There are many orders in Forex. not only buy and sell. Other more advanced orders have been added to help the trader in his trading. These types of orders include:

Instant Execution

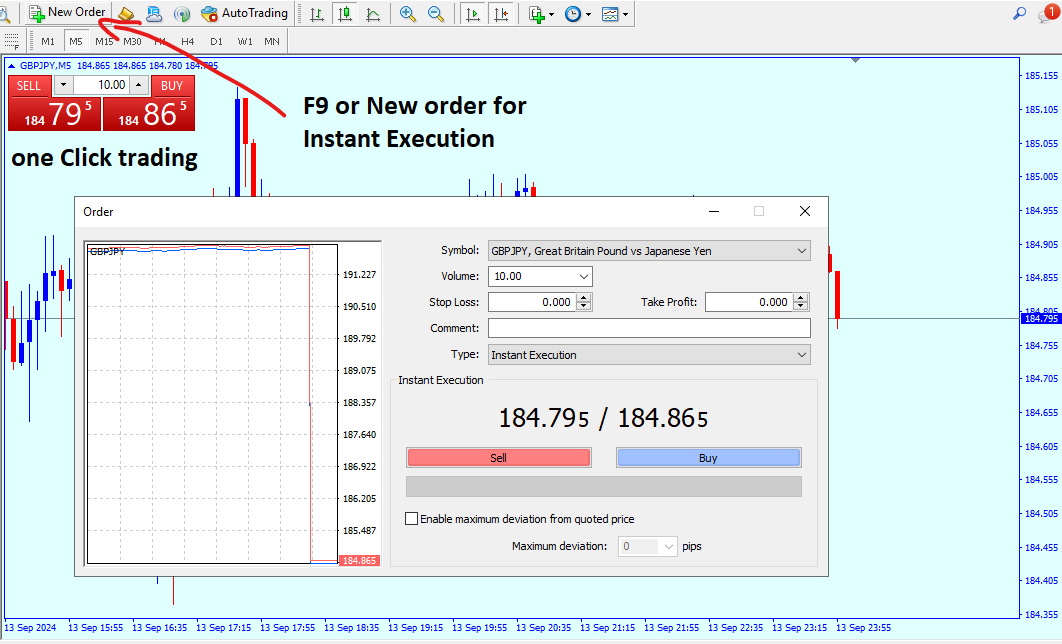

The first type, which is the most common, is instant entry into the trade or (instant execution). Write the lot you want, then press sell or buy, and then the trade will open at the current price.

To open a buy or sell on the MT4 or MT5 platform, you must press F9 or New Order.

- One-click trading

This type of order is an amazing feature and can be said to be a bit faster because in that case, you won’t have to press F9 or New Order Because this Feature will be on the chart and you can open a buy or sell trade with one click, To activate this feature, go to Tools or press Ctrl + O and activate One-click trading.

(when activating this feature you must agree to the terms and conditions when opening your first trade)

Instant Execution

Pending order

The pending order is completely different from the instant order because the pending order allows you to place the order you want at a price different from the current price. This type of order is used by most traders because it helps them if they want to sell or buy in specific areas above or Below the current price, based on their strategies of course. The pending order consists of Three parts:

- Limit order

This type of order allows you to open a buy order at a price lower than the current price. For example, if the current price of the EUR/USD is 1.2050 and you want to buy when the price reaches 1.2000, you can place a limit order at this price and It will be activated as soon as it reaches this level., taking into account that the price will be executed at the ask price, not the bid price.

The opposite is true in the case of Sell Limit. If you want to sell the EUR/USD when it reaches 1.2050 and the current price is 1.2000, you can place a Sell Limit order above the price and it will be activated as soon as it reaches the specific level (the order will be activated at the bid price directly).

- Stop order

This type of order does not need any bounce from the price to be activated. As we have noticed, the limit order must reach a certain level, then we take a trade opposite to this movement. As for the stop order, it is a continuation of this movement. So, if you want to buy the EUR/USD at 1.2050 and the current price is 1.2000, you can place a buy stop at 1.2050 and the order will be activated when it reaches the level.

