The terms margin call and stop out are among the most important terms that you should know immediately after joining Forex because these two terms can help you avoid many losses in the future and you will know their importance with time and how they are essential factors in any trade you make.

The importance of margin call and stop out

1 – Margin call

A margin call is a warning that your margin is about to run out. If the margin runs out, all open trades will be automatically closed by the broker. This warning may come to you via SMS or to your email, You can activate this feature through your broker. Ask him if he provides such a feature or not.

This feature is very good for those who want to follow up on their trades in case it is about to lose, and when the margin call comes and you do not want to close the trade at a loss, you can deposit more money in your account to protect your trade from loss in case you see that the price will go in your favor, of course.

The margin call is closely related to the free margin. If you open a single trade with one lot, the matter will be completely different if you open several trades with more than one lot because the margin will be very small. If the trade goes against you and you incur losses, the trades will be closed automatically because the margin is insufficient to bear all these reversals.

What is Margin

The margin is the amount of money that the broker keeps when you open a trade. It is a certain percentage compared to the lot with which you opened the trade. This procedure is taken so that the broker ensures that you do not get a margin call and lose all your money in the event that the trade is reversed against you and so that you can bear the losses that may occur in the event that your trade is reversed against you.

This procedure is in the interest of the trader and the broker as well, because if a portion of the margin is held as a guarantee, the broker guarantees that if you get a margin call and the trade makes you lose all your account, he will not be harmed and incur losses if margin call happens. This is a good way for the broker to protect his money and the trader’s money as well.

Margin vs Leverage

Margin is closely related to leverage because the margin held by the broker is based on the trader’s leverage, for example:

If your leverage is 1:100 and you decide to enter a trade of one lot, the broker will reserve a certain amount of money, but if your leverage is 1:1000 and you want to open a trade of one lot, the broker will reserve a smaller amount of money.

The higher your leverage, the less money the broker will hold because that way you will have enough money to cover the losses that will occur if the trade goes against you.

The broker does not keep this money for himself but keeps it as a separate part of the account funds so that it is not lost in the event that the price reverses on your trade more than necessary.

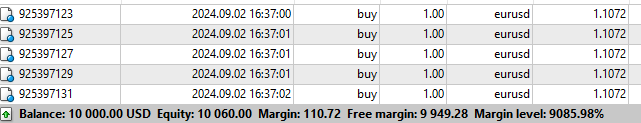

This image shows the margin used and the margin available (Free margin) for you to use. The margin that the broker has held after opening five trades with a total of 5 lots is $110 In other words, he keeps a margin of $22 for each lot.

The Free margin is the available margin for me to use and I can open trades with $9,949 (The remaining capital after deducting the margin reserved for the broker)

This amount was a little less because the trades are currently in profit, which indicates that if the trades you have are in profit, the available margin will increase, and the opposite is also true if the current trades are in loss, the available margin will decrease, and the more trades you open, it will also decrease, and so on.

In short, the factors that cause the margin to decrease are that your trades are negative, and the more losses there are in the account, the more the margin decreases, If you open more trades, the available margin will decrease and will be transferred to the margin reserved by the broker. The factor in determining the amount of money that will be reserved is the lot.

What will happen when the Free margin is about to run out?

Here comes the term margin call. The broker will send a text message to your phone or send an email warning you that your margin is about to run out. There are three options you can choose from in case of a margin call.

Either you choose to leave the trade as it is in the hope that the price may rebound from the current levels And you will not suffer more losses than that., in which case you will not need to make any decision and you will leave the trade as it is, Of course, you will not be concerned about the margin call because whether you lose or win, it will be the same for you in this case.

Or you choose to close the trade because other factors may occur that may affect the trade and make you lose more money and you will accept the current loss that occurred in your account and do not want more losses in this case the margin call will be very useful to you because it will warn you of the approaching loss of most of your money and you will make an appropriate decision for you if this thing happens

Or the last decision you can make is that the trade may go as you want, but the bounce zone is a bit far away and you want your account to bear more reversals (more losses), but there is not enough money to handle all these losses, so you can deposit more money so that the account can bear all these reversals.

