You may have heard of the economic calendar before, but what is it? In the Forex market, there is a lot of news that affects the market, some of which is positive and some of which is negative, and some of this news can be known through the economic calendar.

The power of the Economic Calendar

1- What is an Economic Calendar?

The economic calendar is a tool used by traders and analysts to know the news dates. You will find in the economic calendar many news, Next to each one you will find the strength of the news item. including strong news, medium, and weak. If you click on it, you will find the details and information that will help you analyze the event well.

The economic calendar contains many important news that benefit traders. There is no trader who trades in the Forex market can’t trade without such a tool because knowing the event dates before entering any trade is extremely important and ignoring such a matter may expose the trader to large losses.

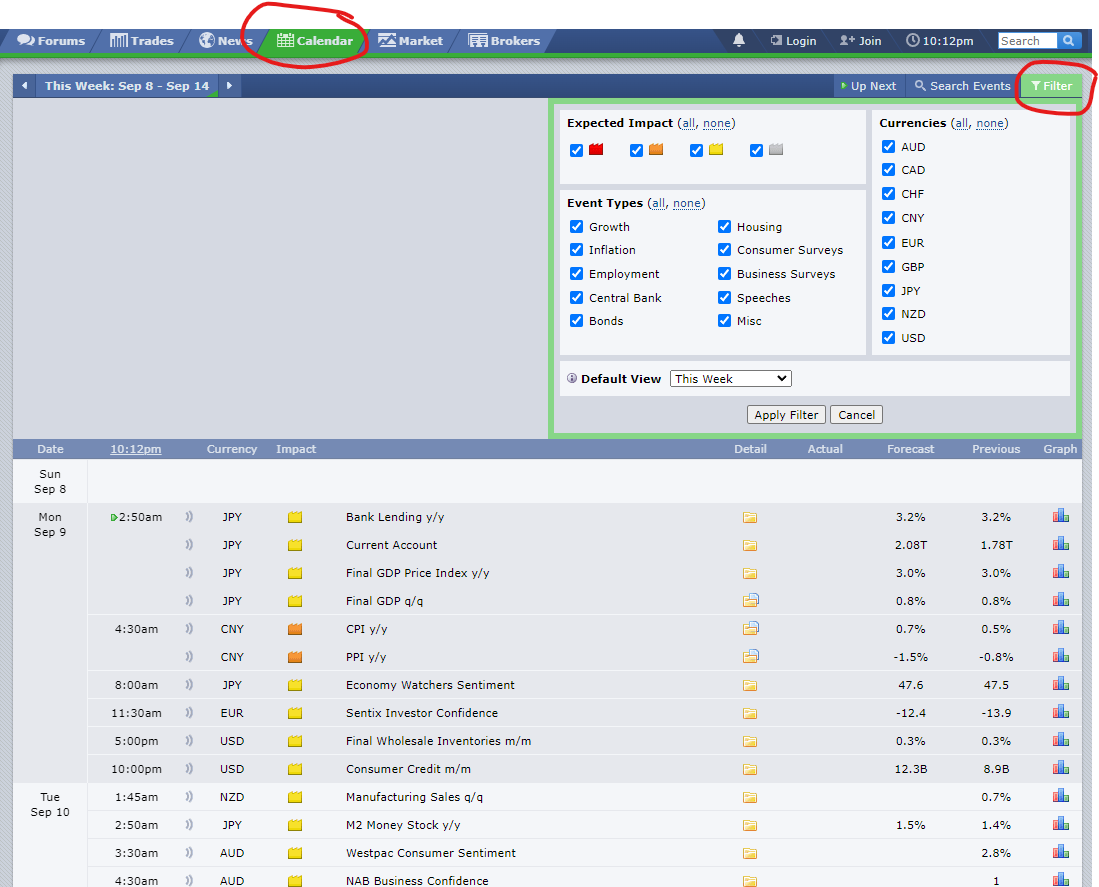

You will find the economic calendar on Forexfactory here.

