization Tools

🔹 Timeframe: current

- EA adapts to the chart timeframe it is attached to.

- Flexible, but results vary significantly between M15, H1, and H4.

🔹 Optimization Criterion (Custom Max): % of Winning Trades

- Focuses optimization on win rate, not net profit.

- High win rate does not always mean high profitability—should be used cautiously.

✅ Final Conclusion

The Market Master EA MT5, based on this configuration, is designed with a conservative entry approach but weak drawdown protection. Key strengths include:

✔ Low fixed lot size.

✔ Controlled grid expansion.

✔ Time-filtered trading.

✔ Hedging capability.

However, notable weaknesses include:

⚠ No effective drawdown limit.

⚠ EA does not stop during extreme losses.

⚠ Optimization prioritizes win rate over profit.

🔍 Overall Verdict

This setup is suitable for small accounts, cent accounts, or strategy testing, but not recommended for aggressive live trading without adding stricter drawdown controls or enabling AutoLot risk scaling.

For best performance, traders should:

- Enable a realistic drawdown limit.

- Consider money-based risk control.

- Adjust grid and profit targets per market condition.