Of course, such a decision must be made after analyzing the market well and searching for the reasons for the price’s reversal of your trades, because this decision may lead to either compensating for the losses that occurred in your trade or bearing more losses, and you may get a margin call and lose your entire account, so this decision is somewhat sensitive and not all traders can make such difficult decisions.

Risks of High leverage

As we said before, choosing high leverage will make the margin reserved by the broker less, and thus you can open more lots and more trades, and this will give you comfort in trading, but high leverage is not good at all times.

High leverage makes you open many lots, so you may ignore your Risk management and open more lots than normal in the hope of more profit, and this is of course greed, and this greed blinds you to your trading plan and makes you make illogical decisions based on your feelings & emotions and not based on logical and sound thinking.

You may disagree with me, but believe me, a margin call comes from several wrong actions, or even from one wrong action, which can cause you to margin call and lose your entire balance, and a simple mistake may make you go too far and will make more mistakes, such as overtrading and opening many lots.

Leverage is an integral part of Risk management that a Beginner trader or even an expert trader must adhere to. Leverage is like a brake that forces you to adhere to a specific lot in your trades. If you want to open more trades or increase the lot, you will not be able to because the margin reserved by the broker will prevent you from doing so.

Benefits of High Leverage

If there are risks to high leverage, there are also benefits, right? You don’t have to stick to low leverage if your trading strategy requires you to open Too many lots. Maybe if the trade turns against you, you will need more margin to be able to open trades with the same order type in order to close all trades with zero profit & loss.

This is a strategy that traders may follow in order to compensate for losing trades by opening more trades, and when the price reaches the entry area of the old trades, they close all the trades, and thus they can exit the market with minimal losses and possibly profit as well.

The use of leverage must be done with extreme caution because leverage is what determines the amount of margin that the broker will reserve. Ignoring such matters may cause you to incur many losses and you will not know what caused these losses.

How to calculate the margin for different pairs

(Protect yourself from margin call)

The margin calculation differs from one account to another. The margin calculator is as follows:

Margin= Trade Size × Lot Size / Leverage = Margin

Example 1: Standard Lot, EUR/USD

Trade Size: 1 lot (100,000 units)

Leverage: 1:100

Margin = (100,000 * 1) / 100 = 1,000 EUR

Example 2: Mini Lot, USD/JPY

Trade Size: 1 mini lot (10,000 units)

Leverage: 1:50

Margin = (10,000 * 1) / 50 = 200 USD

You can use this tool to calculate the required margin without the need for this calculation.

There is also a margin calculator for each broker to help traders calculate the margin without this complicated calculation.

2 – Stop out

To make it simple to understand stop out, We should have explained margin and margin call First. because stop out and margin calls are closely related to each other.

Stop out is the forced closing of trades by the broker because your trades lost more than necessary, which led to the loss of the Free margin (the available money that you can use to open your trades), The margin that the broker has previously reserved for you will remain in the account.

However, The margin that the broker has reserved from you may decrease or disappear in the event that you have lost more money than the margin available to you. The broker will resort to taking some of the reserved margin money to cover the losses that occurred in your account if the losses exceed your margin, of course.

These losses may be more than the reserved margin, i.e. getting a margin call and losing your entire account. In this case, the broker will be forced to compensate for these losses from the margin that he previously reserved from you, then close all the positions you have (or the Highest lot trade), and you will find your account with zero balance after getting a margin call.

Stop out comes after the margin call. They are linked to each other. The margin call comes first to warn you of losing your money, meaning that a stop out is likely to occur in your account. If this loss continues, a stop out will occur, meaning a forced closure of your positions.

How does stop out close trades?

In the event of a stop out, a margin call will occur first, as we mentioned earlier, and the trades will be closed based on the trades with a larger lot size because they require a larger margin. The broker closes the trades with a large lot first To get more margin in the account, It doesn’t matter which pair you are trading, forced closure occurs on a high lot trade.

