Many strategies in Forex aim to compensate for losses if the entry was incorrect or in the event of news…etc. Among these strategies is the Martingale strategy. This strategy may help you compensate for losses in the event that the price reverses against you more than necessary, but this strategy has advantages and disadvantages as well.

Martingale: Recover Losses and Maximize Gains

1 – What is the Martingale Strategy?

The Martingale strategy aims to compensate for losses by opening more orders of the same type of order. This action seeks to compensate for losses for the first trades that were opened previously.

For example, if you opened a sell order on the EUR/USD from the level of 1.1000 and the price rose and reached 1.1050 You can open another sell order with a bigger Lot than the previous one at this level, targeting the 1.1000. Thus, you will exit the first trade without profit or loss, and you will get 50 pips of profit from the second trade.

What happens if the price reverses more and goes up? You can open more sell orders with a larger lot than the previous lot to compensate for the first and second trades…etc. and close all orders with a small profit or no profit or loss.

How it works?

The Martingale strategy aims to compensate for losses resulting from previous trades and exit the market with the least possible losses and possibly profits as well, It is also possible that all losing trades will be compensated for by one winning trade, and this trade will be of a large lot, of course.

When can the strategy be applied?

The Martingale strategy depends on opening more orders of the same type if the price reverses against you, so the strategy will not be good if the pair is in a clear trend.

For example, if the EUR/USD pair has a clear Trend and forms higher highs and higher lows, in this case, it will be difficult to enter many orders because the market will continue to Reverse on you and you will incur many unnecessary losses.

The Martingale strategy becomes good in a ranging market or if the trend is not completely clear. In this case, we can open many trades in the hope that the price will bounce back again to reach a good percentage of profit.

News

Is the Martingale strategy suitable for news time? The answer is a bit difficult because news varies in its impact on the market. There is news that may push prices 50 pips in a moment, but this push is only a bubble and then the market returns again to its previous levels.

The Martingale strategy is very good with this news because in this case, you will be able to achieve many profits no matter how the market turns against you because it will return to the starting levels again (or near it)

But what will happen if the news is very strong and its impact on the market will continue for more than a week or a month? Such news pushes prices to very far levels and it is difficult at that time to open many orders in the hope that the price will reverse to exit at least with the least possible losses.

For example, this was the NFP news, which made the EUR/USD pair rise strongly and the pair did not reach this level again, but it is possible that if you intend to trade at such a time, you will target a level other than the area where you entered the first trade, and thus you will reduce the risks somewhat, You may aim to exit the trades without profit or loss because the market is likely to reverse on you more and more.

2 – The Logic Behind Martingale

The Martingale strategy aims to compensate for losses in the event that the trader believes that the market will reverse at some point. For example, if there are support or resistance levels that the price may respect, such a strategy can be used in the event that the price breaks these levels because this break may be a false break.

In this case, the price will reverse again because the price’s goal is to break these levels in order to hit the stop loss that traders place after these levels, and then it will reverse again. In this case, when you use the Martingale strategy, you will not place a stop loss and you will open more orders.

It is not necessary to open orders with double the lot. you may open the same lot every time the price reverse on you, but the calculation of lots differs from one trader to another.

For example, if the range between each trade is very close, you will slightly increase the lot size, or you may open the same lot. In the end, you will find yourself opening a number of lots that your account can handle. If the range is far, you may double the lot size because the reversal of the trades will be large and the loss will also be large, so you need a large lot size to compensate for all these losses, This strategy helps you achieve very small gains after there was a big loss in the account.

What is the idea of strategy?

The idea of the strategy is that there is no pair or currency that moves in one direction forever, and this is logical, right? Have you ever seen a pair move in one direction without having Highs and lows? Of course, there is a trend, a strong rise, and a strong fall, but for a pair to move in one direction for a long period of time without making some corrective movements, is something very difficult to find.

Therefore, such strategies were created that depend on corrections that may occur in the event that you are wrong in your analysis, and then the price rebounds at some point and achieves some profits for you so that you can exit the market with the least possible loss.

The idea of the strategy is also based on the movement of the pairs for a specific period of time. For example, the EUR/USD pair moves from 50 to 100 pips daily and 70 to 150 pips weekly. When you know such important data, for example, you can enter buy when the pair drops by more than 50 pips at the start of the week. If it continues to drop for the second day, you double the lot on the Hope that it will rise at some point during the week.

After it rises, you will compensate for all the losses that occurred in the first trade… The daily movement of the pairs gives a good indication of the momentum of the pair and knowing whether there is a buying or selling saturation, and based on that you decide whether to enter more trades or not.

Useful Indicators with Martingale

It is possible to use indicators with the Martingale strategy, and these indicators are used to determine the overbought and oversold levels. If there are overbought levels, this indicates that the price may fall, and the opposite is true in the case of oversold levels.

The RSI indicator can help you know the overbought and oversold conditions. If the indicator reaches the 70 level, this indicates overbought and the price may fall. The opposite is true if it reaches the 30 level.

3 – Possible outcomes of the Martingale Strategy

Any strategy in the Forex market has advantages and disadvantages because there is no perfect strategy, right? It is natural that if a strategy has many advantages, it may also have disadvantages that may wipe out all these advantages in one moment.

One of these disadvantages in Martingale is that if the price reverses against you more and more, you will open many lots to compensate for this loss. If the price goes in your favor, you will profit and compensate for your losses, but what will happen if it continues to reverse?

