You may have heard the term spread before, but what is a Forex spread? Because Spread is one of the most important Terminology a trader must be aware of the meaning of this word So that you do not suffer a huge loss without knowing the reason. Many of the traders whose trades are closed without knowing what is the reason behind this and the forex spread is one of the most important reasons behind Closing trades without the Trader knowing what happened!

Find out more about Forex Spread

What is forex spread meaning?

Quite simply spread is the difference between the bid and ask price, or rather the selling price and the buy price.

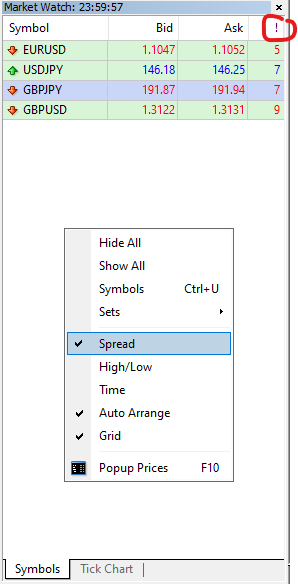

Example: The Bid price in the EURUSD pair is 1.1047 (the number on the left) and the Ask price is 1.1052 (the right number is the Ask price), the difference between the two prices is 5 pips (1.1052 – 1.1047 = 0.0005), and this difference, called the spread, is the difference between the two prices. ask and bid, and this forex spread is taken to the broker that the trader deals with as a commission for the broker. After all, it provides services to the trader and a platform for trading on them and when opening a new trade directly the balance of the transaction will appear negatively because the spread has been deducted.

Please note: This picture was taken at the time of market closing and you will notice that the spread is high because before the market closes, there is an increase in the forex spread prices.

This is a very simple and uncomplicated process, but If this method of calculating the spread is difficult for you, you can easily show the forex spread of the broker you are trading with on the MT4 platform by right-clicking and choosing the spread and all currency spread will appear to you as shown in the picture.

Example (in real life): If you go to a car showroom and want to buy a car, let us assume that this car is for $10,000. Will the owner of the car showroom buy this car for $10,000? Of course not, because he wants to profit from this trade like any person or company, so suppose that he bought this car for $9000 so, the owner will get $1,000 as a commission and this is what is called the spread, i.e. the commission of the person who offers you his service or product, the name varies Among people but in the Forex market it is called spread

The broker takes a spread from you in exchange for providing many trading services such as the pairs you trade on, providing bonuses and special offers for traders, and also competitions…etc.

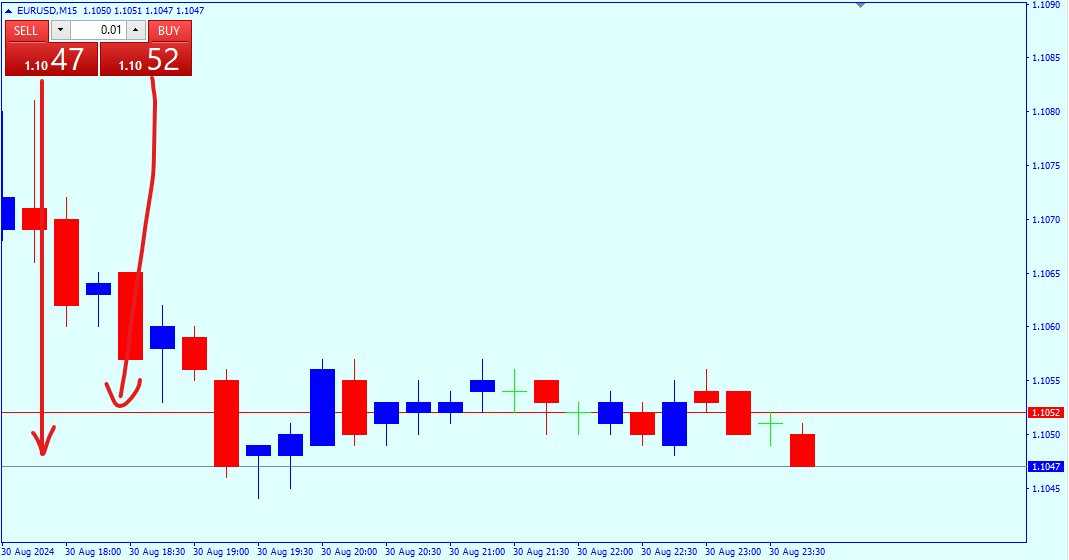

Example: You wanted to open a trade on the EUR/USD pair, there are two different things that you will choose (buy or sell). If you want to buy this pair, the price at which the trade is opened will be 1.1052 and that’s the Ask price but you will notice that the current price of the market is 1.1047 and that’s far from your position by 5 pips.

That’s the spread that the broker take from you once you open the trade and it will be Your profits are calculated after this level in order for the broker to guarantee its spread and this price is the sum of the bid price + the number of forex spread pips i.e. (1.1047 + 0.0005 = 1.1052)

Because the trader adds its forex spread value at the Bid price if you want to buy as shown in the picture and if you want to open Sell position on the pair, the selling price will be 1.1047, But you will notice that the trade was opened at the price of 1.1047, which is the actual market price, but you will find it negative because the Ask price is what the trade is calculated on (in case of selling the pair), and the price must fall in order for your profits to be calculated based on the Ask. and your profit will be calculated after 0.0005 pips (spread) at price 1.1042( bid price 1.1047 – spread 0.0005) = 1.1042

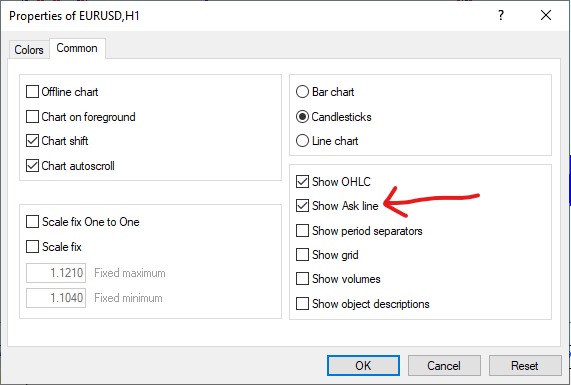

To make it easier to understand, you can add the Ask price to the chart in MT4 or even MT5.

