What is South East EA MT5?

South East EA is a sophisticated, fully automated trading system that uses a powerful Martingale & Grid strategy with dynamic lot multiplier. The system features a maximum safety grid, built-in News Filter and advanced partial order closing logic to manage profit taking and continuous drawdown.

📌📌📌 Buy this unlimited South East EA MT5 product here 📌📌📌

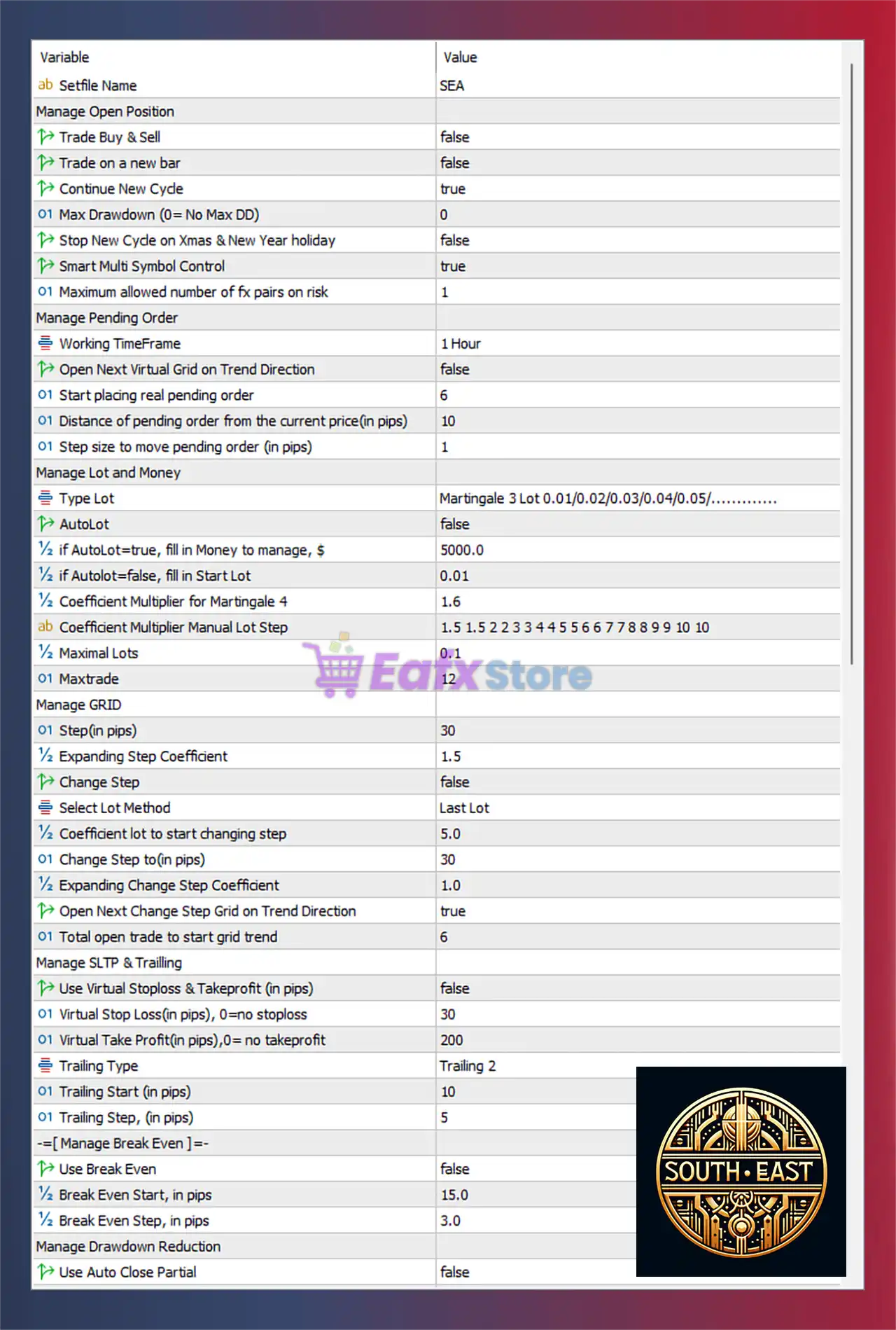

General & Strategy Activation Settings

This section dictates the basic operational rules and strategy triggers for the EA.

