You have probably heard that there are many losers in Forex, but why are there more losers than winners? These losers are the crowd that reacts madly to news, global political events, and any signal that may occur on the chart.

However, not everyone who loses in Forex is considered part of the crowd or the losers in Forex. Losing is natural in a large field like Forex, but joining the crowd is a double-edged sword. If you know how to use it well, you will reap many profits, but if it controls you, you will join 90% of the losers in Forex.

Full Guide about Crowd Sentiment and How They React in Forex

Market makers Control the crowd sentiment

Have you ever wondered who moves the market? You may have heard that it is supply and demand, which is true, but who has the financial power to move a market that trades at least seven billion dollars daily? Is it you and me? If all retail traders gathered to buy a pair, they would not be able to move it to a single pip. This is simply because there are whales that control this market, and they are the market makers.

Why do you think there are more losers in Forex than winners? Losers follow the crowd and traditional methods that can be known with the least available means, but this is not the reason. Be patient with me.

The crowd is most likely trading with good methods and approaches, and I do not criticize any method of analysis, whether technical, numerical, SMC, etc. However, in every analysis method, there are traps that market makers have set to control this crowd so that they do not make large profits from this market.

Market makers are very knowledgeable about how each trader analyzes the market and know very well the price patterns, trend lines, support and resistance, etc. The question here.. if the market makers who want me to lose money know how I analyze the market and how the crowd deals with the price patterns, how will they react? of course, they will put some traps in your way so that you cannot make big profits. Still, they will not put many traps so that you do not despair of Forex and so that you make more deposits and continue the journey of losses.

The Psychology of Crowds in Trading

Many things bring the psychology of traders together and make their behavior and way of thinking very similar, if not identical, such as:

Trend

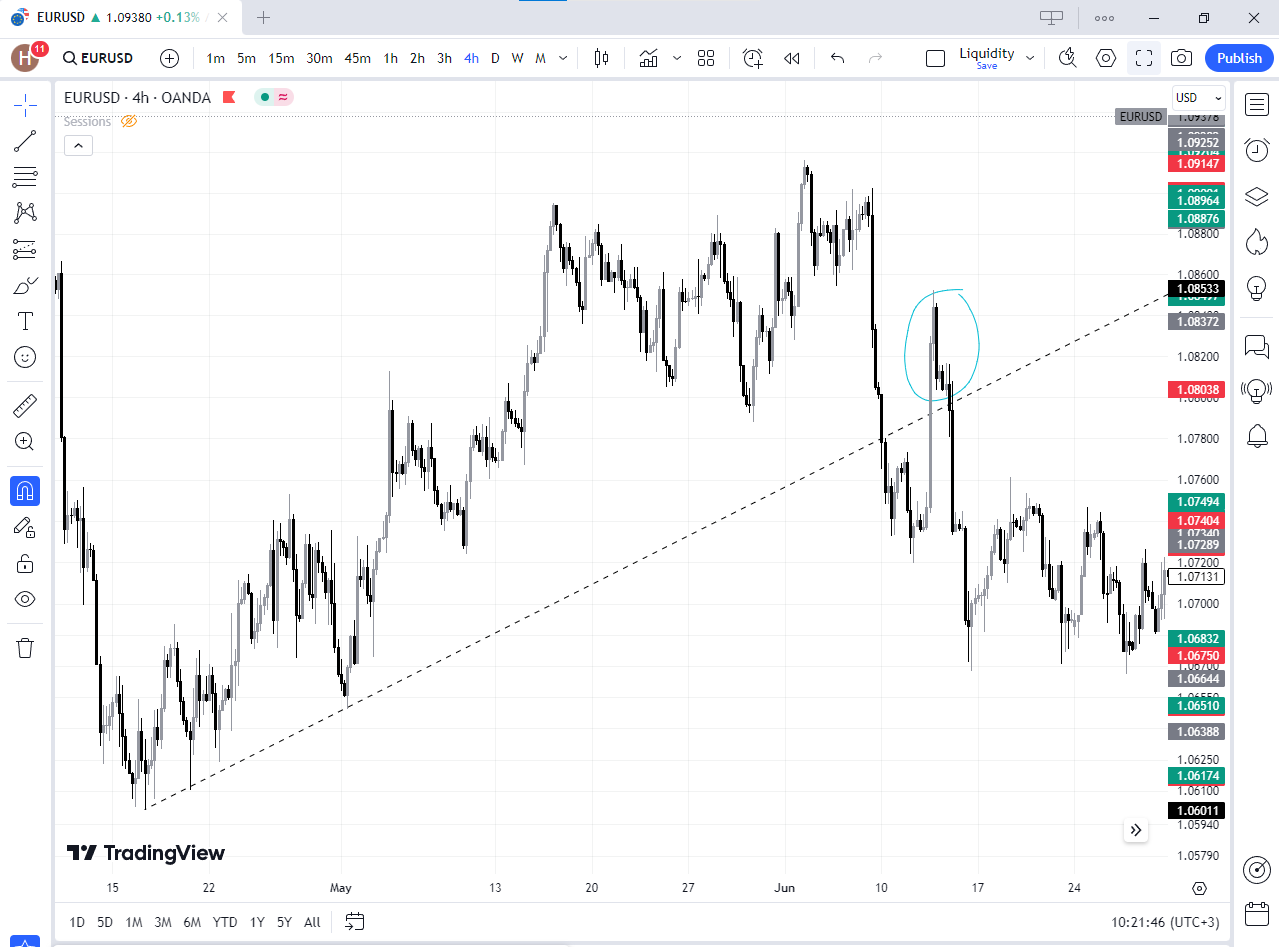

The psychology of the crowd in trading when seeing the trend line is very strong because, as you and I know, when the trend line bounces three times, this means that a new force has entered the market. It is likely that this trend will continue for a longer period, and the price will move away from the trend line as much as possible.

In this example, the price bounced three times, rose to higher levels, and broke the previous peak. This indicates that the crowd has great confidence in this trend, and there are more and more buyers who want to buy from higher levels even though the price has risen a lot. Then, it was time for the market makers to intervene, and the price fell to break the trend line, but this was not what they wanted. It is very natural that any trend will end at some point, but they want the crowd to lose so that the losing percentage becomes more than the winning percentage in Forex, and the market makers get your money.

trend

Here comes the role of price manipulation and the time of margining the accounts, where after the price fell and broke the trend line, it rose again to break the trend but is this normal? If you are trading with technical analysis, you will say yes, this is normal, as it wants to test the broken trend and fall again, right?

But it did not fall again directly. If you entered a sell trade when the price touched the trend line, you would certainly lose because the price rose more and more to liquidate sellers and continue its downward trend, and The price fell after making the sellers lose so that they would not join the market makers in making profits.

Support and resistance

In most Forex analysis schools, it is recommended to buy with support and sell with resistance. This is logical, right? Because you cannot buy from resistance, as the price is very high and will likely fall to make a retracement movement, and you will lose in this case.

If you see this example, you will say that this is an area where the price rebounded, so it is a support area. There is also an additional signal, as the pair is a double bottom pattern, so this is a good signal to enter the buy.

You are right, and the market makers know that, too. So they are watching your behavior and the crowd’s behavior to enter this area and set their traps, and look what happened. The price fell to break the first and second levels of support.

This is a simple example of what happens in the market when support and resistance lines are manipulated. There are other examples of manipulations for traders who place a stop loss much further than 10 or even 30 points to make them lose, and I am sure that some manipulations have happened to you to make you lose as well.

In this example, there was a much bigger drop, and the buyers lost even those who had put a stop loss after 30 or 50 pips. But before that happened, the price bounced from the support area to give false confidence to the crowd to enter this area and buy in large quantities, and then they all lost.

Indicators

Traders, especially beginners, love indicators and experts. The first thing they do is rely on indicators completely when making decisions. However, indicators help you support your decision, and it is possible not to use indicators at all.

And if the market makers know this information, will they let you profit if you use the indicators? Of course, they will manipulate the signals or make the market move in some way so that the indicator gives you a false entry signal, so you enter the trade based on this signal and then lose.

Moving average

Personally, I like moving average 200 and I use it as a tool to help me in my analysis. It gives me an indication of whether the trend will continue or not. Still, I do not rely on it completely because sometimes it may give me fake and random signals, and this is very normal, as the crowd uses the most common indicators in MetaTrader. The moving average is one of the most famous indicators in Forex.

News

Of course, you are not required to trade during the news because during the news, strong movements occur, and it is difficult to predict the direction of the news, but if you want to join the crowd, this will put you at many risks.