It is likely that if the price continues to reverse, you will lose your entire account. This is of course considered very risky trading because if you are wrong in analyzing the pair, your account will bear the full consequences of this mistake and you will lose all your money.

There is another aspect that you should also focus on, which is that the Martingale strategy may get you out of this loss by gaining some profit, or it may be without profit or loss. It saves you from a potential large loss in exchange for risking your account. This decision is not easy because you are putting your entire account at risk.

Account size

The Martingale strategy requires a large balance to be able to bear all these possible reversals. The price may reverse on you by a large number of pips. No one knows when the price will rebound and go in your favor. Therefore, whenever the price moves against your trade, you will open more orders to compensate for these losses. The more orders there are, the more capital you will need.

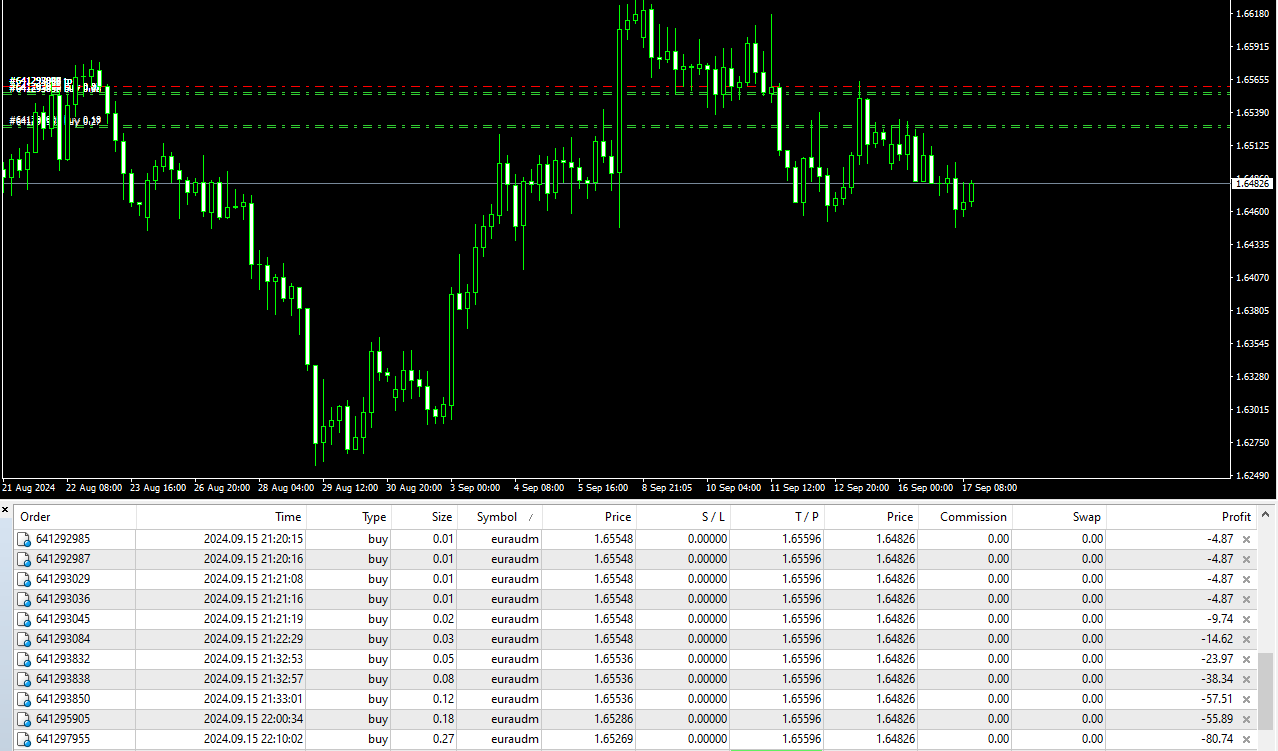

There is no fixed capital for this strategy because the influential factor is the lot. For example, if the lot for the first trade is 0.01 and this lot is doubled over time until it reaches 10.24 lots, this indicates that you have opened a total of 20.47 lots

Can your account bear all this loss with these many lots? If the answer is yes then you can start with this strategy without any problem but do not rush. Will the price go in your favor after all these lots? It is complicated, isn’t it? You must set a maximum limit for the lots that you can bear and based on this limit you deposit the appropriate amount that will bear all this loss.

Also, accept that the Martingale strategy is not perfect. It is possible that after all these losses your account will be margined, and this is not impossible because there is no perfect strategy.

As for leverage, it is preferable to use the highest leverage available at the broker. You will find that most brokers offer leverage of up to 1:2000 and possibly 1:3000. The higher the leverage, the more you will be able to open large lots. This is what is required for the Martingale strategy to work well.

Cent Account

As long as this strategy requires a large capital account, you can open a cent account or Micro account. This account helps you reduce the lot amount from $100,000 to $1,000 per lot by converting your money into cents. For example, if you decide to deposit $100, it will be read in the account as $10,000.

When you open a cent account, you will be able to bear any reversal that may occur in the account with a small deposit amount, and thus you can open a large number of lots, but of course, the profits will be small compared to your deposit, but this is not a bad strategy in the long run, You can also open a mini account. The mini lot is equal to 0.1 standard lot. You are free to choose between the accounts that suit you.

Conclusion

The Martingale strategy is one of the great strategies that can easily turn losing trades into winning trades, but it carries with it many risks that may lead to losing the entire account because it depends on doubling the lots, and if the pair being traded is in a clear Trend, you will incur many losses. It works better with corrections and pairs with an unclear Trend like sideways.