| Parameter | Value | Meaning (Simplified) | Note |

| Setfile Name | SEA | The name of the settings file. | N/A |

| Manage Open Position | false | Disables management features for existing manual trades. | The EA only manages its own trades. |

| Trade Buy & Sell | false | Disables trading on both Buy and Sell sides simultaneously. | The EA likely focuses on one direction at a time or uses a specific entry rule (like a trend filter). |

| Trade on a new bar | false | Allows the EA to open trades at any time, not just at the start of a new candlestick. | Enables faster execution and possibly scalping. |

| Continue New Cycle | true | Allows the EA to start a new trading cycle after the previous one is closed (profit or loss). | Essential for continuous trading. |

| Stop New Cycle on Xmas & New Year holiday | false | Disables the holiday trading stop. | Warning: Increases risk during low-liquidity holiday periods. |

| Smart Multi Symbol Control | true | Likely manages trades across multiple currency pairs to balance the total exposure (risk). | Advanced risk diversification. |

| Maximum allowed number of fx pairs on risk | 1 | Limits the EA to only manage risk on one currency pair at a time (despite the multi-symbol control). | Focuses risk on a single market. |

Export to Sheets

Pending Order Management

The EA uses pending orders (Limit/Stop) which are dynamically managed.

| Parameter | Value | Meaning (Simplified) | Functionality |

| Working TimeFrame | 1 Hour | The main chart time frame the EA uses for its analysis/logic. | H1 is often used for swing trading or longer-term grid strategies. |

| Open Next Virtual Grid on Trend Direction | false | The virtual grid orders do not follow the current trend direction. | Orders may be placed counter-trend or symmetrically. |

| Start placing real pending order | 6 | The pending order logic starts after the 6th order in the grid sequence. | This saves resources and is common in Martingale strategies. |

| Distance of pending order from the current price (in pips) | 10 | The distance (in pips) between the pending order price and the current market price. | Defines the gap before a pending order triggers. |

| Step size to move pending order (in pips) | 1 | The pending order will be moved by 1 pip if the price moves favorably. | Highly dynamic movement to catch the best entry price. |

Export to Sheets

Martingale & Lot Size Management

This is the highest risk section, defining the exponential increase in trade volume.

| Parameter | Value | Meaning (Simplified) | Risk Implication |

| AutoLot | true | Enables automatic lot size calculation based on managed funds. | Recommended over fixed lot for risk control. |

| ½ If AutoLot=true, fill in Money to manage, $ | 5000.0 | Base Capital for Lot Size Calculation. The EA calculates the Lot Size to manage risk based on a $5,000 capital. | If your account is $10,000, lots will be double the size calculated for $5,000. |

| ½ If AutoLot=false, fill in Start Lot | 0.01 | The base lot size if AutoLot is disabled. | N/A (since AutoLot is true) |

| ½ Coefficient Multiplier for Martingale | 1.6 | The Lot Multiplier. Each subsequent order will be 1.6 times the volume of the previous order. | Aggressive Martingale. This is a high multiplier, leading to fast-increasing drawdown in adverse trends. |

| Coefficient Multiplier Manual Lot Step | 1.5, 2, 2, 3, 3, 4, 4, 5, 5, 6, 6, 7, 7, 8, 8, 9, 9, 10, 10 | A custom list of multipliers used for each step of the grid instead of the fixed 1.6. | Since this parameter is present alongside the fixed 1.6, the custom list likely overrides the fixed value, showing a more precise, but still aggressive, multiplier sequence (increasing up to 10x the start lot). |

| ½ Maximal Lots | 0.1 | Maximum allowed lot size for any single trade. | A safety limit to prevent trades from exceeding 0.1 Lot, mitigating extreme risk. |

| 01 Maxtrade | 12 | Maximum number of trades the EA can open in a grid sequence. | A reasonable limit to control grid accumulation. |