And you may also get profits, but the risks are much higher because in this case, you risk all your capital, even if you set a stop loss, the market does not respect stop losses during the news, and it is possible that a very large movement occurs in less than a second and you may lose your account, so it is preferable to stay away completely from the news if you cannot analyze the news or you are a beginner trader, sit and watch what will happen to your beginner friends 😀

Benefits of Following the Crowd

Should I stay away from the crowd completely, or are there benefits to following the crowd? Of course, there are some benefits to following the crowd because, as we said before, the crowd is not always wrong. Anyone can make profits from the market. Even if he is always wrong, he will also make profits, but the losses will be greater. In order to avoid these losses, you must know the traps that market makers set for the crowd.

There is a very famous phrase that says that the trend is my friend, so always follow the general trend of the market. I do not mean the trend line because the trend line can be manipulated sometimes, but I mean that if the market is rising and has higher Highs and lower Lows, then your thinking would be to buy this pair and not sell. If there are signals that support entering with the trend line, then there is no problem entering with it Because it is possible to make profits by following the trend line as well.

Crowd behavior in different types of trends

There are three types of trends (Bullish, Consolidation, Bearish)

Bullish

In the Bullish trend, buyers are in control, So it is not normal if the buyers are in control and you thinking of a sell trade because even if the price falls, will it fall with the same strength of the buying? Anything can happen in the Forex market, but logic dictates that you enter a buy in case the buyers are the most and the crowd, in this case, enters with the buying, and there is no harm in joining the crowd

Consolidation

A sideways trend is when the selling power equals the buying power. In this case, the crowd waits for the Bulls or the Bears to win. In fact, this is a very good decision because the market is not clear. Of course, you can make an entry decision based on the previous direction of the trend, but this direction may change, or this trend may resume, right? Anything can happen, so it is better to wait until the vision is confirmed in the chart and make a logical decision to enter.

Bearish

The Bearish Trend is no different from the Bullish trend, and crowd behavior is considered the same when the market takes a clear direction. However, in this case, if the crowd wants to enter the market, the market makers will also enter with it, so always be careful of their traps.

Riding the momentum for potential profits

There are many benefits to joining the crowd, the most important of which is joining them in the event of clear market momentum and the price rebounding from a good area. You will notice the price moving from this area with high momentum. This indicates that the crowd has joined the market, but it is not the crowd that actually moved the market; it is the market makers and the large companies that moved the market significantly.

Risks of Following the Crowd

Just as there are benefits to joining the crowd, there are also Risks if you join the crowd without knowing the traps that market makers set for you. For example, if you join the crowd with the general trend direction, this trend may reverse its direction, and you may lose with the crowd.

Because it is natural for the trend direction to change, it is very important to know the factors that change it. You must identify the larger trend in a higher time frame to be fully aware of every potential scenario.

You will lose your independence when you start following crowds and ignoring your plan. If you interact with any movement on the chart and completely ignore the strategy you are following, you will become one of the 90% losers in Forex. You will have difficulty entering trades independently without help, so you must be independent in making your decisions. Crowd behavior will be a factor that will be of additional help besides your strategy.

Tools for Gauging Crowd Sentiment

Some tools can help you understand crowd sentiment. However, it is not recommended to rely on them completely because these tools can be helpful in addition to your own analysis.