How to avoid stop out and margin call

In order to avoid stop out and margin calls, you must first understand how margin and leverage work and their role in Risk management. Leverage is an essential part of Risk management. After you have understood what margin is and its role in leverage, you must determine your trading style, whether you are a scalper, intraday trader, or investor.

Because every trader has his own style of trading and each type has the leverage that suits him and based on that he deals with his trades in a different way in order to be able to avoid losses and achieve profits, not every trader uses the same leverage, so it is not necessary for all traders to use a low leverage in order to be able to apply strict Risk management, So be flexible.

For example, a scalper trader uses high leverage because he enters many trades during the day and may enter hedge trades in order to reduce potential losses, and he may also use stop loss. If this type of trader uses low leverage, he will not be able to open trades with a high lot and will miss out on many opportunities.

The same thing applies to the intraday trader, but he needs a medium leverage, for example, 1:500. This is a reasonable leverage. As for the investor, he needs a smaller leverage because his account balance is much larger, and does not open many trades and leaves his trades for a long time. This type of trader does not take many risks, so a leverage of 1:100 or 1:200 is suitable for him.

After knowing the appropriate leverage for you, the last thing you should do is place a stop loss for any trade you enter, because the stop loss is as important as opening the trade.

Make sure to set a suitable stop loss that does not exceed the available margin because if it exceeds the available margin, the trade will be closed with a stop out. In this case, the trade will be closed before it reaches the level you want, and it is possible that the trade will be reversed and go towards your Take profit, If you find the stop loss is not suitable for the available margin, you can reduce the lot.

3- Stop loss vs margin call

The stop loss is well known and most traders use it before opening the trade. They determine the place of the stop loss, but the stop loss in the case of margin is somewhat different.

If you decide to place a stop loss that exceeds your available margin, do you think the price will complete its reversal and reach your stop loss? In fact, if the margin is not enough for all this loss, the broker will not care about your stop loss and the trades will be closed as a result of the stop out.

You must know well what margin is available to you in order to open the trade based on that and choose the appropriate lot in order to place the stop loss in the area that you see as suitable for the stop loss.

Can stop loss be replaced with stop out?

You may have thought that you can not place a stop loss because if the available margin runs out, the trade will be closed automatically by the broker (stop out), but in fact this is not the best thing you can do because the stop loss helps you to cut your losses from the exact area from which the price is likely to rebound (based on your analysis of course) and in this way, you will not need to calculate the available margin.

Just know the margin available to you before entering the trade and determine the appropriate lot for this trade based on that and do not let the broker close the trade forcibly as it may be closed before the area you specified. mistakes happen, right? In the event of this wrong calculation, it will cost you money, so it is easier and safer to set a stop loss.

What will happen if I don’t use Stop Loss?

There are traders who do not use stop losses for several reasons, some of them risk all their money in one trade, and others open hedge in the event that the price goes against them, and they will not need stop loss in this case, and others do not want to get a margin call, so they think that not placing a stop loss will protect their money from loss.

Stop loss is an essential part of Risk management. Without a stop loss, large, uncalculated losses will occur in the account, or even a margin call may occur.

Let’s suppose you didn’t place a stop loss and wanted to enter a trade from this area and an important news event occurred that affected the EUR/USD. What will you do in this situation? Would you have left the trade until the news effect ended, hoping that the pair would rise again? Or will you close the trade if the price reaches the entry zone or will you close it before the news is released?

Any decision you make if you do not add a stop loss, in that way you will expose yourself to loss because of course when entering the trade no one knows what will happen to the price, whether it will rise or fall, and the same applies to the news.

The stop loss protects you from losses that may happen to your account. In this example, if you did not place the stop loss and opened a high Lot trade, you will most likely get a margin call and will lose your entire account with this decline as a result of the strong news.

Conclusion

Margin call and stop out are among the most important terms related to capital management. When a trader starts in the Forex market, he must be familiar with these terms and their relationship to leverage and stop loss and the importance of each of them.