Export to Sheets

Grid Structure & Dynamic Steps

This section details how the distance between grid orders is determined and adjusted.

| Parameter | Value | Meaning (Simplified) | Functionality |

| 01 Step (in pips) | 30 | Base Grid Step. The distance (in pips) between the initial trades. | 30 pips is a medium grid distance. |

| ½ Expanding Step Coefficient | 1.5 | The distance between subsequent orders is multiplied by 1.5. | Dynamic Grid. The grid steps get wider as the market moves against the EA, requiring the price to move further to open the next lot. This slightly reduces the frequency of trades but increases the distance to TP. |

| Change Step | false | Disables the feature to dynamically change the initial grid step. | The 30 pips base step remains fixed. |

| Coefficient lot to start changing step | 5.0 | Multiplier for lot size to start changing the step size. | N/A (since Change Step is false) |

| Change Step to (in pips) | 30 | The new step size when the change is triggered. | N/A (since Change Step is false) |

| Expanding Change Step Coefficient | 1.0 | Coefficient for the step change. | N/A (since Change Step is false) |

| Open Next Change Step Grid on Trend Direction | true | The next grid step opens based on the trend direction. | Introduces a trend filter to the grid logic. |

| 01 Total open trade to start grid trend | 6 | The trend direction filter is only activated after 6 open trades in the grid sequence. | The trend filter is a recovery mechanism for larger grids. |

Export to Sheets

SL/TP, Trailing, and Breakeven Management

These settings define how profits are locked in and losses are managed.

| Parameter | Value | Meaning (Simplified) | Application |

| Use Virtual Stoploss & Takeprofit (in pips) | true | Enables Virtual SL/TP. The EA manages exits internally, without setting physical SL/TP on the broker server. | Faster reaction time, but dependent on the EA’s connection/functionality. |

| 01 Virtual Stop Loss (in pips), 0=no stoploss | 30 | Virtual Stop Loss set at 30 pips. | A small SL for individual trades (but usually a grid only closes the whole basket, not individual trades). |

| 01 Virtual Take Profit (in pips), 0=no takeprofit | 200 | Virtual Take Profit set at 200 pips. | A wide TP, suggesting the EA aims for larger moves or basket closure. |

| Trailing Type | Trailing 2 | Activates a specific Trailing Stop mechanism (Type 2). | This type dictates the specific algorithm for trailing. |

| Trailing Start (in pips) | 5 | Profit level to activate Trailing Stop. Trailing starts when the trade is 5 pips in profit. | Very aggressive/quick activation of Trailing Stop. |

| Trailing Stop, (in pips) | 5 | The distance (in pips) the SL follows the price. The SL will stay 5 pips behind the market price. | Locks in profit quickly, suitable for scalping or volatile markets. |

| Use Break Even | false | Disables the Breakeven function. | The SL is not automatically moved to the entry price. |

| Manage Drawdown Reduction | true | Enables the Drawdown Reduction feature. | A crucial feature for Grid/Martingale EAs, often involves closing profitable trades to offset losses. |

| Use Auto Close Partial | true | Enables Partial Closing of trades. | Part of the Drawdown Reduction strategy to manage open grid positions. |