Click on Calendar to show you the economic calendar, then choose from the filter the type of news you want to follow. You can choose news with a strong, medium, or weak impact. The best thing is to select all the events so that you are always informed of what affects the market movement. If medium news occurs and affects the market and you only select strong news, you will not know what led to this movement.

It is important to identify all types of news that affect the currency. Then, identify the type of news, whether it is related to interest rates, unemployment, inflation, etc. Of course, if you identify all types of news, it is much better because most of the events is important and when it is issued, the market reacts to it and moves strongly.

How to know the details of the news?

Every news contains important details, whether it has a high impact or not. Any news that happened in Forex has data and statements that happened before. Based on this data, the trader can predict what will happen in the future. News is like analysis. You can read the event data, analyze it, and then predict whether it will be negative for the currency or positive.

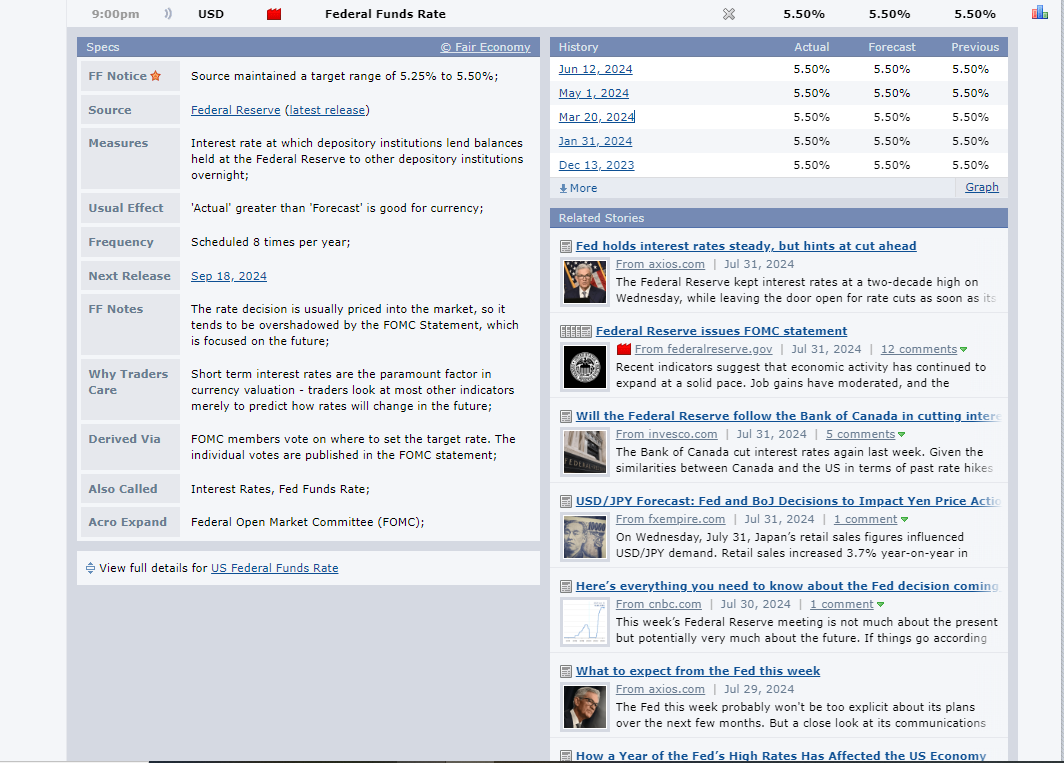

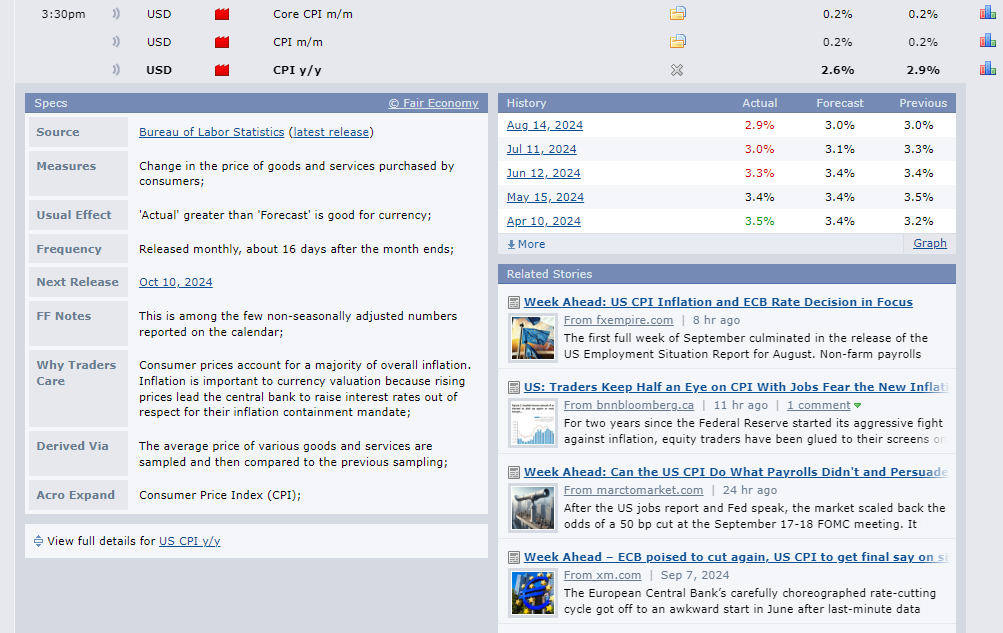

On the left, you will see the event specifications and this box contains the source of the event through which you can follow it at the time of its release from the official website. You may find the official website showing a live video at the time of the release and this video may be of the Chairman of the US Federal Reserve talking about interest rates or inflation…etc. You will find a link to this source in this section.

The part on the right contains very important data, and at first glance, you may find it difficult to understand this data, but it is very easy if you know what these numbers mean. These numbers are the results that occurred previously for the news, and this data contains:

Previous

This is the result that occurred The last time the news was released. For example, if there was an event that would be issued on June 12, 2024, the same event was issued on May 1, 2024, and the result of this news was 5.50%.

Forecast

This is a prediction by professional analysts in the market. They can predict whether the result of the news will be higher than the previous one, lower, or even the same as the previous one. The news is carefully analyzed by analysts, and then they put the final result they got in this part.

Actual

It is the final result of the news. The result may be either higher than expected, lower, or the same. The same applies to the previous result, it can be different from the previous results or the same. The result doesn’t need to be the same result that the analysts expected, So do not rely on analysts completely.

2 – Types of news in the economic calendar

There are three types of news in Forex, Low impact, Medium impact, High impact

Low-Impact Events

You will find such events in yellow and it has a very weak impact and you will not notice its effect on the market, so it is possible to ignore it.

Medium-Impact Events

Medium impact events is in orange and you may find that it affects the market for a few pips and you can follow it, but it does not affect the market in the long term, as its effect is only momentary.

High-Impact Events

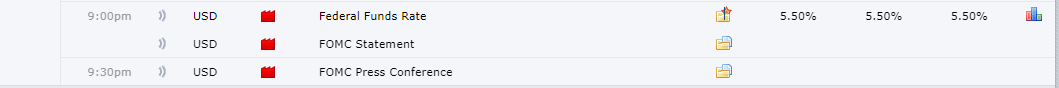

This is the news that moves the market many pips and its impact is long-term and you will find it on the Forexfactory website in red due to its importance.

We will talk about the most important events that has a strong impact on the Forex market. This news is eagerly awaited by traders. Some are released every month or every two months, and it may be issued every week.