Please note that in the case of a Buy Stop, the trade will be executed directly at the Bid price, unlike an instant order.

The opposite is also true in the case of selling. If the current price of the EUR/USD is 1,2050 and you want to open a sell trade when it reaches 1,2000 you can place a Sell Stop order at this level and the order will be executed at the Ask price.

- Buy stop limit & Sell stop limit

This type of order is somewhat new and has been added to the MT5 platform only. You will not see it in MT4 because the MT5 platform is advanced and has many different features, including this order.

This helps you enter with the current trend or movement, but if the price reaches a certain level and rebounds from this level, i.e. when it corrects from this level, then you enter with the General trend and the big push.

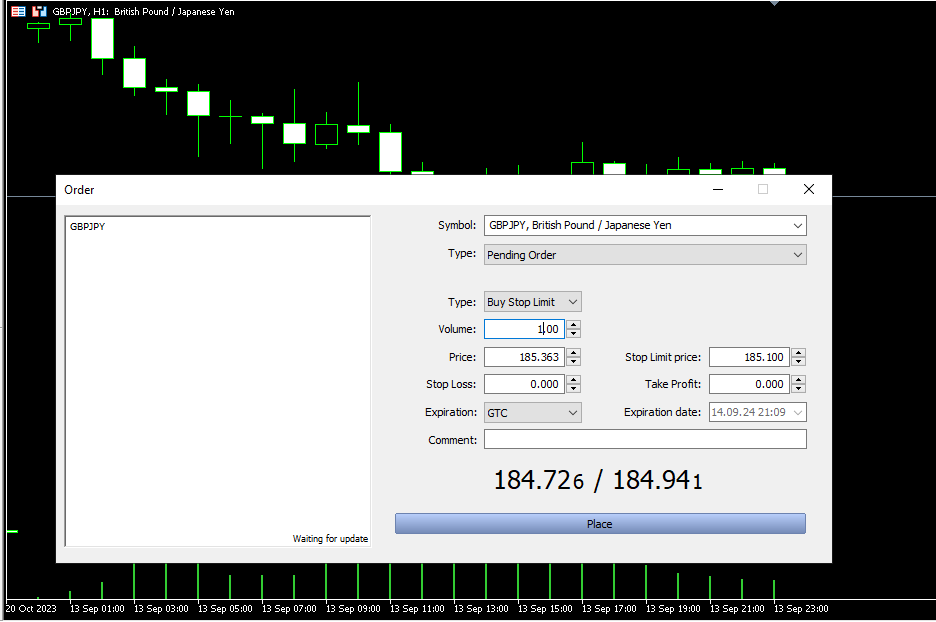

For example, if you want to enter a buy on the GBP/JPY pair and the current price is 184.684, but there is a resistance area that you want the pair to reach first, then you open a buy. For example, the resistance area is at a price of 185.363, and the area from which you want to open a buy is 185.100.

You will write the price you expect the pair to bounce from in the (Price) box, which is 185.363, and then you will write the price at which the trade will be activated in the (Stop Limit Price) box, which is 185.100 in the case of buying.

In the case of selling, you will choose the (Sell limit price) and the price that you will write in the (Price) will be less than the current price, which is the price you are targeting the pair to reach and then bounce back from. The same thing applies to the Stop limit price, the price will be higher than the bounce zone in order to complete the downward trend after opening the trade.

Stop loss

This type of order means you cut the loss in the running trade and You can add the stop loss to the platform when opening the trade or after opening the trade. If you want to open the trade immediately, that is fine. because this type of order allowed you to add & modify the stop loss through F9 or through One-click trading. Then you can add the stop loss to the trade by double-clicking on it or right-clicking and choosing Modify or Delete. Then add the stop loss you want.

In the case of buying, the stop loss will be below the buying price, regardless of the type of order, Stop or limit or Stop limit, as the stop loss is opposite to the direction in which the pair is required to move.

Stop loss is one of the most important orders used by traders because you are telling the loss to stop and stop loss plays a major role in Risk management as most of the strategies that traders trade with depend on stop loss and it is difficult to find a strategy without stop loss.