Export to Sheets

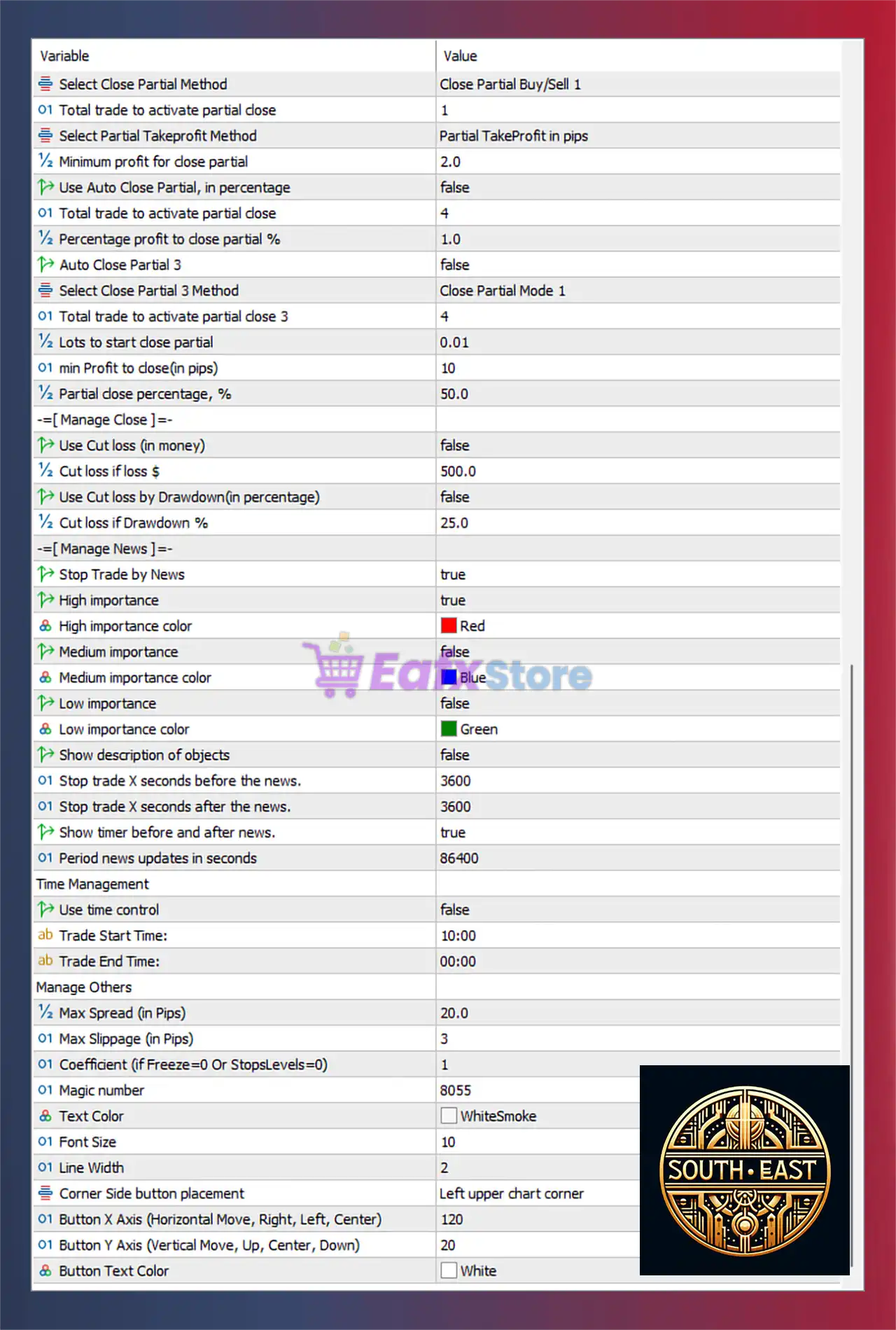

Partial Closing and Drawdown Control

This section focuses on minimizing drawdown by closing portions of trades or the entire basket.