Interest Rate

Interest rates are one of the most important news that you need to follow in the economic calendar because interest rates strongly affect the Forex market and this effect may continue for months if the result is strong and unexpected, The interest rate is issued every two or three months and this date is determined in advance by the US Federal Reserve.

The market is affected as soon as the event of interest rates is released. In fact, Because traders know when it will be released., prices may move in an unusual way a day or two before the news. This movement may be caused by traders or market makers to make traders lose before the news is released.

A press conference always takes place after the interest rate is released, and this meeting is no less important than interest rate itself because the governor of the Central Bank speaks with journalists and explains the decision regarding interest and the plan that will be implemented in the future to preserve the country’s economy.

Interest Rate Impact

In this picture, when the news was released, the price fell sharply by more than 15 pips. After 30 minutes, a press conference was held and the price reacted to this conference and rose by 16 pips. However, this is not the normal impact of important event such as interest rates, since interest rates didn’t change for more than a year. Therefore, it was expected that interest rates would be the same again this time, and the market did not react strongly to it.

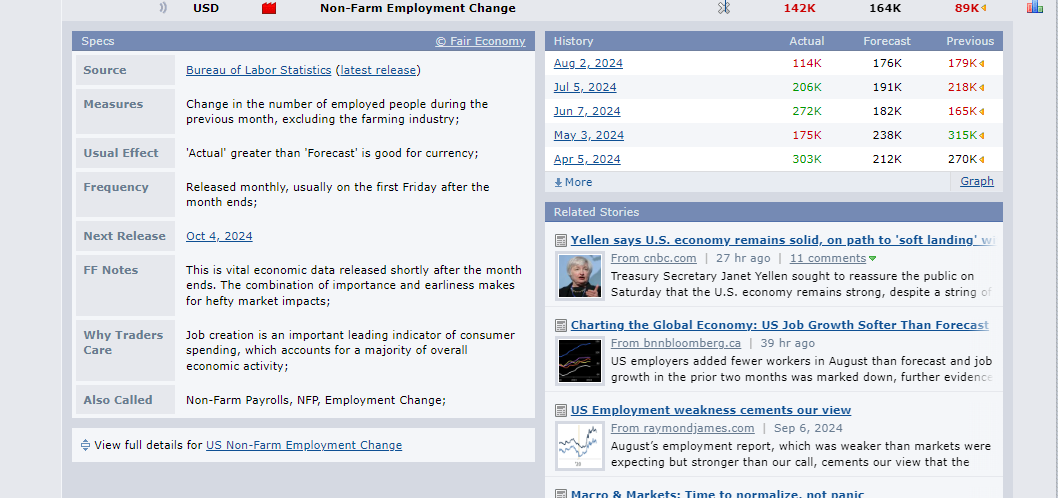

NFP (non farm payroll)

The NFP is released on the first Friday of the month and its a report on the US jobs provided to American citizens, but the agricultural sector is excluded from this report because it is a volatile market and it is difficult to determine its economy, so it is excluded from the report.

The NFP is considered one of the important events for traders, and this event greatly affects the dollar Pairs, including gold, of course

If the result is higher than the previous result, this is good for the currency, meaning that the EUR/USD will fall, and vice versa. If the result is lower than the previous result, the EUR/USD will rise, but there are other factors of course that affect the price movement. If several factors come together to support the negativity of the dollar, But the result is positive., it is difficult to predict the next movement of the dollar in this case.

Please note in the NFP you will notice that the previous written result does not match the result that occurred in the previous month because this result is a preliminary result and after analysts and experts scrutinize the result, they correct it.

NFP (non farm payroll) impact

Normally, the EUR/USD pair moves from 30 to 100 points on the NFP , and it is possible that immediately after the news is issued, it may rise by 20 pips, for example, and then fall strongly by more than 60 pips.

