If there are factors that affect gold to move more or less, it is natural for this ratio to change. Therefore, the Volatility that occurs continuously is not random, but rather Volatility based on events that have occurred.

2 – What affects the volatility in the forex market?

There are many factors that may affect the Volatility that may occur in the market, and the most important of these factors are:

Economic news

News is one of the most important reasons for market Volatility because news plays an important role in price movement, and news’s impact may last for more than two months. If the news is of high importance and greatly affects the country’s decisions, it is possible that the market will be affected by such news for more than a year.

You will notice when important news is released with a big movement in prices. In fact, you may notice a strange movement in prices before the news is released. For example, if the result was expected by traders, you will find that the market moves significantly a day or two before the news, and you will not know the reason at the time, This is because the traders interacted with the news before it was released, and such news will not have much impact at the time of its release because the real impact occurred before it was released.

There is other news that you will find before the news is issued that the price moves very slowly because traders are waiting for the news to be issued in order to trade with it. In that case, you will find that the impact of the news is very strong because there is a great momentum that has entered the market.

Geopolitical events

Political events also have an impact on market Volatility, and you will not find such events in the economic calendar because they occur without a prior appointment, or if there is a conference that will be held to make a decision, you may find it in the calendar.

Political events such as wars, conflicts between countries, presidential elections, political crises, and demonstrations, All these events can cause incomprehensible Volatility in the market and at these times you will find the price movement completely different than before because there are external factors affecting the price movement and traders are not sure whether the current event will end or not.

Breaking news is also news that occurs suddenly and has no prior date. Depending on the strength of the news, it will have an impact on the market. If the news concerns an important politician in the country, the currency will be greatly affected, and vice versa.

Natural disaster

Natural disasters are those that humans have no control over, such as floods, volcanoes, and hurricanes, If this disaster greatly affects the country’s economy, you will find its currency affected as well, but if the country recovers from this damage quickly, its economic growth will return to what it was.

Market sentiment

You may have heard this term before, and in fact this term is used a lot among traders because it reflects the general state of traders, whether they are optimistic about buying a currency or pessimistic, so they sell it, For example, if traders on social media are suggesting buying a currency, they will be dominated by herd mentality and will resort to buying it.

I am not saying that if such decisions are taken, the currency will rise or fall, but rather that such decisions can affect the market positively or negatively, or it may be that there will be no noticeable effect.

Market sentiments do not stop at optimism and pessimism. Traders may make decisions based on an indicator signal or the price reaching the trend line…etc If there are a large number of traders using the same analysis method and the same indicators, it is natural that they will make the same decisions, In this case, you may see some Volatility in the market.

It is possible that if traders are not sure about the results of the news, there will be great Volatility in the market. For example, if there is a presidential election or a disaster, traders will be somewhat disturbed by the outcome of this event and its impact on the economy. Therefore, traders are divided into two groups.

Either they trade at the time of this event and accept this risk, in which case they will be exposed to various market Volatility, Others will stay out of the market for fear of this incomprehensible Volatility and it is difficult to predict the next price movement.

Liquidity

Liquidity is one of the most important factors causing market Volatility. Liquidity comes from liquidity providers. If the amount of liquidity pumped into the market is variable, the market will also be exposed to variable Volatility. Liquidity providers pump liquidity at certain times, including:

Liquidity providers can provide liquidity to the market in the event that the market does not have enough liquidity to move prices and in important rebound areas because in this case, they will make a lot of profits because they are also traders like retail traders, but the difference between them and retail traders is that they have enough money to move prices.

Market makers

Market makers are brokers but at the same time they are liquidity providers to the market and they can manipulate prices in order to make traders lose and thus they win. In this case, when a large amount is pumped into the market, you will find large Volatility in the market.

For example, if a large number of traders have opened sell positions on the EUR/USD, the Market Maker will open buy orders to make them lose, and these orders will be in large sizes so that he can move the market in this case.

Midnight Liquidity

You will find that the liquidity at midnight is very small because at midnight some of the buying and selling positions are closed by traders in order to collect their profits during the day. This can also happen at the end of the week. At these times, you will notice a large movement in prices and there will be violent Volatility due to the lack of liquidity in the market.

In the event of a lack of liquidity in the market, this will result in a significant increase in the spread. In fact, it is not only at midnight, as the spread increases during news and natural disasters as well, so that the broker can seize such opportunities to achieve more profits.