| Parameter | Value | Meaning (Simplified) | Risk Control Function |

| Total trade to activate partial close | 1 | Partial closing can be activated with just 1 open trade. | Very proactive in managing even small drawdowns. |

| Select Partial Takeprofit Method | Partial TakeProfit in pips | The partial close logic is based on achieving a certain pip profit. | Uses pips, not percentages, for closing. |

| ½ Minimum profit for close partial, in percentage | 2.0 | The minimum profit must be 2.0% of the trade volume to close partially. | N/A (Method is based on Pips, not percentage) |

| Total trade to activate partial close | 4 | The second partial close method starts with 4 open trades. | Targets a larger grid for partial closure. |

| Percentage profit to close partial % | 1.0 | Closes a trade if the partial profit reaches 1.0% of the trade volume. | N/A (Method is based on Pips) |

| Auto Close Partial 3 | false | Disables the third partial close method. | N/A |

| min profit to close(in pips) | 10 | Closes a portion of the trade when it reaches 10 pips profit. | A core mechanism for continuous profit taking and drawdown offsetting. |

| Partial close percentage, % | 50.0 | When partial close is triggered, 50% of the current trade volume is closed. | Leaves the remaining 50% open to continue the grid or hit full TP. |

| Use Cut loss (in money) | false | Disables cut-loss based on a dollar amount. | N/A |

| Cut loss if loss $ | 500.0 | The dollar amount to trigger cut loss. | N/A (since Use Cut loss is false) |

| Use Cut loss by Drawdown(in percentage) | true | Enables cut-loss based on a percentage of the total account drawdown. | Crucial Safety Net. |

| Cut loss if Drawdown % | 25.0 | If the total floating loss (drawdown) reaches 25.0%, the EA will close all open positions. | A fixed “stop-out” level controlled by the EA, providing a safety buffer before a broker margin call. |

Export to Sheets

News Filter, Time, and System Management

This group ensures the EA avoids high-risk periods and has proper operational control.

| Parameter | Value | Meaning (Simplified) | Purpose |

| Stop Trade by News | true | Enables the News Filter. The EA will suspend trading around major economic news releases. | Essential for mitigating huge, unexpected moves during high-impact news. |

| High importance | true | Stops trading for High-impact news. | Recommended. |

| High importance color | Red | Visual color indicator for High-impact news. | N/A |

| Stop trade X seconds before the news. | 3600 | Stops trading 3600 seconds (1 hour) before news release. | A long time buffer for high-impact news. |

| Stop trade X seconds after the news. | 3600 | Stops trading 3600 seconds (1 hour) after news release. | A long time buffer for post-news volatility. |

| Use time control | false | Disables trading based on specific daily hours. | The EA trades 24/5. |

| Max Slippage (in Pips) | 3 | Maximum allowed slippage when placing an order. | A tight limit (3 pips) ensures better execution. |

| Magic number | 8055 | The unique ID for the EA’s trades. | Trade identification. |

Export to Sheets

Strategy Risk Assessment and Final Advice

This “SEA” EA utilizes an extremely aggressive strategy built on the Martingale Grid concept, but with complex safeguards.

- Core Risk: The

Coefficient Multiplier Manual Lot Stepincreases lot size rapidly, leading to massive floating loss (drawdown) potential in a strong, sustained trend. The 30-pip base step is wide enough to catch large trends but also requires many high-volume trades to close the basket. - Safety Features: The

Cut loss if Drawdown % = 25.0is the most critical safety net. It ensures the account won’t be fully wiped out, stopping the EA at 25% loss. TheAuto Close Partialfeatures act as continuous recovery tools, chipping away at the drawdown.

CRUCIAL ADVICE: Given the aggressive nature of the Martingale multiplier (up to 10x the start lot) and the 25% fixed maximum drawdown, you must:

- Backtest this EA extensively over various market conditions, including major historical trends (e.g., strong rallies in 2022/2023).

- Monitor Margin Level: The EA is only limited by Lot Size (

0.1) and Max Trades (12), but the margin requirement can spike dramatically due to the exponential lot increase. - Start with minimal capital on a live account, or ideally, only use a Demo account until you fully trust the 25% drawdown safety mechanism.