The Forex market has a very strong correlation with the Central Bank and the decisions issued by the Governor of the Central Bank and also the interest rate issued by the Central Bank greatly affect the country’s currency and its price in the Forex market.

A Complete Guide to Central Banks and Their Role in the Forex

1 – Understanding Central Banks

The central bank is the bank that controls all banks in the country. It is the bank that issues important decisions and laws such as monetary policy, interest rates, and inflation rates. It can also determine the percentage of cash reserves for each bank in the country.

The Central Bank is One of the most important factors affecting Forex that you should follow as a Forex trader because the decisions issued by the Central Bank have a very significant impact on the movement of the markets, and these decisions determine the fate of the country’s currency, whether it will rise in the long term or fall.

Also, the decisions of the Central Bank may be in the long term or the short term. There are very sensitive decisions that greatly affect the currency and its future in the market, and there are decisions that the market may react to temporarily, and then things become normal after that.

Examples of major central banks

Each country has its own central bank to control the rest of the banks, as we mentioned previously. For example, these are the central banks of the largest countries in the world.

Federal Reserve

The Federal Reserve is the central bank of the United States and is considered one of the strongest central banks in the world. Many traders await its decisions in order to make appropriate trading decisions.

European Central Bank

The European Central Bank is responsible for all European banks.

Bank of Japan

Also, the Japanese central bank and the same thing applies to it

2 – Monetary Policy and Forex Markets

Each country has its own monetary policy, and through this monetary policy, the country can grow economically and provide better livelihoods for citizens. The central bank is the one that is keen to present a monetary policy that suits the country and its economy. Among the tools of this monetary policy are:

Interest Rates

You may have heard the term interest rate before, but what is it?

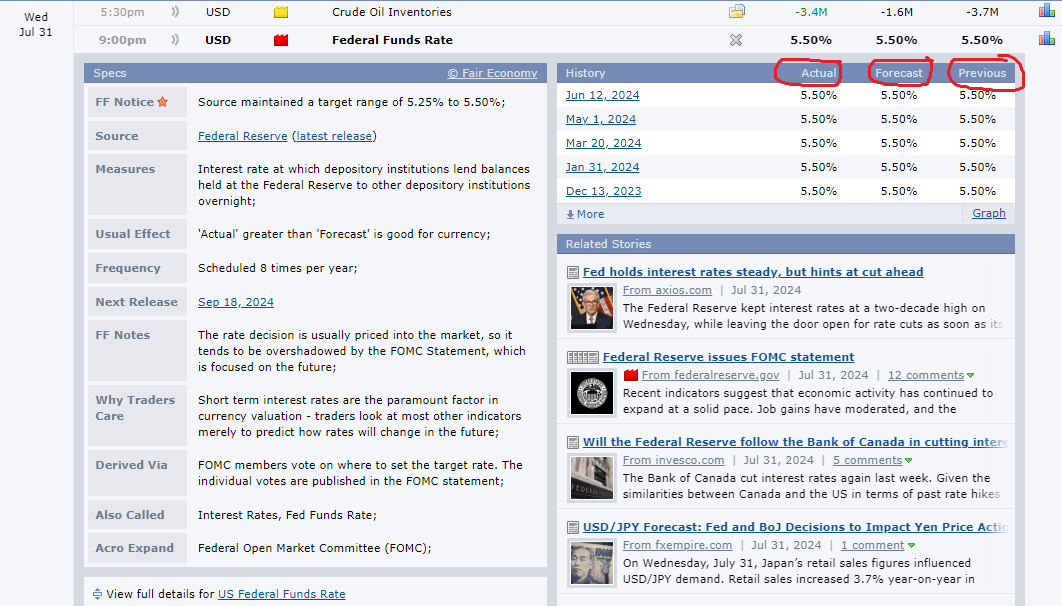

Interest rates are the returns that the bank gives you in return for your deposits or for investment certificates or deposits that the bank offers. The Central Bank of the country supervises these interest rates and all banks are committed to implementing these decisions.

The Central Bank changes interest rates from time to time, either lowering it or increasing it, of course, depending on the country’s economic situation. Such important decisions are taken, It is also possible to not change the interest rates if these rates are satisfactory to the Central Bank, so there is no need to change them.

Interest rates are one of the most important news for traders, so you will notice that when the central bank’s interest rate decision date approaches, you will see that traders are very interested in this timing and are trading at this time in order to take advantage of the crazy movements that occur.

<<<Reasons Why Traders Fail when Trading Forex>>>

For example, the US interest rate (Federal Bank) Because the United States is the largest country in the world economically and the dollar is linked to many currencies in Forex, it is natural that when the dollar is affected by any news (especially Interest rate) most currencies in Forex will be affected too.

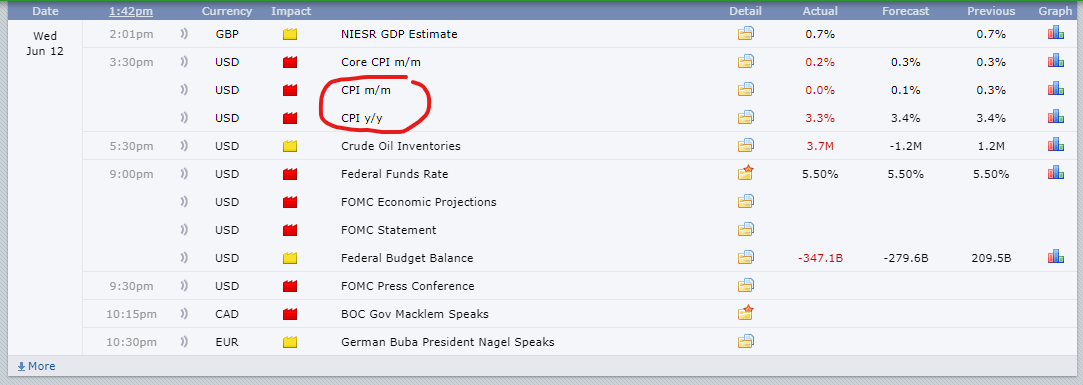

The last interest rate decision issued on July 31 was to keep interest rates unchanged, You can follow interest rates through the economic calendar in Forex Factory from here.

Interest rates are usually issued every two or three months, depending on the monetary policy followed by the Central Bank. The interest rate date is also determined through the meetings held by the Central Bank.

How to read the interest rate News