Economic and Political Factors

Is the pair affected by the news a lot? If the Forex pair is subject to news more than necessary throughout the day, then there is no need to trade on this pair because during the news period, you will not be able to enter a trade based on normal analysis methods, but the movement of the pair is controlled by political news and it moves based on that and will completely ignore your technical analysis.

You will find many forex pairs and currencies that have news about them throughout the day. I do not mean the EUR/USD or the major pairs. Naturally, strong and weak news will occur about them daily, but some forex pairs are affected by the news more than necessary and news will occur about them daily throughout the week. This does not leave you room to trade on these pairs. Therefore, the best solution is to completely ignore these pairs and look for others.

Trading Style & Strategy

What is your trading style? Because your trading style determines which forex pairs are right for you. I mean, do you analyze using technical analysis or fundamental analysis? For example, all types of analysis work with the major forex pairs, and you can start with the EUR/USD.

This is the best pair to work on, whatever your trading style is. But if you want to choose another pair to make quick profits, I will advise you to use the pair nicknamed the “crazy” GBPJPY. This pair moves a good number of pips during the week, and if you can analyze the economic news that occurs on it, you will make good profits by taking advantage of these big movements.

The trading time is very important in choosing the appropriate Forex pairs for you because if you sleep at the opening time of London, this means that the major pairs are not suitable for you because the major pairs that contain the dollar currency move at such times, especially when London overlaps with New York.

If you prefer to trade in the Asian sessions, it will be best for you to choose the JPY, AUD, and NZD pairs, as these pairs move well at the start of the Tokyo session, and you can also take advantage of the New York session.

If you want to trade in the major pairs but will not be able to be in front of the chart in the New York and London sessions, you can place pending orders in the Levels you want, and thus you will seize the largest amount of opportunities so that you do not lose anything.

You can find out the opening and closing times of the sessions according to your local time from the Forex Factory here.

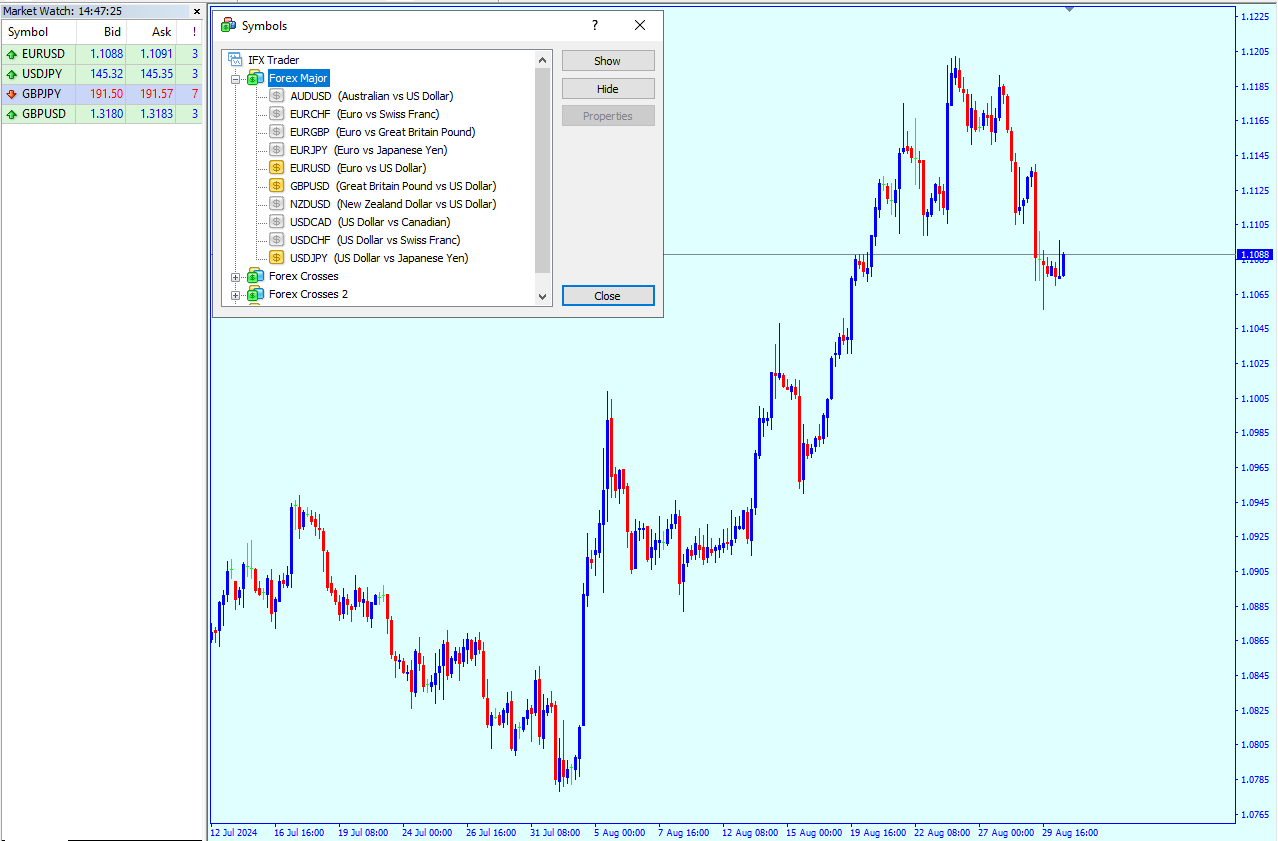

In this example, the EUR/USD is at the top and the GBP/USD is at the bottom. You will notice that when the price fell strongly, it reached a good demand Zone and the EURUSD pair respected it and was unable to break it. However, if you look at the GBP/USD, you will find that this area was already broken and the pair did not respect it at all and continued to fall until it reached the area it wanted at the EUR/USD.

In this case, do you think the decision to enter the trade is based on which of the two zones? The EUR/USD has a supply area that the price has not yet reached, and when it reached it, an hourly candle closed above this level, and the GBP/USD did the exact opposite and did not respect it, so the decision to enter the trade will be better if its on the EUR/USD. Thus, you will have a clearer vision of what is happening in the market when merging more than one pair on the chart, and you will make logical decisions in this way.

On the contrary, in a negative correlation, you can look at the opposite pair in the movement to see better areas to enter your trades from.

You can add the “DXY” dollar index so that you can identify important areas that the pair may respect and that you may have difficulty finding on the EUR/USD or GBP/USD forex pairs.

In this example from the same area that we have previously identified, we find that the dollar index DXY has risen strongly at the time of the news, and somewhat the pips it has risen are slightly higher than the pips it has fallen in the EUR/USD. Do not forget that we are now talking about a pair that moves in the opposite direction of the dollar index because the dollar index is the second currency in the EUR/USD.

DXY ignored the zone from which the EUR/USD bounced, but he was targeting an area higher than it in order to keep pace with the EUR/USD movement. In this case, it is better not to enter a direct trade when the EURUSD reaches the area from which it bounced, and to wait in the event that the Dollar Index reaches this area in order for it to be a strong signal for the Dollar Index to fall and the EURUSD to rise.

One of the strategies that traders use to exploit this correlation between forex pairs is to open hedge orders on pairs by opening buy orders on one pair and opening Sell orders on the other pair with a Negative Correlation.

It is possible to use this method to maintain the profits you have achieved or protect your account from loss in the event that you see that the price is moving in the opposite direction of what you wanted, so you open a trade opposite to the one you had previously opened on a pair with a negative correlation.