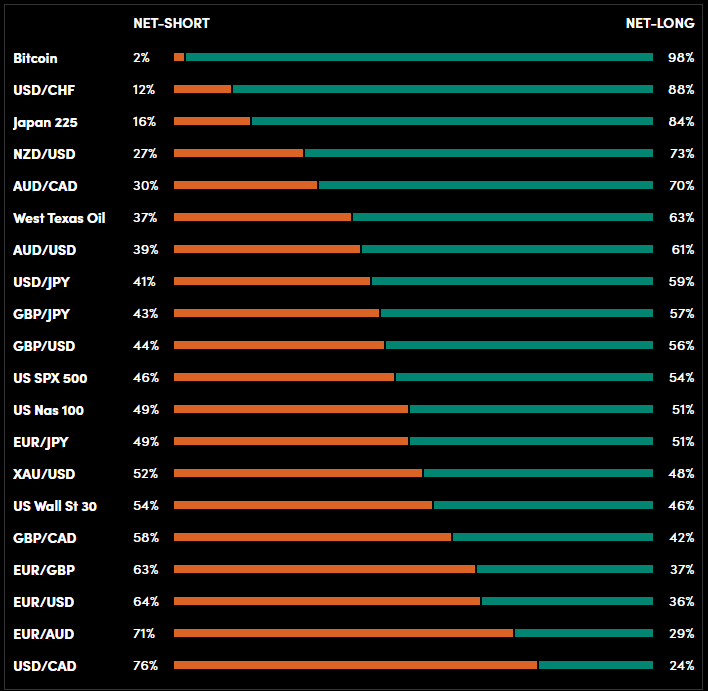

Forex sentiment indicators

There are companies that display all the Trades that their traders enter into, whether buying or selling. For example, the EURUSD pair, OANDA, displays the total number of Traders who enter Buy and Sell transactions in EURUSD.

Here are some tools that will help you identify the Crowd sentiment

Please note that it is not recommended to rely entirely on this data in a buying or selling decision, but these tools help you in analysis, and it is preferable to practice using them first.

COT reports

The COT report is a weekly report issued every Tuesday of each week, and this report displays traders for Commercial Traders, Non-Commercial Traders, and Small Traders.

The COT report can be used to understand the sentiment of different traders. If most non-commercial traders (speculators) are buying or selling a particular Pair, this can indicate the future direction of prices.

How do I know if I’m part of the crowd or not?

If you are confused and want to know whether you are part of the crowd or not, it is easy. Ask yourself, when you open the chart and look for a trade, do you take your time to think before entering, or if you see an entry signal or strong momentum in the market, do you enter immediately?

There is no shame in being part of the crowd because the percentage of losers is very large, 90%. It is natural to be part of the crowd, and as we said before, it is not necessary for you to lose if you are part of the crowd, as it is possible for you to make a lot of money. However, how you deal with your trades, and with the market in general is a very important matter.

How to get rid of the Crowd effect

Do not let the market affect you and your psychology because if that happens, you will join the 90% of losers as the trader’s psychology is very important so that he can control his emotions and feelings in trading, and you will notice that most of the crowd cannot control their feelings in the event of a loss or even a profit as they make rash decisions without any logic

There are many factors that may help you control your emotions while trading so that you do not join the crowd, the most important of which are:

Risk management

Most of the crowd joined Forex because of the big profit they can make, right? In fact, you can make a lot of profits from Forex, but not adhering to risk management will cause you to lose continuously, and you will join the losing crowd in this case, so you must apply strict risk management to preserve your money.

It is always recommended that the amount risked in a single trade does not exceed 1%. In this case, you will stay in the market for the longest possible period. If you see a very good Trade, this percentage may increase to 3% Because Forex has golden Opportunities that come from time to time.

It is natural to seize these opportunities with higher risks than usual, taking into account Risk management and setting a stop loss. Ignoring the stop loss, even in good opportunities, carries with it high risks that may lead to losing your entire account.

How do you attitude when you lose?

How do you deal with loss? It is very normal to lose in Forex, as Forex has profit and loss, but when a loss occurs, do you lose your temper? It is very important to control your nerves when you lose and understand that a loss can happen at any time. Therefore, before starting Forex, you must deposit an amount that you do not need urgently because, at the time of loss, you will not be very sad about it.

Trading Style/Strategy

There are many schools of analysis that you can follow in making a decision to buy or sell, but if the analysis method contains many traps from market makers, the losing trades will be more than the winning ones. For example,

Technical analysis has many traps, such as Double bottom/Top, Trendline, and patterns. These examples are liquidity for market makers as they are very aware of these patterns when they form on the chart. Based on that, they move the price to make the crowd lose, and then the price moves to its original direction.

Social media

Social media, especially Telegram or WhatsApp channels, greatly influence the crowd’s thinking due to the news and Signals they contain. They also completely erase the trader’s ability to make logical decisions on his own without the need for external means.

Social media is also useful; you can follow the news that is happening in the United States or any other country, such as elections or crime rates, and you can follow Signals. Still, it is a double-edged sword that you must use with extreme caution because the Signals that an unknown person may give you may be correct, in which case you will get profits. The opposite is also true, but the loss is the most common possibility for Signals because the one who did the analysis is not you. You are unaware of what might happen in the market, and the pair you want to trade may be new to you.

Summary

Following the crowd is not bad at all, but following it blindly can make you lose a lot of money, and you will have difficulty analyzing the market individually. So you should know the steps of the crowd and how they think in order to avoid them when the market maker sets his traps.