It is logical that in the case of low liquidity, there is no movement in prices, right? At first glance, this is correct and natural to happen in the market, but in the case of low liquidity, there will be much fewer traders in the market, and liquidity providers will seize this opportunity and enter the market because it is somewhat easy to move the market at these times in order to make profits.

When liquidity providers enter the market with a higher Liquidity than normal, this will cause traders to lose, and thus liquidity providers make profits from the spread and from their trades.

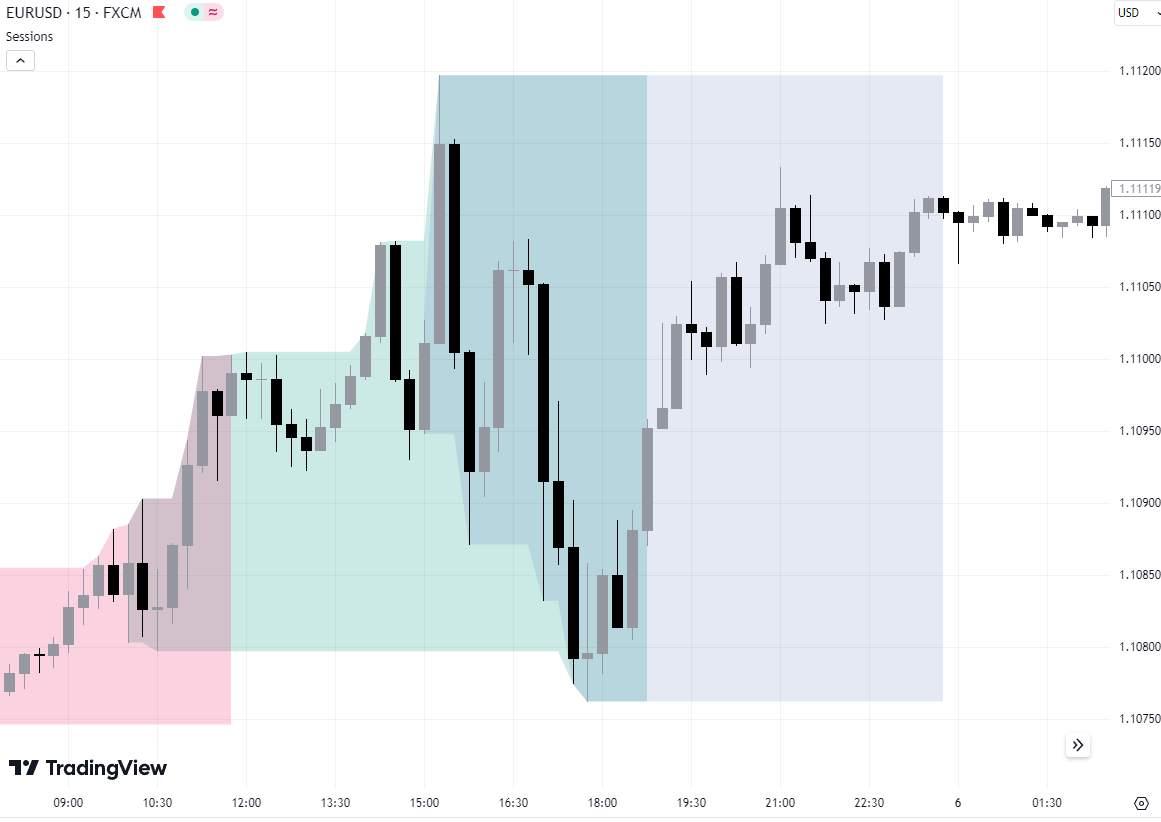

Session Times

New Year’s Eve and holiday times

On New Year’s Eve and holidays, most banks are on holiday, which also leads to a lack of liquidity in the market. Therefore, the market will experience what happens at midnight, which are large Volatility in the markets. These movements may be incomprehensible, especially on Asian pairs, because Traders often resort to them when there is a lack of liquidity in other pairs.

3 – The Impact of Volatility on Forex Trading

What is the impact of Volatility in the Forex market? It is natural that when Volatility occurs, the trader will be affected by it, and the impact of this Volatility is:

Gaps

Price gaps usually occur before the market opens, but they can also occur during periods of strong volatility. If the market moves with high momentum, a gap may occur. Gaps are Empty areas that the price has left without passing through. This gap is likely to be filled again by the price, and traders take advantage of such gaps to trade targeting it.

Slippage

When there are Volatility in the market, it is possible that when you try to open a new trade, this trade will be executed at a price different from the price you specified. This is called price slippage. It can also happen when closing the trade, as it is possible that the trade will not close at the stop loss or take profit you specified.