CPI (Consumer Price Index)

The CPI expresses inflation and this news is considered one of the strongest news that you may see in Forex because the market reacts strongly to this news and it is no less important than interest rates. The impact of this news may remain in the market for a period exceeding three months.

The CPI is usually released at the beginning of the month and possibly in the middle of the month. The annual changes in the prices of goods and services are displayed through the CPI y/y report. The CPI m/m report also displays the monthly changes in goods and services, but the annual report is of course more important.

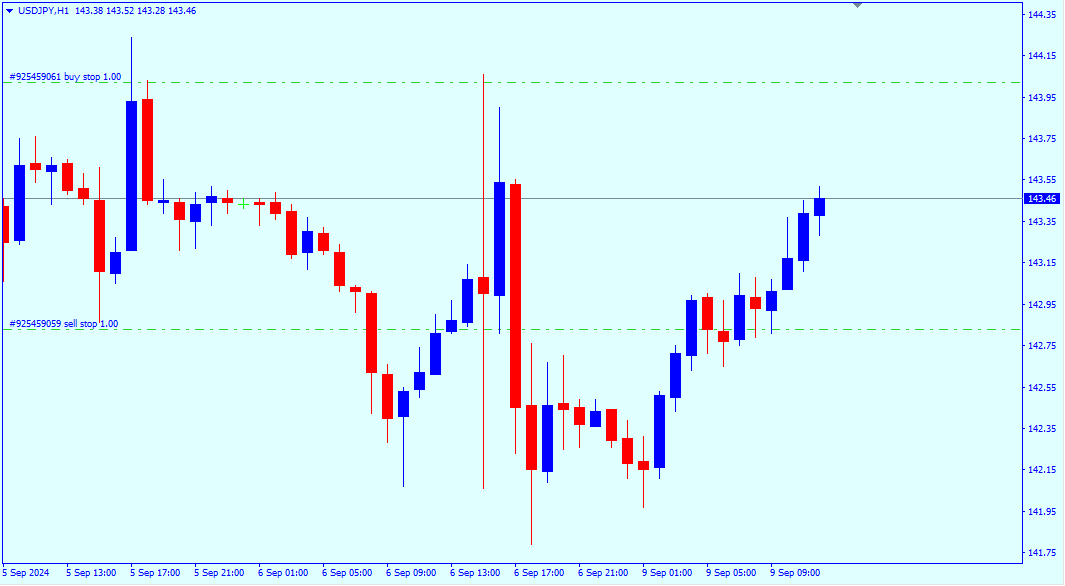

CPI impact

The inflation news (CPI) moves strongly from 50 to 100 pips, and it is not necessary for all these pips to move at the time the news is issued. The effect of the event may remain for a long period, and this movement may exceed 200 pips.

In this example, we see that when the news was issued, the result was negative. This is because the result of the event was less than the previous one and less than what analysts expected. This indicates that the result was somewhat shocking to the market, and the pair reacted strongly to it and rose by more than 50 pips within half an hour.

Inflation is closely linked to interest rates. If the inflation rate rises, this is good for the currency because it will be followed by decisions from the Central Bank to increase interest rates. Consequently, if interest rates rise, the demand for investment and depositing money in banks will increase, and this is a good sign for the country’s economic growth.

So it is logical to think that if inflation rates fall, this is good for the currency, and you are actually right, but the rest of the factors that affect such results are also important. We should not base the decision to raise or lower the currency on one piece of news only, as this news is followed by strict decisions from the Central Bank in order to maintain the stability of its currency.

Unemployment Claims

This report is usually weekly or biweekly,it is a report that has a strong impact on the market as it is linked to the country’s economy because if there are high unemployment , this indicates a rise in the crime rate, an increase in poverty rates, and a decrease in individual consumption of goods and services. There will be pressure on governments to increase salaries and it is possible that there will be demonstrations.

Unemployment Claims impact

Since this news is issued every week, it is natural that its impact will be less because the market has become accustomed to it. You will find that when the news is issued, the price moves from 10 to 20 pips.

