🧩 What is Swing Master EA?

The Swing Master EA is a fully automated trading robot designed for the MetaTrader 5 (MT5) platform. The settings configuration reveals a well-balanced swing and mean-reversion strategy that integrates ATR, Bollinger Bands, RSI, and Moving Average filters to identify high-probability market reversals while maintaining strong risk control.

📌📌📌 Buy this unlimited Swing Master EA MT5 product here 📌📌📌

Below is a full breakdown of its operational logic, money management system, and strategy filters.

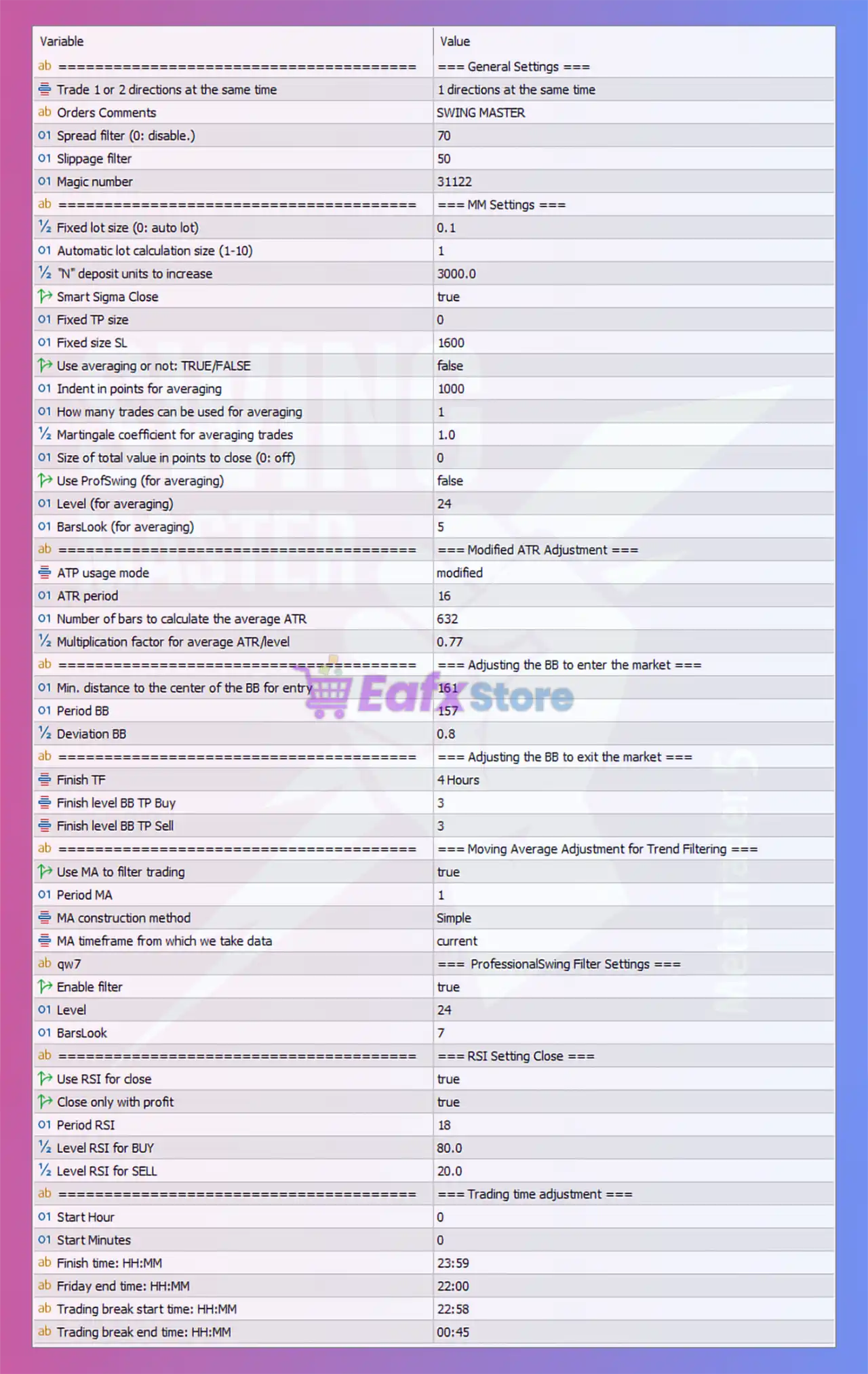

🧩 General Settings

- Trade Direction: 1 direction at the same time

- Order Comment: SWING MASTER

- Spread Filter: 70

- Slippage Filter: 50

- Magic Number: 31122

✅ The EA trades one direction per symbol, ensuring that trades do not overlap or hedge against each other.

