Never Losing EA Overview

Never Losing EA is a cutting-edge forex trading tool designed to seamlessly adapt to various market conditions and account types, maximizing profitability while minimizing risk. This fully automated Expert advisor (EA) eliminates the need for manual intervention, making forex trading more efficient and accessible for traders of all experience levels.

Powered by advanced supply and demand analysis, real-time market adjustments, and an integrated news filter, Never Losing EA ensures precise trade execution while protecting against market volatility. Its built-in take-profit and stop-loss system optimizes risk management, allowing traders to secure profits and minimize losses with ease.

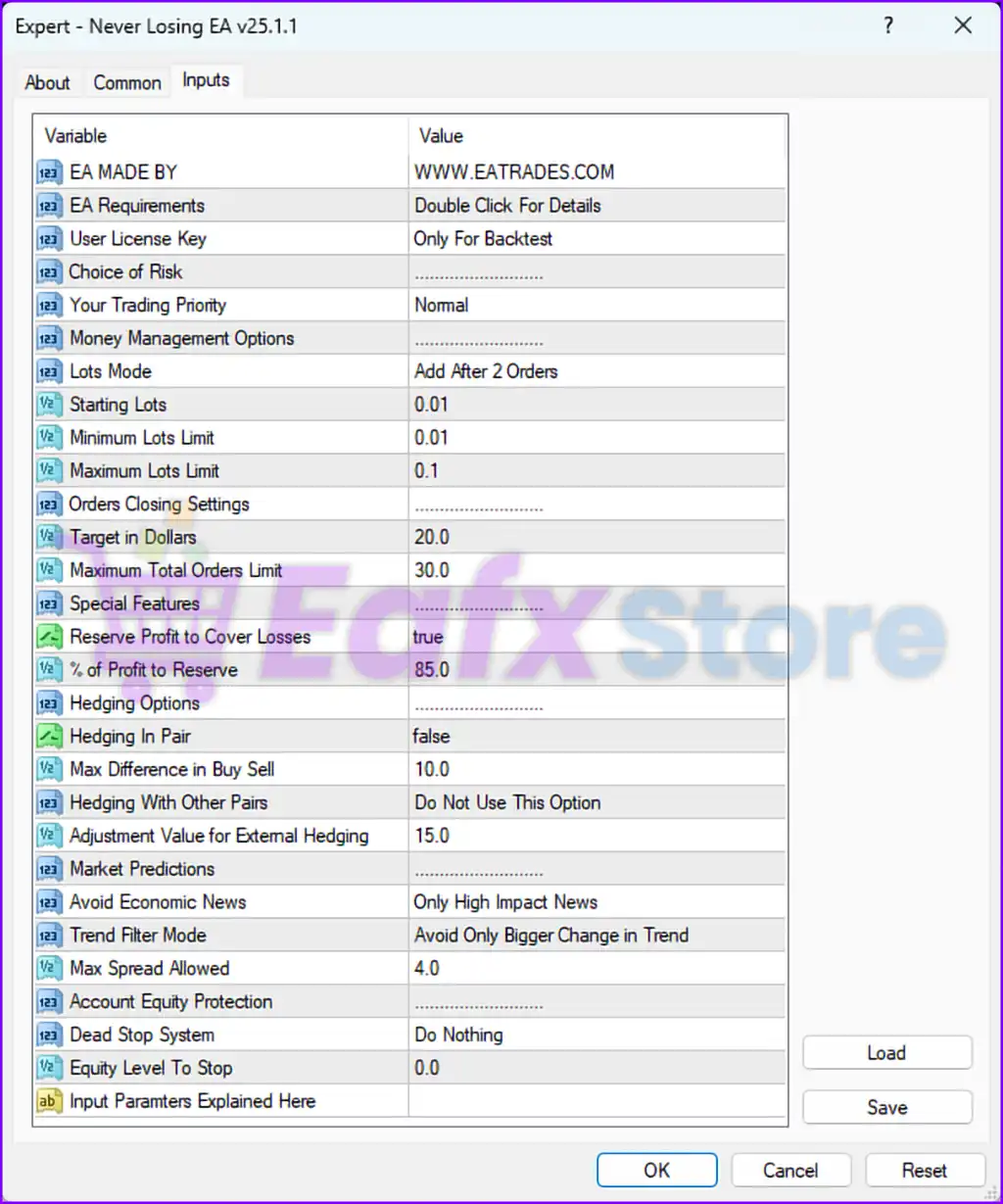

Installation Panel Details

The Never Losing EA appears to be a grid-based or martingale-style expert advisor (EA) that employs profit reservation, hedging controls, equity protection, and market prediction filters to minimize losses and optimize profits. Below is a full breakdown of its settings.

1. General Information:

- EA MADE BY →

WWW.EATRADES.COM- The EA is developed by EATrades.

- User License Key →

Only For Backtest- This EA version is restricted for backtesting only.

- Choice of Risk →

...(Not specified)- This could refer to a risk level selector (e.g., conservative, moderate, aggressive).

- Your Trading Priority →

Normal- This setting likely controls trade execution aggressiveness.