Unemployment Rates

Unemployment rates are somewhat different from Unemployment Claims, as this report is monthly and It is issued at the beginning of the month. its also reflects the percentage of the unemployed and the labor force in the country.

Unemployment Rates impact

The impact of this news is very strong and you will notice that its impact is completely different from Unemployment Claims because this news is issued monthly and it is possible for it to move from 50 to 80 pips at the time of the news release and the impact of the event may continue for a day or two of continuous movement.

In this example you will notice a strong drop in the price of more than 60 pips, but in fact the reason was not only Unemployment Rates, because at the same time there was the NFP, which caused the price to fall strongly at the time the news was issued, and even after the first 30 minutes the price continued to fall by more than 100 pips until the end of the day.

The presence of two pieces of news of this strength can push prices to very low/high levels, especially if the Results of the two pieces of events confirm each other.

3 – Planning Trades Around Economic Events

As we have noticed, when the news occurs, there is a very large movement in prices, and this movement may continue for more than a week. Therefore, it is wise before the issuance of such events not to enter into any trades if you do not know the impact of the event or how to trade with it.

Because the strong events does not respect any method of analysis, but it is possible that if you combine technical analysis with fundamental analysis, you will be able to predict the result of the event, whether it is negative or positive. However, if your information about fundamental analysis is not enough, it is not recommended that you trade in such violent movements.

How to trade with news

Trading with news requires experience first in analysis and understanding the nature of the market well because it is an advanced level, in this case the trader needs to understand the country’s economy and understand the monetary policy of the central bank and the decisions it issues and the plan it follows

After studying the fundamental analysis, the fundamental analysis must be combined with the technical analysis or SMC… etc because both analyses complement each other. The technical analysis gives you a general view of what is happening in the pair, and you can look for good areas to enter in the event of understanding the nature of the news and the possible Results of the event.

For example, you can determine the important areas from which you expect the price to bounce, and if these areas are indeed strong, the news will be the factor that helps the price bounce from these areas and it will reach them and bounce strongly.

In this example, there was an NFP and it was likely that the pair would bounce from the order block area at 1.31488. This zone is confirmed by the presence of the IDM before it. You will most likely notice such a scenario before the NFP, as the price fell to touch the order block and then bounced and rose.

Of course, there are many other ways to trade with strong events, including:

Pending orders

You can place pending orders with a difference of 10 or 20 pips from the current price. For example, there are traders who place Buy Stop and Sell Stop orders above and below the price so that if the price moves in one direction, the stop order will be activated.

This method is good but it has some risks because if the news does not move in one direction, it is possible that what happened with the NFP will happen again and the price will fall to activate the Sell Stop and then rise and activate the Buy Stop. In this case, you may lose your entire account in such a movement.

It is also possible that the price will move very strongly, as the Stop order will not be activated in the desired Level in this case due to the price slippage that occurs during strong events and violent movements in the market.

Predict news results

You may anticipate the result of the event and enter the trade based on that before its released. Of course, such a decision can make you make big profits or make you lose your entire account. Therefore, it is better if you want to enter a trade with it to leave a small amount in your account or the amount that you will bear to lose.

This is because in the event of a price slippage, do not rely too much on the stop loss because the price will completely ignore it in most cases. For example, if you want to risk $100 from your account, withdraw all your money or transfer it to another account and leave only $100 in the account that you will use.

Conclusion

There are many factors that move the Forex market, the most important of which is the news. You will find the dates of this events in the economic calendar. Each of these events has its own impact on the market. There are events that can have an impact that lasts for one day, a week, or even a month. This depends on the strength of the news and the result, whether the result is expected or not.

The strength of the events is divided into three levels: weak, medium and strong. What greatly affects the market is strong events. The most important of this events are interest rates, unemployment rates, NFP and CPI (inflation).