You will notice the addition of another line, which is the Ask price. If you open a buy trade, the trade will be placed at this line.

Why Forex brokers do not make a fixed rate to buy and sell?

As mentioned before, the Forex brokers take their commission from the spread immediately after opening the trade and the broker naturally wants to guarantee by taking the money from you in additional after opening the trade (spread), so the broker taking 5 pips from your trade, meaning that your trade is supposed to be opened at the price of 1.1047 in the case of selling and in that At the time, you must know how many pips of spread a broker will cost you on this pair before entering it.

And after knowing the pips (5 pips for example) the broker performs a very simple calculation (selling price – spread) i.e. (1.1047 – 0.0005 = 1.1042 ) 1.1047 is the price that the trade will be opened at when selling, but your profits will be counted after The price crosses the 1.1042 level to down, In other words, your profit will be calculated based on the Ask price when it falls and exceeds the opening price of the trade.

But when buying the trade will be placed at the Ask price and after 5 pips (the spread) you will get a profit on your trade (the Ask price + spread) (Ask price for buy orders) 1.1052 and your profits will be calculated at after the price exceeds this level

Please Note: The price of the forex spread increases sometimes, such as (news time, before the market closes every week, in some brokers the forex spread rises before midnight or at midnight) so . be careful before opening any Trade and look at the spread first.

Forex spread in different accounts

In Forex, there are many accounts that you may notice the broker offers to traders to suit the needs of each trader in terms of his trading method and the size of his deposits, etc.

Standard account

The standard account is the basic account that you will notice most traders using because its specifications are suitable for most retail traders in terms of the minimum deposit, the speed of execution trades, and also the Low spread that the broker offers through this account, but you will notice that the forex spread is variable, meaning that in the event of news or at midnight at the time of closing the New York session, you will notice an increase in the spread.

Cent Account

The cent account is suitable for very small deposits, smaller than the standard account, and your money will be converted into cents. For example, when you deposit $100, you will notice $10,000 in your account, but in reality, it is 10,000 cents. When you withdraw your profits, you will withdraw them at the same value.

The cent account is not much different from the standard account in terms of spread, but you may notice in some brokers that there is a higher spread in these accounts than standard accounts because they charge you this additional service for the cent account.

Zero spread Account

Zero spread account You can open your trades without the broker charging you any forex spread, and this is really great for those who trade during news time because they will open their trades during news time without worrying about the spread, whether it will rise or not, You will notice that the Ask & Bid price is the same price because there is no forex spread in this case and you will notice that all currencies are without spread in the pairs list.

But the broker charges you a fixed amount of commission to open the trade, which is almost the same as the spread value, but this account is still good for traders who are interested in trading during news times.

ECN account

This type of account offers a very low forex spread compared to the standard account, but in order to open such an account, the broker may ask you to deposit an amount larger than the standard. Remember why we said that the standard is the most popular among traders?

This type of account is suitable for professional traders who are looking for low spreads and do not care about the deposit amount, It also has some features that you will notice during your trading, for example, the speed of executing trades, and some brokers offer commodities and stocks that you will not find in other accounts.

Fixed Spread account

This type of account is somewhat similar to the Zero Spread account, but the spread is fixed in this account. Also, this account is no different for traders who want to trade during news time, you will notice the presence of the Ask & Bid price, but the forex spread is fixed.

Of course, as an additional cost for having such a service that protects you from market fluctuations during news time and midnight, you will notice that the forex spread is slightly higher than the standard and ECN accounts, and this is normal because if you were trading during news time, you would need a fixed spread that would protect you from these fluctuations. If you had chosen a standard account to trade on during news time, you would notice that the spread during news time is 12 and may reach 20 pips on the EUR/USD, for example.

You can follow the News calendar here

Accounts for professional traders

You may notice that there are Brokers who offer other accounts dedicated to professionals with different features such as spread and speed of order execution and there is no commission when opening a trade..etc Such accounts attract trading professionals and brokerage companies compete to satisfy different traders so that they deposit and trade with them in order to benefit from the spread they get even if they will reduce the forex spread they get.

Please note that you may notice that the names of these accounts differ from one broker to another, so you should know what type of account you want and not focus on its name because you will most likely notice that its name is different in your broker.

Demo account

The demo account has nothing to do with the forex spread, but if you have decided what type of account you want to open, you must first choose it as a demo account in order to test the spread and how it works when prices move and discover for yourself what happens during news and how the spread jumps in a crazy way. You will discover all of this with the demo account, and when you finish the test period, you can open a real account.

Conclusion

Forex spread is very important and you should know what it is before starting Forex because it is an integral part of Forex basics. To know what the spread is, you should first know why there is a spread. Have you ever asked yourself how brokerage firms make money? The spread is one of the most important factors that make brokerage firms make a lot of money. They compete with each other and reduce the spread to satisfy traders so that they can trade with them.

Therefore, you will find many brokers offering different types of accounts, so you must choose the account that suits you and your capital.