✅ The spread and slippage filters protect the system from volatile market conditions or broker manipulation, ensuring execution only in stable liquidity environments.

✅ The use of a unique magic number allows tracking of individual EA trades for account management and backtesting accuracy.

💰 Money Management (MM Settings)

- Fixed Lot: 0.1

- Automatic Lot Calculation: Enabled (size 1)

- Increment Step: $3000

- Smart Sigma Close: True

- Fixed Stop Loss: 1600 points

- Averaging: Disabled (false)

- Indent for Averaging: 1000 points

- Martingale: 1.0 (disabled)

✅ This shows a risk-controlled trading structure, avoiding dangerous Martingale or averaging tactics.

✅ Fixed SL (1600 points) ensures trades are always protected, a strong point for prop firm and long-term reliability.

✅ The Smart Sigma Close feature intelligently closes positions when volatility contracts, locking in profits dynamically.

✅ Automatic lot scaling maintains consistent risk per capital growth, improving long-term compounding.

📈 ATR (Average True Range) Adjustment

- Mode: Modified

- ATR Period: 16

- Bars for Average ATR: 632

- ATR Multiplier: 0.77

✅ The modified ATR algorithm dynamically adjusts stop levels and entry filters based on market volatility, ensuring adaptive performance in both trending and ranging markets.

✅ A long historical lookback (632 bars) adds statistical depth and smoothness, reducing noise and false entries.

📊 Bollinger Bands Entry Logic

- Minimum Distance to Center: 161

- Period: 157

- Deviation: 0.8

✅ These settings define a wide Bollinger Band structure for entry. The EA waits until price moves far from equilibrium, then anticipates a reversion to the mean — a classic swing trading setup.

✅ The moderate deviation (0.8) allows early positioning without excessive drawdown, maximizing profit on retracements.

💵 Bollinger Bands Exit Logic

- Exit Timeframe: 4 Hours

- TP Level for Buy/Sell: 3

✅ The EA exits trades based on Bollinger Band mean-reversion points within the 4-hour timeframe, locking profits as price returns to balance.

✅ This higher timeframe ensures smoother exits and reduces intraday noise.

📉 Moving Average Trend Filter

- Enabled: True

- Period: 1 (fast MA)

- Method: Simple

- Timeframe: Current

✅ The EA uses a simple moving average filter to confirm trade direction, avoiding countertrend entries.

✅ With a period of 1, this acts as a microtrend alignment filter, synchronizing the system with short-term momentum before executing entries.

🧠 Professional Swing Filter

- Enabled: True

- Level: 24

- BarsLook: 7

✅ This proprietary ProFSwing filter further validates entries using historical swing points, ensuring the EA trades only after clear momentum exhaustion.

✅ The multi-bar lookback improves timing precision and avoids false reversals.

📊 RSI Settings for Trade Closure

- RSI Close Enabled: True

- RSI Period: 18

- RSI for Buy Close: 80

- RSI for Sell Close: 20

- Close Only with Profit: True

✅ This module intelligently manages exit points using RSI overbought/oversold conditions, ensuring trades are closed only when in profit.

✅ This disciplined approach improves profitability consistency and aligns with the swing-reversal nature of the system.

🕒 Trading Time Controls

- Active Trading Hours: 00:00 – 23:59

- Friday End Time: 22:00

- Trading Break: 22:58 – 00:45

✅ Swing Master EA trades throughout the day, but avoids high-spread rollover hours between 22:58 and 00:45, which is essential for minimizing overnight volatility risk.

✅ The Friday cutoff at 22:00 prevents exposure to weekend gaps.

🔍 Summary of Strategy Logic

The Swing Master EA combines volatility-adaptive entries (ATR) with mean-reversion timing (Bollinger Bands), refined through RSI and MA filters to trade only in favorable setups.

It avoids over-leveraging, averaging, or Martingale systems, focusing instead on technical precision, risk limitation, and consistent profitability.

🏁 Conclusion

✅ Swing Master EA demonstrates a well-engineered, risk-averse swing trading framework, blending volatility, momentum, and price-action filters for reliable medium-term gains.

✅ The configuration shows a professional-grade balance between profit potential and capital preservation, making it suitable for funded account trading, prop firms, and long-term portfolio diversification.

In short:

- 📊 Volatility-adaptive ATR management

- 🎯 Precise Bollinger Band mean-reversion logic

- 🧠 AI-style Swing filters and RSI exits

- 💰 No Martingale, No Grid, Fixed SL for stability

- 🕒 Intelligent trading time protection

➡️ The Swing Master EA is a robust, professional-level swing trading robot designed to deliver steady profits with low drawdown, ideal for traders seeking smart automation on MT5.