Take profit

This type of order is the opposite of stop loss because if the price reaches the stop loss, you will lose the money you set and the trade will be closed, but take profit will determine when the trade will be closed with a profit and not a loss. If you open a buy order, take profit will be higher than the Execution price and vice versa when selling.

There are two ways to add a stop loss and take profit, either by writing the price at which you want the trade to be closed, either at a profit or a loss, or by dragging the trade Line from the chart up or down. If the trade is a buy and you drag the order line up, you are setting the take profit in this way, and if you drag it down, this is the stop loss.

You can also place the stop loss and take profit at the entry-level. For example, if the current order is in profit, you can place the stop loss at the entry-level. Thus, the entry-level of the trade is the same as the stop loss. The opposite is true in the event of a loss. If the current trade is in a loss, you can place the take profit at the entry-level.

Partial lot closure

You can also close a part of the trade, which is very important for some strategies. This type of order can help many traders implement their strategies that rely heavily on closing half or part of the trade. of the order when making some profits, in order to protect themselves from loss in the event that the price reverses against them.

The feature of closing part of the trade is only available in the MT5 platform, and this is also because it is a much more advanced platform than MT4 and has many advantages. You can close part of the order for the open trade only by clicking on the trade twice or choosing (Modify or delete) and selecting the lot you want to close.

Trailing stop

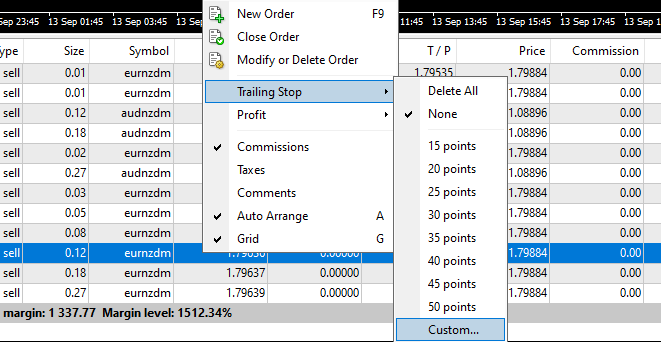

This type of order is a moving take profit. If the trade makes a profit, the take profit will be moved by a certain number of points. You can specify the number of points you want by right-clicking on the trade, then choosing trailing stop, then specifying the number of points, or choosing custom to write the points you want.

Please check if the account you are trading on has five decimal places or only four because it will help you better determine the Trailing Stop so that you do not set it incorrectly.

For all these types of orders, you can set an expiration date. If it is not activated within a certain period of time, this order will be deleted.

How do traders benefit from these types of orders?

These types of orders are important for different traders because not all traders use the same strategy and each trader is different from the other. Some of them trade daily and this type of trader is called Day trader & Scalping. He will most likely not need pending orders and will use more one-click trading.

Others may use pending orders because they will not be able to be in front of the chart until the price reaches the area they want. This type may be the investor or the day trader because it is natural for the intraday trader to analyze and wait for the price to reach the area they want, but sitting in front of the chart is not the best thing to do in your day. It is better to place a pending order and close the platform completely.

After opening the trade, there are other orders that help you manage the trader well and are consistent with Risk management. For example, Trailing Stop is a very important order in case you cannot open the chart or you are busy with something. You can place this order and it will reserve part of the profits continuously.

There are traders who, if they find that the price may reverse against them, place a stop loss at the entry-level or book profits through the stop loss. This is of course a good strategy so that you do not exit the market with a loss if you see that it will reverse against you.

Speed of execution

The speed of executing trades is very important for the trader. A trader may not be able to open a trade manually quickly (Especially in the news), unlike a pending order., because if the price reaches the desired level, it will be activated quickly. However, if you decide to open the trade manually, it may be executed at a price different from the price you want, and this gives some advantage to pending orders.

There are many types of orders in Forex and knowing them is not difficult, but using them is very important because these types of orders will help the trader in managing his trade and in how to open trade in the appropriate levels for him based on his strategy.

There are orders that you may not find in the MT4 platform, such as partial lot closure and buy & sell stop limit. Such orders are somewhat advanced and have been added to the MT5 platform, along with many advanced features in the platform.