2. Money Management & Lot Sizing:

- Lots Mode →

Add After 2 Orders- The EA increases lot size after every two consecutive trades, suggesting a grid or martingale strategy.

- Starting Lots →

0.01- The initial lot size per trade is 0.01, which is the minimum lot size.

- Minimum Lots Limit →

0.01- The EA will not place orders below this value.

- Maximum Lots Limit →

0.1- Lot sizes are capped at 0.1, preventing excessive risk.

🟢 Implications:

- The lot-scaling method suggests martingale/grid trading, which increases exposure after a certain number of trades.

- A low max lot limit (0.1) ensures the EA does not escalate risk uncontrollably.

⚠️ Recommendation: If trading manual risk, consider a lower max lot size if the account balance is small.

3. Trade & Profit Management:

- Target in Dollars →

20.0- The EA stops trading when a $20 profit target is reached.

- Maximum Total Orders Limit →

30.0- The EA will not open more than 30 trades at a time, limiting excessive exposure.

🟢 Implications: A fixed profit target and order limit help maintain controlled drawdowns.

4. Profit Reservation System:

- Reserve Profit to Cover Losses →

true- The EA reserves a portion of profits to offset future losses.

- % of Profit to Reserve →

85.0- The EA keeps 85% of profits in reserve, possibly for recovery-based trading.

🟢 Implications: This setting reduces immediate withdrawals to ensure a capital cushion for drawdowns.

5. Hedging & External Adjustments:

- Hedging In Pair →

false- The EA does not hedge positions within the same currency pair.

- Max Difference in Buy Sell →

10.0- The EA allows up to 10 pips difference between buy/sell orders, likely for averaging trades.

- Hedging With Other Pairs →

Do Not Use This Option- The EA does not hedge across multiple pairs, meaning it trades each pair independently.

- Adjustment Value for External Hedging →

15.0- If external hedging were enabled, the EA would adjust hedged trades by 15 pips.

🟢 Implications:

- The lack of hedging means this EA follows a pure averaging/grid approach rather than dual-side protection.

- If manual intervention is required, hedging must be enabled outside the EA.

⚠️ Recommendation: Enable hedging if using this EA on volatile pairs like XAUUSD (Gold) or GBPJPY.

6. Market Predictions & Trade Filtering:

- Avoid Economic News →

Only High Impact News- The EA avoids trading during major news events.

- Trend Filter Mode →

Avoid Only Bigger Change in Trend- The EA filters trades, avoiding entry during significant trend reversals.

🟢 Implications:

- News avoidance helps reduce exposure to high volatility spikes.

- Trend filtering ensures trades are only placed in stable trend conditions.

⚠️ Recommendation: If using scalping strategies, consider disabling trend filters to allow more trades.

7. Risk Management & Protection:

- Max Spread Allowed →

4.0- The EA will not trade if the spread exceeds 4 pips, preventing poor executions.

- Account Equity Protection →

...- No specific setting is listed, but this likely refers to automatic drawdown control.

- Dead Stop System →

Do Nothing- The EA does not automatically stop trading when reaching certain conditions.

- Equity Level To Stop →

0.0- The EA does not have an automatic equity stop-loss.

🟢 Implications:

- A 4.0 pip max spread is reasonable for major forex pairs, but not ideal for gold or exotic pairs.

- The lack of equity stop-loss means manual monitoring is required.

⚠️ Recommendation:

- Set an Equity Level To Stop at 10-20% drawdown to avoid large losses.

- Reduce Max Spread to 2.0-3.0 for forex trading.

📌 Final Summary

| Feature | Setting | Analysis |

|---|---|---|

| Lot Scaling | 🔄 Grid/Martingale | Lot size increases every 2 trades |

| Profit Target | ✅ $20 | Locks in profits per cycle |

| Max Orders | ✅ 30 | Prevents excessive exposure |

| Profit Reservation | ✅ 85% | Keeps capital safe for recovery trades |

| Hedging | ❌ Disabled | No dual-side protection |

| News Filter | ✅ Active | Avoids high-impact events |

| Trend Filter | ✅ Active | Prevents trades in reversals |

| Max Spread | ❌ 4.0 pips | Too high for forex, should be 2.0-3.0 |

| Equity Stop-Loss | ❌ 0.0 | No auto protection – should be set |

✅ Suggested Optimizations

1️⃣ Lower Max Spread → Reduce from 4.0 → 2.0-3.0 pips for better execution.

2️⃣ Enable Hedging → If using on XAUUSD (Gold) or volatile pairs, consider enabling pair hedging.

3️⃣ Set an Equity Stop-Loss → Avoid unlimited losses by setting 10-20% drawdown limits.

4️⃣ Consider Lower Risk Lot Scaling → Instead of adding lots after 2 orders, consider adjusting risk per trade.

5️⃣ Test News Impact Filter → If using scalping strategies, disable trend filtering for higher trade frequency.

Conclusion

The Never Losing EA v25 is a controlled Grid/Martingale EA that reserves profits, manages lot scaling, and avoids high-impact news events. However, risk management settings (equity stop-loss, hedging, and spread limits) should be adjusted for safer performance.